Discharging Student Loans in Bankruptcy: Important Legal Terms

1 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

One of our goals this year is to publish a comprehensive guide on filing an adversary proceeding as part of a bankruptcy to discharge student loans. It will initially be published as a series of Learn Articles. The following is a guide to important legal terms that come up in adversary proceedings.

Written by Attorney Andrea Wimmer.

Updated August 1, 2023

The vocabulary used by courts and lawyers is different from how we speak in real life. Understanding the terminology will go a long way to make you feel more comfortable representing yourself in an adversary proceeding to discharge your student loans.

Upsolve Member Experiences

1,938+ Members OnlineLearn the Lingo (Part I): Legal Terms You'll Want to Know

This article will explain cover some of the terms you'll come across when you prepare to file your adversary proceeding to discharge your student loans.

Plaintiff - the party bringing a lawsuit. You.

Defendant - the party against whom the lawsuit is filed. The bank.

Complaint - the document listing the allegations or claims made in the lawsuit. It is filed by the plaintiff.

Summons - issued by the court clerk once a complaint is filed. It “summons” the defendant to come and answer the allegations described in the complaint.

Adversary Proceeding - a lawsuit filed in the bankruptcy court; it’s connected to the bankruptcy case (called the administrative case) but assigned its own case number and docket.

Service / to serve - the plaintiff has to “serve” the defendant with the summons and complaint. This can be as simple as mailing the summons and complaint to the defendant but it is subject to very specific and strict rules.

Allegations - each paragraph in the complaint is an allegation. Paragraphs (and as a result the allegation contained in the paragraph) are often only 1 sentence long.

Answer - the document a defendant files in response to being served with a summons and complaint. Literally “answers” each individual allegation in the complaint.

Default judgment - If a defendant doesn’t file an answer by the deadline, the plaintiff can ask the court to grant them a judgment against the defendant by default. This is called a default judgment.

Pleading(s) - document(s), other than the official bankruptcy forms, that are filed with the court. The complaint, answer, and any motions are pleadings.

Motion - a document requesting the court take a certain action.

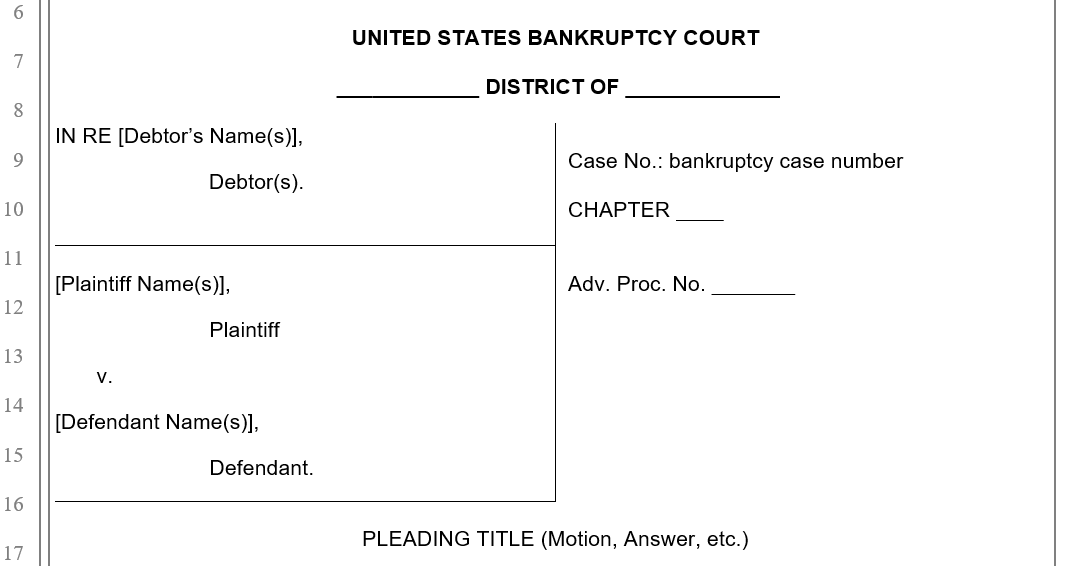

Pleading Paper - the caption, together with the lined numbers on the left side of the page make up the pleading paper. You can create “lined” paper in your word processor. The sample caption below is “on pleading paper.”

Caption - located at the top of all pleadings filed with the court, listing the person filing the document, the name of the court, the type of pleading, and specific case information. For an adversary proceeding, It should follow this template and will look something like this:

Exhibits - documents submitted to the court as part of the complaint or other pleading. Exhibits back up the story you’re telling by providing the court with evidence.

Discovery - method of exchanging evidence after a case has been filed before a trial is held.

Stay tuned for Learn the Lingo Parts II - ?? and other sections of Upsolve's Guide to Student Loan Adversary Proceedings.