How To Answer a California Court Summons for Debt Collection

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you’re sued for a debt in California, you have 30 days to respond to the lawsuit by filing an answer and proof service form with the court and having an adult who isn’t part of the lawsuit serve a copy of the answer on the person suing you. This can be done by first-class mail, but it can’t be done by the person being sued. After filing your paperwork, wait to receive further instructions from the court. Be sure to comply with any pretrial requests and show up to scheduled hearings. There are many legal aid (free legal help) services available in California if you need help with this process.

Written by Upsolve Team.

Updated August 26, 2025

Table of Contents

How Do Debt Collection Lawsuits in California Work?

If you don’t respond to a debt collector or creditor who is contacting you about an overdue debt, they may eventually bring a debt collection lawsuit against you. Most debt collectors hire lawyers to file these cases on their behalf.

In California, consumer debt collection lawsuits are civil cases. They’re filed in local trial courts, which are also called superior courts. These courts are different from small claims courts, which tend to be less formal and have fewer rules.

In California, small claims courts are reserved for individuals suing other individuals or businesses for $10,000 or less and for businesses suing for $5,000 or less. Lawyers are not generally allowed in small claims courts in California, which is why consumer debt collection cases aren’t usually heard in small claims.

You’ll know you’ve been sued if and when you receive a summons and complaint.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped over 300,000 respond to debt lawsuits and settle debts for less.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

What Is a Summons and Complaint?

The summons is formal notice stating that you’re being sued, who is suing you (the plaintiff), which court is dealing with the case, and what the deadline is for you to respond to the case.

The complaint is the plaintiff’s list of allegations or claims against you. For example, if you’re being sued for unpaid credit card debt, you may be sued for breach of contract and whatever amount (plus interest) you owe on the debt. The plaintiff often also tries to get their legal fees and court costs covered if they win.

Ultimately, the debt collector is hoping that the judge will side with them and issue a court order called a judgment. If this happens, you’re at risk of a potential wage garnishment, bank account levy, or property lien.

What Happens if You Don’t Respond to the Lawsuit?

If you don’t respond to the summons or respond to the summons but don’t later appear in court as required, you’ll likely lose the lawsuit by default. If you don’t respond or show up, the court can issue a default judgment. A default judgment also has the power to help the debt collector garnish your wages, take money directly from your bank account with a levy, or put a lien on your property.

Getting notice of a lawsuit can be incredibly stressful and confusing. You have free legal help resources (see more information at the end of this article) available to you, but you can also represent yourself. Your chances of winning the debt collection lawsuit might be better than you think. Debt buyers and debt collection agencies use lawsuits as a strategy. They’re hoping you don’t respond to the lawsuit so they can get an easy win. Don’t let them.

How To Answer a California Court Summons for Debt Collection

You have 30 days from the day you were served with the summons to respond to the debt collection lawsuit. You do this by filling out a court form (called an answer form), filing it with the court, and delivering it to the person who sued you (called the plaintiff).

The California court system offers exceptional online self-help guides. The self-help guide for debt lawsuits is easy to navigate and easy to understand. You can also speak with the court clerk at the court where your case was filed if you have questions about forms, fees, deadlines, or court rules. Court clerks can’t give legal advice, but they’re very knowledgeable about court processes.

Step 1: Get an Answer Form

After you receive the summons and complaint, you have 30 days to file a response with the court. You do so by filing an answer form, which you can download as a fillable PDF from the court online. You could also print the form or get a copy from the courthouse and fill it out by hand.

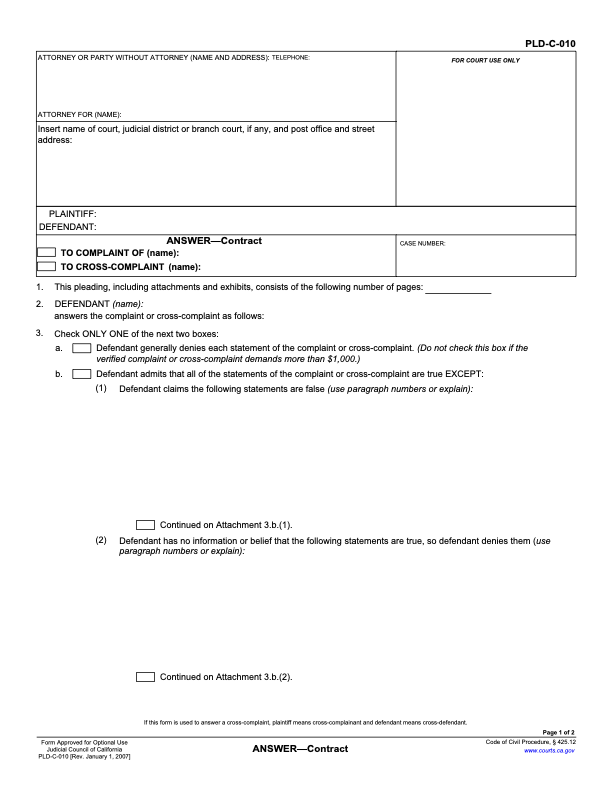

The first page of the answer form looks like this:

Step 2: Fill Out the Answer Form

The top part of the answer form is straightforward. You’ll write or type the plaintiff’s name and contact information as well as the court’s. You can get this information from the summons and complaint documents you received.

Since this is an answer to a complaint, where it says “ANSWER–Contract” you can check the “TO COMPLAINT OF” box and add the name of the party suing you.

The first numbered item on the form asks how many pages total are included with your answer form. You can fill this out when you’re finished preparing your answer. You may want to include extra pages to explain your answers or to provide evidence of any defenses you raise (most on this soon).

Write in your name under “2. DEFENDANT”

The third numbered item on the form asks you to check one of the two boxes. The first box is a blanket denial of all the claims in the complaint. The second box allows you to agree with some claims while also:

Denying others — or as the form says “Defendant claims the following statements are false”

Telling the judge that you don’t know if certain claims are true — or as the form says “Defendant has no information or belief that the following statements are true, so defendant denies them)

You’ll notice that after both of these statements, the form asks you to “use paragraph numbers or explain.” This is referring to the claims on the complaint form, which should be listed in numbered paragraphs. This is an easy way for you to reference any claims in your explanation that you believe are false or that you don’t have enough information about.

You don’t have to provide an explanation, you could just write in the paragraph numbers in the space provided. If you do include an explanation, it’s best to keep it brief. For example, if one of the claims is that you owe a certain amount of money, but you have proof that you paid the full amount, you can say so in your explanation and attach proof of payment.

Step 3: Assert Your Affirmative Defenses & Request to the Court

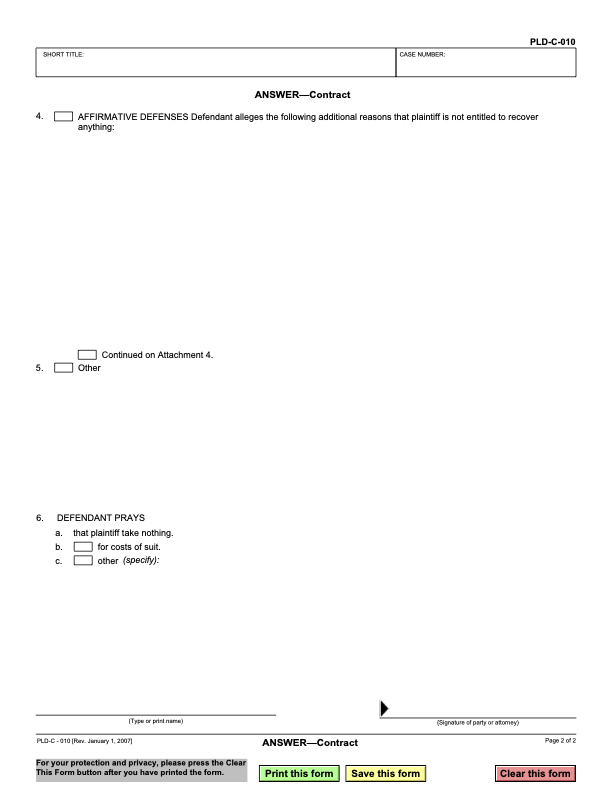

The answer form in California is two pages long. On the second page, you have the opportunity to list any affirmative defenses you have.

This is what the court form looks like:

Affirmative defenses are reasons you believe that the plaintiff shouldn’t win the case. For example, if the debt collector broke state or federal consumer protection laws when trying to collect the debt from you, you can raise this as an affirmative defense.

Here are some common affirmative defenses in debt collection lawsuits:

The debt is too old (aka the statute of limitations has expired).

You don’t owe the debt either because you were a victim of identity theft or you already paid the debt off

The debt was discharged in bankruptcy

You must list your affirmative defenses as part of your answer. You can’t bring them up later if you didn’t include them in your answer form.

The Ventura County Superior Court has a self-help document that goes into more depth about affirmative defenses in debt lawsuits.

The final item on the form reads “DEFENDANT PRAYS” and offers three options. Essentially, this is what you’re asking the court to do. You can ask:

That the plaintiff take nothing — in other words, you just want the court to dismiss the case

For money to cover the costs of the lawsuit

For another remedy, which you must specify — you’ll likely only use this if you bring a counterclaim against the plaintiff

Finally, you’ll sign the form. Then, make three copies: one for you, one to file with the clerk, and one to send to (serve on) the plaintiff. Bring all three copies with you to the court for the clerk to stamp.

Step 4: Deliver a Copy of Your Answer to the Plaintiff

Before you file your answer forms with the court, you’ll need to deliver a copy to the plaintiff. The formal way of saying this is “serving a copy on the plaintiff.” Service is a legal term that means formally delivering court paperwork to an opposing party.

California has specific rules for service. The papers can be mailed first-class, but you can’t do the mailing yourself. You must choose an adult who is not involved in the case to serve (mail) the court papers for you. This can be someone you know and trust or a professional process server. Professional servers charge fees for serving paperwork.

You’ll also need to ask the person who serves the answer form to fill out and sign a Proof of Service form. Make two copies of the completed form.

Step 5: File Your Answer Form and Pay the Filing Fee (or Request a Fee Waiver)

When you file your answer paperwork with the court, you’ll need:

Two copies of the answer form

Three copies of the proof of service form

The filing fee or fee waiver request

California has steep fees to file an answer, but you can file a waiver request. You can qualify for the fee waiver if:

You receive public benefits such as Medi-Cal, Food Stamps (Cal Fresh), or SSI or you’re currently receiving unemployment benefits

Your household income is below a certain threshold

You can prove to the court that you can’t pay the filing fee and meet your household’s basic needs

You can file your forms with the court in person at the courthouse listed on the summons or by mail. If you file by mail, include the filing fee and a self-addressed stamped envelope for the court to return stamped copies of your document. If your local court allows, you may be able to e-file the forms online. Check with your local court clerk.

Upsolve Member Experiences

4,444+ Members OnlineWhat Happens After You Respond to the Lawsuit?

After you file your papers with the court, wait to receive information from the court about an upcoming hearing (trial) or other appearances like a case management conference. Respond to any requests you get that are related to the case. If you don’t, you can lose by default.

Debt collection cases for credit card debts, medical bills, and other consumer debts are heard in civil trial courts in California. Though it’s possible to represent yourself in these cases, it’s important to have the time and commitment required to properly prepare for the trial. If you want to have an attorney represent you but can’t afford to hire one, check out the final section of this article on how to get free legal help.

What Do You Do if the Court Already Issued a Default Judgment Against You?

You may be able to get the court to set aside (cancel) the default judgment against you if:

You didn’t receive the summons and complaint

You had a good reason for not responding to the summons

You didn’t understand the court case or didn’t know there was one

You responded to the summons and didn’t attend the hearing, but you have good cause for missing it

You must make a formal request to the court if you want the judge to consider setting aside the default judgment. This formal request is called a motion. The court acknowledges that this can be a complicated process and advises getting legal help if you want to do it. You may be able to get free legal help from the resources listed below.

Need Free Legal Help?

The State Bar of California has compiled a list of resources for free legal help.

The Legal Aid Association of California has a legal directory that allows you to search for free legal help by location and legal topic.

Public Law Libraries have self-help information online and also offer in-person legal clinics where you can get assistance.

You can get free legal help, but not advice, from the California Courts’ Self-Help Service.

SoloSuit is an online service that can help you respond to a debt lawsuit for a small fee.