Is 600 a Good or Bad Credit Score?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

A credit score of 600 is below average. If your credit score is 600 or less, it may be difficult to get a new loan at an affordable interest rate. Most lenders who see borrowers with a credit score of 600 or lower will only offer high-interest loans with strict terms. If the borrower fails to pay each month, then the lender can send the account to collections. Thankfully, you can do several things to improve your credit score. We’ll cover some strategies in this article.

Written by Mae Koppes. Legally reviewed by Attorney Andrea Wimmer

Updated August 25, 2025

Table of Contents

600 Credit Score: Good or Bad Score?

A 600 credit score is considered below average. The average credit score for Americans in recent years is 741.

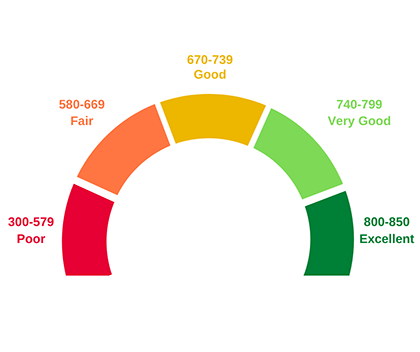

In the most popular credit scoring model, FICO, a score of 600 is considered fair. In the second most common model, VantageScore, it’s labeled as very poor.

Credit scores range from 300 to 850. Most credit scores are computed using the information in the borrower’s credit report. This includes your payment history, debt-to-credit ratio, and other factors related to borrowing.

Image Credit: Equifax

Why You Have a 600 Credit Score

If you have a 600 credit score, you may have had some financial struggles or credit missteps. Here are some common things that land people in the 600 range.

Negative payment history: Late or missed payments hit hardest. One credit card bill paid 30 days late can shave dozens of points off your score.

High credit utilization ratio: Using a big chunk of your credit limit signals risk. People with lower credit scores tend to be using a lot of their credit limit or have maxed-out credit cards.

Short credit history: Lenders like long track records. Closing older accounts shortens your average age of credit and hurts your score. If you’re just starting out building credit, you don’t have control over this factor. Let time do its work.

Too many recent hard credit inquiries: Every time you apply for new credit, the lender runs a hard inquiry. Several applications within a few weeks can chip away at your score.

Delinquent accounts: Accounts that sit 60–90 days late or go to collections weigh heavily. Paying or settling these delinquent accounts can help boost your score.

What Is Credit Scoring Anyway?

Your credit score is like a grade. It grades you on how well you’ve managed your debts in the past.

Credit scores range from 300 to 850. Most credit scores are computed using the information in the borrower’s credit report. This includes your payment history, debt-to-credit ratio, and other factors related to borrowing.

If you usually repay your debts on time, then you’ll likely have a good score (680 or higher). But if you have defaulted on several debts, your score will be much lower (620 or lower).

The Credit Score Formula

Here are the key factors that go into computing your credit score:

Payment history (35%)

Total amount of debt you still owe all lenders (30%)

Credit history (15%)

New credit (10%)

Credit mix (10%)

As you can see, about a third of your credit score is based on your payment history. This is the single largest factor in the equation.

Credit information is compiled by credit bureaus, including TransUnion, Experian, and Equifax. The three major credit bureaus use the FICO Score, while others may use a different kind of credit score called the VantageScore.

Credit monitoring companies will monitor your payment history and watch your credit score range to see what rates you should be charged in the future. You can monitor your own progress by getting a free credit report each year. Many financial institutions will also provide a free credit score as part of their account services.

Can I Get a Credit Card With a 600 Credit Score?

💳 With a 600 credit score, many large banks and financial institutions may still approve you, but the offer often includes a lower credit limit, a higher interest rate, and sometimes an annual fee.

That said, some banks offer specific credit cards for those with a fair credit score. If you’re worried about getting approved, try getting prequalified first to avoid a hard credit inquiry and a ding to your score.

If you don’t qualify at a national bank, check with a local credit union or an online lender. They often charge lower fees and focus on helping members rebuild credit. After you receive a card, keep your balance below 30% of the limit and pay the full amount each month.

🗓️ Six months of on-time payments can raise your score.

If you can’t qualify for an unsecured card yet, a secured card is a helpful fallback. You provide a small cash deposit, make on-time payments, and then move to an unsecured account once your score improves.

Can I Get a Car Loan With a 600 Credit Score?

Yes, but most auto lenders see a 600 credit score as higher risk, so they usually quote interest rates a few points above what drivers with excellent credit pay. That means the loan will be more expensive in the long run.

You can offset that by making a larger down payment, picking a less expensive car, and/or comparing offers before heading to the dealership.

Also, don’t just go with dealer financing. Credit unions and online lenders often beat dealer financing for people with scores between 580 and 640, and their applications are quick to complete.

Some dealerships promote “special financing” for fair-credit borrowers, but be sure to check for add-on fees or very long loan terms that can raise the total cost.

📈 Once the loan is in place, paying every bill on time — ideally with automatic payments — builds positive history. Many borrowers who keep a perfect payment record for 6–12 months see their score climb enough to refinance at a lower rate.

Can I Get Housing With a 600 Credit Score?

Landlords and mortgage lenders read a 600 score as a warning sign, but it isn’t always a deal-breaker.

When it comes to rental housing, many landlords run a soft credit check. If your score lands near 600, some may ask for a larger security deposit or a co-signer.

🔑 Offering proof of steady income and good rental references can tip the balance in your favor.

As far as mortgages go, conventional home loans usually require at least a 620 score, so a 600 score often pushes borrowers toward government-backed options. An FHA loan, for example, technically allows a score as low as 580 with a 3.5% down payment, though individual lenders may set higher cutoffs.

👉 Expect a higher interest rate and mortgage insurance premiums until your score improves. Some homebuyers work with a credit counselor, pay down credit-card balances, and wait a few months to push their score above 620 before reapplying.

How To Improve Your Credit Score

It takes some work, but it’s totally possible to improve your credit score. Remember, it can take some time, but it may not be as long as you think! Many people see progress within months.

🔑 The key to improving your low credit score is patience and consistency.

Start by making all your payments on time, not applying for new credit for a while, checking your credit report, and keeping your old accounts open.

If you want some extra support, consider free credit counseling. Credit counselors can help you budget and make a plan to deal with your debt.

Let’s dig into ways to build your credit.

Make On-Time Payments

One of the greatest enemies of a good credit score is late payments. Late payments hurt your score and make it harder to qualify for lines of credit or loans. When you do qualify, they’ll be more expensive.

Schedule automatic payments or mark payment due dates on your calendar. Make your payments on time every month to boost and preserve your credit score. And, if possible, pay more than the minimum payment.

Give Your Credit Cards a Break

If you’re struggling to pay the debts you currently owe, it might be time to give your cards a break. Every new credit card means another monthly payment to keep track of. Plus, when you apply for a new credit card, the lender makes a hard inquiry on your credit, which lowers your score slightly. The more hard inquiries lenders make, the more your score is affected.

Check Your Credit Report

It is important to stay on top of your credit score and pull a free copy of your credit report from each of the three major bureaus (TransUnion, Experian, and Equifax) at least a few times a year.

Make sure that there are no errors on your credit report, and take action immediately if there are. Dispute errors as soon as you see them. If you’re working hard to improve your credit score, you don’t want an error on your credit report to set you back.

Keep Old Accounts Open

Even if you no longer use a particular credit card or line of credit, don’t close the account, especially if you have a long history of timely payments on it. One measure of your credit score is the length of open accounts. The older the account, the better for your credit.

Avoid High Credit Card Balances

Regardless of what your credit limit is, it’s best to use only about 30%–35% of your credit. In financial terms, this is called your credit utilization ratio. Spending about 30% of your credit limit each month and then paying your bill off in full is the best way to use your card.

Track Your Score, but Don’t Get Obsessed

It can be helpful to use a credit monitoring service to track your score over time. There are a lot of free services out there, such as the Nerdwallet App, Experian, and Credit Karma. If you already have a bank account or credit card, check those financial institutions to see if they offer free credit score tracking.