If I Go To Grad School, Can I Defer My Student Loans?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

In many cases, you can defer your undergraduate student loans if you go to grad school. When you defer a loan, you aren’t responsible for making the monthly payments for a period of time. Interest on the loan may continue to accrue though.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated June 9, 2025

Table of Contents

Can I Defer Undergraduate Student Loans While in Graduate School?

If you have federal student loans, you can defer them if you go back to school and you’re enrolled at least half time. This is referred to as “in-school deferment.” Often, but not always, this deferment period is automatic because schools report enrollment status for students. You should receive a notice that your loan is deferred. If not, you’ll need to call your student loan servicer to make an in-school deferment request. If you are enrolled in a graduate fellowship program, you can also make a graduate fellowship deferment request.

If you have a federal student loan — Direct Plus loans are the most common — you’ll also have a six-month grace period after you leave grad school before you have to start repayment. You do not have to make payments on your loans during this time.

If you stop attending grad school but then return to grad school (with half-time enrollment or more) during the grace period, your loan will be deferred again. When you stop attending grad school the next time, you’ll get a fresh six-month grace period.

Will My Student Loans Accrue Interest While in Deferment?

There are two categories of federal student loans: subsidized and unsubsidized. Subsidized federal student loans will not accrue interest while you, the borrower, are in grad school. Unsubsidized loans will accrue interest even if you’re enrolled in school.

Your loan servicer can tell you how repayment and interest work on your private student loans. Usually, you have to keep paying your loans, with interest, even if you return to school.

If your loan does accrue interest, your total student loan amount can be reduced if you pay the interest while you’re enrolled in school. If you don’t pay the accrued interest, it will capitalize.

What Is Capitalization of Unpaid Interest?

Unless you have a subsidized loan, interest will continue to accrue on your undergraduate student loans even if they’re deferred while you’re a grad student. If you don’t make an interest-only payment on your loans, the unpaid interest will capitalize. This means it’s added to the principal balance of your loan. Essentially, you end up paying interest on your interest. When this happens, your outstanding balance grows.

Interest capitalization makes your loan balance higher because you will be charged interest based on the new, higher principal balance. If you pay just the interest while attending school, deferred interest won’t be added to your principal balance. You won’t end up paying interest on the deferred interest.

What’s the bottom line? You don’t have to pay the interest while your loan is being deferred, but you’ll end up paying less overall on your student loans over time if you do.

What Are My Student Loan Repayment Options?

Federal student loan borrowers have many repayment options. Your eligibility for different options will depend on what type of student loan you have, and in some cases, your income and household size. If you have several student loans, you may want to look into a consolidation loan to streamline your repayment process.

If you have a private student loan, you may have fewer repayment options. Talk to your lender or loan servicer to see what payment plans are available under your loan terms.

Standard Repayment Plan

By default, you’ll be placed in a Standard Repayment Plan, which has a 10-year repayment period. Because this repayment plan is relatively short, your monthly payments will be higher on this plan than they would be under other types of repayment plans. If you can afford the payment, this is a good way to pay off your student loans fast. If you're like many borrowers, though, the monthly payment won’t be affordable. If that’s the case, check out income-driven plans.

Income-Driven Repayment Plans (IDR)

If your student loan debt is high compared to your income, an IDR may be the way to go. Your payments could be $0 under an IDR. If you plan to apply for the Public Service Loan Forgiveness (PSLF) program, you must be enrolled in an income-driven repayment plan.

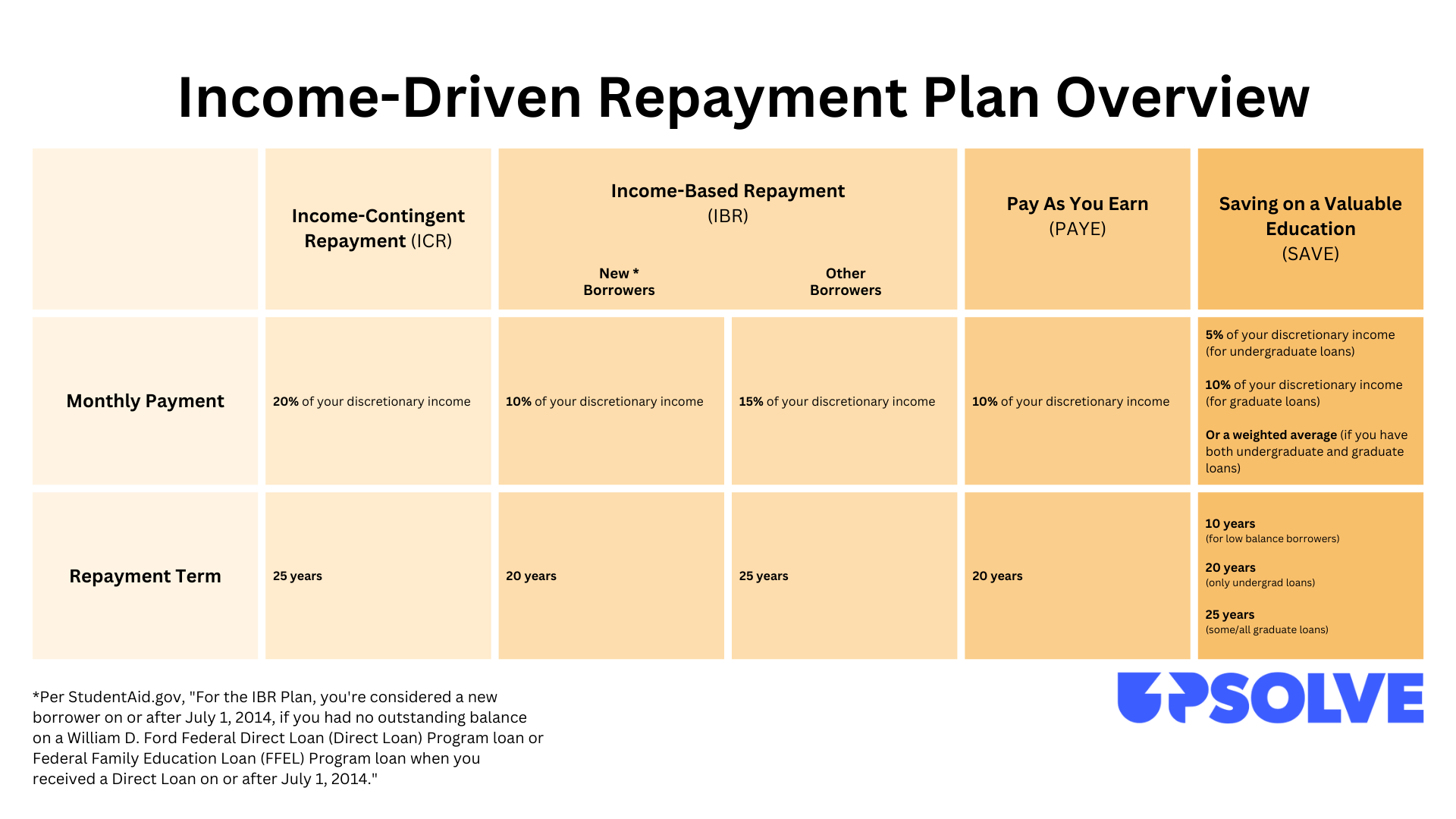

There are four types of income-driven plans:

Extended and Graduated Repayment Plans

To qualify for an Extended Repayment Plan, you must have at least $30,000 in Direct Loans. You can choose to have fixed or graduated payments. This may be a good option if your monthly payment under the Standard Repayment Plan is too high but you don’t qualify for an income-driven repayment plan.

Graduated repayment plans allow borrowers to start with lower payments, which increase every two years as the borrower's income increases. The idea here is that many graduates start off making less but will earn more over time as their work experience increases.

What if I’m Experiencing Financial Hardship?

If you’ve graduated or left your grad program and your six-month grace period has ended, your undergraduate and graduate student loans enter repayment status. If you experience financial hardship at this time, you have a few options that may help.

You can look into a financial hardship deferment or forbearance. If you’re struggling financially, you’ll likely be eligible for one or both. In addition to financial hardship, you may also qualify if you’re in the Peace Corps, in a rehab treatment program, or have another qualifying reason.

If you have a public loan and receive help from public assistance programs (TANF, SNAP, etc.) or you’re working and earn less than 150% of the poverty guidelines for your state and family size, you could qualify for an Economic Hardship Deferment and postpone your payments for three years. If you’re in the Peace Corps, you’re also eligible for this program.

There are general and mandatory forbearance plans for federal student loans. Through these, you can postpone your payments for up to a year. You may also be able to reapply and extend this. Keep in mind, you’ll still be charged interest and that interest will be added to the principal once you start paying on your student loan. Postponing your loan payments can help in an emergency, but it makes financial sense to try other payment options first.

How Does Student Loan Forgiveness Fit In?

If you qualify for student loan forgiveness, keep the requirements in mind as you set a repayment plan and make decisions about student loan deferment or forbearance. The most popular student loan forgiveness program is the Public Service Loan Forgiveness (PSLF) program.

To qualify, you must work full time in public service (for government or a nonprofit). You also have to make 120 qualifying payments on your Direct Loans. To qualify, you must be on an income-driven repayment plan.

You may also qualify for student loan forgiveness if you have a total and permanent disability, if your school closes, and in other situations.

Let’s Summarize...

Undergraduate student loans can be deferred while you attend graduate school at least half time. The process is often automatic. If you need payment options, the government has plans for deferment, income-based payments, and forbearance. If you start an income-based or deferment plan, pay the interest so you can have more money after you graduate! If you have private loans from your undergraduate education, call the loan servicer to find out your options.

Graduate school is tough. Graduate students shouldn’t have to worry about their undergraduate student loan payments while they are focusing on their studies. Do some research and find the best payment options for you so that you can focus your energy on your grad program.