Your Guide to Illinois’ Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Illinois has two state laws that protect its residents against unfair, deceptive, harassing, or fraudulent debt collectors: the Illinois Collection Agency Act (ICAA) and the Illinois Consumer Fraud and Deceptive Business Practices Act (ICFDBPA). Additionally, a 2018 Illinois Supreme Court Rule sets certain requirements for creditors and debt buyers who file debt collection lawsuits. This is unique to the state of Illinois and helps protect consumers from being sued without proper evidence.

The statute of limitations for credit cards and medical debt is five years in Illinois.

Written by Upsolve Team.

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Illinois?

Illinois residents facing debt collection are protected by two state laws and a state Supreme Court rule:

The Illinois Collection Agency Act (ICAA)

The Illinois Consumer Fraud and Deceptive Business Practices Act (ICFDBPA)

Illinois Supreme Court Rule 208.2

If you live in Illinois, you’re also protected by a federal law called the Fair Debt Collection Practices Act (FDCPA).

How Does the Collection Agency Act Protect Consumers in Illinois?

The Illinois Collection Agency Act (ICAA) was passed to help protect consumers against harassment, fraud, and deception in the debt collection process. It applies to third-party debt collection agencies, but not to original creditors or lenders.

Under the ICAA, debt collection agencies must:

Be licensed in the state of Illinois if the company is based in Illinois or is based in a state that doesn’t require licensing

Properly identify itself by its registered name when contacting someone for debt collection purposes

Tell you the reason they are contracting you

Under the ICAA, debt collection agencies can’t:

Call you at inconvenient times

Speak to a third party (such as a friend or family member) about your debt without your consent

Make certain threats against you, such as threatening to publicize your debt or to sue you if they don’t plan to actually do so

Send you documents that are made to look like official legal documents but aren’t

Speak to you using profane, obscene, or otherwise abusive language

Misrepresent how much debt you owe

Engage in any other conduct that’s meant to deceive you

How Does the Illinois Consumer Fraud and Deceptive Business Practices Act Protect Consumers in Illinois?

The Illinois Consumer Fraud and Deceptive Business Practices Act (ICFDBPA) is a consumer protection law. While it’s not aimed specifically at debt collectors or debt collection activity, it may still provide important protections for those facing debt collection in Illinois.

Essentially, the law prohibits unfair and deceptive business practices in consumer transactions. Unlike the ICAA, the ICFDBPA gives consumers the right to sue companies that violate this law for actual and punitive damages. Actual damages are costs you incurred or money you lost. Punitive damages are compensation for breaking the law.

In fact, the ICAA states that debt collectors who violate its harassment or communication provisions are also violating the ICFDBPA. In other words, these two laws can work together on behalf of consumers in Illinois who want to sue debt collectors who break the law.

How Does Supreme Court Rule 208.2 Protect Illinois Consumers?

Knowing Illinois’ debt collection laws helps you understand your rights and can also help you identify potential defenses if you get sued by a debt collector. Unfortunately, this is becoming an increasingly common practice. Many states don’t have any laws or rules requiring debt collectors to provide evidence that they own the debt and can legally collect it. Illinois is an exception thanks to Supreme Court Rule 208.2.

This rule applies to third-party debt collectors, credit card collection agencies, and original creditors. This means it has a wider reach than Illinois’ consumer protection laws.

Under Rule 208.2, to file a debt collection lawsuit, you must also complete an affidavit that includes:

The underlying debt contract or proof of the debt if there wasn’t a written contract

The date of the most recent activity on the account

Proof that the debt collector owns the debt and has the legal right to sue to collect it

An explanation of any additional money the debt collector is suing for beyond the debt itself (for example interest, fees, attorney fees)

Again, in other states, the debt collector can just file a lawsuit with minimal or no evidence. They aren’t expected to provide this evidence or additional information unless you show up to fight the lawsuit and ask them to prove their case.

However, in Illinois, debt collectors have to do more work upfront to sue you. This may make it easier for you to identify defenses in the case or for the judge to dismiss it before it goes to trial if the debt collector hasn’t properly followed the rule.

To learn more, read Upsolve’s guide to debt collection lawsuits in Illinois.

How Does the Federal Fair Debt Collection Practices Act Protect Consumers in Illinois?

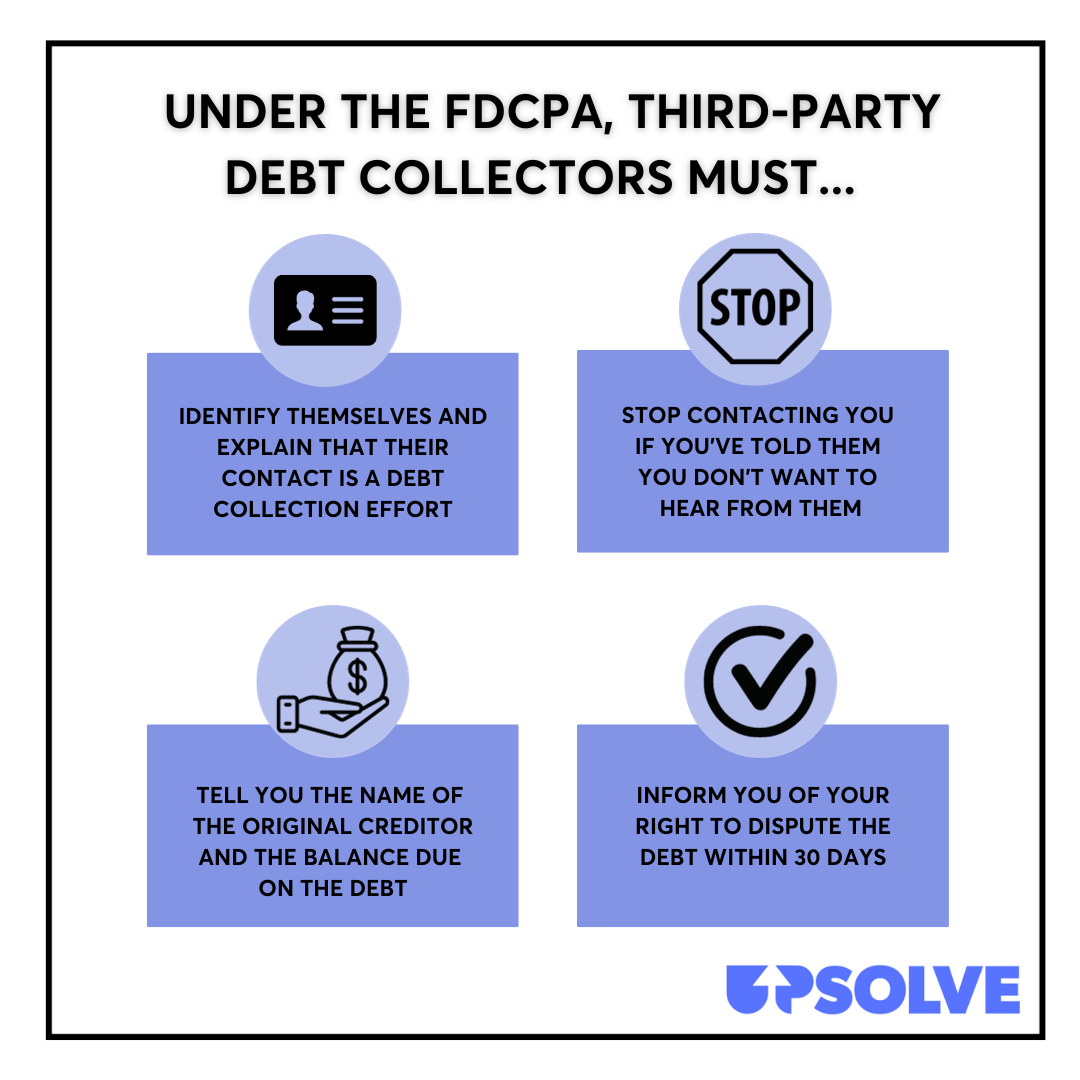

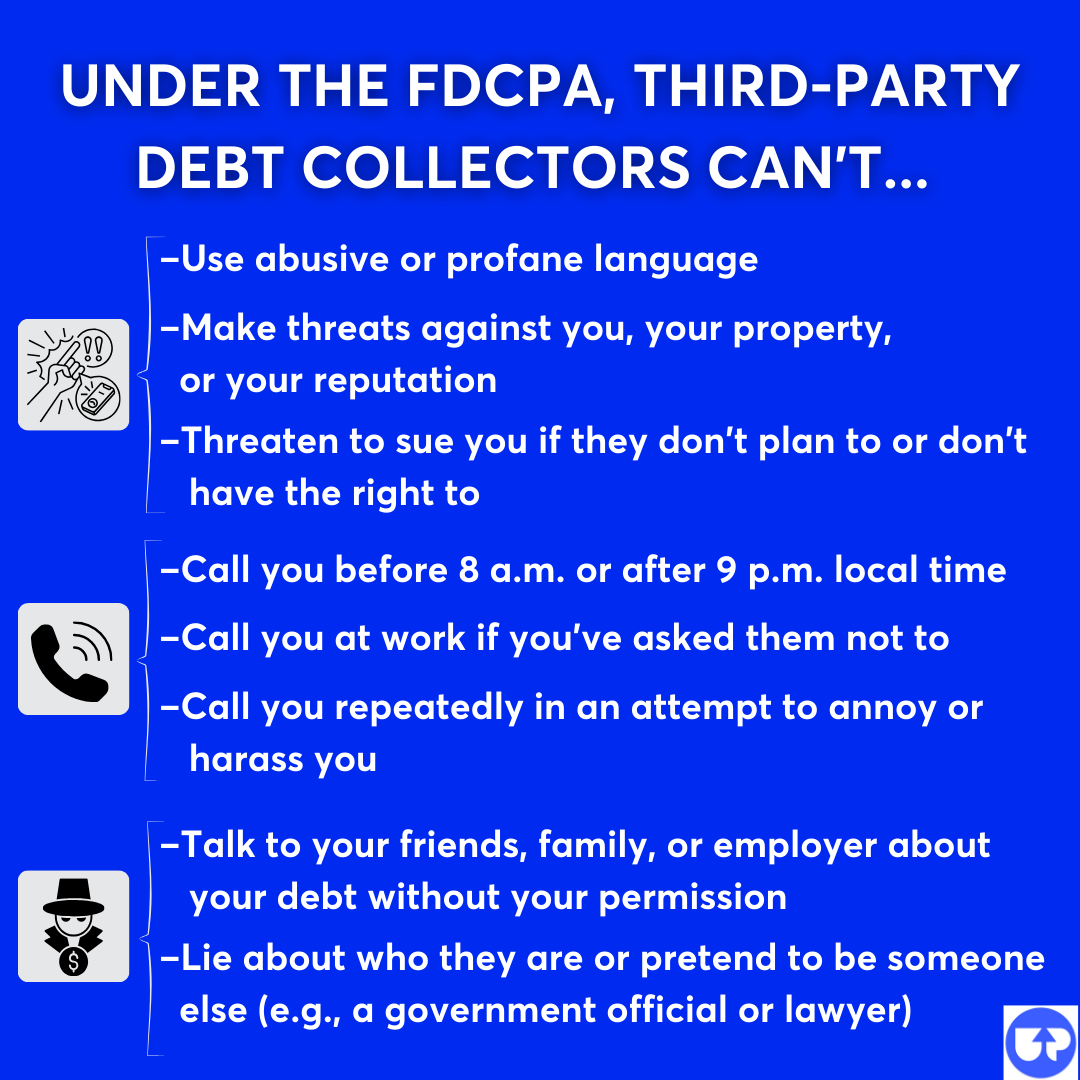

In addition to the state laws and rules listed above, Illinois consumers are also protected by the Fair Debt Collection Practices Act. You’ll notice that the FDCPA has a lot of similar rules as the Illinois Collection Agency Act.

Here’s a basic overview of the FDCPA:

Here’s a summary of the major protections and prohibitions under the FDCPA:

To learn more, read Upsolve’s Guide to the FDCPA.

What Can You Do if a Debt Collector Breaks the Law in Illinois?

If you believe a debt collector has broken a state or federal law while trying to collect a debt from you, you can file a complaint with state or federal agencies or sue them in court for damages.

File a Complaint

At the state level, you can report bad debt collector behavior to the Illinois Department of Financial and Professional Regulation or to the attorney general. Filing a complaint helps flag issues, which ultimately helps the attorney general and others to enforce state laws and penalize those who violate them.

You can also file a complaint with the Consumer Financial Protection Bureau (CFPB). This is the federal agency that helps enforce the FDCPA.

File a Lawsuit

If you believe the debt collector has violated the Illinois Consumer Fraud and Deceptive Practices Act, you can bring a civil lawsuit against them in a state court to try to recoup actual damages.

If a third-party debt collector has violated the FDCPA, you can also bring a lawsuit against them in federal court. If you win the case, you can receive actual damages for harm or loss and statutory damages of up to $1,000.

If you need free or low-cost legal advice to help with a lawsuit, check out:

Upsolve Member Experiences

3,804+ Members OnlineWhat Is the Statute of Limitations for Debt Collection in Illinois?

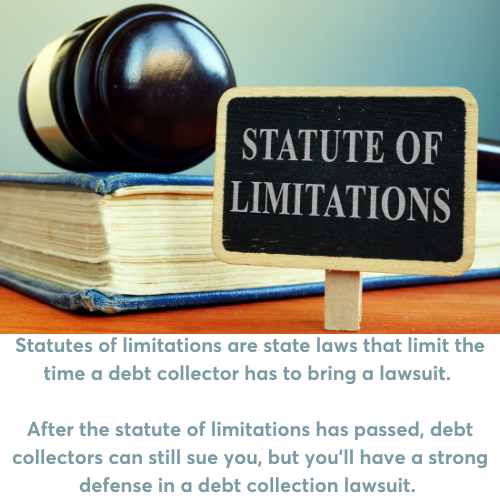

The statute of limitations is a state law that defines how much time a debt collector or creditor has to sue you for an unpaid debt.

Here’s the statute of limitations for debt in Illinois for the most common types of debt:

| Debt Type | Statute of Limitations |

|---|---|

| Credit cards (and other open-ended agreements) | 5 years |

| Medical debt | 5 years |

| Auto loans | 4 years |

| Mortgages (and other written agreements and promissory notes) | 10 years |

| Oral contracts | 5 years |

What Can Debt Collectors Do To Collect Debt in Illinois?

Debt collectors aren’t supposed to harass you or use deceptive tactics to try to collect a debt they believe you owe. But they can call you and send you written communication. Often, they’ll try to get a hold of you for a while before they take further action.

That further action depends on the debt in question. If you’re late on an auto loan payment, the debt collector could repossess your vehicle. If your credit card or medical debt has been sent to collections, you may eventually find yourself facing the debt collector in court.

If the debt collector wins the lawsuit against you, they can get a court order to garnish your wages or bank account. If you own property, they could ask for a lien against your property. Wage garnishment is the most common of these three options. If a debt collector gets a wage garnishment order, Illinois law limits how much of your income they can take.

The most important thing you can do if you’re sued for a debt is fight the lawsuit. If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Need Help With Debt Relief? Here Are Some Options

If you’re being contacted by debt collectors, chances are you might be behind on more than one debt. With high credit card interest rates and unexpected expenses like medical bills, debt can pile up fast. If you’re stressed out and aren’t sure how to make a plan to deal with your debt, it may be time to ask for help.

You can go to a nonprofit credit counseling agency and speak to a certified credit counselor for free. These professionals are trained to look at your debt and finances with you and explain your debt relief options, including debt management plans, debt consolidation, and bankruptcy.

If you don’t see a way out of your current debt and you want to file bankruptcy to get a fresh start, Upsolve can help. See if you’re eligible to use Upsolve’s free filing tool to complete your Chapter 7 bankruptcy. Since 2016, Upsolve has helped 300,000 people erase over $700 million in consumer debt … all for free.