Can You File Bankruptcy on Student Loans? Yes. Here's How.

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you're eligible, you may be able to get certain federal student loans discharged through Chapter 7 or Chapter 13 bankruptcy. After you file your bankruptcy case, you must take an additional step to start an adversary proceeding to have your loans discharged. In recent years, this process has been streamlined, and many filers with federal student loan debt have been able to do this on their own without hiring a lawyer to help. Only federal Direct Loans or Direct Consolidation Loans held by the Department of Education can be discharged through bankruptcy. Also, you must be able to show that you are unable to make payments but have made a good faith effort to do so in past years.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated June 9, 2025

Table of Contents

Key Takeaways

You can get rid of federal student loans in bankruptcy.

Thanks to updated guidance from the Department of Justice (DOJ) and Department of Education, more borrowers are now successfully discharging their federal student loans through bankruptcy.

Only certain federal loans qualify.

Right now, only Direct Loans and Direct Consolidation Loans held by the U.S. Department of Education are eligible. Private student loans generally aren’t dischargeable through bankruptcy.

You must meet the “undue hardship” standard.

This means showing that you can’t afford to repay your loans now, your financial hardship is likely to continue, and you’ve made a good faith effort to repay them.

There’s an extra step after you file your bankruptcy case.

To get student loans discharged, you need to file an adversary complaint and complete an attestation form that outlines your income, expenses, and payment history.

Success rates are higher than ever.

As of mid-2024, 98% of court decisions under the new process have granted full or partial student loan discharges, giving hope to borrowers who may have felt stuck before.

Can Filing Bankruptcy Help You Get Rid of Student Loan Debt?

✅ Yes, if you meet the eligibility requirements, bankruptcy may help you wipe out some or all of your federal student loan debt.

‼️ You can’t erase private student debt in bankruptcy.

To get your federal student loans discharged, start by making sure you’re eligible to file a personal bankruptcy case. This could be either Chapter 7 or Chapter 13, depending on your financial situation and goals.

Then, make sure your loans qualify.

Finally, see if you meet the undue hardship standard for discharging student loans through bankruptcy.

Step 1: See if You Qualify To File Bankruptcy

If you’re thinking about filing bankruptcy to get a fresh start, start by considering your whole financial situation, including:

What types of debt you have

Whether you own any assets — like a car, home, or retirement accounts

🔎 You may also want to research other debt relief options to make sure bankruptcy is the best fit for you.

To see if you’re eligible for Chapter 7 bankruptcy, you’ll need to know your income and expenses for the means test. This is a test that all Chapter 7 bankruptcy filers must pass to prove they are eligible to file.

If you don’t pass the means test, you may still be able to file bankruptcy, but you might need to look into Chapter 13.

✨ Take Upsolve’s two-minute screener to see if you’re eligible to use our free filing app to file Chapter 7 bankruptcy.

Step 2: See if Your Student Loans Qualify

You’ll also want to look at what type of student loans you have.

👉 Currently, only Federal Direct Loans and/or Direct Consolidated Loans held by the U.S. Department of Education are eligible for a bankruptcy discharge under the new guidance.

If you aren’t sure what type of loans you have, you can get that information from the National Student Loan Data System (NSLDS). The NSLDS can provide you with a report on all federal student aid you’ve received.

Perkins Loans, FFEL/FFELP loans, and private student loans aren’t currently eligible to be discharged through bankruptcy. In some cases, you can file bankruptcy on these and private student loans, but the process will look different.

💡To learn more, read our article Can I Discharge a Private Student Loan in Bankruptcy?

Step 3: Understanding the Undue Hardship Requirement

To discharge your federal student loans in bankruptcy, you’ll have to meet the undue hardship requirement.

Courts assume that repaying your student loans would cause undue hardship when you:

Can demonstrate that you don’t currently have the financial ability to make the monthly payments on your federal loans while maintaining a minimal standard of living

Can demonstrate that this inability to pay your loans is likely to continue in the future

Have made a good faith effort to repay your loans

💡 These three elements make up what’s often called the Brunner test.

In the past, bankruptcy law hasn’t clearly defined how filers can demonstrate their inability to pay or that they’ve made a good faith effort to do so. But the 2022 DOJ guidelines help bankruptcy judges interpret the Bankruptcy Code more uniformly by further defining these elements of the Brunner test. You can read more about each of these below in our section on the attestation form.

✨ You can use Upsolve’s free screener to see if you’re eligible to prepare your student loan bankruptcy paperwork for free. It only takes a few minutes to see if you qualify. Upsolve has helped individuals get rid of over $750 million in debt and over $2 million in student loan debt specifically.

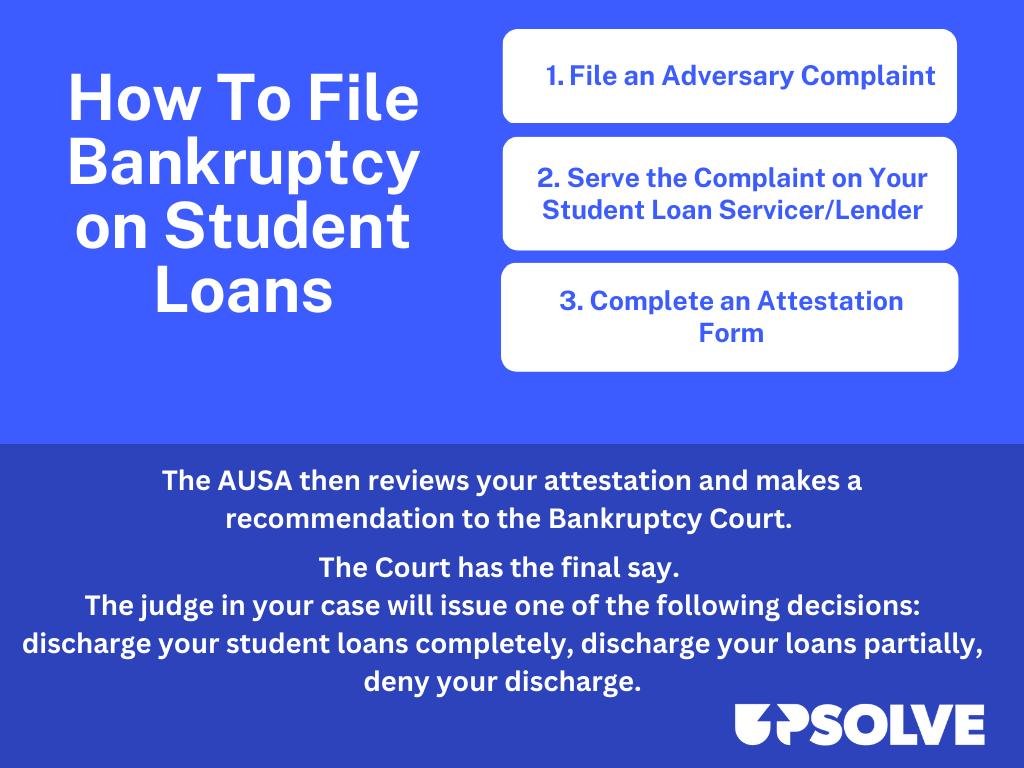

How To File Student Loan Bankruptcy in 3 Steps

Let’s lay out the steps to getting your student loans discharged in bankruptcy.

👀 To keep things concise, we’ll assume you’re already familiar with how to file a bankruptcy case. If not, read our popular article How to File Bankruptcy for Free first.

Here's a visual summary of the process.

Assuming you’ve filed your bankruptcy case, here are the basic steps to get a student loan discharge.

Step 1: File an Adversary Complaint

An adversary complaint initiates the adversary proceeding, which is the first step to discharging your student loans in bankruptcy.

📃 You initiate the adversary proceeding by filing a complaint with the court clerk. A complaint is a formal legal document.

Depending on which district you’re in, you may be able to file your complaint electronically. If you don’t file it electronically, you’ll need to submit it with a cover letter, which the court provides as a PDF form.

👉 If you qualify to file your case with Upsolve, our nonprofit will help you prepare this complaint paperwork.

Important: Include Your NSLDS Report With Your Adversary Complaint!

You must include a complete list of your student loans along with your adversary complaint. To get this list, you can download a report from the NSLDS.

🌐 Here’s an article detailing exactly how to do that: How To Use the National Student Loan Data System (NSLDS).

The Assistant United States Attorney (AUSA) will represent the U.S. Department of Education in the proceeding. The AUSA will review the adversary complaint and your attestation form.

Step 2: Serve the Complaint on Your Student Loan Servicer or Lender

After you file the complaint with the court, you must “serve” the complaint to the defendants you named — your federal student loan lender(s) — and send a copy to certain parties in the bankruptcy case.

💡 Serving the complaint simply means sending a copy by mail or delivering it in person. The point is to let the defendant — your lender — know about the adversary proceeding. You’ll also need to make sure to serve the AUSA with a summons and complaint.

✅ Generally speaking, student loan bankruptcy filers will send the complaint to the following four parties:

The U.S. Attorney of the Bankruptcy Filing District

The Attorney General of the United States, DOJ

The student loan servicer (i.e., the Department of Education)

The U.S. Trustee of the Bankruptcy Filing District

Step 3: Complete the Attestation Form

📃 Next, you’ll fill out an attestation form. This is the form that will be used to determine if you meet the undue hardship requirements. There are several main parts to this form as covered below. 👇

The Attestation Form: Income and Expense Information

The form begins by asking basic questions to gather some personal financial information, including:

Income information, such as your household gross income, unemployment benefit payments, and Social Security payments

Expense information, such as your basic living expenses, uninsured medical costs, payroll deductions, housing costs, transportation costs, and other necessary expenses, such as child care

What you’ll need to answer these questions: It’s helpful to gather recent paystubs, bank statements, and unemployment or Social Security paperwork (if applicable) to help you fill out the income portion of this form.

💰 For the expenses, gather recent bills, including medical bills, insurance payments, your paystub (to see deductions), recent transportation bills and receipts (including for maintenance and gas).

🧾 If you use a credit card or debit card to pay your expenses, you can look at your recent transaction history to capture expenses that you may not keep receipts for, like groceries, housekeeping supplies, apparel, personal care products, gas for your car, or public transportation costs.

👶 Be sure to include expense information for your dependents as well.

The Attestation Form: Information on Your Present Ability To Pay Your Student Loan Debt

The rest of the form asks for information related to the undue hardship standard by asking about your income and expenses.

There’s a pretty simple formula to determine your ability (or inability) to make your monthly student loan debt payment: your gross income minus your allowed expenses. These expenses are detailed on the attestation form starting on page 5.

You’ll tally your gross income and allowed expenses on your attestation form. If you run these numbers through the formula and it shows there is $0 remaining each month, this shows an inability to pay your student loan debt.

💡 If you have some income remaining, you may still be able to have some of your debt discharged. The AUSA will look at your loan payment to determine if you qualify for a partial discharge.

The Attestation Form: Information on Your Future Inability To Pay Your Student Loan Debt

The attestation form will ask you a series of questions to get a sense of whether you’ll be able to repay your student loan debt in the future.

The AUSA can presume you will not be able to repay your loans in the future if you meet any of the following criteria:

Are 65 or older

Have a disability or chronic injury that impacts your ability to work

Have been unemployed for five or more years in the last decade

Didn’t get a degree that the loan was meant to finance

🗓️ The AUSA can also presume an inability to pay if your loan has been in repayment status for 10 years or more.

These presumptions provide a more straightforward case to the AUSA, but they aren’t the only way to show an inability to pay. If your reason falls outside these presumptions, you can explain it in the space provided on the attestation form.

The Attestation Form: Information Showing a Good Faith Attempt at Repayment

The next portion of the attestation form helps the bankruptcy court determine whether you’ve made a good faith effort at student loan repayment.

The DOJ cites several examples of evidence of good faith. To demonstrate good faith, you need to demonstrate that you’ve done one or more of the following:

Made at least one student loan payment

Applied for or been approved for deferment or forbearance

Applied for or enrolled in an income-driven repayment plan

Applied for or received a federal consolidation loan

Contacted the loan servicer/lender or responded to a contact from the loan servicer or a collector regarding their repayment options

Contacted a third-party organization whose goal was to help the borrower manage their student loan debt

To demonstrate good faith, you must also show you’ve made an effort to work or find work and to maximize your income while minimizing expenses. Essentially, filers must show they have managed their debts and finances responsibly given their circumstances.

Step 4: The AUSA Makes Its Recommendation to the Bankruptcy Court

The AUSA will review your attestation form to assess whether they believe the undue hardship standard has been met. Then, the ASUA makes a recommendation to the bankruptcy court handling the case.

The DOJ guidance notes that this recommendation “is not binding on the bankruptcy court.” Though, the court will use this information to determine whether or not to discharge all or a portion of the filer’s student loan debt.

⚠️ It’s common for AUSAs to request extensions to review a filer’s paperwork. These extensions may last weeks or even months. Though the wait can be frustrating, it’s often seen as a routine part of the process, and many filers choose to agree to these requests.

Step 5: The Bankruptcy Court Issues a Decision

The judge in your case may decide to hold a hearing on your request. (Many are being held virtually.)

If so, it’s a good idea to attend the hearing so you can answer any questions the judge may have and so you can then hear the judge’s decision.

If you don’t agree with the judge’s decision, you can appeal the decision.

Why Did the DOJ Issue New Guidance for Bankruptcy and Student Loans?

The DOJ’s guidelines are part of a broader set of efforts to address the $1.6 trillion in student debt in this country. Though the new DOJ guidelines could have a significant impact on student loan borrowers, they didn’t garner as much media attention as other student debt relief measures like the student loan repayment pause and Biden’s student loan forgiveness proposal.

But for the many thousands of student loan borrowers who do opt to file bankruptcy, clarifying and simplifying the student loan discharge process could be life-changing.

Federal Student Loan Relief: Alternatives to Bankruptcy for Managing Debt

If you’re struggling with student loans, there are options to manage your debt without filing for bankruptcy. Federal government programs and other solutions can help make payments more affordable and provide long-term relief.

Income-driven repayment plans (IDRs): These plans lower your monthly payments based on your income and family size. After 20–25 years of qualifying payments, the remaining balance may be forgiven. Keep in mind, forgiven amounts could be taxable.

Loan forgiveness programs: Programs like Public Service Loan Forgiveness (PSLF) forgive loans for borrowers working in qualifying public service jobs after 10 years of payments. Other forgiveness options exist for teachers, healthcare workers, and military personnel.

Loan consolidation: Combining multiple federal loans into one can simplify payments and open up new repayment options. However, it may increase the total interest paid over time.

Deferment or forbearance: These options let you temporarily pause payments during financial hardship. Interest may still accrue, especially with forbearance, so they’re best used as short-term fixes.

Refinancing (private loans): Refinancing can lower your interest rate but comes with risks. For federal loans, refinancing into private loans means losing federal benefits like income-driven plans and forgiveness options.

These solutions can help make student loan debt more manageable.