Using the National Student Loan Data System (NSLDS) To Get Your Federal Student Loan Information

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

You can find all of the info you need to know for your federal student loans in the National Student Loan Data System. This central database contains all of the information you will need to understand your federal student loans including: your loan balance, due dates, eligibility for new loans, and more. If you need to download an NSLDS report, log in to your account on studentaid.gov using your FSA ID and password. Once you're in your account, hover over your name on the top right of the screen and select "My Aid." From there, you can select "Download My Aid Data." Your data will be downloaded as a .txt file.

Written by Attorney Andrea Wimmer. Legally reviewed by Jonathan Petts

Updated September 1, 2025

Table of Contents

- What Is the National Student Loan Data System?

- How To Access Your Federal Student Loan Information on the NSLDS

- How To Download Your NSLDS Report

- How Do I Figure Out How Much Student Loan Debt I Have?

- Why Do I Need To Know How To Access the National Student Loan Data System?

- Student Loans and Bankruptcy

Many student loan borrowers have multiple federal student loans. Keeping track of the loan details for each one can be quite difficult. The good news is that you can find information on all of your federal student loans in the National Student Loan Data System (NSLDS).

What Is the National Student Loan Data System?

The NSLDS is a central database for all your federal student loan and grant information. It's run by the U.S. Department of Education, which runs studentaid.gov and oversees federal student aid.

From the NSLDS dashboard, you can get your loan details or the contact information for your loan servicers. You can also view information about any grants (such as Title IV Aid) you've received as well. The NSLDS gets this data from universities and colleges, guaranty agencies, and Department of Education federal student loan programs like the Direct Loan program.

If you have private student loans, they will not show in the NSLDS. The system only houses federal student loan information for loans and grants administered by the U.S. Department of Education. This includes: Title IV loans, Plus Loans, and loans from the Direct Loan Program.

How To Access Your Federal Student Loan Information on the NSLDS

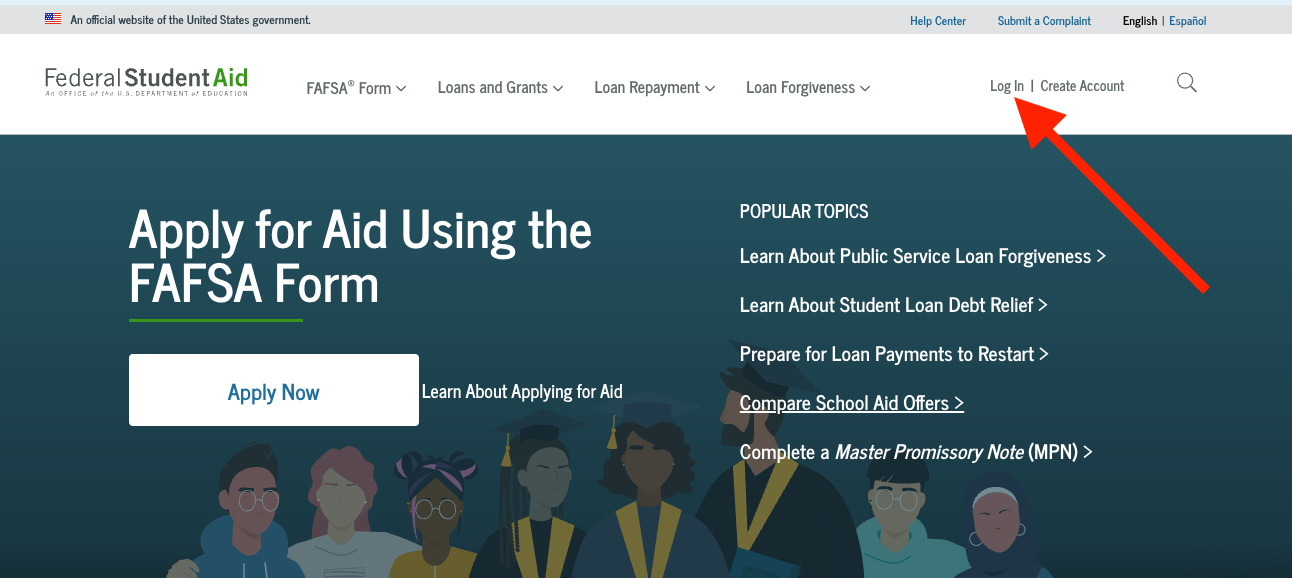

To access your information in the NSLDS, navigate to studentaid.gov and log in to your account:

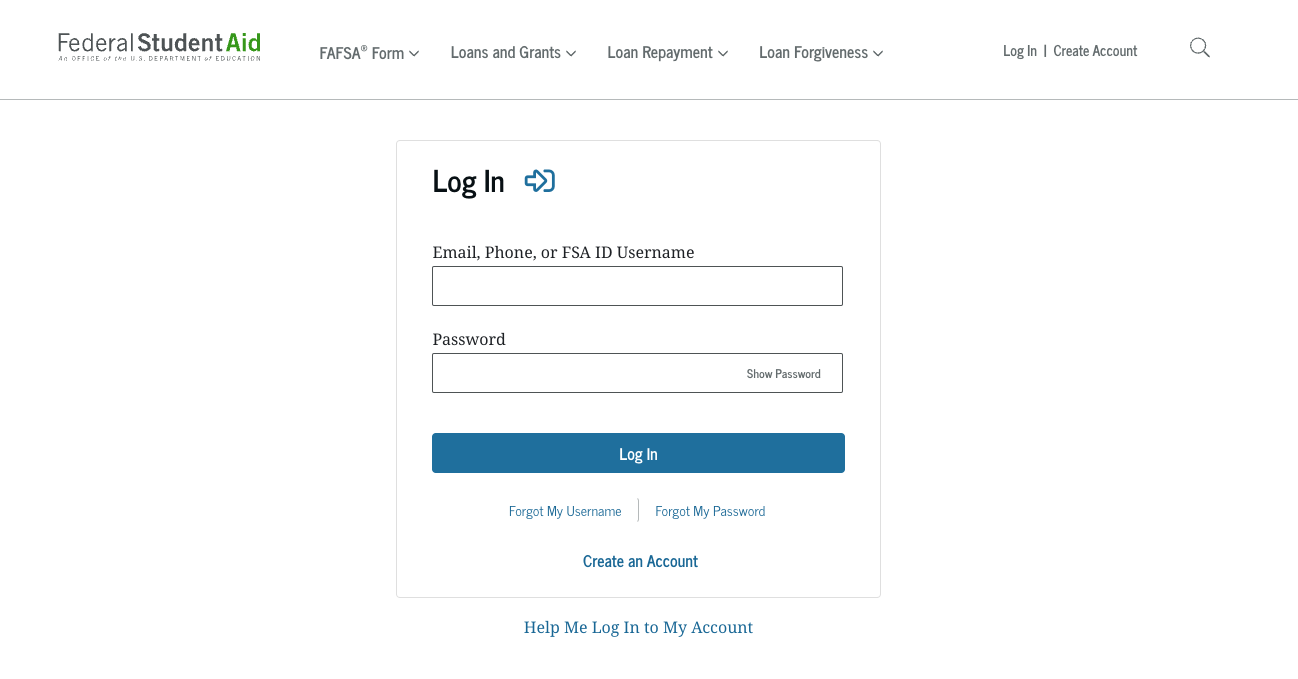

To log in to your account, you'll need your FSA ID username, e-mail or mobile phone number, and password. This is the same log-in you would use for your FAFSA.

If you don’t have an account, you can create one using your Social Security number and your mobile phone number and/or email address. You cannot create an account for someone.

To get to your dashboard, you'll need to accept the NSLDS website's terms and conditions. To do so, simply click"Accept" when the terms and conditions pop up after you log in.

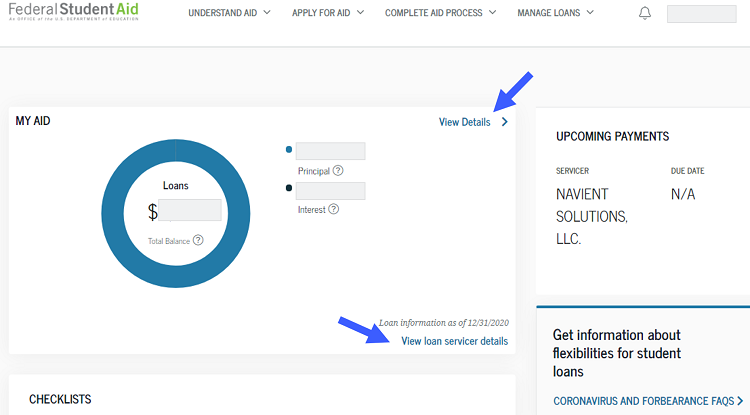

Once logged in, you’ll see your dashboard. It will show your total loan status/balance, and a breakdown of your student loan(s).

From there, you can view your loan details and your servicer details, including their phone number and mailing address.

How To Download Your NSLDS Report

If you're accessing your student loan data for your own information, you can see what you need right on screen in your account. Sometimes, though, you'll need to download an NSLDS report. If you are filing for Chapter 7 bankruptcy and want to discharge your student loans as part of the process, you'll need to download your NSLDS. Luckily, it's easy to do.

First, follow the steps above to access your account. On your dashboard, look at the top right where you'll see your name and a down arrowhead to the right of it. Hover over your name and a menu will appear. Click the second menu item: "My Aid."

This will bring up an aid summary. On the top right of the summary, you'll see a link that says "Download My Aid Data." Click that link.

Finally, you'll see a pop up message explaining that this report contains personal and financial information and that you should only download it from a secure internet connection. Press "Continue" to download your NSLDS report. Save the file where you want it on your computer or look in your downloads to find it. The file will be a .txt file.

How Do I Figure Out How Much Student Loan Debt I Have?

Americans currently owe $1.77 trillion in student loan debt, and the average borrower owes just under $40,000. Do you know what your student loan debt is?

If not, you’re not alone! Before you can manage your student debt effectively, you need to know what you’re working with. Luckily, it’s pretty easy to figure out how much student loan debt you have, who your loan servicer(s) is, and what your repayment history looks like.

Student Loan Debt by Loan Type: How Private and Federal Loans Differ

There are two main types of student loans: federal and private.

Federal student loans are loans that are made and serviced by the federal government. To get federal student loans and other financial aid like grants and scholarships, you fill out a FAFSA each year on StudentAid.gov. There are several kinds of federal loans. Currently, the most common type of federal loans are Direct Loans.

Private loans are offered and serviced by private lenders like banks, credit unions, and online financial institutions. Private loans aren’t as standardized as federal loans. Each private loan has its own loan agreement, which spells out the terms and conditions of the loan and its repayment.

Many individuals fill out the FAFSA and start by getting federal student aid, including loans. But the federal government caps how much money you can take out in student loans. When this happens but borrowers still need money to pay for tuition or other school fees, they often look to private student loans.

Here’s why all this matters: Figuring out how much you owe and who you owe looks a little different for federal and private student loans.

How Do I Find Out What I Owe on My Federal Student Loans?

By the time you graduate or leave school, you’re probably pretty familiar with StudentAid.gov — the site run by the Department of Education where you fill out your FAFSA each year. You may be less familiar with the National Student Loan Data System (NSLDS).

This site is also run by StudentAid.gov, and it's important because it stores all the information you’ll need to figure out how much you owe (student loan balance), how much you’ve paid, and who is servicing your federal loans. Alternatively, you can call the Federal Student Aid Information Center (FSAIC), your loan service company, or your school’s financial aid office to inquire about your loan amount and details.

Did you know? There are loan holders and loan servicers. The loan holder is the company that owns the loan. The loan servicer is a company that administers and manages the loan. The U.S. Department of Education is the loan holder of federal student loans, but it assigns loan servicing companies to help manage billing and other administrative tasks for student loan accounts.

How Do I Find My Private Student Loan Balances?

To figure out how much you owe on a private loan, you can call your loan servicer or check your account online. If you borrowed money from more than one private lender, you’ll have to call each lender to get the information you need.

Tip: If you can’t remember the name of your private student loan provider or service company, check your credit report. You can get a free credit report once a week from AnnualCreditReport.com.

Why Do I Need To Know How To Access the National Student Loan Data System?

For your federal student loans, NSLDS is an invaluable resource, especially if you have multiple loans with multiple different loan servicers/lenders. With all of the information in one place, it makes a complicated system more manageable. Knowing the ins and outs of your loans can help you stay on top of your student loan repayments, know when disbursement or consolidation is possible, determine eligibility for new loans, and more.

Student Loans and Bankruptcy

In November 2022, the Department of Justice and Department of Education released updated guidelines for using bankruptcy to discharge student loan debt. One goal of the new guidelines was to "reduce the burden on borrowers" seeking to discharge (get rid of) their student loans as part of their bankruptcy proceeding.

This means that if your student loan debt is a qualifying educational debt under the Bankruptcy Code[1] and repayment could cause you “undue hardship,” you may be eligible to discharge your student loans through bankruptcy, and it's easier to do now than it was before the new guidelines were released.

Upsolve has helped thousands of people prepare their Chapter 7 paperwork for free. If you're considering filing bankruptcy to get rid of your student loan and other debt, check your eligibility today. If you want to talk about your options with a bankruptcy attorney, we can refer you to one for a free consultation.

Sources:

- (n.d.). U.S. Bankruptcy Code. U.S. Bankruptcy Code. Retrieved from https://www.google.com/url?q=https://www.txs.uscourts.gov/sites/txs/files/CLE%2520Discharge%2520and%2520Dischargeability%2520%25202019%2520%2520Podcast.pdf%23page%3D13&sa=D&source=docs&ust=1681855322294359&usg=AOvVaw3fAzmNYndYKYWni-aBw2u2