What Are the Idaho Bankruptcy Exemptions?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Exemptions help you protect what you own when you file bankruptcy. If you file Chapter 7 bankruptcy as an Idaho resident, you must use the state’s exemption laws. Idaho provides a generous homestead exemption up to $175,000 and a motor vehicle exemption of $10,000. Additionally, Idaho offers a wildcard exemption of $800, which you can apply to any property you choose.

Written by Attorney Eva Bacevice. Legally reviewed by Jonathan Petts

Updated May 15, 2025

Table of Contents

Why Are Idaho Exemptions Important in Chapter 7 Bankruptcy?

Exemptions are laws that allow you to protect your property from your creditors when you file a Chapter 7 bankruptcy case. Most Chapter 7 filers get to keep everything they own.

This article explains Idaho’s exemptions, but if you just want help with your bankruptcy case, consider taking our free two-minute screener to see if you qualify for free help with your Chapter 7 case.

Can Idahoans Use Federal Bankruptcy Exemptions?

Each state has different rules for bankruptcy, including what you can keep through exemptions. The U.S. Bankruptcy Code also lists federal exemptions, but states can choose not to use these.

Idaho has chosen not to use the federal exemptions, so Idaho residents must follow Idaho's state exemptions in bankruptcy. If you live in Idaho, you can also use federal non-bankruptcy exemptions, which help protect benefits like Social Security from being taken.

If you've lived in Idaho for at least two years before filing for bankruptcy, you must use Idaho's exemptions. If you recently moved, read this article to see where you’ll need to file: Can I File For Bankruptcy After Moving To a New State?

What Are the Idaho Bankruptcy Exemptions?

Exemptions cover a lot of different kinds of property. Let’s take a look at some of the most common exemptions in Idaho.

And if you’re feeling overwhelmed by all this, don’t worry! If you have a simple Chapter 7 case, you may be eligible to use Upsolve’s free tool to file your case, which includes figuring out which exemptions apply to you.

Real Property: The Idaho Homestead Exemption

The Idaho homestead exemption is very generous. It allows you to protect up to $175,000 of equity in a home or mobile home that’s your primary residence. This amount is the absolute limit for protecting your homestead. Even if you are a married couple filing jointly, this exemption can’t be doubled.

The Idaho homestead exemption also covers sale proceeds for six months or insurance proceeds (with specific conditions) for one year.

See Idaho Code §§ 55-1001, 55-1002, 55-1003, and 55-1008, 55-1113

Personal Property Exemptions

Idaho bankruptcy exemptions are contained in the Idaho Code, Titles 11, 41, 45 and 55. Married couples filing jointly can usually double their exemptions unless expressly prohibited, so long as they have an ownership interest in the property.

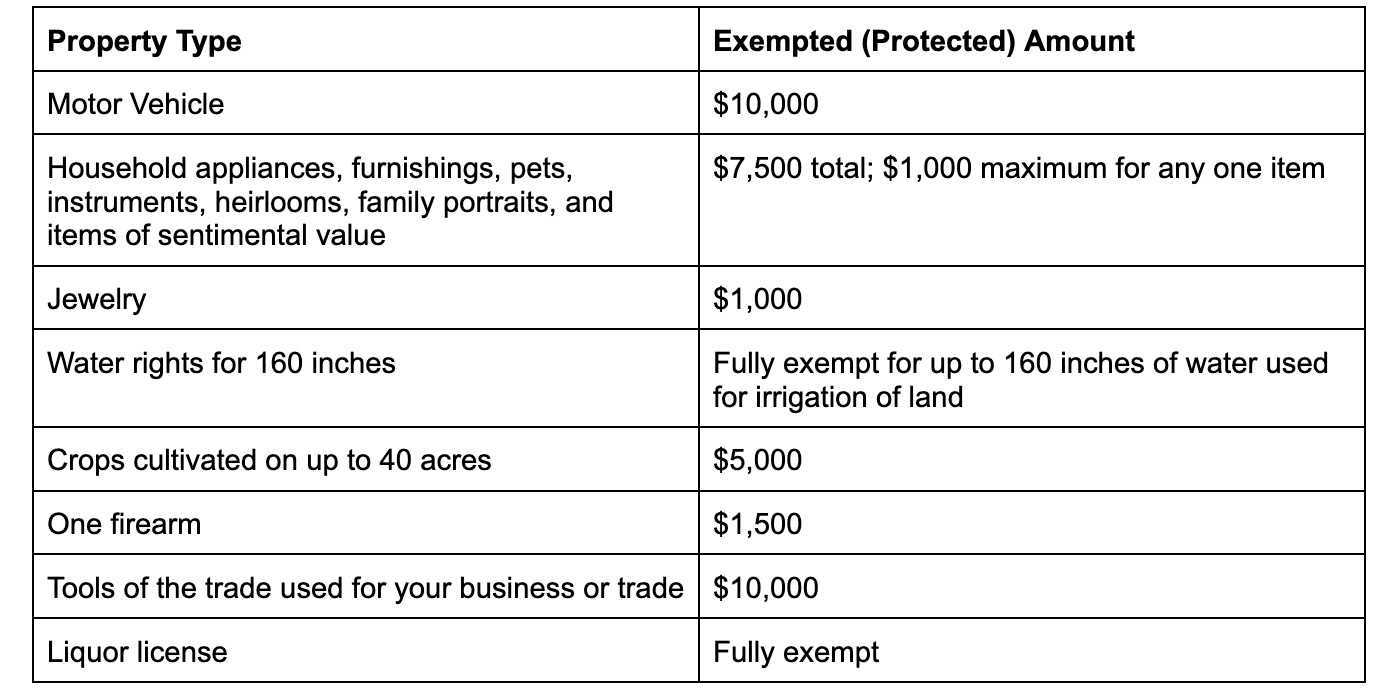

Filers in Idaho can protect the following items up to the stated dollar amounts:

See Idaho Code §§ 11-605(3), 11-605(1)(a), 11-605(2), 11-605(7), 11-605(8), 11-605(3), and 23-514

Filers in Idaho can protect the following items with no limit, so long as certain conditions, if any, are met:

Burial plot

Health aids that allow you or a family member to work and maintain your health

Provisions of food or water together with storage containers and shelving, sufficient for 12 months for use of the debtor or dependents

Building materials if furnished for use in construction are protected from all creditors other than creditors who financed the purchase of the materials

See Idaho Code §§ 11-603(1), 11-603(2), 11-605(4), 11-605-(7), 45-514

Idaho Wildcard Exemption

Idaho allows for a wildcard exemption of up to $800 for any tangible personal property. This can’t be used on real estate or nontangible property interests. A wildcard exemption is a special provision in bankruptcy law that allows you to protect a certain amount of any personal property you choose. This means you can use the exemption to protect items that don't fall under other specific exemption categories.

See Idaho Code §11-605(10)

Idaho Money Benefit Exemptions

Idaho bankruptcy exemptions protect the below funds or benefits up to the amounts stated:

Wages: Up to $2,500 in disposable earnings per calendar year are protected

College savings program account: Fully protected

Annuity contract proceeds protected up to $1,250 per month; if no payments are currently being made under the contract, the cash surrender value is protected up to the amount of premiums paid during six months before filing

The following insurance and other money benefits are protected without limit:

Insurance benefits

Group life insurance benefits

Life insurance proceeds

Fraternal benefit society benefits

Medical, surgical, or hospital care benefits and amount in medical savings account

See Idaho Code §§ 11-605(11), 11-604A(4)(b), 41-1836, 41-1833(1), 41-1930, 41-1835, 41-1930, 41-3218, and 11-603(5)

The below funds and benefits are fully exempt so long as they are deemed reasonably necessary to support the filer and their dependents:

Alimony or support payments

Death or disability benefits

Personal injury or wrongful death recoveries

See Idaho Code §§ 11-604(1)(b), 11-604(1)(a), 11-604(1)(c)

Other Idaho Exemptions

The above exemptions are all available in the Idaho Code. There are, however, additional protections available under Idaho law to protect your property, whether or not you file for bankruptcy.

Public Benefits

There are no monetary limits to the following exemptions:

Aid to blind, aged, disabled and general assistance

Social Security and veterans’ benefits

Unemployment compensation

Earned income tax credit (but not the child tax credit or education tax credit)

Federal, state, and local public assistance

Workers' compensation

See Idaho Code §§ 56-223, 11-603(3), 11-603(6), 11-604(4), 72-802

Pension and Retirement Benefits

All Idaho filers have options to protect their pensions and retirement benefits:

Idaho filers who have ERISA-qualified benefits use Idaho Code §§ 50-1011, 11-604A to exempt their pension.

Idaho filers who are public employees use Idaho Code §§ 59-1317, 59-1325 to exempt their pension.

Firefighters can protect their firefighters fund retirement benefits under Idaho Code § 72-1422.

Any Idaho filer can exempt their employee plan benefits under Idaho Code §§ 11-604(1), 11-604A, 41-1834.

Need Help Filing Chapter 7 Bankruptcy?

If you’re feeling overwhelmed trying to understand exemptions and other bankruptcy rules, you’re not alone. And the good news is that help is available. If you have a simple Chapter 7 case, you may qualify to use Upsolve’s free filing tool, which simplifies the process.

If you aren’t eligible for our tool or you prefer to work with an attorney, you can schedule a free consultation with a qualified bankruptcy attorney near you.