How To File Bankruptcy for Free in Massachusetts

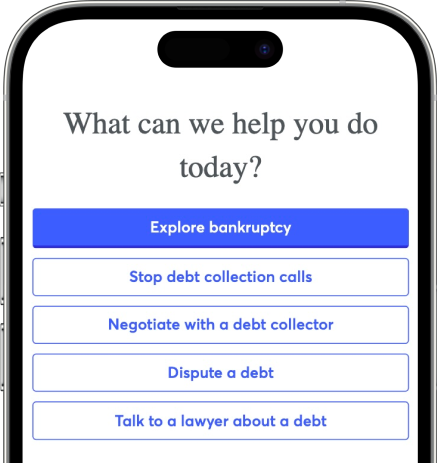

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Filing for bankruptcy doesn’t have to be scary and confusing. We provide helpful tips and resources to help you file Chapter 7 bankruptcy in your state without a lawyer.

Written by Attorney Andrea Wimmer.

Updated March 13, 2024

It’s no coincidence that the U.S. Constitution enables Congress to create bankruptcy laws. Living and struggling with debt is something even the Founding Fathers knew. In fact, most early residents in the colonies started their life in the New World as debtors.

If you’re struggling to make ends meet every month, you may be wondering if bankruptcy is the answer to your financial problems. While there are other debt relief options you may want to consider, bankruptcy can offer the fresh start you so desperately need. And when you file, it’s possible to start having some immediate relief from your debts.

How To File Bankruptcy for Free in Massachusetts

It’s easy to feel like you’re too broke to file Chapter 7 bankruptcy, but don’t worry, there’s a way to file your case for free. The most expensive part of the process is hiring a bankruptcy attorney to help you. Luckily, you don’t have to have a lawyer to file personal bankruptcy in Massachusetts. This guide takes you through the 10 steps of filing Chapter 7 bankruptcy without a lawyer.

- Collect Your Massachusetts Bankruptcy Documents

- Take a Credit Counseling Course

- Complete the Bankruptcy Forms

- Get Your Filing Fee

- Print Your Bankruptcy Forms

- File Your Forms With the Massachusetts Bankruptcy Court

- Mail Documents to Your Trustee

- Take a Debtor Education Course

- Attend Your 341 Meeting

- Dealing with Your Car

Collect Your Massachusetts Bankruptcy Documents

The first step in the process of filing bankruptcy in Massachusetts is to collect and organize your bankruptcy documents. You’re required to submit some of these documents, and they’ll also help you prepare the bankruptcy forms that you’ll submit to the bankruptcy court.

You’ll need the following documents, even if you have an attorney helping you with the process:

Your last two years of tax returns,

Your last 60 days of paycheck stubs, and

A bank statement that covers the filing date (you’ll probably get that after filing your case, that’s totally normal).

There are also documents that are useful to have but that aren’t required by the court, including:

The past 6-12 months of bank statements. These help show your income and expenses.

A recent credit report. This shows all your creditors, debts, and debt amounts. You’re entitled to one free report every 12 months from each of the three consumer credit reporting agencies.

Any creditor statements and bills, as well as letters from collection agencies or other third-party debt collectors. These will help when listing your creditors and debts.

There may be other documents that’ll be helpful, so if you come across any real estate appraisals or other valuations, deeds, life insurance policy statements, or similar documents keep them nearby.

Take a Credit Counseling Course

You have to complete a credit counseling class before you can file Chapter 7 bankruptcy. It’s required by the Bankruptcy Code, which is the federal law that applies to all everyone filing bankruptcy. When it comes to taking this required course, remember:

You have to complete the course in the 180 days before you file your case.

The course isn’t free, but you can apply for a fee waiver if you can’t afford the course fee.

You have to take the course from a state-approved credit counseling provider.

You need to submit a course certificate to the court along with the rest of your bankruptcy paperwork. This shows the court that you completed the course and met this requirement to file your case.

The purpose of this credit counseling course is to make sure you’re aware of all of your debt relief options. It's intended to make sure that only people who really need a Chapter 7 bankruptcy in Massachusetts end up filing.

Complete the Bankruptcy Forms

Bankruptcy is a federal proceeding, outlined in federal law. To allow the U.S. Courts and all parties involved in a bankruptcy case to process all of the filer’s information in an efficient and uniform way, everyone in the nation has to use the official national bankruptcy forms when filing bankruptcy.

If you hire a lawyer, they’ll put together your bankruptcy forms for you based on the information you give them. You’ll need to review and sign them. Since your lawyer is relying on you for your personal and financial information, it's important to answer all of their questions and requests as completely as possible.

If you decide to file bankruptcy on your own, all the forms are available as fillable PDFs that you can get for free on USCOURTS.gov. If you decide to file using Upsolve's filing tool, you’ll fill out an online questionnaire, and our software will generate the forms based on your responses.

Get Your Filing Fee

There is a $338 filing fee for Chapter 7 bankruptcy. You need to pay this or apply for a waiver or to pay in installments when you submit your bankruptcy petition. If your income falls below 150% of the state poverty guidelines, you may be eligible for a fee waiver. (See the “Massachusetts Fee Waiver Eligibility” table below.)

The court only accepts cash, money orders, and cashier’s checks, so don't plan on bringing a personal check, debit card, or credit card. If you need to file bankruptcy quickly to stop a foreclosure or wage garnishment, you can ask to pay the filing fee in installments if you don’t qualify for a waiver and can’t pay the full fee yet.

This allows you to get the bankruptcy process started and get the automatic stay protection. If you go this route, make sure you’re able to make all payments on time. If you miss even one payment, the bankruptcy court can dismiss your case.

Print Your Bankruptcy Forms

Whether you’re filing with a lawyer or on your own, at some point someone has to print out a hard copy of the full bankruptcy petition. That's because you have to actually sign many of the documents that are filed with the bankruptcy court. Without a lawyer, that task falls to you.

When printing your bankruptcy documents, remember:

Use regular white, letter-size paper.

Print in black ink only.

Just print on one side of the page. Don’t print double-sided.

Sign in all necessary spots.

Double-check that you’ve printed everything.

If you’re using Upsolve’s free filing tool, you’ll receive a single PDF containing all of the documents you need to file, complete with dividers that flag each signature page.

File Your Forms With the Massachusetts Bankruptcy Court

Even though Massachusetts is a single federal district, it has three divisions. There’s a courthouse located in each division. The Massachusetts courthouse where you’ll file your Chapter 7 bankruptcy will depend on the city or town you live in. You can look up the appropriate location for filing your case either by town or zip code.

While you can file all of your documents by mailing them to the courthouse, if it’s not a hardship and the courthouse isn’t closed to the public due to the coronavirus, it’s a good idea to do it in person. That way the clerk's office can let you know right away if there are any apparent issues or missing documents. Make sure you bring the original you’re filing with the court and a copy, so the clerk can stamp it for you. Finally, remember that this is a federal building, so you’ll have to pass through security on your way inside.

Right now, only attorneys are allowed to file online in all districts.

Mail Documents to Your Trustee

One of the first things the court does in every Chapter 7 bankruptcy is assign a Chapter 7 bankruptcy trustee and schedule a date and time for the creditors' meeting. (More on this later.) Your trustee will generally mail you a letter with their contact information after you file.

The Chapter 7 trustee will want to review some documents. You’re responsible for mailing the documents at least seven days before your meeting of creditors. At a minimum, you need to send:

Your federal income tax return for the last two years,

A bank statement that is good through the date you filed for bankruptcy, and

Copies of each paycheck stub you received in the 60 days before your case was filed (redact, or black out, sensitive information excluding the last four digits of your SSN).

Your trustee may send you a letter asking you to submit other documents or information to their office as well. Since everyone filing Chapter 7 has a duty to cooperate with their trustee's reasonable requests for information, make sure to keep an eye out for these kinds of requests from your trustee after filing your bankruptcy case.

Take a Debtor Education Course

In addition to the course you're required to take before filing bankruptcy, you also have to take a course after filing your case. This second course focuses on financial management. Everyone filing a Chapter 7 bankruptcy in Massachusetts has to complete this course before the court will enter a bankruptcy discharge erasing their debts.

There is a time limit on how long you have to take this course. You need to file a certification of course completion within 60 days from the date of your creditors' meeting. If you don’t, you risk having the court close your case without a discharge. You need to take the course from a state-approved provider.

Attend Your 341 Meeting

The creditors' meeting is sometimes referred to as the 341 meeting based on the section of the Bankruptcy Code that requires it. This meeting takes place about 20-40 days after you file your Chapter 7 bankruptcy with the Massachusetts bankruptcy court.

You’ll learn the date and time of your creditors' meeting when you receive this official notice from the court in the mail. Generally, if your Massachusetts bankruptcy case is being handled by the court in Boston, your creditors’ meeting will take place in either Boston or Brockton, depending on where you live. If your case was filed in the Worcester court, your 341 meeting will be scheduled to take place in either Worcester, Pittsfield, or Springfield.

Most meetings take less than 10 minutes to complete. The trustee will ask you the standard questions they’re required to ask everyone filing Chapter 7 in Massachusetts. If you take just a few minutes to prepare and review all of your bankruptcy forms before going in, the creditors' meeting won’t be as stressful as you might fear! Just be sure to bring your picture ID and proof of Social Security number with you. After the meeting, you’re one step closer to your bankruptcy discharge.

It’s important to note that all 341 meetings are currently being held via telephone or video conference due to COVID-10, but this hasn’t yet been adopted as a standard practice moving forward.

Dealing with Your Car

Your car plays two important roles in your case. First, it’s an asset in your Chapter 7 bankruptcy estate. Though most of the time it’s an asset with no value if you have a large loan balance and no equity.

Second, if you have a car loan, your car is collateral for one of your creditors. Your car loan has to be listed as a secured debt on your Schedule D, and you have to explain what you want to do with it in your Statement of Intentions. Everyone who has a car loan when filing Chapter 7 in Massachusetts has the same options to deal with their car and the loan it secures. There are also options for those who are leasing their car.

If you own your car free and clear, your options depend on what your car is worth. Massachusetts has a $7,500 vehicle exemption. This means that if you have a vehicle worth $7,500 or less you may keep it.

If your car is in good shape and the loan and monthly payment work for you, you can keep everything essentially the same by entering into a reaffirmation agreement. To do this, you must be current on your loan payments. If you aren’t current on the loan or don’t want to keep making payments, you can surrender your car to the lender and have the loan debt discharged as part of your case.

Even if you can keep your car, it may be in your best interest to get rid of it at this time and purchase another one after bankruptcy.

Massachusetts Bankruptcy Means Test

The means test for bankruptcy determines whether you’re eligible to file under Chapter 7 of the Bankruptcy Code. It first compares your household income against the income limits for Massachusetts bankruptcy cases. This is based on the state’s median income for a similarly sized household.

Some people can show that they’re eligible to file a Chapter 7 case even though they make more than the median income by completing the second part of the means test analysis. The second part isn’t as straightforward. It looks at your expenses and disposable income to see whether or not you have enough disposable income to pay at least 25% of your debts over five years.

If you don’t qualify to file Chapter 7 bankruptcy, you may qualify to file Chapter 13 bankruptcy, which allows you to repay certain types of debts over time with a repayment plan.

Data on Median income levels for Massachusetts

Massachusetts Median Income Standards for Means Test for Cases Filed In 2024 | ||

|---|---|---|

| Household Size | Monthly Income | Annual Income |

| 1 | $6,496.75 | $77,961.00 |

| 2 | $8,276.33 | $99,316.00 |

| 3 | $10,190.75 | $122,289.00 |

| 4 | $12,898.17 | $154,778.00 |

| 5 | $13,723.17 | $164,678.00 |

| 6 | $14,548.17 | $174,578.00 |

| 7 | $15,373.17 | $184,478.00 |

| 8 | $16,198.17 | $194,378.00 |

| 9 | $17,023.17 | $204,278.00 |

| 10 | $17,848.17 | $214,178.00 |

Data on Poverty levels for Massachusetts

Massachusetts Fee Waiver Eligibility for Cases Filed In 2024Eligible for fee waiver when under 150% the poverty level. | ||

|---|---|---|

| Household Size | State Poverty Level | Fee Waiver Limit (150% PL) |

| 1 | $1,132.50 | $1,698.75 |

| 2 | $1,525.83 | $2,288.75 |

| 3 | $1,919.17 | $2,878.75 |

| 4 | $2,312.50 | $3,468.75 |

| 5 | $2,705.83 | $4,058.75 |

| 6 | $3,099.17 | $4,648.75 |

| 7 | $3,492.50 | $5,238.75 |

| 8 | $3,885.83 | $5,828.75 |

| 9 | $4,279.17 | $6,418.75 |

| 10 | $4,672.50 | $7,008.75 |

Massachusetts Bankruptcy Forms

The Massachusetts Chapter 7 bankruptcy forms are the official forms used nationwide. Everyone who files a Chapter 7 bankruptcy uses these forms. Although there are several local Massachusetts bankruptcy forms, you won’t need any of them when you first go to court to file your case. You can find all these local forms on the court's website.

Upsolve Member Experiences

1,990+ Members OnlineMassachusetts Districts & Filing Requirements

As noted above, Massachusetts has one district with three different courts. The court accepts money orders and cashiers checks for all fees. The court also provides a convenient list of bankruptcy FAQs and their answers.

Finally, the Massachusetts Bankruptcy Court has published a detailed guide for people filing bankruptcy without a lawyer ("pro se"), that you can download for free.

Massachusetts Bankruptcy Exemptions

You may be under the impression that filing bankruptcy means you’ll lose everything you own, but this isn’t true. You’re protected by bankruptcy exemptions. Exemptions allow you to keep some property from being sold. In fact, most Chapter 7 filers are able to protect all their property using exemptions.

If you’ve lived in the Bay state for at least two years when you file your Massachusetts bankruptcy, you can choose between Massachusetts bankruptcy exemptions and the federal bankruptcy exemptions. Massachusetts’ state bankruptcy exemptions are more generous than the federal exemptions and protect more of your belongings from liquidation. Among other things, you can protect a (declared) homestead with equity of up to $500,000 and a vehicle worth up to $7,500. A homestead is your home, the land it’s located on, and any outbuildings.

Massachusetts law even includes a wildcard which allows an exemption for any item of your choosing up to $1,000. You can add to this up to $5,000 of any other unused exemption as well.

Massachusetts Bankruptcy Lawyer Cost

Though you may want to save money by filing a Chapter 7 bankruptcy in Massachusetts without a lawyer, this may not always make sense. That’s especially true if the cost of a bankruptcy attorney is less than the assets you might lose without legal advice. Massachusetts bankruptcy lawyers charge an average flat fee of $1,100 to $1,700 for legal services, but the cost varies depending on the complexity of the case. When choosing a lawyer, you’ll want to look at several factors, not just the cost.

Massachusetts Legal Aid Organizations

Legal aid in Massachusetts is available for low-income individuals and families needing help with civil matters, including Massachusetts bankruptcy cases. If you’re worried about filing a Chapter 7 bankruptcy in Massachusetts by yourself, the court has listed several resources for Massachusetts legal aid organizations as well as pro bono lawyer referral resources.

Community Legal Aid, Inc.

(508) 752-3718

405 Main Street, Worcester, MA 01608

Northeast Legal Aid, Inc.

(978) 458-1465

50 Island Street, Suite #203A, Lawrence, MA 01840

South Coastal Counties Legal Services

(508) 979-7160

22 Bedford Street, 2nd Floor, P.O. Box 2507, Fall River, MA 02722

Volunteer Lawyers Project of the Boston Bar Association

(617) 423-0648

99 Chauncy Street, Suite 400, Boston, MA 02111

Upsolve

Nationwide Service (NYC Office)

Massachusetts Court Locations

300 State Street

413-785-6900

300 State Street Springfield, MA 01105

Harold D. Donohue Federal Building and United States Courthouse

508-770-8900

595 Main Street Worcester, MA 01608

John W. McCormack Post Office and Court House

617-748-5300

5 Post Office Square Boston, MA 02109

Massachusetts Judges

Massachusetts Bankruptcy Judges | |

|---|---|

| District | Judge Name |

| District of Massachusetts | Hon. Melvin S. Hoffman |

| District of Massachusetts | Hon. Joan N. Feeney |

| District of Massachusetts | Hon. Frank J. Bailey |

| District of Massachusetts | Hon. William C. Hillman |

| District of Massachusetts | Hon. Robert Somma |

| District of Massachusetts | Hon. Christopher J. Panos |

| District of Massachusetts | Hon. Joel B. Rosenthal |

| District of Massachusetts | Hon. Elizabeth D. Katz |

| District of Massachusetts | Hon. Henry J. Boroff |

Massachusetts Trustees

Massachusetts Trustees | |

|---|---|

| Trustee | Contact Info |

| Warren E. Agin | wea@swiggartagin.com (617) 742-0110 |

| John J. Aquino III | jja@andersonaquino.com (617) 723-3600 |

| Joseph H. Baldiga | jbaldiga@mirickoconnell.com (508) 898-1501 |

| Joseph G. Butler | JGB@jgbutlerlaw.com (781) 636-3638 |

| Joseph B. Collins | jcollins@hendelcollins.com (413) 734-6411 |

| Gary W. Cruickshank | gwc@cruickshank-law.com (617) 330-1960 |

| Mark G. DeGiacomo | mdegiacomo@murthalaw.com (617) 457-4000 |

| John O. Desmond | john.desmond@jdesmond.com (508) 879-9638 |

| Jonathan R. Goldsmith | jgoldsmith@gkalawfirm.com (413) 747-0700 |

| Stewart F. Grossman | sgrossman@pbl.com (617) 973-6280 |

| Jack E. Houghton Jr. | JHoughtonJr@aol.com (413) 447-7385 |

| Donald R. Lassman | Don@LassmanLaw.com (781) 455-8400 |

| David B. Madoff | madoff@mandkllp.com (508) 543-0040 |

| Janice G. Marsh | janicemarsh1@gmail.com (508) 797-5500 |

| Harold B. Murphy | hbm@murphyking.com (617) 423-0400 |

| David M. Nickless | dnickless@npolegal.com (978) 342-4590 |

| David W. Ostrander | David@Ostranderlaw.com (413) 585-9300 |

| Lynne F. Riley | riley@casneredwards.com (617) 426-5900 |

| Gary M. Weiner | gweiner@weinerlegal.com (413) 732-6840 |

| Steven Weiss | sweiss@ssfpc.com (413) 737-1131 |

| Anne J. White | awhite@jdemeo.com (617) 263-2600 |