Your Guide to Pennsylvania Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Pennsylvania has two state debt collection laws: the Pennsylvania Fair Credit Extension Uniformity Act (FCEUA) and the Pennsylvania Unfair Trade Practices and Consumer Protection Law (UTPCPL). Combined, these two laws provide important protections for state residents against both original creditors and third-party debt collectors. Pennsylvanians get further protections from the federal Fair Debt Collection Practices Act (FDCPA) offered to all states. The statute of limitations for all debt contracts (including credit cards and medical bills) in Pennsylvania is four years.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated May 6, 2025

Table of Contents

What Are the Debt Collection Laws in Pennsylvania?

Pennsylvania has two state debt collection laws: the Pennsylvania Fair Credit Extension Uniformity Act (FCEUA) and the Pennsylvania Unfair Trade Practices and Consumer Protection Law (UTPCPL). These laws work together to protect Pennsylvania residents: The FCEUA specifies what debt collection activities are unlawful, and the UTPCPL gives prosecutors and/or consumers the right to take action for FCEUA violations.

Pennsylvania Fair Credit Extension Uniformity Act (FCEUA)

The FCEUA establishes what acts (or practices) are considered unfair or deceptive in the realm of debt collection, beyond the Fair Debt Collection Practices Act (more on this act below). The FCEUA applies to both third-party debt collectors and original creditors.

This act doesn’t apply to purchase-money mortgages on real estate, but does apply to home equity loans. It also doesn’t apply to federal tax debt or tax debt owed to the state of Pennsylvania, but does apply to all other taxes, interest, and penalties.

The FCEUA itself doesn’t allow the right to sue the creditor or the debt collector in civil court, but Pennsylvania courts allow consumers to use the Unfair Trade Practices and Consumer Protection Law (UTPCPL) to sue for FCEUA violations in civil court.

Pennsylvania Unfair Trade Practices and Consumer Protection Law (UTPCPL)

The UTPCPL gives consumers the right to sue debt collectors or creditors who violate the Fair Credit Extension Uniformity Act (FCEUA). You can sue the creditor/debt collector in a state civil court, but only if you’ve suffered an “ascertainable loss of money or property” as a result of the violation. In other words, you’ll need to show the court that you’ve suffered a concrete and quantifiable loss, such as money lost due to the debt collector unlawfully charging fees or interest.

If you’re successful in court, the judge can award you up to triple the actual damages, plus attorney fees and costs.

Federal Fair Debt Collection Practices Act (FDCPA)

Both of Pennsylvania's state laws work alongside the federal Fair Debt Collection Practices Act (FDCPA). This federal law protects consumers from harassment and abusive debt collection practices. Every citizen in Pennsylvania is protected under the FDCPA.

Here’s an overview of the law:

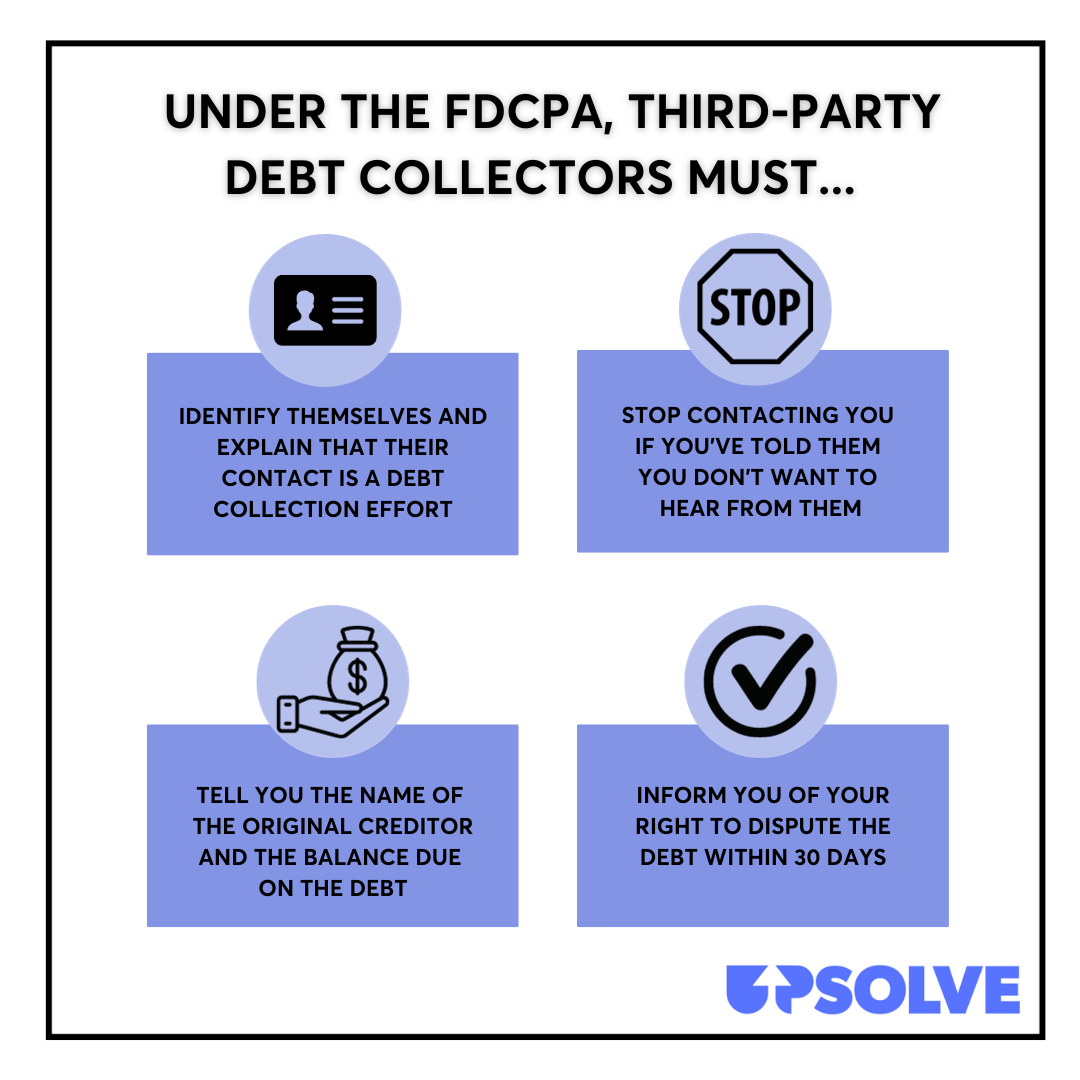

The main purpose of the FDCPA is to provide protections for consumers against third-party debt collectors. It also outlines what certain responsibilities debt collectors have.

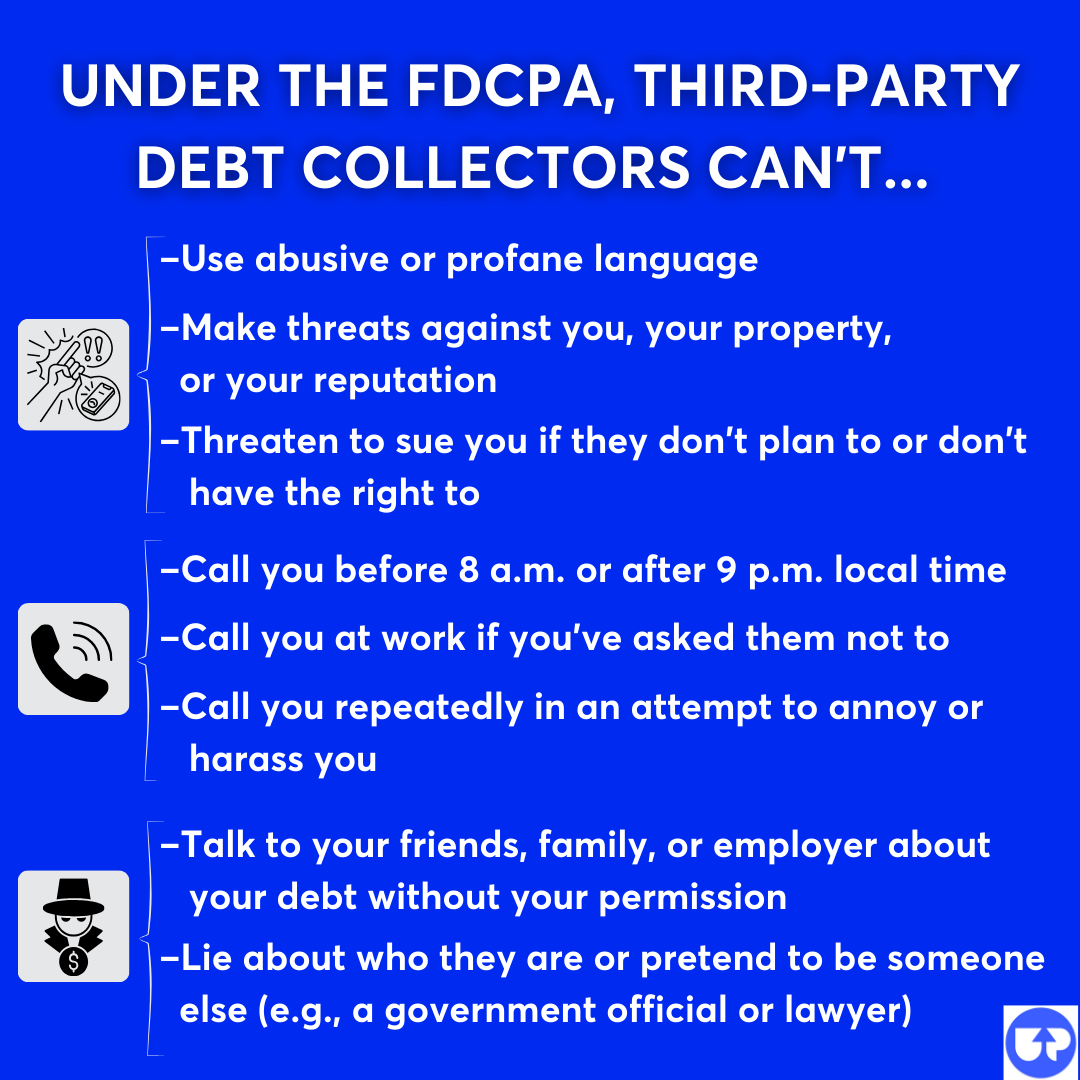

While it does outline what debt collectors can do, the FDCPA also outlines what third-party debt collectors can’t do:

Pennsylvania Provides Additional Protections Beyond the FDCPA

Not every state provides protections beyond the FDCPA for its residents. Pennsylvania, however, does provide additional protections beyond the FDCPA.

Though the FCEUA doesn’t create additional protections for consumers that aren’t already in the FDCPA, it does expand some of the FDCPA’s provisions to apply to original creditors. The FDCPA only applies to third-party debt collectors, so Pennsylvania’s state law provides greater protections for consumers

In Pennsylvania, the statute of limitations to bring legal action against creditors and debt collectors is two years. In other words, you have two years after a violation to file a lawsuit in Pennsylvania if a debt collector or creditor violates state law. By contrast, under the FDCPA, consumers must bring legal action within one year after a violation.

What Can You Do if a Debt Collector Breaks the Law in Pennsylvania?

If you think a debt collector has broken the law by violating either of Pennsylvania’s debt collection laws or the federal FDCPA, you can submit a complaint to the Pennsylvania attorney general’s office.

If you’ve suffered actual damages (monetary losses or harm) as a result of an FCEUA violation, you can even sue the creditor or debt collector in Pennsylvania state court. You can also bring a lawsuit in federal court for FDCPA violations.

If you can prove that a debt collector violated the FDCPA, then that means you can also show they violated the FCEUA and the UTPCPL. You don’t have to show separate proof for each one. That said, you can't hold them liable under both state and federal laws for the same activity. If you do follow through with a lawsuit, you’ll have to decide which laws to collect under.

What Is the Statute of Limitations for Debt Collection in Pennsylvania?

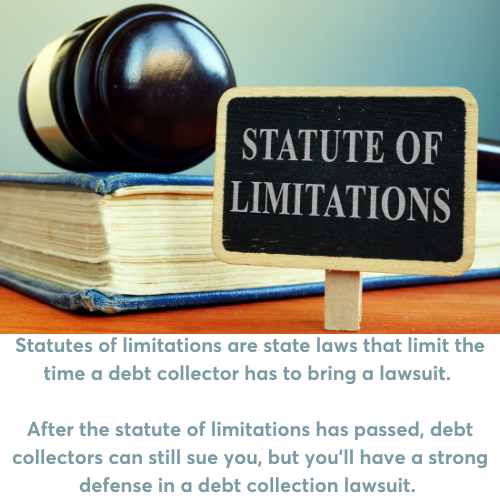

The statute of limitations for all debt contracts in Pennsylvania is four years.

This applies to:

Written contracts

Installment contracts

Medical debt

Open-ended accounts, including credit cards, oral contracts, implied contracts, contracts for secured debts (both purchase-money and no-purchase-money)

The statute of limitations does not apply to first mortgages on property or to state or federal tax debt. There is no statute of limitations for these.

In most cases, the four-year time frame begins on the date of the last payment made on the debt. Making a payment — or a promise to pay — restarts the statute of limitations, so be careful if you’re contacted about an older debt. To learn more, read What To Do if You’re Contacted About an Old Debt.

What Can Debt Collectors Do To Collect Debt in Pennsylvania?

It’s important to know what debt collectors legally can do so you know if you’re being taken advantage of. Debt collectors will start with phone calls and written notices and escalate their efforts from there. If you ignore their efforts, that is when things can escalate to debt collectors following through on their collection efforts. For example, in Pennsylvania debt collectors can eventually garnish your wages and repossess your property (typically your car). They have to take you to court first, though.

If you do get sued, don't panic. You may be able to respond on your own and avoid wage garnishment. SoloSuit, an Upsolve partner, helps you draft and file a response to the lawsuit and has helped over 280,000 people handle debt lawsuits. They offer a money-back guarantee if your documents aren’t accepted by the court.

Debt Collectors Can Garnish Your Wages (With a Court Order)

Debt collectors can take you to court for an unpaid debt. If you get sued by a collection agency and lose, the judge will issue a court order called a judgment to the collector. This allows the debt collector to get an order for wage garnishment, a bank levy, or a property lien. Of these, wage garnishment orders are the most common. Pennsylvania state law does limit how much a debt collector or creditor can take from your paycheck.

Debt Collectors Can Repossess Your Car

If you don’t make your car payments on time, the lender can legally repossess the vehicle, and they aren’t required to give you prior notice. They also don’t need a court order to take your vehicle. If you default on your auto loan, you’re at risk of repossession. This could happen after only one missed payment, so it’s important to review your auto loan contract to understand your terms.

Need Help With Debt Relief? Here Are Some Options

If you are overloaded with debt, you may not know where to start. Please know it is completely normal to feel overwhelmed. If you’re not sure where to start, you may want to consider scheduling a free consumer credit counseling session.

Meeting with an accredited nonprofit credit counselor can give you personalized insight into how to tackle your debt and where to start your journey. A counselor might suggest a debt management plan, debt consolidation, or even bankruptcy.

Bankruptcy is a powerful legal tool that gives you the power to reclaim your finances. If your debt has become unmanageable and you’re looking for a fresh start, filing bankruptcy might be the right option for you. Filing bankruptcy also stops all collection efforts, including any wage garnishment orders against you.

If you’re looking to file Chapter 7 bankruptcy, you can use Upsolve’s free online filing tool. It walks you through the Chapter 7 process so you can file on your own with confidence.

Need Legal Help?

Pennsylvania Legal Aid: Online hub with links to legal aid programs and organizations across the state

PALawHelp.org: Self-help guides and resources online; maintained by PA Legal Aid Network

The following legal aid agencies provide free or low-cost legal aid services to qualifying low-income residents across Pennsylvania:

Community Legal Services of Philadelphia and Philadelphia Legal Assistance serve Philadelphia (and nearby) residents.

Legal Aid of Southeastern Pennsylvania serves residents of Bucks, Montgomery, Chester and Delaware counties.

MidPenn Legal Services serves residents of central Pennsylvania.

Neighborhood Legal Services Association serves Pittsburgh-area residents.

North Penn Legal Services serves residents of northern Pennsylvania.

Northwestern Legal Services serves residents of Cameron, Crawford, Elk, Erie, Forest, Mercer, McKean, Potter, Venango, and Warren counties.