Repossession Laws in Maine

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Repossession is the process of taking back a car after the owner defaults on their auto loan. Each state has different laws and regulations that dictate every step of the repossession process from start to finish. This page will provide an overview of Maine's Repossession Laws and what you should know if you've fallen behind on car payments.

Written by Upsolve Team.

Updated March 22, 2024

When you finance a motor vehicle, you sign a contract with the lender and promise to make payments until the vehicle is paid off. If you don’t make your payments as agreed, the lender has the right to take the car back. That’s because the lender has a security interest in the loan, and the car is the collateral. In other words, the loan is secured by your car. The process of the lender taking your car back is called repossession.

Maine has laws and regulations that govern debt collection and lay out the procedures the lender must follow for repossession. These laws also establish your rights during the repossession process.

How Many Payments Can I Miss Without Risking a Repossession in Maine?

Maine law states that 10 days after you miss a car payment, the creditor can send you a letter explaining its intention and right to repossess your vehicle. The letter will tell you how much you must pay and when you must pay it to keep your vehicle. If you miss this deadline, your car may be repossessed at any point after that.

Will I Be Notified Before the Repossession? How?

Creditors in Maine mail you a letter 10 days after you miss your car payment. The letter will contain the following:

The name, address, and telephone number of the creditor you need to make the payment to.

A brief identification of the credit transaction, which basically explains the loan you have defaulted on and the car they plan to take back.

The amount you need to pay and when you need to pay it to cure the default.

Notice that they may repossess the motor vehicle.

It’s important to note that the creditor is only legally required to send you this notice once in a 12-month period. In other words, if you receive this letter then pay the amount as requested in the letter, but six months later you miss another payment, the creditor isn’t required to mail you another notice before repossessing the vehicle.

How Can I Prevent a Repossession?

The best way to prevent a car repossession is to be careful when you first purchase a vehicle. Don’t agree to a payment that’s a stretch for your budget. But if you’re already in a car loan contract, you may encounter unexpected financial challenges. In that causes, you can prevent having your Maine motor vehicle repossessed by:

Paying the amount due: Pay the amount listed in the notice the creditor mails you once your payment is 10 days late. This may not be possible if you’re experiencing financial hardship. In that case, contact the lender.

Contacting the lender: Your lender may be willing to change the terms of your loan agreement or lower your monthly payments to an amount you can afford, but you need to reach out to them and be proactive if you anticipate missing a payment.

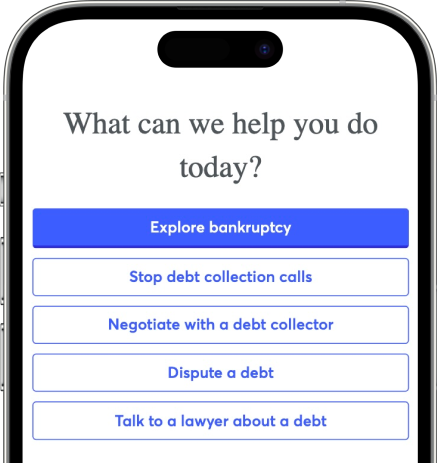

Filing bankruptcy: Filing either a Chapter 13 bankruptcy or a Chapter 7 bankruptcy may be able to stop or delay a repossession.

Purchasing wisely: When initially financing your vehicle, look for low interest rates and make a down payment, if possible. Also, don’t trade vehicles often if you can help it. These precautions will help you keep your payments low and prevent you from being upside-down on your loan.

Should I Do a Voluntary Repossession if I Can’t Make the Payments?

When you know you can’t continue to make the payments on your motor vehicle, you may choose to return it to the creditor or dealership that sold it to you. While this will likely still have a negative impact on your credit score, there are some advantages to voluntary repossession, including:

You won’t have to pay the costs of having your car repossessed. This can lower a potential deficiency balance.

You get to control when and how the car is returned to the lender.

You avoid having your friends and neighbors witness your car being repossessed.

You may be able to lessen the negative impact on your credit report.

What Can Repo Companies in Maine Do?

Creditors use companies that specialize in vehicle repossession to take back cars when owners don’t make their payments. In Maine, these repossession companies are allowed to go on your property and take possession of the car once your loan is in default and your lender has given the required notice. The repo companies don’t need a court order to repossess your car if they can do so without a breach of the peace. This means they can’t break locks or use force to repossess the vehicle. You’re also not allowed to breach the peace or use force to prevent the repossession agents from taking the motor vehicle.

The state of Maine also requires that repo companies be licensed as debt collectors through the Maine Bureau of Consumer Protection.

What About the Personal Property in My Car?

If there’s a chance that your car may be repossessed, you should remove all of your personal belongings. If you don’t, and the car is repossessed, you can still get your belongings back. The laws in Maine are clear that the repo company must inventory any unsecured property left in the motor vehicle and immediately notify you that the property will be made available in a manner convenient to you.

Upsolve Member Experiences

1,858+ Members OnlineWhat Happens After a Repossession in Maine?

Maine law states that a creditor must give you reasonable written notice of the time and place of the sale of the vehicle if the sale is public. If it’s private, you must be notified of the date after which the car will be sold. It’s up to the lender whether to sell the car in a private sale or at a public auction. If you don’t feel you were given a reasonable amount of notice, you can consult an attorney to see if it’s worth suing the lender.

If you’ve paid 60% or more of the cash price of the car or the balance on the loan, your creditor must sell the vehicle within 90 days. If you’ve paid less than 60%, the lender can choose to keep the vehicle. They must notify you if they decide to keep it. You can object to this and insist the creditor sell the vehicle.

Every aspect of the vehicle’s sale must be commercially reasonable, which means the lender must sell it in a fair and appropriate manner. For example, if the car sells for significantly less than fair market value, it may not be considered commercially reasonable.

Should I Demand the Creditor Sell the Car if the Lender Decides To Keep It?

If the car is worth more than you still owe on the loan, it’s in your best interest to deny the creditor’s request to keep your motor vehicle. But keep in mind that the car may still sell for less than what you owe.

Creditors in Maine are allowed to use the sale proceeds to pay for the costs of the repossession so long as they’re reasonable. This includes storage fees and costs to prepare for the sale. After that, the proceeds are applied to your loan balance. If the proceeds don’t pay off the repo costs and your loan debt, you'll be responsible for the deficiency balance.

Let’s say, for example, that you owe $7,000 on your motor vehicle (including creditor’s repossession costs) and the car sells for $4,000. The $3,000 difference is the deficiency balance. There’s an important exception though. If your initial car loan was $2,800 or less, the creditor can’t pursue you for the deficiency balance. If the repossessed vehicle brings in more at the sale than you owed, the lender must give you the surplus.

Do I Still Owe After a Repossession in Maine?

Having your car repossessed doesn’t mean you no longer owe on the loan. In fact, you may owe more than just the balance of the loan. That’s because the lender adds the costs of repossessing the car to your loan balance. If the car doesn’t bring in enough money at auction to cover all these expenses plus the loan amount, you have to pay this deficiency balance.

While a voluntary repossession won’t eliminate the possibility of a deficiency balance, it can help reduce it.

Can I Get My Car Back After a Repossession in Maine?

According to state law, you have the right to redeem your car any time before it’s sold. To redeem the car, you have to pay off the entire loan balance plus any of the lender’s reasonable fees and costs for repossession. If you have the money available to pay the loan balance plus the reasonable fees, reach out to your lender as soon as possible and ask what you need to do to redeem your vehicle. Make sure you have them send you everything you agree to in writing.

Where Can I Find More Information About Repossession Laws in Maine?

The Maine Bureau of Consumer Credit Protection has information on financing a vehicle and how to avoid repossession.

Pine Tree Legal Assistance has self-help information and provides free legal services for low-income individuals.

Information on vehicle repossessions from Maine Legal Services for the Elderly.