Guide to Extended Repayment Plans & Managing Student Loans

4 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

An Extended Repayment Plan is a student loan repayment plan that allows borrowers to lower their monthly payment amount by stretching repayment over 25 years. To qualify, you must have Direct Loans or Federal Family Education Loans (FFEL), and your loan balance must be at least $30,000. You can choose from fixed payments or graduated payments in an Extended Repayment Plan. You will not be eligible for Public Service Loan Forgiveness (PSLF) if you enroll in an extended plan.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated September 1, 2023

How Does an Extended Repayment Plan Work?

If you have over $30,000 in Direct Loans or Federal Family Education Loans (FFEL), you can enroll in an Extended Repayment Plan to get a lower monthly payment than you’d have under the Standard Repayment Plan (SRP). Direct Loans are federal loans made by the U.S. Department of Education and FFEL loans are made by private lenders and guaranteed by the federal government.

Enrolling in an Extended Repayment Plan lowers your monthly payment amount by stretching your repayment over 25 years (versus 10 years in the SRP). Eventually, you’ll make 300 total payments, instead of the standard 120. While this reduces your monthly payment amount, you’ll end up paying more in interest over time since your repayment period is several years longer.

You can use the Federal Student Aid loan simulator to determine your eligibility and compare different repayment plan options. You can also contact your student loan servicer directly.

What Loans Qualify for the Extended Repayment Plan?

Not all types of federal student loans qualify for enrollment in an Extended Repayment Plan.

Direct Loans and FFEL loans are eligible, including:

Direct Subsidized Loans

Direct Unsubsidized Loans

Direct PLUS Loans

Direct Consolidation Loans

Subsidized Federal Stafford Loans

Unsubsidized Federal Stafford Loans

FFEL PLUS Loans

FFEL Consolidation Loans

Perkins loans don’t qualify for the Extended Repayment Plan. If you have a Perkins loan and want to enroll in this plan, you can consolidate your loan(s) with a Direct Consolidation Loan. Then you’ll qualify for the plan.

The Pros and Cons of Extended Repayment Plans

Choosing a repayment plan for your student loans isn’t always an easy task! If you’re looking at an extended plan, it’s likely because you don’t qualify for income-based repayment plans.

The biggest upside of the Extended Repayment Plan is that it allows borrowers to lower their monthly payment (compared to a Standard Repayment Plan) when they don’t qualify for other IDR plans.

The biggest downside of an extended plan is that you end up paying more — sometimes thousands of dollars more — over the life of the loan in interest.

What Are the Advantages of an Extended Repayment Plan?

An Extended Repayment Plan may be a great option if you need to lower your monthly payment, but your income is too high to qualify for an Income Based Repayment Plan (IBR).

Extended plans also allow you to choose between fixed or graduated monthly payments. A fixed payment is exactly as it sounds: It remains the same over the repayment period. A graduated payment starts lower and increases incrementally as you earn more money. This option is called an Extended Graduated Plan.

Extended Repayment Plan vs Graduated Extended Repayment Plan

Graduated Repayment Plans, Extended Repayment Plans, and Extended Graduated Plans are often lumped together when talking about federal student loan repayment plans. But there are some meaningful differences.

A Graduated Repayment Plan has a 10-year repayment term. It’s like the Standard Repayment Plan except the initial payments start lower and increase every two years under the graduated plan.

An Extended Graduated Repayment Plan has a 25-year repayment term. Payments start lower and increase every two years.

An Extended Repayment Plan has a 25-year repayment term. The monthly payment amount doesn’t change.

No matter which you choose, after making all of your minimum payments your loan balance will be paid in full.

What Are the Disadvantages of an Extended Repayment Plan?

The biggest disadvantage of an Extended Repayment Plan is the cost. You end up paying more in interest than you would under other payment plans.

There’s an inherent trade-off between your monthly payment and how much you pay in interest over time. You usually get lower monthly payments by increasing your repayment period. This means more interest paid over time. If you repay your loan in a shorter time period, you’ll have higher monthly payments but pay less in interest paid.

With an extended plan, interest has more time to accrue, so you end up paying more over the life of the loan than you would under the Standard Repayment Plan.

Also, payments made under the Extended Repayment Plan are not considered qualifying payments for Public Student Loan Forgiveness (PSLF). You must be enrolled in an income-driven repayment plan to qualify for PSLF.

Upsolve Member Experiences

1,739+ Members OnlineWhat Are Some Other Student Loan Repayment Options?

If the Extended Repayment Plan isn’t right for you, there are other ways to tackle student debt. Before committing to a repayment plan you should explore all your options.

Standard Repayment Plan

All borrowers default to the Standard Repayment Plan (SRP) unless they choose a different plan. Participating in the SRP is the fastest way to repay your loans. It has a 10-year loan term. This usually results in the highest monthly payment of any plan type, but it also means you’ll pay the least in interest over time.

Income Driven Repayment Plans

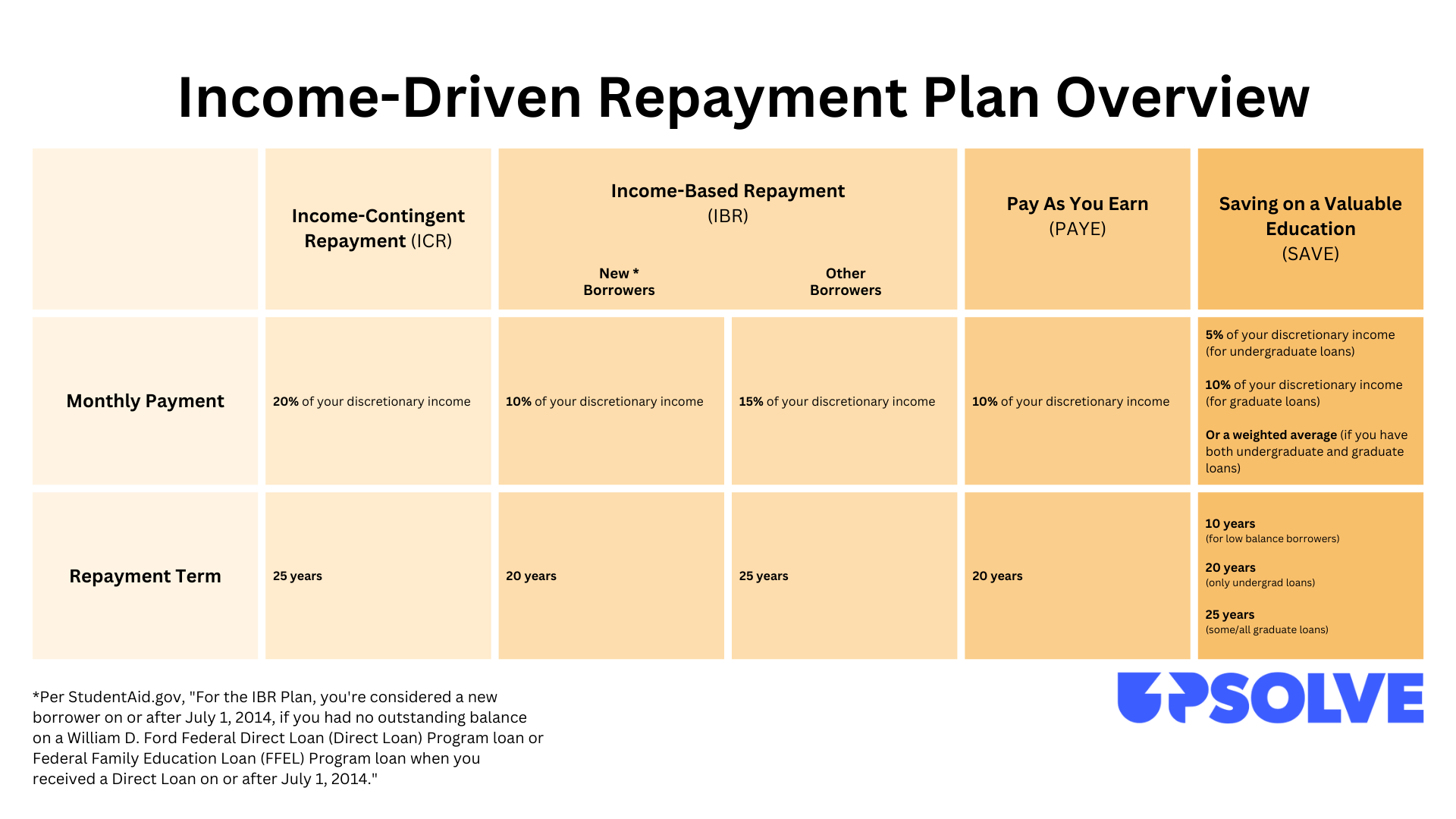

If you have federal student loan debt from Direct Loans or FFEL loans, you may qualify for an Income Driven Repayment (IDR) plan. IDR plans include:

Income-Based Repayment (IBR)

Income-Contingent Repayment (ICR)

Pay As You Earn (PAYE)

Saving on a Valuable Education (SAVE)

Formerly the Revised Pay as You Earn (REPAYE) Plan

Under these plans you make payments equivalent to 10%–20% of your discretionary income (calculated based on income, family size, and local poverty level.)

Here’s an overview of these plans:

If you are seeking student loan forgiveness through the PSLF, you’ll need to be enrolled in an income-driven repayment plan.

Public Service Loan Forgiveness

If you work for a government, non-profit, school district, or other qualifying employer, you may be able to have your loans discharged under the Public Service Loan Forgiveness (PSLF) program. You must make 10 years of qualifying payments and submit information annually to prove eligibility. After 10 years, any remaining balance on your loans will be forgiven.

Help! I’m Still Having Trouble Paying My Student Loan Debt

Managing student loan debt can feel overwhelming. If you’ve tried changing your repayment plan, applying for forbearance or deferment, and other ways of managing your student loans, but you’re still struggling to repay your debt, you may want to consider filing bankruptcy. If you’re eligible, you can discharge your student loan debt through bankruptcy.

Want to see if you meet the eligibility requirements for bankruptcy? Complete our student loan screener to see if you can join the thousand of people Upsolve has helped to get a fresh start! It just takes five minutes to get started, and our services are always free.