How To Respond to a Colorado Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you’re sued by a debt collector in Colorado, you’ll receive a summons and complaint. These official documents inform you of the lawsuit against you and the deadline you have to respond. You’ll also receive a blank answer form where you can write your response to the court, including any defenses you have. Then you sign the form and make copies. You’ll file one copy with the court clerk, send one via mail to the person suing you, and keep one for your records.

Written by Upsolve Team.

Updated May 8, 2025

Table of Contents

How Do Debt Collection Lawsuits in Colorado Work?

If a creditor or debt collector is after you for an unpaid debt, they may eventually decide to sue you if they haven’t been successful in contacting you. Debt collection lawsuits are more common than you might think: Over 44% of all civil cases in Colorado are debt collection cases. Many of these cases involve claims of $1,000–$2,000. If you’re sued for $15,000 or less, your case will likely be filed in county court.

Most debt collectors hire lawyers to help them with debt collection lawsuits. Small claims court in Colorado is reserved for individuals or parties representing themselves, so these cases aren’t usually filed in small claims.

No matter which Colorado court you’re sued in, you’ll be notified with a summons and complaint.

What Is a Summons and Complaint?

A summons is a court document notifying you that you’re being sued. The complaint is an official document that explains how much you’re being sued for and why you’re being sued.

What the Summons Tells You

The summons is the official notice that you’ve been sued. You’ll likely receive it in person from the county sheriff or a professional process server.

The summons will tell you:

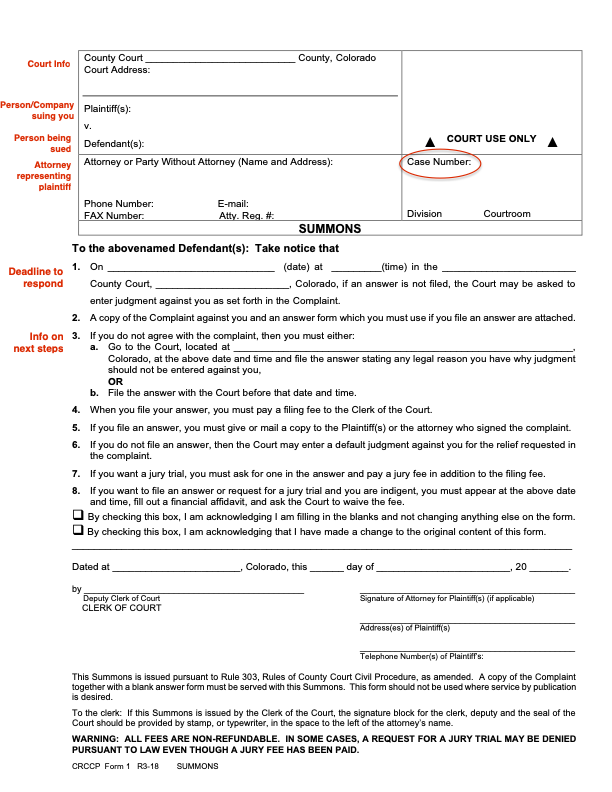

Court info: the name and address of the county court where the case was filed

Plaintiff’s name: The name of the person or company suing you

Defendant’s name: The name of the person being sued (your name)

Attorney’s name: The name of the law firm or attorney representing the plaintiff (if applicable)

Case number: The number the court has assigned to identify your case

Deadline to respond: The date and time by which you must file your answer (respond) with the court or show up at the court to contest the case

Information about next steps: Explanation of your two choices to respond to the lawsuit

Here’s what the summons looks like with the above elements named in red:

What the Complaint Tells You

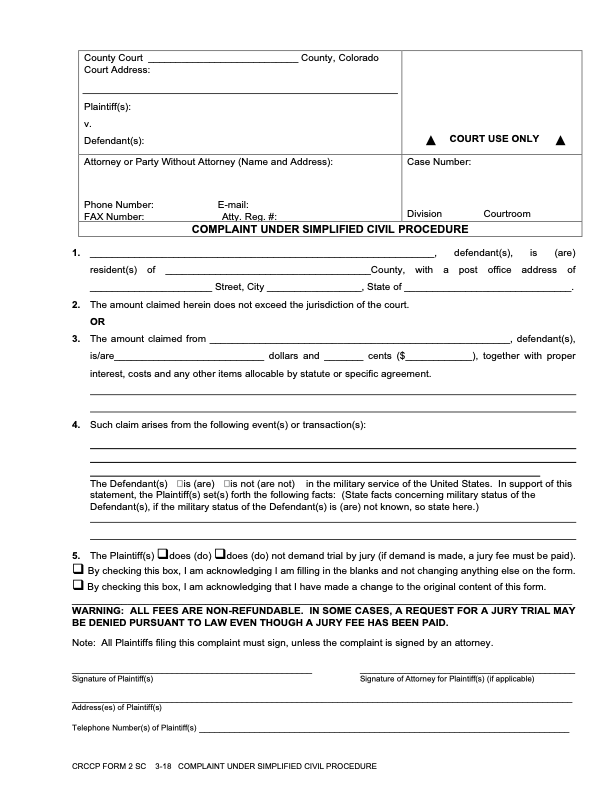

A complaint will accompany the summons you receive. This is a court document that outlines the plaintiff’s claims against you. Here’s what the Colorado court complaint template looks like:

The complaint you receive may look a little different, but it should contain the same information. It may list the claims (allegations) against you in numbered paragraphs.

The complaint also tells you the amount the debt collector is suing you for. If they win the case, the judge will issue a judgment, which is an order mandating that you pay the debt collector for the amount listed in the complaint. The judgment can include the original debt, interest charges, and legal and court fees, which means you may end up paying far more than just the original debt they claim you owe.

The debt collector must win the lawsuit to get the judgment. This is why it’s so important for you to respond to the summons by the deadline. If you don’t, you’ll probably lose by default.

How Do You Respond to a Colorado Court Summons for Debt Collection?

In Colorado, you have 21 days to respond to a debt collection court summons. To respond, you need to file an answer with the court. An answer form should be included with the summons you received. You can also go in person to the courthouse listed on the summons to file your answer. This is your chance to address each claim or allegation in the complaint and raise any defenses you may have. You’ll also need to deliver a copy of this form to the person suing you (the plaintiff). Then, be sure to watch for court notices about scheduled appearances and show up for them.

Here’s more information on each of these steps.

Step 1: Find the Court-Provided Answer Form

Under Colorado court rules, the person or company suing you is required to include a blank answer form when they serve you the complaint.

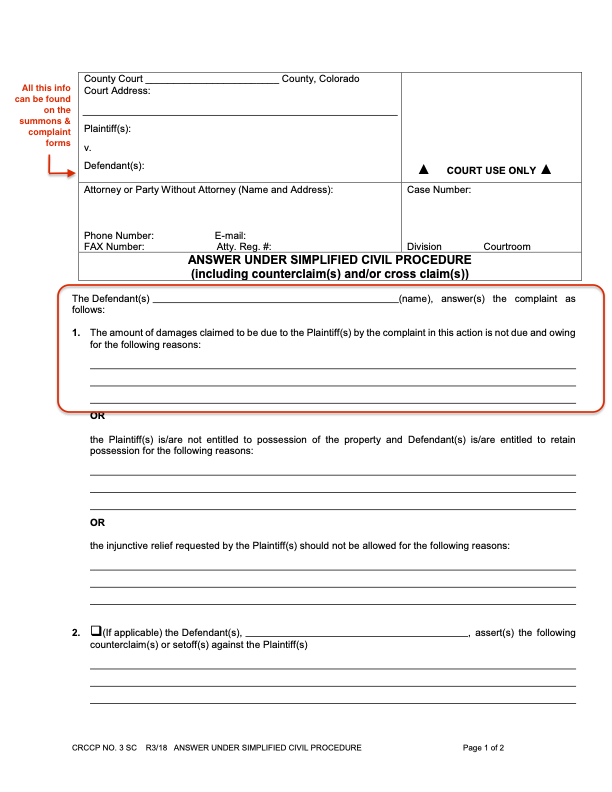

This is a two-page form. Here’s what the first page looks like:

Once you have this form, fill out the top portion (court, plaintiff, attorney, case number). You can find all this information on the summons and complaint you received. Next, you’ll write your response.

Step 2: Write Your Response

The answer form is used for different kinds of civil cases, not just debt collection lawsuits. That’s why there are three options for providing a response. The first response is where you’ll write your answer. It says:

“The Defendant(s) (name), answer(s) the complaint as follows:

1. The amount of damages claimed to be due to the Plaintiff(s) by the complaint in this action is not due and owing for the following reasons:”

This is basically saying that you don’t believe you owe the money you’re being sued for or that you disagree with the amount. Then, you have space to explain why you believe that. If you have a defense or evidence showing that you don’t owe the plaintiff’s claim, you’ll list that here. You can also say that you don’t have enough information to admit or deny the claims against you. This forces the debt collector to prove every allegation against you.

Step 2: Raise Your Defenses and Counterclaims

As part of your response, you may want to raise an affirmative defense or bring a counterclaim. You don’t have to do this, but if you have a valid defense or counterclaim, this is your chance to bring it up.

What Is an Affirmative Defense?

An affirmative defense is a reason why the debt collector shouldn’t win the case, even if everything in the complaint is true.

You can use an affirmative defense even if you owe the debt. If you don’t actually owe the debt, raising a defense allows you to tell the judge your side of the story.

Here are some common affirmative defenses in debt collection lawsuits:

The debt is too old because the statute of limitations has expired.

The debt isn’t yours (because you were misidentified or a victim of identity theft).

The debt has already been paid.

The debt was discharged as part of a bankruptcy case.

What Is a Counterclaim?

A counterclaim is like a lawsuit within a lawsuit. If the person suing you did something wrong or broke the law, you can bring a counterclaim in addition to defending yourself against their claim. You can sue for damages, which is a fancy way of saying compensation.

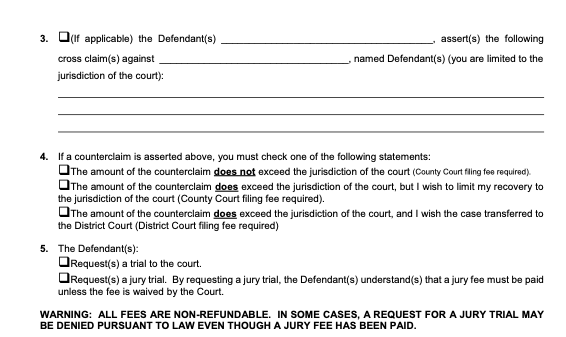

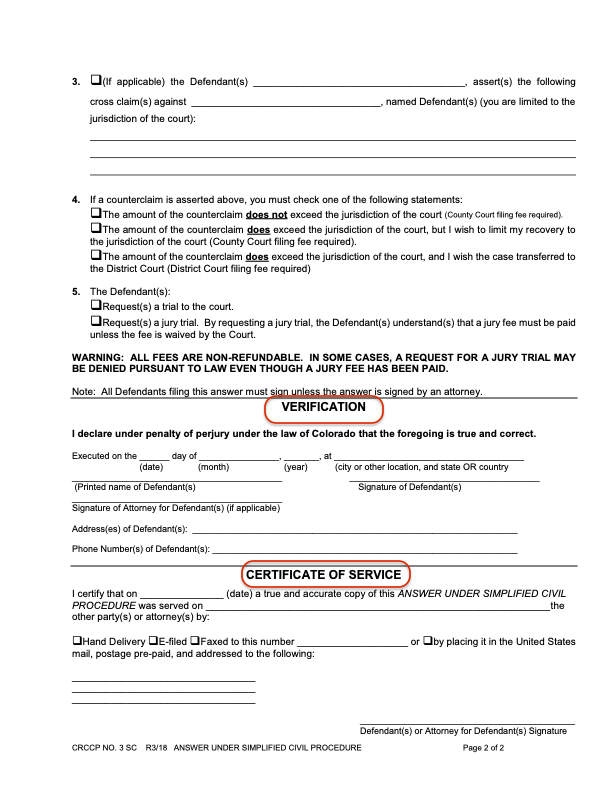

The second page of the court-issued answer form has a space for counterclaims. That portion of the form looks like this:

Filing a counterclaim can get complicated. When you’re filing an answer, you’re on defense, but when you file a counterclaim, you’re on offense. It takes more work, energy, and know-how. But if you were harassed by the debt collector or they broke any laws when trying to collect from you, you are entitled to file a counterclaim or bring a lawsuit against them.

If you want to assert your right to do this, it’s best to get legal help. If you have a strong case, the lawyer may work on contingency, which means you don’t have to pay them upfront, and they are paid from the money they help you win in the lawsuit.

Step 3: Complete the Verification and Certificate of Service Portion of the Answer Form

These two sections of the form — Verification and Certificate of Service — are pretty easy to complete, but it’s important to understand what they mean.

First, here’s what this part of the form looks like:

Verification

When you sign your name under the verification section, you’re telling the court that the information you’ve provided in your response is true and correct. You’re providing the signature under penalty of perjury, which means that there can be legal consequences if you knowingly provide false information and the court finds out.

Certificate of Service

You’re required by the court to deliver a copy of your answer form(s) to the plaintiff or their attorney at the address listed on the summons. The Certificate of Service section of the answer form is verifying that you’ve done this. It asks what date you sent the forms and what method you used to deliver them.

Finally, make three copies of the form: one for your records, one to file with the court, and one to send to the plaintiff. You can complete the last two steps in any order. Just be sure that the date and method you list on the Certificate of Service are accurate.

Step 5: Send a Copy of the Answer to the Plaintiff

When there’s a lawsuit, anytime either side files forms with the court, they must provide a copy of the form to the other side. This is why the plaintiff submitted a complaint to the court and sent a copy to you. In return, you must make a copy of your answer and send it to them. In formal terms, this is called service or serving the papers.

It’s important to send the plaintiff a copy of your answer form so they’re aware that you are contesting the case and have responded. The court recommends mailing your answer to the plaintiff or their attorney at the address listed on the summons. You may also be able to e-file the forms, deliver them in person, or fax them to the plaintiff.

Step 4: File Your Forms With the Court Clerk Within 21 Days

You can file your answer form by mailing it to the court at the address listed on the complaint.

Colorado has a filing fee for the answer form. This fee depends on the claim amount in your case (the amount the plaintiff says you owe) and whether or not you file a counterclaim. Assuming you aren’t filing a counterclaim, the fees are as follows:

$80 filing fee if the claim is between $0.00 – $999.99

$100 filing fee if the claim is between $1,000 – $14,999.99

$130 filing fee if the claim is between $15,000 – $25,000

It probably feels unfair that in addition to being sued for a debt you have to pay a fee to respond to the court case so you don’t lose and face even more serious collection measures. Thankfully, you can file to request a fee waiver. To do so, you need to show up to the hearing at the date listed on the summons and complete an affidavit.

You can qualify for an automatic fee waiver if you can show proof that you receive benefits from any of the following:

Aid to the Blind Colorado

Aid to the Needy and Disabled (AND)

Old Age Pension A & B

Supplemental Security Income (SSI)

Note that you still have to file paperwork to be granted this automatic waiver.

The court provides instructions on filing a fee waiver. After you read the instructions to see which form or forms you need to fill out, you can find and download forms on the court webpage.

Upsolve Member Experiences

4,312+ Members OnlineWhat Happens After You Respond to the Lawsuit?

After you file your answer and deliver a copy to the plaintiff, you can start preparing for your court hearing. The hearing date, time, and place will be listed on the summons.

Going to court might feel intimidating, but if you prepare, you can ease your stress and build your confidence. The Colorado Legal Help Center provides information about how to prepare for trial. They can also help you find a lawyer if you want legal help.

What Happens if You Don’t Respond to the Lawsuit?

Unfortunately, ignoring the lawsuit doesn’t make it go away. If you don’t file an answer or you don’t show up to scheduled court appearances, you will likely lose the lawsuit by default. When this happens, the judge issues a default judgment against you.

A default judgment is a court order that then allows the plaintiff to get permission to garnish your paycheck or take money from your bank account to satisfy the debt. Wage garnishment creates a real financial hardship for many people, but Colorado limits how much of your paycheck a debt collector can take.

Default judgments are really common in debt collection cases because many people think they need to hire a lawyer to fight them, and they can’t afford to do that. But it’s easier than you think to fight back and maybe even win the debt collection lawsuit.

Filing your answer shows the debt collector you’re taking this seriously. If you don’t owe the debt, you can raise defenses to try to get the case dismissed. If you do owe it, you put yourself in a good position to come to a debt settlement agreement with the debt collector and pay less than the total amount you owe.

If the judge has already issued a default judgment against you, you may be able to file a motion to vacate (cancel) the judgment or otherwise reopen the case. Filing a motion simply means submitting a formal request (usually via a form) to the court. Speak to the court clerk, tell them your situation, and ask about your options. They can’t give legal advice, but they should be able to tell you if there’s a process in place to contest the judgment.

Need Legal Help?

Colorado Legal Services helps low-income Coloradans access legal services.

Colorado Legal Help Center has information about how to find a lawyer or deal with a lawsuit while representing yourself.

Colorado Judicial Branch - Small Claims Cases provides easy-to-understand information about the small claims process in Colorado as well as downloadable forms.