Should I Pay the Debt Collector or the Original Creditor?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you’re able to do so, pay the original creditor before your debt goes to collections. Having a debt sent to collections will damage your credit score and may limit your options for repayment. In most cases, the original creditor will offer better repayment options than a debt collector will. However, if your debt has been sold to a debt buyer and the original creditor no longer owns it, you’ll need to pay the collection agency to clear up the debt.

Written by Mae Koppes. Legally reviewed by Jonathan Petts

Updated September 1, 2025

Table of Contents

Debt Collection 101: How Debt Goes From the Original Creditor to a Debt Collector

The original creditor is the financial entity that originally lent you money. For example, if you have credit card debt, the original creditor is the credit card company. If you owe money on a personal loan, the lender where the loan originated is the original creditor.

If you fall behind in your monthly payments to the original creditor, they will first try to collect the debt from you. They may call or send you notices about the past-due debt.

If you don’t make a plan to address the past-due debt with the original creditor, they may hire a debt collection agency (or have an in-house collections department) to help recoup the debt. Eventually, some creditors will charge off your debt altogether and sell it to a debt buyer. This means the original creditor has deemed the debt non-collectible.

If your debt is still with the original creditor or with a debt collection agency working on behalf of the original creditor, you can contact the original creditor to see what your options are to address the past-due debt. They may be willing to put you on a payment plan, remove late fees, or come to a settlement agreement.

Once your debt has been charged off and sold, it’s unlikely you’ll be able to work with the original creditor to come to a settlement agreement or make a payment plan.

Is It Better To Pay the Company or Collections?

If you’re still able to pay the original creditor, it’s best to do so. There are a few reasons for this.

First, having a collection account on your credit report will hurt your credit score. The major credit bureaus that keep your credit history view charge-offs and collections as very serious. This is why having one on your report can cause your score to fall.

This can make it harder to get approved for new credit in the future, can make the credit you do get more expensive (due to higher interest rates), and can even affect your employment and housing opportunities in some cases. Collections stay on your credit report for seven years.

Second, the original lender usually treats you better than a collection agency. Remember, you are a customer in this situation. Most creditors want to keep their customers. Losing customers and charging off debts costs them money. This is why many lenders are willing to negotiate and help you figure out how to get current on your account. They may even contact you to see whether you can make any type of payment on their debt to stop it from going to collections.

Third, contacting the original lender to deal with the debt can save you from debt collection phone calls and letters and increased financial stress. You’re probably already feeling some stress, but this can really be heightened by debt collectors’ aggressive collection techniques.

How Do Debt Collection Agencies Work?

Debt collection agencies specialize in trying to collect uncollectible debts. They are motivated purely to recoup as much of the unpaid debt as possible. If they can get you to pay the full amount of the debt, they can make a nice profit.

Though it’s best to deal directly with the original creditor, if you have to deal with a debt collector because your debt has been sold, remember that you have some power to negotiate. They purchased your debt for pennies on the dollar, so they may be willing to negotiate on the amount of debt you have to pay back with a debt settlement agreement.

How Do You Find Out if Your Debt Has Been Sent to Collections?

In most cases, if you are only a few months behind on your debt, your original creditor probably still owns your account. After several months of nonpayment, the account is in danger of being turned over to a debt collector. Each creditor has its own internal rules for the collection process, so it’s impossible to say exactly how much time you have before your debt is charged off.

That said, the creditor will likely communicate with you about the debt. You’ll likely even receive a prior written warning informing you that your account is about to be turned over to a debt collection agency. If you haven’t already, this is the time to get in touch with the creditor.

You may be feeling ashamed or embarrassed that you haven’t paid, but, remember, these things happen. And communicating with the creditor directly can go a long way toward helping you get back on track.

If you’re unsure of whether your account has been turned over to a debt collection agency or not, you can always contact your original lender and ask.

Can You Negotiate With the Original Creditor if Your Debt Is in Collections?

Maybe. If you want to try to negotiate with your original creditor but your debt has been turned over to a collection agency, start by contacting the agency.

Ask them to give you the contact information for your original creditor’s collection department. Then, you call them to see if you can negotiate with them directly. In most cases, the original creditor will only take your account back if you have made a repayment plan with the debt collector and have made at least two or three on-time payments with them already.

If your debt has been sold and the original creditor no longer owns it, you won’t be able to negotiate with the original creditor. You’ll have to deal with the debt collector at this point.

How To Negotiate With the Original Creditor

Some people are surprised to learn that you can negotiate your debt with the original creditor. If you aren’t able to negotiate the total debt amount down, you may be able to negotiate the interest rate or have late fees (or other fees) waived retroactively. Stay positive and follow these tips.

Know What and How You Can Pay

Before you try to negotiate a payment plan or settlement agreement, figure out how much you can pay on your debt. Look at your personal budget and other debt payments and see what you can reasonably afford. If you’ve recently received a windfall (through a tax return, inheritance, etc.), you may be able to use this to offer a lump-sum settlement and pay less than the full amount you owe on the debt.

Negotiate a Payment Plan or Debt Settlement Agreement

You’ll probably have a few options when dealing with the creditor. You may be able to get on a payment plan to make debt payments, or you may be able to negotiate a debt settlement agreement. Either is better than having your account charged off to collections!

If you are negotiating a debt settlement with the original creditor, know that they’ll favor a lump-sum settlement over a series of payments because the lump sum is guaranteed. If the debt is at least nine months old, then the creditor is more likely to accept a settlement offer. You can negotiate by phone but send a follow-up letter to keep everything documented.

Get It in Writing

Before you embark on any type of repayment plan — whether with your original creditor or a debt collection agency — get the terms of the repayment agreement in writing so that you have proof of what they said at the outset.

How To Deal With Debt Collectors

Debt collectors must follow the rules established by the federal Fair Debt Collection Practices Act (FDCPA). This is a federal law that covers several different types of debts, including credit cards, student loans, and medical debts. Although you’re still responsible for paying your debt, the FDCPA gives you some legal rights and allows you to take legal action if those rights are violated.

Contact the Consumer Financial Protection Bureau (CFPB) or Federal Trade Commission (FTC) if you think that you have been treated unfairly by a debt collector. It may also be wise to enlist the help of a credit counseling service to deal with creditors if you don’t feel able to do this yourself.

Let's look more closely at your rights.

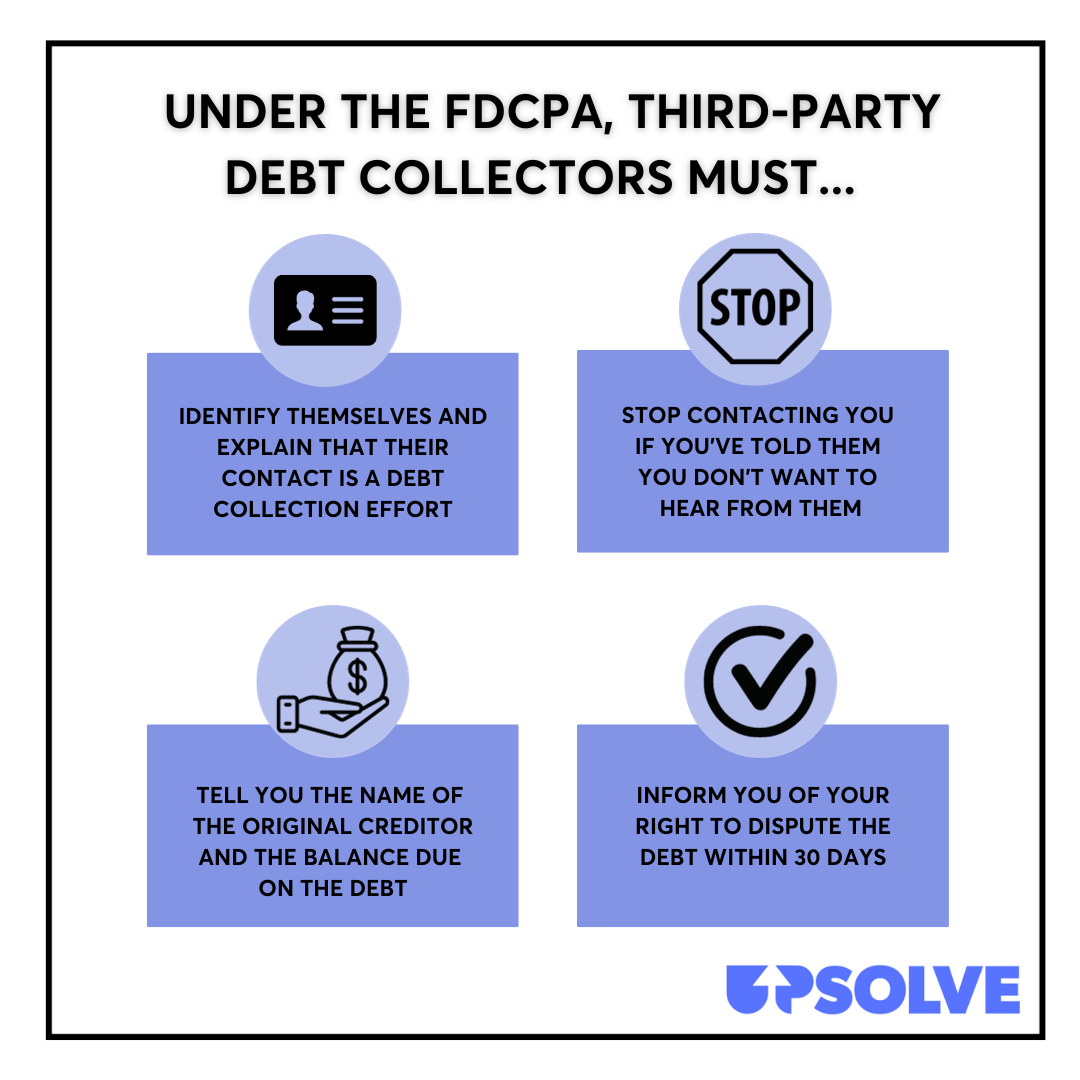

What Debt Collectors Must Do

Importantly, debt collectors must provide you with a written notice within five days of contacting you about a debt. The written notice must contain the name of the original creditor and the amount you owe. If you don’t receive this letter or want more details about your debt, you can request a debt validation letter.

What Debt Collectors Can't Do

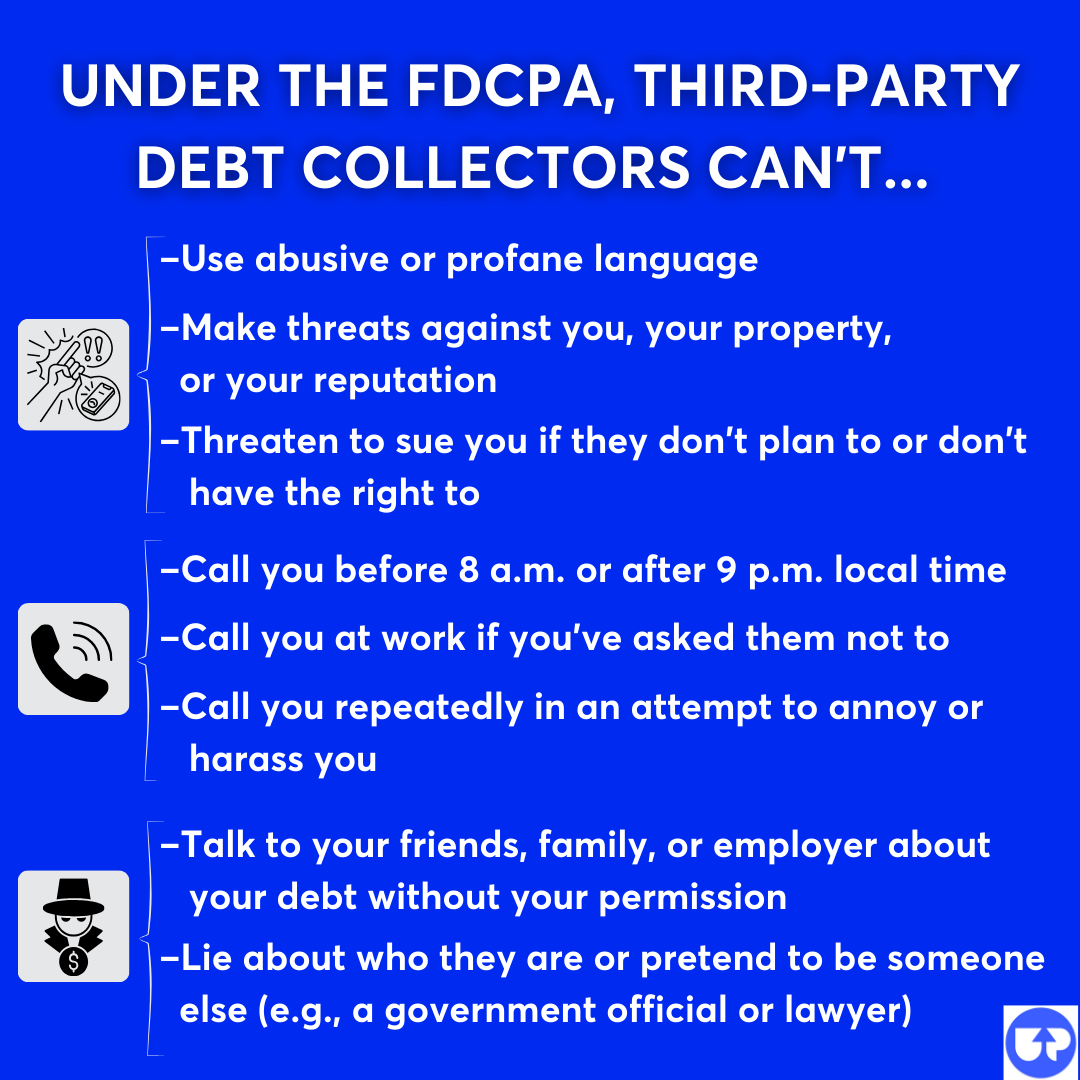

Under the FDCPA, debt collectors cannot threaten you in any way, including physical violence, intimidation, or any other form of bullying. They can only state the facts and the legal consequences of not paying your debt. They can’t threaten to seize your bank account or other property. And they can’t force you to pay old debts that are now past the statute of limitations.

Let’s Summarize…

If you have unpaid debt, it’s best to pay the original creditor if possible before your account is sent to collections. Once a debt goes to a collection agency, it can hurt your credit score and make repayment more complicated.

If your debt is already in collections, you may still have options to negotiate. Debt collectors often buy debt for less than what you owe, so they may be willing to settle for a lower amount.

No matter what, you have rights under the Fair Debt Collection Practices Act (FDCPA). Debt collectors can’t harass you, lie to you, or threaten you. If they do, you can report them to the Consumer Financial Protection Bureau or Federal Trade Commission.

Taking action early can help protect your credit, reduce stress, and give you more control over your finances.