I’m Getting Collection Calls on Sunday. What Are My Rights?

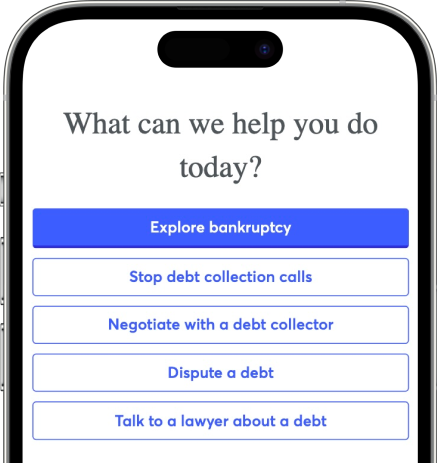

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Unless and until you tell them otherwise, debt collectors can call you from 8 am to 9 pm local time on any day of the week, including Sunday. The good news is that federal law protects you against harassment and unfair treatment by debt collectors. The Fair Debt Collection Practices Act (FDCPA) empowers you to instruct a debt collector not to contact you on Sundays if you consider this an inconvenient time. If a debt collector doesn't honor your request, you can report them to the Consumer Financial Protection Bureau for violating the law.

Written by Attorney Eric Hansen.

Updated September 18, 2023

Can Debt Collectors Call on Sundays?

The short answer is, yes. Debt collectors can contact you on Sunday.

That said, they can’t call repeatedly (on Sunday or any other day), and phone calls must be made at a “reasonable” time. That’s generally defined as 8 a.m. to 9 p.m. local time. Debt collectors also can’t call you at times they know are inconvenient for you — for example, if you work nights and must sleep during the day.

Also, you have the right to tell debt collectors not to contact you on Sundays if you consider it inconvenient. Many people observe important religious practices on Sunday or focus on spending time with their family. To effectively stop Sunday phone calls or otherwise limit how a debt collector contacts you, send a cease and desist letter.

Before you send this letter, it’s a good idea to make sure the debt is valid. The debt collector should send you a debt validation letter with details of the debt and the collection agency contact information. They’re required to do this before their first contact with you or within five days after first contact. If they don’t send this letter, you think something is off about the debt, or you simply want to buy yourself some time, send the debt collector a debt verification letter to get the details you need.

Validating the debt helps you avoid debt collection scams and verify that you really owe the debt. If you do owe it, sending a cease and desist letter will stop debt collectors from contacting you, but it won’t make your debt disappear. You’ll need to make a plan to deal with the debt.

If the debt isn’t yours or you don’t believe you owe it, you can send a dispute letter. Read our article How to Dispute a Debt You Don’t Owe to learn how.

What’s a Cease and Desist Letter?

A cease and desist letter is a written notice you send the debt collector to tell them to stop contacting you about a debt. This can be a helpful tool to stop collection calls, text messages, and other unwanted contact.

You don’t have to be a lawyer or a collections expert to send one either. Upsolve has a cease and desist letter template you can use to get started.

Though you can also tell a debt collector to stop contacting you via phone, sending a letter (and keeping a copy of it!) provides important documentation and proof. Better yet, send the letter via certified mail so you can also prove the debt collector received it.

If I Stop Hearing From Debt Collectors, Does That Mean My Debt Is Gone?

Probably not.

If you send a cease and desist letter and the debt collector follows the law, they will stop contacting you. But that doesn’t mean they’ll stop their collection activities. In fact, they may decide to sue you as a last resort. (If they do, fight back.)

If they sue you and win, they can get a court order to collect the debt via other means. If a debt collector sues you and wins a judgment, they may have access to wage garnishment or a bank account levy until repayment of the debt is complete.

Upsolve Member Experiences

1,739+ Members OnlineKnow Your Rights When It Comes to Debt Collection Agencies

Telling a debt collector to stop contacting you is just one of many rights you have under the federal Fair Debt Collection Practices Act (FDCPA).

The FDCPA is a federal law that protects consumers from third-party debt collector harassment. If you have unpaid debts that have been sent to collections, you’ve probably already noticed that debt collectors can be relentless in their communication.

The FDCPA prohibits collection agencies and debt collectors from abusing, harassing, and misleading consumers during the debt collection process.

What Types of Debt Are Covered Under the FDCPA?

The FDCPA applies to consumer debts such as credit card debt, medical bills, payday loans, and student loans.

It’s also important to note that the FDCPA only applies to third-party debt collectors, not (in most cases) the original creditor. That means the bank or financial institution that originally lent you the money or extended credit isn’t subject to the FDCPA’s restrictions.

What Does the FDCPA Prevent Debt Collectors From Doing?

Debt collectors can now legally reach you at home, by mail, on your cellphone, and even through social media. But no matter how they contact you, they must follow the law.

The FDCPA aims to prevent debt collection agencies from harassing you or treating you unfairly. This can encompass a wide range of behaviors and practices, including but not limited to:

Debt collectors can’t verbally abuse you, use profane language, or threaten you.

Debt collectors can’t show up at your place of work or call you at work if you’ve told them not to.

Debt collectors can’t discuss your debt with any third party, including friends, family, or your employer (though they may ask for your contact information from a third party).

To learn more, read our article What Is the Fair Debt Collection Practices Act?

I Told a Debt Collector To Stop Calling on Sundays, but They Haven’t Stopped — Now What?

If you’ve explicitly told a debt collection agency not to call you on Sundays, but they continue to call, this is a violation of the FDCPA. You can submit a complaint to the federal agencies that enforce the FDCPA and/or pursue legal action.

Where Do You Report Violations of the FDCPA?

You can and should take action if debt collectors are harassing you. Remember that the FDCPA gives you rights. To help assert those rights, document your interactions with debt collection agencies. Keep a written log of what has been said, when they’re calling, and what efforts you’ve made to negotiate.

If you believe a collection agency has broken the law, you can file a consumer complaint online via the Consumer Financial Protection Bureau (CFPB). The CFPB works with the Federal Trade Commission (FTC) to enforce federal debt collection laws. You can also file a complaint with the Better Business Bureau (BBB) and your state attorney general’s office.

Can You Sue Debt Collectors for FDCPA Violations?

Yes. If a debt collector violates the FDCPA, you can sue them for damages. Bringing legal action against a collection agency won’t make your debt disappear if you owe it, but it can help you win damages and may provide some bargaining power to negotiate a debt settlement.

It may be helpful to contact a consumer rights attorney to get legal advice and assert your rights. A skilled attorney will be familiar with federal and state laws designed to protect you. If you win the case, you may be able to recover attorney fees and court costs.

Let’s Summarize...

Bill collectors are legally allowed to call you on Sundays so long as they do so during reasonable hours. However, if you tell them not to call you on Sundays, they must stop. Continuing to call is a violation of the FDCPA. You can report the collector for this violation to several state and federal agencies.

Debt collection calls can be stressful, but knowing your rights can empower you to stand up for yourself and deal with that stress. Remember, federal law protects you against harassment and unfair treatment by debt collectors.