Help! I’m Being Sued For An Old Debt

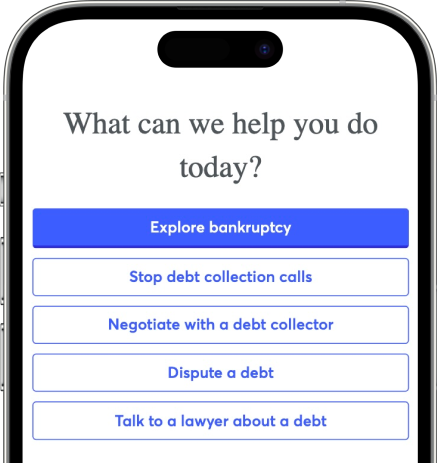

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

This article will discuss the ways to handle a debt collection lawsuit. You'll learn how to save time and money when defending against a debt collection matter and may even learn how to win the case.

Written by Lawyer John Coble.

Updated June 5, 2021

These days, debt collection lawsuits by businesses against consumers represent roughly half of all state court civil cases in America. Most of these lawsuits are initiated by financial services companies such as banks, credit card companies, and debt-buying companies. It hasn't always been this way. In the past, these collections lawsuits represented a much smaller percentage of court dockets.

If you’re one of the many Americans subjected to one of these lawsuits, this article is for you. This article will discuss the ways to handle a debt collection lawsuit. You'll learn how to save time and money when defending against a debt collection matter and may even learn how to win the case.

What Happens When A Creditor Sues You?

Most people first learn of a lawsuit when they're served with notice that a lawsuit has been filed. This often occurs when a sheriff's deputy hand delivers a summons and complaint. Sometimes, the lawsuit will be hand delivered by a process server instead of a deputy. In many cases, the service will occur via certified mail.

Once you've been served, you need to "answer" the plaintiff's complaint. The "plaintiff" is the company or individual that's suing you. The "complaint" is an outline of the plaintiff's claims against you. You’ll receive a copy of the complaint when the lawsuit is served. Your next question is probably, "How do I answer a lawsuit?" The answer to this question depends on a few different factors.

Before anything else, you’ll need to know which court has been assigned to your case. If your case is in a small claims court, the response process will be much less formal than it would be if it was being handled by other parts of the court system. With these courts, in many states, you'll receive a special "answer" form that allows you to check a few boxes to complete your answer. These lower-level courts are designed to be self-help-oriented. That is, you can represent yourself and you won’t have to pay attorney's fees. In trial courts of higher jurisdiction, you may need to provide a formal legal pleading for your answer.

The basis to determine where a creditor will choose to file their lawsuit often depends on how much money they’re owed. For example, a particular state's law may require that lawsuits concerning more than $6,000 owed be filed in the "district court." The same state may require lawsuits valued at over $10,000 (or requiring a jury) to be filed in the "circuit court." Different states have different terms for their higher-level trial courts. Sometimes they're called "superior courts."

Regardless of the court you're dealing with, the court papers served on you should let you know how many days you have to answer the lawsuit. If you fail to answer within the prescribed time, the plaintiff can move for a default judgment. If a default judgment is entered against you, it can be enforced just as a judgment after a trial is. While it's possible to have a default judgment set aside, it's best to answer the lawsuit in time so that a default judgment is never entered.

You’ll also need to know the reason the plaintiff is claiming you owe them money. Did this plaintiff loan money or extend credit to you? If so, the plaintiff is the original creditor. Does this plaintiff claim to have bought your debt from the original creditor? If so, the plaintiff is a debt buyer. Which type of plaintiff you have can affect how you'll prepare your defense.

You Can Still Settle Even Though You Have Been Sued

The plaintiff doesn't want to have to pay their attorney any more than they have to. They may be able to win a judgment wherein you pay for their collection costs and court costs, but they have to pay these costs out of their own pockets immediately. The creditor also doesn't want to risk getting a worse deal from the court than you could offer them. For these reasons, there's still time to get a reasonable settlement from the plaintiff, even if you’ve been served with notice of a lawsuit. It may benefit you to try and negotiate with a creditor instead of having to gamble on the outcome of the lawsuit.

Upsolve Member Experiences

1,739+ Members OnlineThe Litigation Process

After answering the complaint, discovery is often the next step in the litigation process.

Discovery

Discovery is an exchange of facts and legal information used by attorneys after a lawsuit is filed, but before the case goes to trial. Discovery often isn't allowed in small claims courts. Or, if the small claims court allows discovery, it might require the permission of the judge. Discovery is more common in the higher-level courts. The most common types of discovery are interrogatories, requests for production, requests for admissions, and depositions.

Interrogatories are written questions you're required to answer. Requests for production are demands for the opposing party in a lawsuit to produce certain items. Usually, this means that they want you to produce certain documents.

It's more likely that you'll need an attorney if your lawsuit is being tried in a higher-level court, due to the more formal rules imposed by these courts. Small claims courts are intended to facilitate a self-help approach. It's all right to have a lawyer in small claims in most states, if you want to work with one. But, some states require you to represent yourself in small claims court. It's not a good idea to hire a lawyer that will charge you $700 when the amount the plaintiff is claiming is only $500. Yet, if you're a low-income defendant and you're sued for $5,000, losing the lawsuit could be catastrophic for you. If you need an attorney, but can't afford one, it's a good idea to look into free legal aid options.

Defenses

The most common defenses used in collections cases are:

Time-barred by the statute of limitations

You don't owe the amount the plaintiff claims you owe

The plaintiff is a debt collector that can't prove it has the right to collect the debt

The plaintiff is a debt collector and they have violated the Fair Debt Collection Practices Act (FDCPA)

The debt was discharged in bankruptcy

Identity theft

With old debts, there's a good chance they may be too old for the creditor to file a legal claim lawfully. For example, if there's a 10-year statute of limitations for debt collection in your state and the debt is over 10 years old, you could win the case because the claim is time-barred by the statute of limitations. The problem with the statute of limitations defense is the date when the time starts to run isn't so straightforward. With an installment loan, it might be the date you took out the loan but it could also be the date upon which the account went delinquent. With an open account like an active credit card, it might be from the date of your last charge on the card, but it could also be from the date of the last payment. Statutes of limitation for consumer collections are governed by state laws. These laws vary from state to state. You might need an attorney's help to deal with these complex laws.

The plaintiff needs to prove its case. That is, they need to prove you owe the amount they say you owe. Make them prove it. If the plaintiff is a debt buyer, they must prove they have the right to collect the debt. If the lawsuit involves a debt you never heard of, you may be a victim of identity theft. The Federal Trade Commission (FTC) has extensive information on how to deal with identity theft. If you suspect identity theft, it's a good idea to check into it and work on getting it resolved. The evidence you gather during this process can be used in your defense to the debt collection lawsuit.

If you filed bankruptcy and the debt was discharged, you can use this as a defense. You may also have a claim against the plaintiff for having violated the bankruptcy discharge injunction. If the particular debt wasn't listed on your bankruptcy petition, it may have still been a discharged debt. In "no-asset Chapter 7 bankruptcies,” the debt is often discharged even if not listed on case-related paperwork. The reason is that even if the creditor had received notice of the Chapter 7 bankruptcy, they wouldn't have recovered any money in a no-asset bankruptcy.

With debt-buyers or collection agencies, you may have a claim against the plaintiff if they violated the FDCPA. Except in rare cases, the FDCPA won't apply to the original creditor. FDCPA claims deal with harassing communications during the collection process. If you win on your FDCPA claim, you may reduce the amount you owe to the plaintiff, or it may turn out that the plaintiff owes you. The Consumer Financial Protection Bureau (CFPB) has in-depth rules for the FDCPA on its website.

Post Judgment Enforcement If You Lose

If you go to court and lose, or if a default judgment is recorded against you, the plaintiff will then be classified as a judgment creditor. At this point, you may have to comply with post-judgment discovery. This will probably occur in the form of interrogatories (lawyer-speak translation: written questions) asking you about your employer, your bank account, as well as other questions. The point of the questions will be to find ways for the judgment creditor to collect the money owed, including court costs. The next step may be wage garnishments and/or seizures of your bank accounts. These actions will likely continue until your debt is paid in full.

You can limit the amount that the judgment creditor can take from your paycheck. Federal law provides a 25% of disposable income ceiling for garnishments. You can also use state law exemptions and federal exemptions for federal benefits to limit what can be taken from your bank accounts. If you don't have a job or a bank account, you can't feel secure. The creditor can also seize your cars, personal property, real estate, and even your home. It's good to know that you’ll probably have exemptions available for those assets though. Furthermore, you can still avoid much of the pain of post-judgment enforcement by settling after losing the case - it’s usually not too late to negotiate with your creditor.

Let’s Summarize…

If you've been sued by a creditor, it's important to answer the lawsuit. Even if you know that you owe the creditor, you'll at least want them to prove that you owe the amount they say you owe. By answering the lawsuit, you’ll give yourself more time to settle the lawsuit.

It's important to realize that even if you know you owe the creditor, you may still have defenses. These defenses could include statutes of limitations for time-barred debts, the FDCPA, and the fact that the debt collector may not have the legal right to collect the debt. If you've never heard of the debt, you may have been a victim of identity theft. To raise the defenses, it's important to file a timely answer.

You may need a lawyer to help you with your case. Upsolve can help you find an attorney in your area. If you can't afford an attorney, you may be able to find free legal services through the website of the American Bar Association.

The worst thing you can do is nothing. If you do nothing, you lose. It's not uncommon for defendants to lose cases that they could have won had they just answered the lawsuit in a timely fashion. Defendants in debt collection cases who actually fight win much more often than you would think.