You could be debt-free in as soon as 4 months.

You could be debt-free in as soon as 4 months.

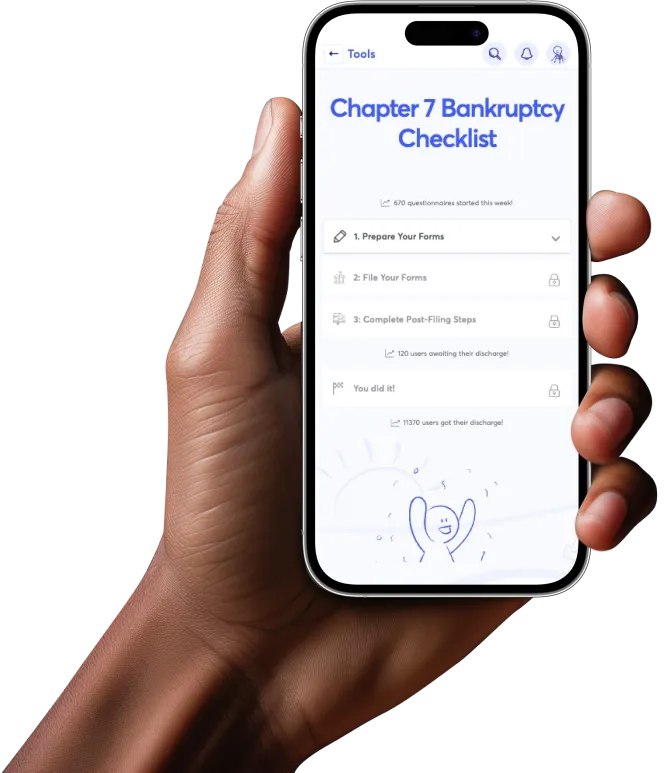

Here's how long each part of the process takes.

1.

Take a screener to see if Upsolve is right for you: 2 minutes

2.

Fill out a questionnaire about your financial situation: a few hours

3.

We double-check your forms for completeness and accuracy: 1-2 weeks

4.

File your forms at your local court: 1 afternoon

5.

Work with the court and get your discharge: 2-3 months

Total debt relieved by Upsolve members since 2018

$1,023,990,262

Why Trust Upsolve?

You're in control: We explain exactly what info you need for your forms, and why. You're in full control of your information at every step of the way.

Privacy: We keep your data safe and secure. It only leaves our servers when you print out your forms.

Affordability: Upsolve is a nonprofit, and our tools are 100% free.

Is Upsolve Right for You?

Chapter 7 bankruptcy is a legal process that everyday people use to clear certain debts and get a financial fresh start.

Like everything, filing Chapter 7 bankruptcy has its pros and cons. The main pros are that collection calls and other actions (including wage garnishment) must stop and, if your case is successful, you will get a financial fresh start by wiping out (most of) your debt for good. The biggest cons are that you cannot get rid of some debts in Chapter 7 and your credit score can take a temporary hit.

To file Chapter 7 bankruptcy yourself, without hiring an expensive lawyer, follow our 10-step guide or start our screener to see if you qualify for help.

To be eligible for Chapter 7, you will need to pass the means test. This looks at your income and expenses to determine whether you have the means or ability to repay your debt. If you make too little to repay your debt, you pass the means test and are eligible to file Chapter 7.

There are four main types of costs associated with filing bankruptcy:

Court filing fees, which are $338 for Chapter 7 (you can apply for a waiver of these fees).

Credit counseling course fees, which can range from $0-$50 (you can apply to waive these fees).

Miscellaneous costs such as printing, traveling to the court, etc.

Attorney fees, which can range from $1,000-$1,500 or more, depending on the complexity of your case and where you live.

The good news is that you do not have to hire a lawyer to file successfully. Upsolve may be able to help you file Chapter 7 bankruptcy for free.