Credit Report Fraud

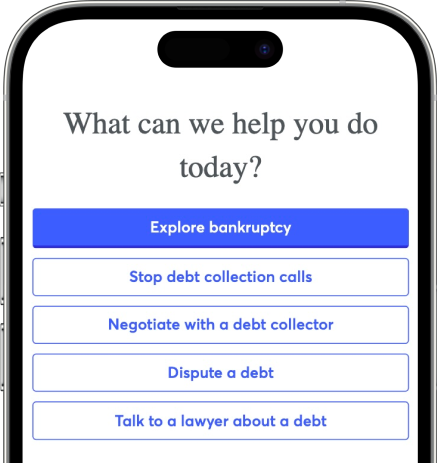

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Millions of people are victims of identity theft and other forms of credit report fraud each year. By carefully monitoring your credit and diligently rooting out credit report fraud, you can better ensure that, even if you’ve become a victim of fraud, your financial future will be protected.

Written by Attorney Alexander Hernandez.

Updated August 5, 2020

Table of Contents

Becoming a victim of identity theft can happen to anyone, so it’s important to take steps to protect yourself. In this article, you will learn about the different steps you can take to safeguard your identity and learn how to spot and report identity theft and credit fraud.

Identifying Credit Report Fraud and Identity Theft

Your credit report provides a history of all of the unsecured and secured debt activity that your creditors have reported over the last several years. This activity remains on your credit report for years, whether the accounts have been closed, remain open, or are in collections. Your credit history also includes any bankruptcy filings, judgments, repossessions, and related financial activity that has been reported to the major credit bureaus for the last several years. Some activity may remain on your credit report for 7-10 years. It is therefore important to ensure that your credit history is accurate. Misinformation, identity theft, and credit fraud will impact your credit history and your overall credit score as well.

To protect yourself from becoming a victim of fraud, there are several protective measures you can take. Start with reviewing your credit card statements regularly, at least every month, and immediately dispute any transaction you didn’t authorize, no matter how minimal the amount charged is. You can dispute the transaction online with the credit card company. If you have tried using your credit card and it was rejected, immediately call the credit card company and find out why. Your credit limit may have been reached or exceeded because of fraudulent transactions.

Another simple method to reduce your chances of becoming a victim of identity theft or credit report fraud is to register for credit monitoring. This service is offered by the credit bureaus and most credit card companies. Some credit card companies will even offer this service free of charge. With credit monitoring, you’ll receive notices every time your credit card is used. You can even receive fraud alerts whenever a new account is opened or a hard inquiry is made. Hard inquiries are not only a red flag but important to track because they affect your credit score. Initiating a hard inquiry also means your personal information was used to apply for credit. Your credit report will additionally show when soft inquiries are made. Soft inquiries occur when creditors have searched your credit file and credit history with the intent of offering you credit. This is common with notices and promotions you receive via mail to apply for new credit or debt consolidation. Soft inquiries don’t affect your credit score.

Another effective method to combat fraud and prevent fraudulent accounts from being opened with your personal information is to regularly review your credit report. Any new credit cards, applications for credit, and hard inquiries will be listed on your credit report.

Request a Copy of Your Free Credit Reports From the Credit Bureaus

Thanks to the Fair Credit Reporting Act, you can get a free copy of your credit report at least every 12 months from the major credit bureaus. You can get your free credit report by calling 877-322-8228 or by requesting it online at AnnualCreditReport.com.

Upsolve Member Experiences

1,839+ Members OnlineSteps You Can Take If You Discover Credit Report Fraud

Credit reporting companies have different types of fraud alerts that can be placed on your credit file to protect you. Once you receive notice of a possible fraud alert or you have detected fraudulent activity on your report through personal review of your credit history, take quick action to avoid further damage to your credit report.

Start by changing your login information such as passwords and PINS. Next, notify your creditor(s) of possible fraud and the credit reporting bureaus as well. You can even take the extra step of placing a one-year fraud alert on your credit report with each of the three major credit reporting agencies: Experian, Equifax, and Transunion. There is no charge for the fraud alert and an extended fraud alert could be issued if need be.

Another option is to request a credit freeze, which will deny access to anyone trying to obtain your credit report. This service is also free. With a credit freeze, you can place or remove it at any time versus a fraud alert which stays on your credit file for one year or 7 years for an extended fraud alert. However, you do have the option of removing it sooner.

When and How to Place a Credit Freeze

A credit freeze, also known as a security freeze, is stricter than a fraud alert. With a credit freeze, new creditors are prohibited from obtaining your credit report, credit score, or credit history, even if it’s to offer you new credit. If you believe identity thieves have stolen your personal information and may continue to try to use this information for their benefit moving forward, you may want to request a security freeze that way no new credit cards or lines of credit can be obtained under your name. However, note that with a credit freeze, every time you apply for credit, you will have to remove it so that specific creditors can again access your credit, since the credit freeze will last as long as you leave it in place. This is known as “thawing” your credit freeze.

To request or remove a credit freeze on your account, you can contact the credit bureaus either by phone, or complete an online form with Equifax, Experian, or Transunion. If by phone, you can contact Equifax at 1-800-685-1111, Experian at 888-Experian or 888-397-3742, and Transunion at 888-909-8872.

When and How to Place a Fraud Alert

A fraud alert can be a good alternative to a credit freeze. You don’t even have to be a victim of identity theft to place a fraud alert on your credit file. For example, it might be a good idea to place a fraud alert on your credit file if you have lost personal information such as your wallet, driver’s license, or Social Security card. If there was a data breach with your credit card company, you could also place the fraud alert if you’re concerned your personal information was exposed. By placing a fraud alert, any business, such as a potential employer, landlord, or potential creditor will have to take extra steps to gain access to your credit report. Even if you try to open a new account, you’ll have to take extra steps to confirm your identity. This makes it more difficult for an identity thief to access your credit.

When adding a fraud alert to your credit report, include copies of any police reports or reports from your local law enforcement agency to your credit file. If you’re in the military and have orders to be shipped overseas, you can protect your credit and identity with an active-duty alert. An active-duty alert is similar to a fraud alert, except it’s for active members of the military. Proof of military orders is required for an active-duty alert.

Regularly confirm that your contact information such as your phone number and email is up to date with the credit bureaus and creditors. That way, if there is potentially suspicious activity on your account or credit report, you can be contacted immediately by phone, email, or text message. To place a fraud alert or credit freeze on your account, you can contact the credit bureaus by phone or complete an online form with Equifax.com, Experian.com, or Transunion.com. A fraud alert won’t hurt your credit score.

Disputing Fraud on Your Credit Report

If you discover fraud on your credit report, you’ll need to contact each credit agency accordingly. After contacting the credit bureaus, your next step will be to file a complaint under the Fair Debt Collections and Practices Act (FDCPA). Your complaint will be filed with the Federal Trade Commission (FTC), which is a government agency. There is no cost for filing a dispute. However, you should act fast once you confirm the fraud, if not, your credit score can be affected, preventing you from being approved for credit in the future.

For example, if an identity thief has opened multiple credit cards in your name, maxed out the credit limit, and defaulted on the payments, if you were in the process of applying for credit, the creditor will reject your application since they aren’t aware of the fraud and will believe you have poor credit. Therefore, if you don’t monitor your credit report regularly, defaults or even an increase in your total debt will negatively impact your credit score. But by catching fraud early, you can reduce the stress and aggravation of having to file multiple disputes, saving you time. There’s a lot to be said for peace of mind knowing that your credit report is protected because you took protective measures early on.

The three major credit bureaus can be reached by postal mail or phone at:

TransUnion.com

Fraud Victim Assistance Department

P.O. Box 2000

Chester, PA 19016

1-800-680-7289

Equifax.com

P.O. Box 105069

Atlanta, GA 30348-5069

1-800-525-6285

Experian.com

P.O. Box 9554

Allen, TX 75013

1-888-397-3742

Conclusion

Millions of people are victims of identity theft and other forms of credit report fraud each year. By carefully monitoring your credit and diligently rooting out credit report fraud, you can better ensure that, even if you’ve become a victim of fraud, your financial future will be protected.