What’s the Best Student Loan Repayment Plan for Me?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

The best student loan repayment plan is the one that works for you, your goals, and your financial situation. To figure out your best option, do your research and consider the pros and cons of each plan. (Hint: Consider whether the monthly payment will be affordable and also how much interest you’ll pay over the life of the loan.) Then sign up for the plan that makes the most sense for you. The good news is that the federal government provides a lot of flexibility to borrowers, and you can change your repayment plan anytime. There are four types of federal student loan repayment plans. Most borrowers stick with the 10-year Standard Repayment Plan or choose an income-driven repayment plan. Though they are less common, Graduated Repayment Plans or Extended Repayment Plans offer a smart option for some borrowers.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated January 30, 2025

Table of Contents

- Federal Student Loan Repayment Options

- Which Student Loan Repayment Plan Should You Enroll In?

- What Is the Standard Repayment Plan (SRP) and What Are the Pros and Cons?

- What Is the Graduated Repayment Plan and What Are Its Pros and Cons?

- What Is an Income-Driven Repayment Plan and What Are the Pros and Cons?

- Help! I Still Can’t Pay My Student Loans. What Are My Options?

Repayment plans are not one-size-fits-all. To figure out which one fits you best, consider your annual income, how much debt you have, your family size, and your current financial situation.

Knowing the key differences, benefits, and financial impact of each federal student loan repayment program can empower you to make a choice that’s tailored to your situation.

The bottom line is, you have options! Let’s explore them now.

Federal Student Loan Repayment Options

There are four types of repayment options for federal loans. Here’s a quick summary before we dig into the details of each plan:

Standard Repayment Plan: The default plan with a 10-year repayment period that borrowers are automatically enrolled in unless they choose a different plan

Income-Driven Repayment Plans: IDR plans are based on the borrower’s income and family size; there are four main programs:

Income-Based Repayment (IBR) Plans

Income-Contingent Repayment (ICR) Plans

Pay As You Earn (PAYE) Plans

Saving on a Valuable Education (SAVE) Plan

Formerly the Revised Pay As You Earn (REPAYE) Plan

Graduated Repayment Plan: Payments increase every two years of the loan’s 10-year repayment period

Extended Repayment Plan: Payments increase every two years of the loan’s 25-year repayment period

Which Student Loan Repayment Plan Should You Enroll In?

It depends on the state of your finances and your main goal. Which of the following do you identify with most:

I want the lowest monthly payment possible.

I want to pay the least interest possible.

I want to enroll in whatever plan qualifies me for Public Service Loan Forgiveness (PSLF) or another forgiveness plan.

Jump to the section to learn about your best options. We’ll look at the pros and cons of different plans later on.

I Want the Lowest Monthly Payment Possible

If you’re trying to get the lowest monthly payment possible, you have two options, depending on your income.

If your income is too low to be able to afford the monthly payment under the Standard Repayment Plan, start by looking at income-driven repayment options.

If you make enough income that you can afford the monthly payment under the Standard Repayment Plan but don’t want to make a payment that high, start by looking at a Graduated Repayment Plan.

Most borrowers find themselves in the first situation: They can’t afford to pay what’s required under the Standard Repayment Plan because they don’t make a lot of income.

I Want To Pay Off My Loans as Fast and Cheaply as Possible

If your main goal is to pay off your loans fast so you don’t have to pay a lot of extra money toward accumulated interest, stick with the Standard Repayment Plan. The SRP has the shortest repayment period of all the federal repayment plans — 10 years.

If you’re really committed to tackling your student loan debt and you can afford it, pay more toward your principal balance each month or put a chunk of “found” money toward your principal as it comes in. For example, some people use all or some of their state or federal income tax refund money to make extra payments on student loans.

I Want To Enroll in a Repayment Plan That Is Eligible for Student Loan Forgiveness

PSLF is the most popular forgiveness program and, unfortunately, it’s also one of the most cumbersome for borrowers to understand. If you want to qualify for Public Service Loan Forgiveness (PSLF), you’re required to enroll in an income-driven repayment plan. You also have to work for a qualifying employer. Learn more in our Ultimate Guide to PSLF.

There are other types of student loan forgiveness that may have their own eligibility requirements.

What Is the Standard Repayment Plan (SRP) and What Are the Pros and Cons?

After you graduate or leave school, you get a six-month grace period, during which you don’t have to make student loan payments. After that, federal student loans automatically enter into the Standard Repayment Plan unless you choose a different payment plan.

The Standard Repayment Plan requires you to make fixed monthly payments for 10 years. Every borrower is eligible for the SRP, and you don’t need to apply to get on this plan unless you previously changed your repayment plan and want to re-enter the SRP.

The main upsides to the SRP are that you’ll pay your loan off in just 10 years and you’ll pay the least in interest of any plan. Another benefit: Since your loans are put automatically into the Standard Repayment Plan after you graduate, you don’t have to make an extra effort to change your plan.

The main downside to the SRP is that you’ll have the highest monthly payment of any repayment plan. This may not be a con if you can afford it! But if you can’t afford it, you risk missing or falling behind on payments, which comes with serious consequences (luckily, you can apply for a new plan or request a forbearance or deferment if you can’t afford the SRP payments).

What Is the Graduated Repayment Plan and What Are Its Pros and Cons?

All borrowers are eligible for the Graduated Repayment Plan. Unlike the Standard Repayment Plan, your monthly student loan payments will increase over time. Your monthly payments will start lower at first and then increase every two years. This payment plan will ensure that your federal student loans are paid off within 10 years or within 10 to 30 years for consolidated loans.

Federal student loans eligible for the Graduated Repayment Plan include:

Direct subsidized and unsubsidized loans

Subsidized and unsubsidized federal Stafford loans

All PLUS loans

All consolidation loans — Direct or Federal Family Education Loans (FFEL)

Like the Standard Repayment Plan, this is not ideal for those seeking Public Service Loan Forgiveness because it is generally not a qualifying repayment plan for PSLF.

Here, borrowers will pay more over the life of the loan because of higher accruing interest in the initial years when monthly payments are lower.

Extended Repayment Plan for Federal Student Loans

Borrowers will be eligible for the Extended Repayment Plan if they have one of the following loans:

Direct Loans* (subsidized and unsubsidized)

Federal Stafford loans (subsidized and unsubsidized)

PLUS loans (any)

Direct Consolidation Loans or Consolidated FFEL loans

*If you are a Direct Loan borrower, you must have more than $30,000 in outstanding Direct Loans to qualify for the Extended Repayment Plan.

Under this plan, your federal student loan monthly payments will be lower than with both the Standard and Graduated Repayment plans. However, since the loans are paid off within 25 years, you will pay more over the life of the loan.

Borrowers can choose to have fixed monthly payments (meaning the payment amount remains the same for the 25-year term). Or borrowers can choose to start with a lower monthly payment at the beginning of the repayment plan, which increases as the loan progresses.

What Is an Income-Driven Repayment Plan and What Are the Pros and Cons?

While there are four different types of income-driven repayment plans, they all have a few things in common:

Your monthly payment is tied to your income and family size, and you must recertify this information annually, even if nothing has changed.

After you make payments for the full loan term (which varies by the plan type), you are eligible to have any remaining balance forgiven.

Your monthly payment amount will always be lower under an IDR plan than it would be under the 10-year Standard Repayment Plan.

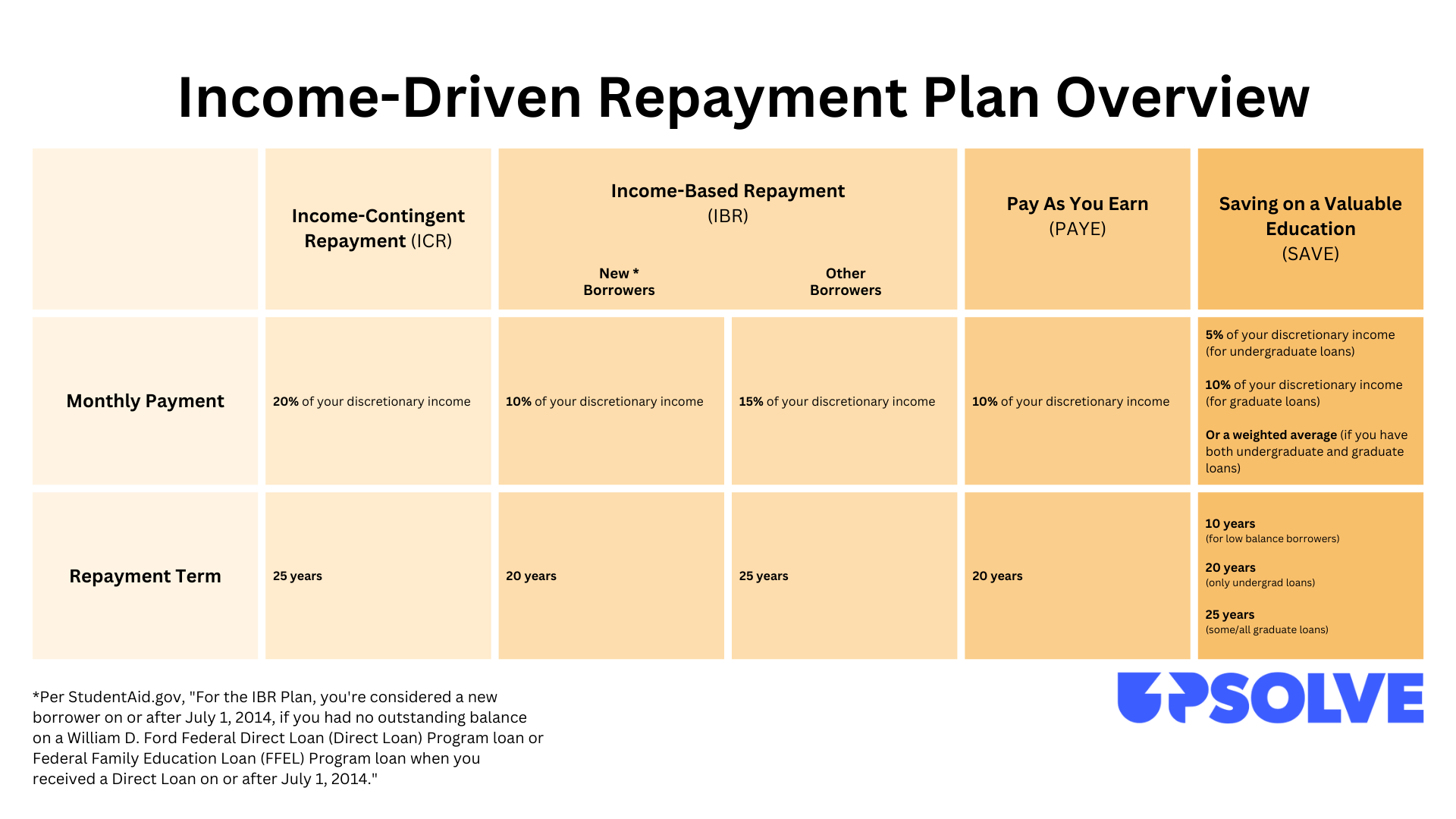

Here’s a quick overview of the different IDR plans by monthly payment and repayment term.

Income-Based Repayment Plan (IBR Plan)

To be eligible for an Income-Based Repayment Plan, you must have high debt relative to your income. Your monthly payments will either be 10% or 15% of your discretionary income, depending on when you first took out your loan. Your repayment period will be 20 or 25 years, again depending on when you received your first federal student loans.

Income-Contingent Repayment Plan (ICR Plan)

If you have a Direct Loan (subsidized or unsubsidized), Direct PLUS loan (made to students), or a Direct Consolidation Loan, you are eligible for the Income-Contingent Repayment Plan.

Your monthly payments will be either 20% of your discretionary income OR the amount you would pay on a fixed payment plan over 12 years, adjusted according to your income. If that sounds confusing, it’s because it is! You can speak with your loan servicer to see what your payment would be under this or another IDR plan. They can help you figure out which plan is best for you given the type of loan(s) you have and your income and family size.

This plan may be advantageous to parent borrowers, who do not qualify under the Income-Based Repayment Plan. Parent borrowers can access this plan by consolidating their parent PLUS loan into a Direct Consolidation Loan.

Pay As You Earn Repayment Plan (PAYE) for Federal Student Loans

To qualify for PAYE, you must meet both of the following requirements:

You must be a new federal student loan borrower on or after Oct. 1, 2007.

You must have received a disbursement of a Direct federal student loan on or after Oct. 1, 2011.

The Pay As You Earn (PAYE) Plan calculates monthly payments at 10% of your discretionary income.

Saving on a Valuable Education Plan (SAVE) for Federal Student Loans (Formerly the REPAYE Plan)

The SAVE Plan decreases monthly payments (compared to the previous REPAYE Plan) by increasing the income exemption from 150% to 225% of the poverty line.

Your monthly payment under a SAVE Plan is either 5% of your discretionary income (for undergraduate loans), 10% (for graduate loans), or a weighted average (if you have both undergraduate and graduate loans).

The forgiveness timeline for the SAVE Plan is 10 years (for low balance borrowers*), 20 years (for undergraduate loans), and 25 years (for graduate loans).

* low balance borrowers are borrowers who owe less than $12,000 in federal student loans.

If you are married and file your taxes separately from your partner, The SAVE Plan excludes spousal income.

Do Private Student Loans Qualify for Repayment Plans?

This article focuses on repayment plan options for federal student loan borrowers. These options are standardized because they’re set by the federal government. Private lenders back private student loans, and the lender gets to set the terms of repayment.

If you have private student loans, your repayment plan is spelled out in the loan agreement you signed with the lender when you took out the loan. If you can’t afford the monthly payment for your private loans, you can call the lender to see if they offer any other repayment options. If you qualify, you can refinance your loan and get new loan terms like a lower interest rate or lower monthly payments. To refinance, you usually need a good credit score.

Help! I Still Can’t Pay My Student Loans. What Are My Options?

If you feel like you’ve tried everything to figure out a workable repayment plan but you’re still drowning in student loans or other debt and don’t see relief in sight, you may want to consider bankruptcy.

Bankruptcy is a legal tool created to help people (and businesses) get a financial fresh start. While businesses take advantage of this all the time, people often feel ashamed or embarrassed to file. But we’ve helped thousands of people file Chapter 7 for free, and many of those people say they wish they’d done it sooner. Why? Debt is stressful.

The good news is that you don’t have to continue living with that burden. Yes, even if you have student loans! In fact, the U.S. Department of Justice and Department of Education made new rules in late 2022 to make it easier to erase student loan debt in bankruptcy.

Want to learn more? Read our popular article Yes, You Can File Bankruptcy on Student Loans. Here’s How. If you want to see if you’re a good candidate for bankruptcy, start our free eligibility screener now. It only takes about five minutes to see if we can help.