Can I Buy a Car After Bankruptcy?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Yes, but it makes sense to wait as long as you can after receiving your discharge. You'll need to be careful and make certain that you’re getting a good deal.

Written by Attorney Andrea Wimmer. Legally reviewed by Jonathan Petts

Updated May 15, 2025

Table of Contents

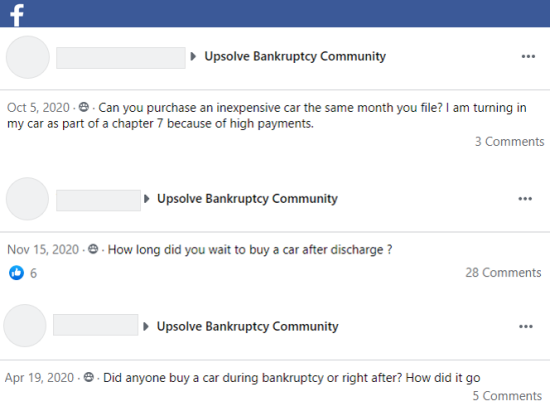

Odds are, you need your car. You need it to get to work, to drive your kids around, to go grocery shopping. Scrolling through the Upsolve User Facebook Group confirms that being able to buy a car after bankruptcy is a worry for many.

“Can I buy a car after Chapter 7 bankruptcy” is really two questions:

How long do you have to wait to buy a car after Chapter 7?

How long after bankruptcy can you get a car loan?

How long do you have to wait to buy a car after Chapter 7?

If you don’t need a loan for it, you don’t have to wait at all.

If you’re able to save up after filing to buy a used vehicle outright, or you have a family member or friend able to loan or give you the money, you can get a car whenever you want.

Keep in mind: If the money you’re using is property of the bankruptcy estate that you protected with an exemption, it’s best to run this by your bankruptcy trustee first. You want to make sure they won’t object to the exemption or otherwise have a problem with your plan.

What if someone wants to give me a car to help me out?

That works, too! If you know someone who might do this, let them know that it’s best to wait until after your bankruptcy case has been filed. That way you don’t have to worry about claiming an exemption for your new set of wheels.

How long after bankruptcy can you get a car loan?

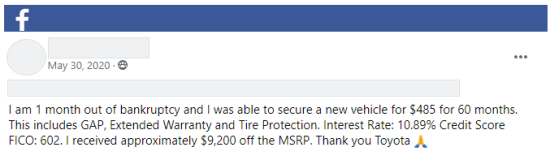

You can get a car loan immediately after filing bankruptcy. In fact, you’ll probably get quite a few ads from auto lenders and car dealerships even before your 341 meeting takes place. The key is to be smart about it and if you can, wait before getting a new car loan.

Why does it make sense to wait?

You want to make the most of your fresh start and the best way to do so is by setting yourself up for best loan terms for your auto loan.

Getting better terms, like a lower interest rate, is hard with bad credit and a low credit score. Immediately post-bankruptcy, you likely have bad credit. As a result of your subprime credit rating, the loan terms you’ll be offered for this new debt won’t be ideal.

But, you’re also closer to having good credit than you were before your bankruptcy filing. Your bankruptcy filing gives you the chance to build a good credit history. And, good credit = better terms.

For now, if you had a repossession or surrendered your car and need a replacement before you can build up a better credit rating, ask yourself this:

Can I buy a cheap car for cash to get through the next 6 - 12 months?

The car you can afford now may not be pretty, but if it gets you around it’ll be worth it in the long run because it buys you time to:

rebuild your credit (for example, by getting a secured credit card), and

save up money for a down payment

Both of these things will help you qualify for better auto loan terms when you go to buy the next car. The longer that you can wait to finance a large purchase after receiving your bankruptcy discharge the better off you will be.

Of course if your car is unsafe or requires a costly repair, you may need to get a new one earlier than you had hoped. There are steps that you can take to put yourself in the best position possible for a big purchase like a car.

How to prepare yourself for a post-bankruptcy car purchase:

Explore all of your financing options. Check with different financial institutions, including credit unions, to see what type of auto financing is available. Ask whether having a cosigner would help you get a better interest rate. Learn about subprime lenders.

Know what you can afford before you shop. Make sure your new car payment will not make meeting your other living expenses harder. You don’t want to end up in a stressful financial situation all over again.

Do some window shopping. It can be hard to get excited about buying a used vehicle. To combat this and feel better about buying something other than a brand new car, do some research. Find out which cars hold their value the longest, have the features you’re looking for while fitting into your budget, and … well… excite you the most.

Learn the numbers. By the time you’re at the car dealership, you should know not only what kind of car you want but more importantly, what kind of down payment and monthly payment you can afford.

Avoid “buy here, pay here” offers. “Buy here, pay here” dealerships often charge extremely high interest rates, up to 29%, and many have a reputation for not treating their customers well.

Curious how a 29% interest rate affects you compared to a rate of 9.99% or even 0.99%?

Rebuild your credit for as long as possible. This will allow you to make the most of your fresh start and apply for a car when your credit is stronger. The longer you can wait, the better.

Build Your Savings. The longer you are able to wait, the more money you can set aside for a down payment. Being able to put down a larger chunk of money will reduce the overall size of the loan and help you keep loan payments down even with a less than ideal interest rate.

Let’s Summarize….

Buying a car after completing a Chapter 7 is definitely possible and not uncommon.

The longer that you can wait to make a large purchase after receiving your discharge, the better off you will be. While a bankruptcy does stay on your credit report for 7-10 years, it also erases most of the other dings on your report and allows you to start rebuilding almost right away.

Following the above suggestions can help ensure that you get the best deal possible. Remember that buying a used car and/or obtaining a car loan that you can afford without financial strain will help to build back up your positive credit after a bankruptcy and help maintain your financial health moving forward.

Related Questions:

What happens to my car during a Chapter 7 bankruptcy?

If you have a car loan that you are up-to-date on when you file Chapter 7 bankruptcy and it’s not a hardship to keep making payments, you can likely keep the vehicle – if you want to.

To learn more about keeping the car you already have when filing Chapter 7 bankruptcy, head to our Learning Center and read Can I Keep My Car If I File Chapter 7 Bankruptcy?

What if I need to buy a car during my Chapter 7 bankruptcy?

It IS possible to buy a car during an active Chapter 7 case. To learn more about buying a new car (or refinancing your current one) during bankruptcy, check out Can I buy or refinance a car during Chapter 7 bankruptcy?