How To Sue Debt Collectors Who Break the Law

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment, abuse, and other behavior intended to bully debtors. If a debt collector is violating the FDCPA in their attempts to collect money from you, you have the right to sue them. In this article, we explain how to sue an abusive debt collector, what an FDCPA lawsuit can and cannot help you with, and what other options you have to stop communication from collectors.

Written by Natasha Wiebusch, J.D..

Updated July 28, 2023

Table of Contents

In 1978, Congress passed an important amendment to the Consumer Credit Protection Act to protect debtors from abusive third-party debt collection agencies. This amendment was called the Fair Debt Collection Practices Act (FDCPA), and it prohibits harassment, abuse, and other behavior intended to bully debtors.

If a debt collector is violating the FDCPA in their attempts to collect money from you, you have the right to sue them. In this article, we explain how to sue an abusive debt collector, what an FDCPA lawsuit can and cannot help you with, and what other options you have to stop communication from collectors.

Your Rights Under the FDCPA

If you’re being contacted by a debt collector, you have rights under the FDCPA. The FDCPA is a federal law that limits what a debt collector can do while attempting to collect money from you. Most importantly, if a debt collector violates the FDCPA while trying to collect money from you, you can sue them.

So, what rights do you have under the FDCPA?

Communication Rights

You have the right to not be contacted at unusual times or at times that they know are inconvenient for you. Specifically, debt collectors can’t contact you before 8:00 a.m. or after 9:00 p.m.

You have the right to not be contacted at work if the debt collector knows you can’t take calls from them at work.

You have the right to not be contacted by a debt collector if you send them a written request to stop all contact.

You have the right to NOT be harassed by debt collectors. Harassment can include using profane language, name-calling, calling repeatedly even when you don’t answer, or threatening to arrest you.

Debt collectors cannot use abusive, unfair, or deceptive practices while trying to collect on a debt.

Debt collectors must contact your attorney, not you, as soon as they know you are being represented by an attorney.

Validation of Debt Rights

Verifying that the debt is valid is very important. To verify the debt, collectors must provide the following information in a validation letter:

The name of the creditor.

The total debt owed to that creditor

Your right to dispute the debt within 30 days.

The FDCPA is the most comprehensive consumer protection law that regulates third-party debt collection agencies’ activities. It applies to various kinds of debt, including student loans, personal loans, and credit card debt.

Deadline To Sue a Collector for FDCPA Violations

Again, if a debt collector is violating these rules while attempting to collect money from you, you can exercise your rights under the FDCPA by suing them. To do this, you must sue them before the deadline, called a statute of limitations, passes. If you miss this deadline, you’ll lose your right to sue the collector for their violations. Under the FDCPA, you have one year to file a lawsuit for FDCPA violations.

How To File a Lawsuit Against Your Debt Collectors

You can file an FDCPA lawsuit in either state or federal court. Consumer protection laws also exist at the state level, so you may consider filing your complaint in state court since they’ll have more experience applying state law. Even if you do file in state court, you’ll still be able to bring your FDCPA claims.

On the other hand, federal courts will most likely be more familiar with the FDCPA since it’s a federal law. For this reason, you may choose to file in federal court. And, even if you choose state court, the collection agency may request that the lawsuit be moved to federal court. This can happen because even though state courts can hear cases on federal law, federal courts have the right to take cases that interpret federal law away from state courts.

Do you need a lawyer?

Legally speaking, you don’t need to hire a lawyer to represent yourself in court against a debt collector. However, hiring a lawyer can provide some great advantages.

First, lawyers are legally trained professionals who know the ins and outs of court proceedings. They’ll be able to handle the paperwork and communications that typically cause debtors a lot of stress in the process. Most importantly, they’ll be able to give you expert legal advice as you navigate the lawsuit.

Second, even if you don’t have a lot of money, some lawyers offer their clients representation on what’s called a contingency fee basis. Under this type of arrangement, a lawyer does not charge their clients any money out of pocket. Instead, they only get paid if their client wins. Typically, they’ll take a percentage of the money awarded to their client as payment.

If you’re considering hiring a lawyer, you’ll want to find a lawyer who has the right experience to represent you in an FDCPA lawsuit. So, you’ll want to search for a lawyer who has experience suing debt collectors under the FDCPA. These lawyers are often called consumer debt lawyers, debt collection lawyers, or debt collection harassment lawyers.

What You Can Recover From an FDCPA Lawsuit

By filing a lawsuit against a debt collector for violating the FDCPA, you can recover money in the form of damages. That is, if you win your lawsuit, the debt collection agency will have to pay for any of the following:

Medical bills

Lost wages

Emotional distress

Wage garnishments that were collected because of the collector’s violations

Other monetary losses you suffered because of the debt collector’s FDCPA violations

You can also be awarded up to $1,000 in statutory damages and money for attorney’s fees and court costs.

Upsolve Member Experiences

1,760+ Members OnlineThings That Will Help Set You Up for a Successful Lawsuit

If you’re preparing to sue a debt collection agency for FDCPA violations, there are some important steps you can take to set you up for a successful lawsuit:

Keep good records of every contact with the debt collection agency. Keep all mail, emails, and text messages they send you. Also, keep a record of your calls with them and take notes about what was said during those calls. Depending on the phone recording laws in your state, you may be able to present recorded phone calls to the court as evidence.

Use certified mail for written communications you send to the collection agency. You can request this option at your local United States Post Office.

Take photos of all written communications and screenshots of any relevant information you have on your cell phone and save them in a folder on your computer or in a safe cloud storage location. This way, if you lose any letters or your phone, you’ll still have evidence like text messages.

What an FDCPA Lawsuit Can’t Solve

Although suing your debt collector for FDCPA violations will help you recover damages, there are things that a lawsuit can’t do.

First, winning your FDCPA lawsuit will not erase your debt. You’ll still have to pay it back as long as it’s not old debt. If you don’t pay the debt, the lender can sue you to recover the debt. Through this kind of lawsuit, they can request the court for an order allowing them to garnish your paycheck or seize your assets, like the money in your bank account.

Also, the FDCPA doesn’t apply to the original creditor (the original lender) who gave you the money that you now owe. The FDCPA protects you only from third-party debt collection agencies. So, even if your original credit card company, student loan lender, auto lender, or other lender engages in behavior that would violate the FDCPA, you still can’t sue them for violations of the FDCPA. This is understandably frustrating, but there are laws in some states that prohibit original creditors from harassing debtors while trying to collect on a debt. If your state has such a law, you can sue under that law.

Other Ways to Stop Harassment From Debt Collection Agencies

If you don’t want to take direct legal action against the collection agency that’s harassing you, there are other ways to stop them.

Report it to a federal government agency

You can report their abusive practices by filing complaints with the Federal Trade Commission (FTC), which is charged with enforcing the FDCPA. You can also report their practices to the Consumer Financial Protection Bureau (CFPB). Although the FTC and the CFPB are independent federal government agencies, they have an agreement called memorandum of understanding to help them coordinate enforcement of the FDCPA.

Report it to the state attorney general

You can also report the debt collection agency’s behavior to the state attorney general. Attorneys general are the leading legal officers in their respective states, and they have the power to enforce the state’s laws, including state consumer protection laws.

File for bankruptcy

Another way to stop collection agencies from calling you is by declaring bankruptcy. This may be a good choice for you, depending on your financial situation and the amount of debt you have. There are two types of bankruptcy you can file: Chapter 7 bankruptcy and Chapter 13 bankruptcy.

Chapter 7 bankruptcy will allow you to discharge certain debts to help you start over, while

Chapter 13 will help you create a repayment plan to pay off your debt over a period of about five years. Both forms will stop collection calls.

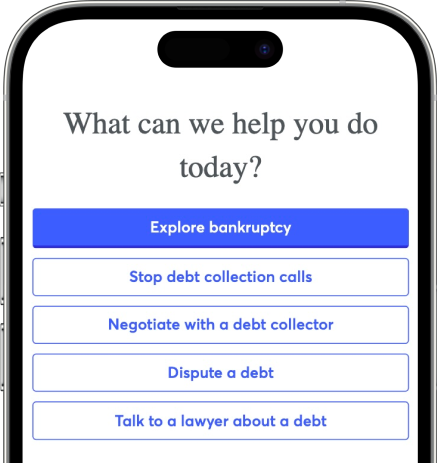

If you’re considering bankruptcy, Upsolve can help you file for Chapter 7 bankruptcy for free. Use our screener to see if you qualify. Even if you don’t qualify, we can connect you with a lawyer to get a free bankruptcy evaluation.

Let’s Summarize...

When Congress passed the Fair Debt Collection Practices Act, it gave individual consumers the right to sue and win damages when debt collectors violated the law. If you plan on asserting your rights by suing a debt collector under the FDCPA, remember that keeping records of unlawful behavior and staying organized will give you the best chance of success.

Unfortunately, this doesn’t solve the problem of the debt itself. If you need help with debt relief, you have options, including filing for bankruptcy. Through bankruptcy, you may be able to have some of your debt forgiven.