How To Respond to a Virginia Warrant in Debt

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you’re sued for a debt that’s $5,000 or less in Virginia, the case will be filed in a general district court. You do not have to file an answer form to contest the lawsuit, but you must show up to the hearing listed on the Warrant in Debt form. This is the form you’ll get that notifies you that you’ve been sued for a debt. From there, you’ll follow the court’s instructions.

Written by Upsolve Team.

Updated April 18, 2025

Table of Contents

How Do Debt Collection Lawsuits in Virginia Work?

Debt collectors are notoriously persistent. Most will try calling you or sending you notices in the mail. Eventually, they may decide to bring a debt collection lawsuit against you. If you get sued, you’ll be notified with a document called a Warrant in Debt.

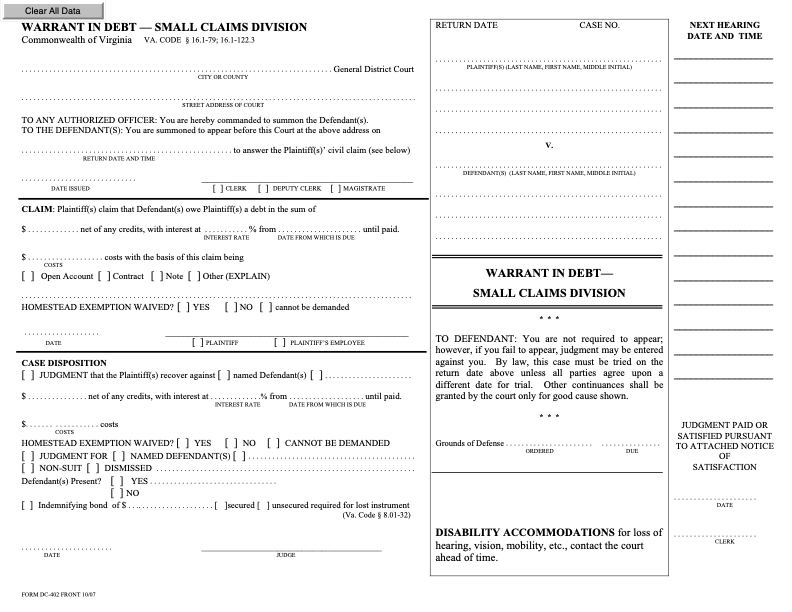

The first page looks like this:

What Is a Warrant in Debt?

A Warrant in Debt is an official court document notifying you that a debt collection lawsuit has been filed against you. There are a few important pieces of information in this document, including:

The court location: The name and address of the city or county district court you’re being sued in is listed on the top left-hand portion of the form.

The return date and time: This is the date and time of your initial court appearance. If you want to fight the lawsuit, you must show up to this court hearing.

The claim amount: This is the amount the debt collector claims that you owe.

Notice of what happens if you don’t appear: This notifies you that you aren’t required to appear for the hearing but that if you don’t, the court can enter a judgment against you. In other words, you lose and the plaintiff gets the claim amount they asked for.

Upsolve Member Experiences

3,270+ Members OnlineHow Do You Respond to a Virginia Warrant in Debt?

Virginia has a unique process for responding to debt lawsuits. It can be broken into the following steps:

Attend the scheduled hearing (listed on the Warrant in Debt).

Ask for more detailed information about the debt.

Be prepared to explain your defenses.

Ask for a trial and await next steps from the court.

Step 1: Show Up to the Scheduled Hearing

The Virginia Warrant in Debt will list the date, time, and place of your court hearing. You must show up to the hearing if you want to respond to the plaintiff’s (the person suing you) claims against you. If the hearing date or time doesn’t work well for you, call the clerk of court to ask what you need to do to reschedule it.

This initial appearance isn’t run like a trial. It’s an opportunity for you to let the judge know that you don’t agree with the claims against you. It’s still a good idea to dress formally (like you would for a job interview), arrive early, and address the judge as “your honor.”

Step 2: Ask for More Detailed Information on the Debt

You can also ask the court to order the plaintiff to give you more detailed information about the debt they claim you owe. This is done in an official document called a Bill of Particulars that the plaintiff can be ordered to fill out and file. This is an important and easy way to make sure that the plaintiff must explain exactly why they believe you owe the debt and must prove that they, in fact, own the debt and can legally collect on it. Be prepared to request this from the judge.

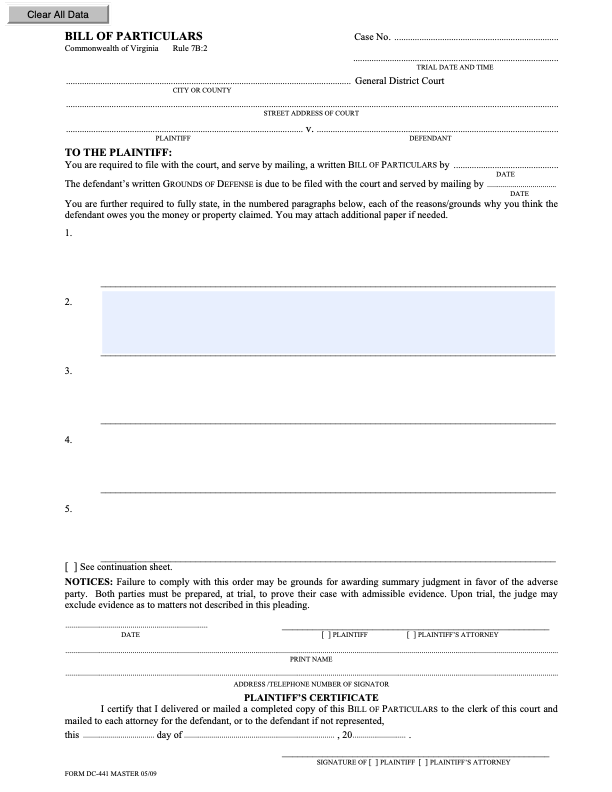

What Is a Bill of Particulars?

This is a formal court document that the plaintiff fills out to explain why they think you owe the debt. Each of their claims against you is listed in numbered sections.

The form looks like this:

Reading the Bill of Particulars carefully can help you figure out what defenses or affirmative defenses you want to raise in the case. Essentially, you’ll think about how and why you want to contest what the plaintiff has written in this document.

Step 3: Be Prepared To Explain Your Defenses

Just like you can request extra information from the plaintiff, they may also ask the judge to order you to fill out an official form explaining your defenses. This form is called DC-442 Grounds of Defense. The court also has form instructions to help you fill out the form.

How Do You Fill Out a Grounds of Defense Form?

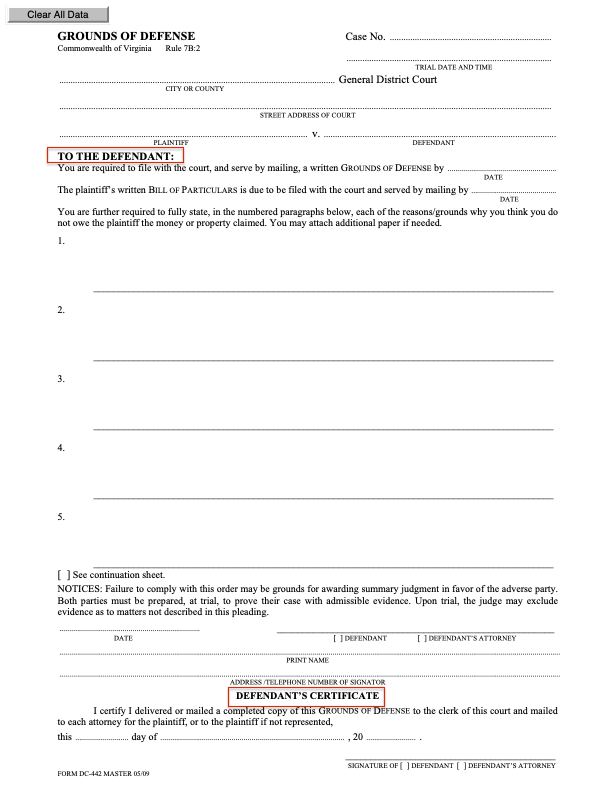

The Grounds of Defense form is a one-page form that looks like this:

The top portion of the form lists the court name and location and the names of the parties in the lawsuit. You are the defendant. The person or company suing you (or the lawyer representing them) is the plaintiff.

The second portion of the form labeled “To the Defendant'' is where you write in your defenses to the claims the plaintiff has brought against you. If you write that you deny the claim(s) against you, this is simply raising a defense. But you can also use affirmative defenses. These are reasons that the plaintiff shouldn’t win whether or not their claims are true.

Here are some common affirmative defenses in debt lawsuits:

The debt is too old and the statute of limitations has expired.

You already paid the debt.

The debt was discharged in bankruptcy.

You don’t owe the debt because you were wrongly identified as the debtor or because of an identity theft issue.

Be sure to include proof to back up your defenses and affirmative defenses. This could be in the form of receipts, billing or account statements, correspondence with the creditor or debt collector, a credit report, or anything else that helps illustrate your claim.

You Must Deliver a Copy of the Grounds of Defense Form to the Plaintiff

The final portion of the form is the “Defendant’s Certificate.” When you sign and date this, you are telling the court that you sent a copy of the form to the plaintiff or their attorney. You should be able to find the plaintiff’s name and address on the Warrant in Debt.

You can send the form in the mail or deliver it in person. You need to do this by the date listed on the top of the Ground of Defense form. That’s also your deadline for filing a copy with the court. You can usually do this in person or via mail, but call the clerk of the court listed on your forms to verify your options.

Step 4: Ask for a Trial and Await Next Steps

While you’re at the initial court hearing, you can ask for a trial along with your request for a Bill of Particulars to learn more about details of the debt the plaintiff alleges that you owe.

It might sound intimidating to go to a trial, but the trial will be scheduled after you’ve gotten the Bill of Particulars and filled out the Grounds of Defense. At this point, you should have a good idea of why you’re being sued and how you’re going to try to stop it. At the trial, you’ll essentially tell your story, again, to the judge in person (or remotely) after the plaintiff tells their side of the story. The judge will make a decision at or after the trial.

Your trial may be several months from your initial appearance. Be sure to meet any court-ordered deadlines in the meantime! And always contact the court if your address changes.

What Happens if You Don’t Respond to the Lawsuit?

If you don’t respond to Warrant in Debt, you risk losing the lawsuit by default.

As mentioned above, there is a notice section in the Warrant in Debt that explains that failing to appear at the scheduled hearing can lead to a judgment. A judgment is a court order. In this case, it’d be a court order for you to pay what the plaintiff claims you owe.

With a court order in hand, the debt collector can also get direct access to money in your paycheck or bank account through wage garnishment or a bank account levy. Wage garnishment is the most common collection method at this point, but the state of Virginia limits how much anyone can take from each paycheck.

Give yourself a fighting chance to win the debt collection lawsuit by showing up and fighting the claim. Empowered with the knowledge from this guide, you can do this on your own, without a lawyer's help.

If the court has already entered a default judgment against you, you can be able to file a motion to have it set aside (canceled). The court provides instructions on how to do this.

Need Legal Help?

Virginia Legal Aid provides free legal help for eligible individuals. Search for help in your areas here: Find Legal Help.

Virginia Free Legal Answers allows you to ask volunteer attorneys specific questions about your case online. It’s a service of the American Bar Association.

Call or visit a local law library and speak with a librarian to learn more information on Vi