When Debt Collectors Break The Law: FDCPA Violations

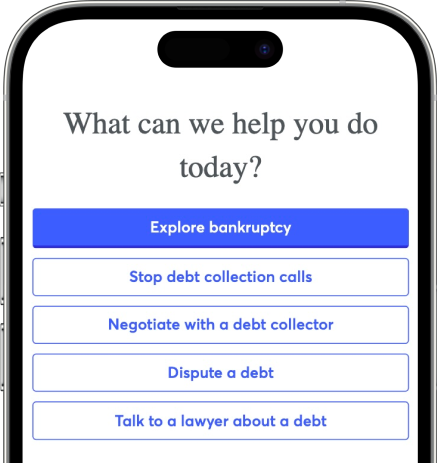

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

The FDCPA is a federal law that protects debtors by preventing third-party debt collectors from engaging in harassment or unfair activities while trying to collect money. Here’s a list of the six most common violations of the FDCPA: - Attempting to collect debts you don’t owe - Sending written notifications with insufficient information about the debt - Taking or threatening to take legal action or other negative actions - Making false statements or misrepresenting themselves or the debt - Engaging in harassment (usually with repeated calls) or using abusive language - Threatening to contact a third party about your debt (such as a friend, family member, or employer) or to otherwise improperly share information about your debt publicly

Written by Natasha Wiebusch, J.D.. Legally reviewed by Attorney Paige Hooper

Updated April 12, 2024

What Is the Purpose of the Fair Debt Collection Practices Act (FDCPA)?

The FDCPA is a federal law that prevents third-party debt collectors from engaging in harassment, deceptive practices, or unfair debt collection techniques.

The purpose of the FDCPA is to protect consumers from being abused or treated unfairly by debt collectors. It applies to consumer debts like credit card debt or medical bills. It does not apply to business debt.

Importantly, the FDCPA is targeted at third-party debt collectors. It generally doesn’t apply to original creditors (the person or business to whom you originally owed the debt).

The Consumer Financial Protection Bureau (CFPB) helps oversee and enforce the FDCPA. The CFPB fields complaints about FDCPA violations and helps consumers resolve issues with debt collectors who violate the law.

Fast Fact: The CFPB’s most recent data shows consumers filed almost 122,000 debt collection complaints (in 2021).[1]

What Are the Most Common FDCPA Violations?

Here is a list of the six most common FDCPA violations, according to the Consumer Financial Protection Bureau’s 2022 report:

Debt collectors attempting to collect debts you don’t owe

Debt collectors sending written notifications that have insufficient information about the debt

Debt collectors taking or threatening to take legal action or another type of negative action

Debt collectors making false statements or misrepresentations about themselves or the debt

Debt collectors engaging in harassment (usually with repeated calls) or using abusive language

Debt collectors threatening to contact a third party about your debt (such as a friend, family member, or employer) or otherwise improperly share information about your debt publicly

Look out for these FDCPA violations and report debt collectors who engage in these practices.

FDCPA Violation #1: An Attempt To Collect Debts You Don’t Owe

This was the number one complaint the CFPB received in 2021. In fact, 56% of the CFPB’s debt collection complaints were related to debt collectors attempting to collect on a debt the consumer didn’t owe.

Here are some reasons people get contacted about debts they don’t actually owe:

The debt was a result of identity theft.

The debt collector misidentified the debtor.

The debt was already paid off.

The debt was discharged in bankruptcy.

If you receive calls or other communications from a collection agency demanding payment on a debt, verify, verify, verify. Also, check your credit report regularly! If you see a debt or a charge-off to collections that you don’t recognize, do your research and dispute the debt if you don’t owe it.

FDCPA Violation #2: Insufficient Information on Written Notification About Debt

This is the second-most common FDCPA violation complaint. Under the FDCPA, debt collectors must provide you with a written notification (often called a validation notice) of the debt either before contacting you or within five days after first contacting you. This notice must also advise you of your legal right to dispute the debt within 30 days.

Of these complaints, 25% of people said they never received information regarding their legal right to dispute the debt. 75% of people said the written notice they received was “vague” and didn’t include enough information for the consumer to verify the debt.

If you receive a vague notice, know your rights and take action as soon as possible. You can always send a debt verification letter requesting more detailed information on the debt, including the name of the original creditor, the alleged amount owed, and other details. If the details of the debt are incorrect, dispute it.

FDCPA Violation #3: Threats To Take Legal Action or Other Negative Actions (That Aren’t Allowed by Law)

Under the FDCPA, debt collectors can’t threaten consumers with illegal actions. Here are some red flags that indicate the debt collector may be breaking the law:

Threats about damage to your credit

Threats to sue on an old debt (an old debt is one that is past the statute of limitations)

Attempts to sue without proper notification

Threats or attempts to illegally seize your property

Threats to arrest or jail consumers

Threats to garnish exempt funds like child support or unemployment benefits

Does the FDCPA Cover the Statute of Limitations?

The statute of limitations is a law that establishes the deadline for a creditor or debt collector to sue you for an unpaid debt. Each state has its own statutes of limitations. Since these laws vary by state, it’s important to understand what protections you have under your state’s laws.

Here’s where things get tricky: After the statute of limitations passes, the debt is considered time-barred. This means that debt collectors can no longer sue you to collect the debt. It does not mean you no longer owe the debt.

Because you still owe the debt, the FDCPA doesn’t prohibit debt collectors from trying to collect on a debt that is time-barred or past the statute of limitations for debt in your state.

It’s important to know what the statute of limitations is for your debt. If a debt collector threatens to sue you for a time-barred debt, they are likely committing an FDCPA violation. In some states, the debt collector must tell you if the statute of limitations has expired.

FDCPA Violation #4: False Statements or Misrepresentation

Under the FDCPA, debt collectors must disclose who they are and what debt they’re trying to collect. They can’t make false statements, misrepresent themselves, or misrepresent any aspect of your debt.

The most common violations reported to the CFPB in this category include:

False representation about the amount of the debt (81%)

Impersonation of an attorney, law enforcement officer, or government official (13%)

Misrepresenting that a consumer is committing a crime by not paying their debt (5%)

FDCPA Violation #5: Unlawful Communication Tactics

Under the FDCPA, a debt collector cannot harass or abuse you while attempting to collect money. The most common complaints the CFPB received in this category were:

Frequent or repeated phone calls

Continued contact after the consumer requested the debt collector stop contacting them

The use of profane language or otherwise obscene or abusive language

Phone calls at unusual times, outside of legal calling hours (generally 8 a.m. to 9 p.m. local time)

FDCPA Violation #6: Threats To Contact Friends, Family, or Others About Your Debt

This was the least common complaint by consumers, but it still happens.

Know your rights!

It is legal for a debt collector to call your friends, family members, or employer, but they’re limited in what they can say. They can ask for your contact information, but they can’t discuss your debt or harass your friends, family, or employer in any way.

Also, if the debt collector knows that you’re represented by an attorney, they must contact your attorney instead of calling you directly.

Finally, if you make a written request for debt collectors or collection companies to stop contacting you, they must comply or they’re breaking the law.

Upsolve Member Experiences

1,739+ Members OnlineHow To Get a Debt Collector To Stop Contacting You

Under the FDCPA, if you send the debt collector a written request to stop all communication with you, the debt collector must honor that request.

Be specific about the ways in which you do not want to be contacted. Debt collectors can legally contact you by phone (at home or at work), by mail, by email, and even via your social media accounts.

You can tell the debt collector to stop calling you if you speak to them on the phone, but be sure to follow up with a written request. Here’s how to write a cease and desist letter. Send the letter via certified mail and keep a copy for your records. This will come in handy if you want to file a complaint or sue the debt collector for violating your request.

Important! You can stop a collection agency from calling you, but that doesn’t get rid of your debt. You have a right not to be harassed by debt collectors, but if you truly owe the debt, it’s usually in your best interest to work out a plan to repay it.

If you’re struggling to pay a debt in collections, explore your debt relief options. You can get a free consultation with a nonprofit credit counselor who can help you understand your options.

What Can You Do if a Debt Collector Violates the FDCPA?

Nobody should have to deal with a debt collector who is violating the FDCPA. Unfortunately, as the statistics from the CFPB above show, it does happen.

If you believe a debt collector is violating the law, start by filing a complaint with the CFPB. You can do this entire process online from the comfort of your home.

The CFPB handles many complaints directly, but if your complaint is outside of its purview, it may send it to the Federal Trade Commission (FTC). The FTC has the right to enforce the FDCPA, and it may take action against the lender based on your complaint.

Can You Sue a Debt Collector for Harassment?

Yes. Under the FDCPA, you have the right to sue debt collectors who violate the FDCPA.

You must file your lawsuit in federal court as opposed to a local or state court. Also, you need to file the complaint within one year of the date that the debt collector violated the law.

Often, debt collectors who violate the FDCPA are also breaking state laws. If a debt collector is violating state law, you can file a complaint with your state attorney general’s office.

Lastly, it’s important to know that even though you can sue a debt collector for abusive debt collection practices, this doesn’t mean you won’t still owe them money. If you’re overwhelmed by debt collection calls but can’t afford to pay your debt, you may want to consider filing for bankruptcy.

What Is the Penalty for Violating the FDCPA?

If you win a lawsuit against a debt collector for violating the FDCPA, the collector could be required to pay actual damages, which is the amount of money you’ve lost.

For example, if the debt collector’s actions caused you to lose wages or pay more on your cell phone bill because they were harassing you with phone calls, they would have to pay you to cover those costs.

The debt collector could also have to pay up to an additional $1,000 in statutory damages, along with possibly paying your attorney’s fees. If you think you might have a case against a debt collection agency, you can usually get a free consultation for legal advice with a debt collection attorney.

Sources:

- Consumer Financial Protection Bureau. (n.d.). Fair Debt Collection Practices Act: CFPB Annual Report 2022 . Annual Report 2022. Retrieved August 3, 2023, from https://s3.amazonaws.com/files.consumerfinance.gov/f/documents/cfpb_fdcpa_annual-report-congress_04-2022.pdf