What Is a Debt Validation Letter and How Do You Get One?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

A debt validation letter is a letter that includes basic information about a debt someone is trying to collect from you. If a debt collector is trying to collect an unpaid debt, they’re required by law to send you a debt validation letter before contacting you or within five days of their first contact with you.

Written by Curtis Lee, JD. Legally reviewed by Jonathan Petts

Updated April 17, 2025

Table of Contents

What Is a Debt Validation Letter?

Creditors often turn unpaid debts over to debt collectors or collection agencies. Federal law requires that these third-party collectors give you certain information about any debt they try to collect from you. They must do this by sending you a debt validation letter (sometimes called a debt validation notice).

Debt collectors and collection agencies must send you a debt validation letter either before they contact you or within five days after the first time they contact you.

What Does a Debt Validation Letter Look Like?

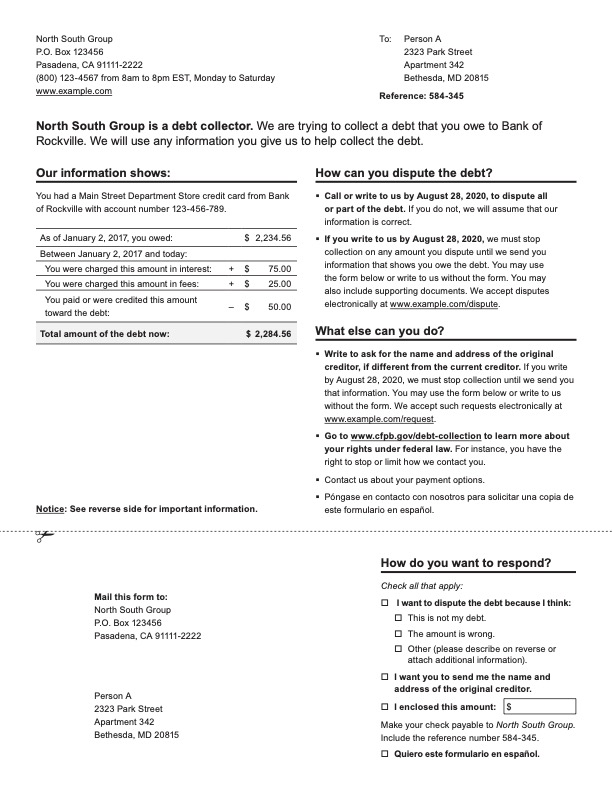

Below is a sample debt validation letter from the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that, together with the Federal Trade Commission (FTC), helps protect consumers from debt collector harassment and misconduct. This sample letter contains all the information required by federal law, including a tear-off portion you can use to dispute the debt.

Different collection agencies may use different letter formats, but they must still provide all the required information. More on these requirements later.

How Do You Get a Debt Validation Letter?

Debt collectors should send you a validation letter without you having to ask. But if you haven’t received one within 10 days after the debt collector’s first contact, you should request one.

It’s best to make your request in writing if you know the debt collector’s mailing address or email address. Otherwise, request a validation letter by phone the next time the debt collector or collection agency contacts you.

Make a note of when and how you requested the validation (e.g., “by phone on July 31, 2023”). You may need this information as evidence if you file a complaint against the collector.

If the debt collection agency doesn’t respond to your request for a debt validation letter, it is violating the Fair Debt Collection Practices Act (FDCPA). This is the federal law that governs third-party debt collection practices.

You can report this violation to the CFPB and/or your state’s attorney general’s office. You can also bring legal action against the debt collector to recover damages of up to $1,000 per violation, plus attorneys fees and court costs.

What Should a Debt Validation Letter Include?

Federal law requires every debt validation letter to include the following information:

Notice that the correspondence is from a debt collector

The current amount of the debt as of the notification date

Any account numbers associated with the debt

An itemized accounting of the debt including interest, fees, payments, and credits. If the debt is a residential mortgage, they must also include a copy of the most recent billing statement sent to you.

The name of the creditor that owns the debt — this may or may not be the original creditor(s) you owe the debt to

Notice that you have the right to dispute the debt within 30 days, including an end date for the 30-day period (more about this later)

Notice that if you don’t dispute the debt within 30 days, the debt collector may assume the debt is valid

The debt collector’s name and address

All of these items are included in the sample debt validation letter pictured above. Depending on where you live, additional information may be required. For example, many states require collectors to tell you if the debt is considered time-barred under your state law.

If you don’t think you owe the debt, or you need more information, you can submit a response using the detachable form or your own letter. Your response should say whether you are disputing the debt, requesting more information, or both.

If your validation letter is missing required information, you should respond to the letter and request this information. In this case, you can also file a complaint with the CFPB.

What Is a Debt Verification Letter?

The terms debt validation and debt verification are often used interchangeably. In this article, “debt validation letter” means the initial notice a debt collector must send you under federal law, and “debt verification letter” means a letter you send to the debt collector to request more information and/or to dispute the debt.

You can use the tear-off form attached to the debt validation letter as your verification request, or you can write your own debt verification letter.

Debt Validation vs. Debt Verification Letters: What's the Difference?

Why Should You Send a Debt Verification Letter?

You don’t have to send a debt verification letter, but it’s often a good idea to do so. This is especially true if any of the following apply:

You don’t recognize the debt

You don’t recognize the name of the creditor

You don’t recognize the debt collection agency that contacted you

You don’t agree with the amount owed

You think the debt is an old debt past the statute of limitations

Trust your gut. If something feels off or unusual about the debt collector, it doesn’t hurt to make them confirm they and the debt are legitimate.

When Should You Send a Debt Verification Letter?

When you receive a debt validation notice, that starts the “validation period.” Under federal law, the validation period ends 30 days after you receive the debt validation notice. The validation notice should tell you the specific date on which the validation period ends.

The validation period is important because if you send a debt verification letter or dispute notice during the validation period, the debt collector must stop all collection efforts until they provide the required information or respond to the dispute.

If possible, send your debt verification letter using certified mail with a return receipt requested. This gives you proof of when you sent the letter and when the debt collector received it.

You can still send a debt verification letter after the validation period ends, but the collection agency can continue trying to collect the debt.

What Information Can You Request in a Debt Verification Letter?

Many people use the debt verification letter to request the original creditor’s name and address. But you can also ask for any other information you want about the debt, such as:

Why the debt collector believes you owe the debt

The age of the debt, including when the last payment was made

Whether the statute of limitations has run out on the debt

When the debt collector purchased the debt (if applicable)

Whether the debt collector is licensed to collect the debt (if this is required by your state’s law)

Any other relevant details about the debt

This information can help you confirm the validity of the debt, that the debt belongs to you, that you haven’t already paid the debt, and that the debt collector is authorized to collect the debt. It can also help you avoid debt collection scams.

One caveat: While you can request anything in a debt verification letter, the debt collector isn’t necessarily required to provide it. If you file a complaint or lawsuit against a debt collector for violating the FDCPA, it will be up to the judge to decide whether the collector provided enough information.

To learn more about debt verification letters and get a template for writing one, see our article: What Is a Debt Verification Letter?

I Got a Debt Validation Letter, How Do I Respond?

First, send a debt verification letter to determine whether the collection agency is legitimate and the debt is valid. Report any suspected scammers to the CFPB. If the debt collector is legitimate, your next steps depend on whether you believe the debt is valid.

The Debt Is Valid. What Do I Do Next?

If the debt is valid and you owe it, you can reach out to the collection agency and try to set up a payment plan. You can also propose a debt settlement agreement to pay less than the full amount you owe. This works best if you can offer a lump-sum payment.

If you can’t repay the debt, you can discuss your debt relief options during a free consultation with a credit counselor. A nonprofit credit counseling agency can also help you with budgeting and getting your personal finances in order. Credit counselors can help with common debts like credit card debt and medical bills, but they may not be able to help with debts like student loans.

I Don’t Think the Debt Is Valid. What Can I Do?

If a debt collection company is trying to collect a debt from you that you don’t believe is valid or you don’t believe you owe, you can dispute the debt with the debt collector. You must notify the debt collector that you dispute the debt and why. For example:

The amount of the debt is wrong

The debt isn’t yours (wrong person)

You already paid the debt

The debt was discharged in bankruptcy

If you dispute the debt during the validation period, the debt collector must stop all collection efforts until they respond to the dispute. You can still dispute the debt after the validation period has ended, and the debt collector must still respond. But in the meantime, they can continue to make phone calls and other attempts to collect the debt.

Check Your Credit Report!

If you’re contacted about a debt that you don’t owe, you’ll want to dispute the debt with the debt collector and also with the credit bureaus if the debt or collection activities appear on your credit report.

The information on your credit report is used to calculate your credit score. Having incorrect information on your credit report, especially information about collection activities, will hurt your credit score and may make it harder to get credit cards or loans or to get a good interest rate on future credit.

Let’s Summarize…

The law requires a debt collector to send you a debt validation letter with information about the debt and an explanation of some of your rights concerning the debt. If they don’t provide you with this letter, you can sue them and/or report them to federal agencies that protect consumer rights, including the FTC, CFPB, and your state’s attorney general’s office.

After you receive a debt validation letter, you can send a debt verification letter to request more information or to dispute the debt. If you send this during the 30-day validation period, the debt collector must pause their collection efforts until they respond to your letter.