How To Win Against Aldous & Associates

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Aldous & Associates is a third-party debt collector that collects consumer debts for telecommunication companies, property management firms, and health and fitness clubs. If they contact you, they are likely looking to settle a debt. Before you pay anything, it’s best to validate the debt. If the debt is legitimate but you can’t afford to pay it in full, you can try to negotiate the amount down. If Aldous & Associates sues you for unpaid debt, file an answer form as soon as possible to avoid wage garnishment or other serious consequences.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated November 10, 2025

Table of Contents

- Why Is Aldous & Associates Contacting Me?

- Do I Have To Pay Aldous & Associates?

- How To Negotiate a Debt Settlement With Aldous & Associates in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Aldous & Associates in a Debt Lawsuit

- Let’s Summarize…

Why Is Aldous & Associates Contacting Me?

Aldous & Associates is a law firm that collects consumer debts. If they’re reaching out to you, you may have an unpaid debt they believe you owe.

Aldous focuses on debts from the health and fitness industry, but they also collect for telecommunications and property management companies.

Learn more about this company, read Upsolve’s guide to How To Deal With Aldous & Associates.

Do I Have To Pay Aldous & Associates?

It depends on whether the debt is valid.

If Aldous & Associates can prove the debt is valid, you probably need to pay or you risk facing serious consequences like wage garnishment or a bank account levy.

If you disagree with Aldous & Associates’s information about the debt account (the amount or who owns it), you can dispute the debt.

Either way, it’s best not to ignore the debt outright, or Aldous will likely continue their collections efforts.

If the debt is valid and you agree you owe it, but you can’t afford to pay it, you still have an option: You can negotiate a debt settlement. If Aldous agrees on a settlement amount, you can repay a portion of the debt but get the account closed once and for all.

How To Negotiate a Debt Settlement With Aldous & Associates in 3 Steps

It may seem strange, but debt collection is a business and debt collectors are looking to make a profit. It may sound surprising, but this actually gives you an advantage when dealing with them.

Since collection agencies buy your debt for pennies on the dollar, they're often open to negotiating. Most debt collectors will settle for 40%–60% of the original debt amount. Why? They can usually still make money even if you pay less than the full amount you owe. Plus, settling an account helps them save money in the long run on continued collection efforts like phone calls and letters.

While it may feel intimidating, you can start negotiations with Aldous & Associates or any other debt collector. Here's the three-step process.

Step 1: Make Sure the Debt Is Valid

Debt collectors have to send you a debt validation letter and give you 30 days to dispute the debt. That’s according to the Consumer Financial Protection Bureau’s (CFPB) debt collection rule.

You’re supposed to receive a debt validation letter within five days of their first contact. If you haven’t gotten one, don’t be afraid to ask for one — it’s your right to have a validation letter! You can use this letter to verify the details of the debt, including:

The account holder’s name (make sure it’s actually you!)

Aldous & Associates legitimately owns the debt or has the legal right to collect it

The debt amount is correct

If you need more information than you got on the validation notice, you can respond with a debt verification letter to ask follow-up questions.

Step 2: Figure Out What You Can Pay

Before you make an offer, you need to figure out how much of the debt you can comfortably pay. Start by looking at your monthly take-home pay and comparing it to your monthly expenses. If you need help with this, CFPB has a great budget tool and a helpful debt worksheet you can use for free.

If you need extra assistance, you can work with an accredited nonprofit credit counselor by scheduling a free consultation.

If at all possible, see if you can find the funds to offer a one-time lump-sum payment. You’ll probably get the best deal if you can pay the agreed-upon amount quickly and in one go. If you have some money you can use in savings or you’re expecting a little extra from work bonus or a tax return, consider whether you want to use this in your negotiations.

A lump-sum payment simply isn’t an option for many people in debt. If that’s the case for you, that’s okay! Negotiate a repayment plan instead. Think about how much you can comfortably agree to pay each money and how long it’ll take to pay off the debt at that amount. If the debt collector is hesitant to agree to a payment plan, consider offering to set up automatic withdrawals if that works for you.

Step 3: Make a Settlement Offer to Aldous & Associates

It’s best to negotiate your settlement over the phone. Know your numbers and stick to them. Don’t agree to a settlement you can’t afford. Debt collectors often have internal rules about negotiating. If you aren’t getting what you want, thank the person you’re speaking to and politely end the call. Then, try back again in the next day or so.

Once you reach an agreement, ask the Aldous representative to send a written copy by mail or email.

Don’t Just Negotiate the Amount… Negotiate Everything!

Many people don’t realize that they can also negotiate how Aldous & Associates reports the collections account to the credit bureaus. Negotiating this can really help boost your credit score, so consider bringing this up in your settlement conversation.

Debt collectors can report collections accounts to the major credit bureaus in three ways: “paid in full,” “partial payment,” or “settled.” Having the account reported as “paid in full” can help a lot if you’re trying to repair your credit.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Yes, most of the time, you can still negotiate a settlement even if there’s a debt collection lawsuit against you. But you still need to actively participate in the lawsuit until the case is closed or dismissed. This could include filing a response, showing up for court appearances, or taking other actions the court requires.

Learn more about negotiating a settlement while navigating a lawsuit in Upsolve’s article: Can I Settle a Debt After a Lawsuit Has Been Filed?

Tips for a Successful Debt Settlement

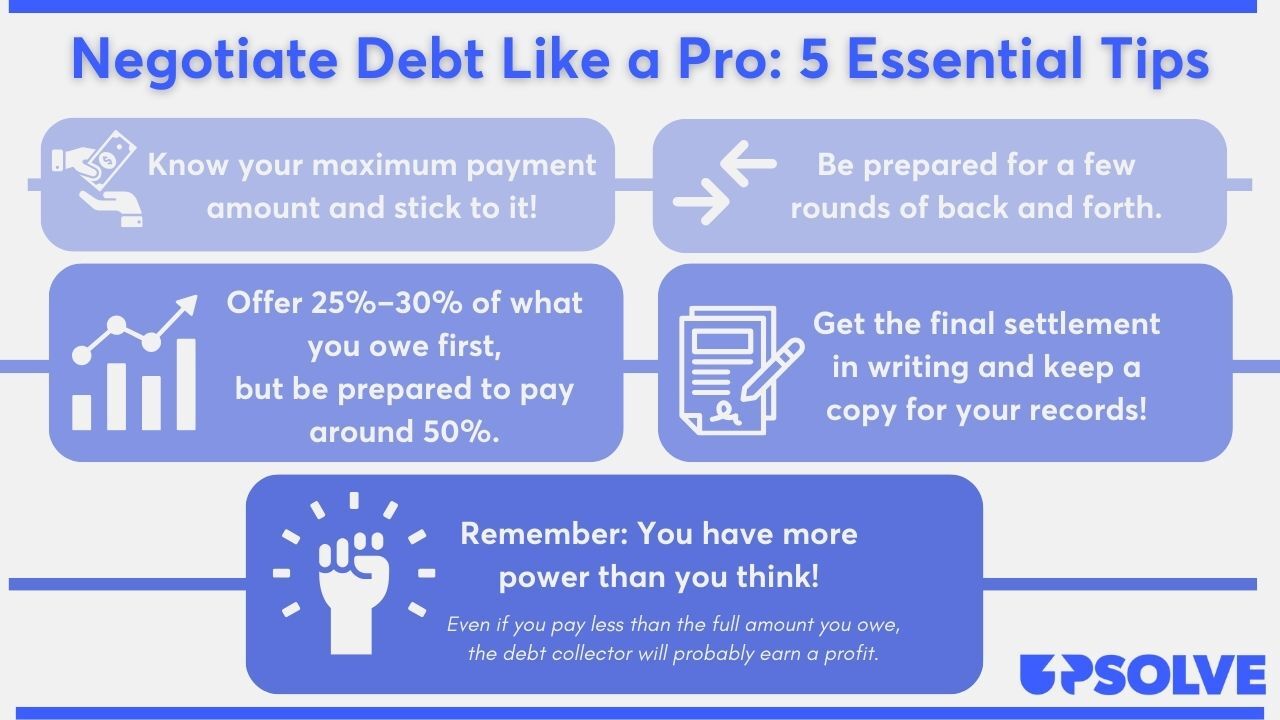

Learning to negotiate can feel overwhelming. Our infographic below breaks down our best tips on negotiating with confidence.

For more tips on negotiating like a pro, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Aldous & Associates in a Debt Lawsuit

While it probably won’t be their first move, Aldous & Associates has the right to sue you. If you get sued, you’ll be notified with a summons and a complaint — official court documents. If you are sued, the most important thing you can do is respond to the lawsuit as soon as possible.

If you respond to a lawsuit (and quickly), you may be able to avoid future issues like having your paycheck garnished.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Responding to a lawsuit isn’t as intimidating as it may seem! Here’s how to respond in just three steps.

Step 1: Read the Summons and Complaint Carefully

The summons is the document that notifies you that you’re involved in a lawsuit. A summons typically has all of the key information you need to know, including:

Court name and address

Contact information for all parties involved

Nature of the lawsuit

Instruction for responding to the lawsuit

Consequences of not responding to the lawsuit

Summons forms vary a bit by court, so your form may include more information or omit certain things listed above.

Complaint forms usually arrive alongside a summons. This court document explains Aldous & Associates’ claims against you. It’s helpful to have both the summons and complaint handy when you go to fill out your answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

You will respond to the lawsuit by filing a document called an answer form. The answer form is your chance to tell your side of the story and raise any defenses you may have.

Most courts provide a blank answer form you can use to draft your reply. Google “[court name] + answer form” or “court forms” to see if your court has a template for you to use. If you can’t find an answer form online or if you have any questions about the filing process, reach out to your court clerk. A court clerk can’t give you any legal advice, but they can help you locate forms and understand your court’s procedures.

Note: Some courts require additional paperwork, like a certificate of service. Check your court’s website or talk to your court clerk if you're unsure about your court’s procedure.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

The answer form filing process is different for every court. You can usually file in person at the courthouse listed on your summons, but you may also be able to file online or through the mail. Check with your court’s website or ask the court clerk if you have any questions about the filing process.

Regardless of how you file, you likely have to send a copy of your answer form to Aldous & Associates. This is called “service.” You can usually do this through the mail. Anytime you send court documents via mail, it’s preferable to use certified mail, so you have a receipt for your records.

Let’s Summarize…

If Aldous & Associates contacts you about a debt, start by validating the debt. If the debt is valid, you can start negotiating a debt settlement right away. With a debt settlement, you only pay a portion of the debt owed. If Aldous & Associates files a debt collection lawsuit against you, respond to the lawsuit by filing an answer form as soon as you can.