The Government Lawsuit Against Ocwen

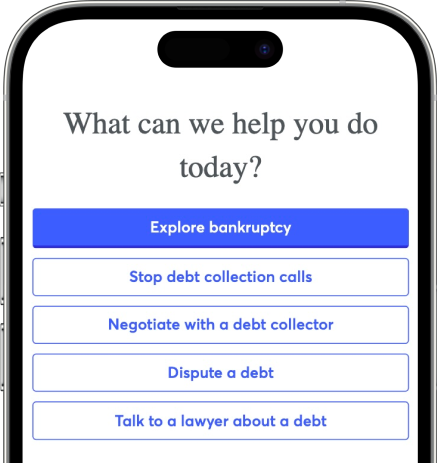

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Even after the multibillion-dollar settlement, Ocwen has continued to violate the law when servicing mortgage loans. As a result, some borrowers may still have reasons to make claims against Ocwen for unlawful practices related to their mortgage loans, including illegal foreclosures.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated November 15, 2021

Table of Contents

In 2013, Ocwen Financial Corporation paid $291 million to settle a lawsuit that was initially filed in California for mortgage servicing misconduct. In that same year, the Consumer Financial Protection Bureau (CFPB) and 49 states sued Ocwen for similar allegations in a class-action lawsuit. Ocwen was ordered to pay $2.1 billion, which included $125 million to borrowers who lost their homes between 2009 and 2012.

Ocwen Was Accused of Multiple Legal Violations

Ocwen was accused of violating federal and state laws that address consumer protection and real estate. These included violations of the federal Consumer Financial Protection Act and state laws governing unfair and deceptive business practices.

After an in-depth investigation, the CFPB and state regulators found that Ocwen:

Failed to promptly and accurately apply borrowers’ loan payments

Failed to maintain accurate account statements

Didn’t provide accurate and timely information to eligible borrowers who sought information about loss mitigation services, such as loan modifications

Charged unauthorized fees for services related to default and foreclosure

Provided false or misleading information to customers for loans transferred from other loan servicers

Misrepresented loss mitigation programs and the relief they’d provide from foreclosure

Improperly denied loan modification relief to eligible borrowers

Provided false or misleading reasons for denying loan modifications

Failed to honor modifications that were already in process and that had been agreed to by prior lenders and servicers that had transferred loans

Robo-signed (signing a document without reviewing its contents or supporting documents) affidavits in foreclosure proceedings

Upsolve Member Experiences

1,760+ Members OnlineThe Ocwen Settlement

In 2012, the CFPB and the attorneys general of 49 states and the District of Columbia sued Ocwen. Oklahoma was the only state that didn’t join the lawsuit. The suit was settled in December of 2013. As part of the settlement, Ocwen agreed to pay $125 million in cash to foreclosed homeowners and $2 billion in principal reduction to borrowers. These homeowners and borrowers included people who’d been customers of Ocwen, Litton, and Homeward from 2009-2012. The customers who chose to receive payments weren’t required to release any claims and were free to seek additional relief.

The settlement involves and covers Ocwen and two other loan servicing companies Ocwen had recently purchased: Litton Loan Servicing LP and Homeward Residential Holdings, LLC (previously known as American Home Mortgage Servicing, Inc. or AHMS).

Ocwen customers who meet the following requirements are eligible for a share of the settlement:

Your home was foreclosed on or between January 1, 2009, and December 31, 2012.

At the time of foreclosure, your loan was serviced by Ocwen, Litton, or Homeward.

You made at least three payments on the loan.

You lived or intended to live in the property as your principal place of residence when the loan was originated.

The property was a 1-4 unit residential property.

The unpaid principal balance of the first lien did not exceed $729,750 for a one-unit property, $934,200 for a two-unit property, $1,129,250 for a three-unit property, or $1,403,400 for a four-unit property.

You made a valid claim.

Why Is Settlement Still Relevant Today?

Despite the lawsuit and settlement, Ocwen and its primary successor, PHH Mortgage Corporation, are still financing real estate purchases and servicing mortgages. That’s why this lawsuit is still relevant. As part of the settlement, Ocwen must change its future business practices. The company agreed to reform its mortgage servicing practices, especially those that affect customers facing foreclosure.

For example, Ocwen must provide 36-day and 45-day notice requirements of loss mitigation options to customers. It can’t pursue a foreclosure at the same time that it’s evaluating a borrower for a loss mitigation option like a loan modification. Borrowers must be 120 days behind on their payments before Ocwen can initiate foreclosure proceedings.

As part of the settlement, Ocwen must also comply with the loan servicing standards outlined in the 2012 National Mortgage Settlement between the state attorneys general, the federal government, and the five largest mortgage banks: Ally/GMAC, Bank of America, Citi, JPMorgan Chase, and Wells Fargo. The CFPB added several new provisions to this agreement. These standards were later incorporated into CFPB rules in 2014, which are intended to help current and future prospective borrowers.

Has Ocwen Treated Borrowers Fairly Since the Settlement? No.

Despite the nationwide coverage of the lawsuit and settlement, Ocwen has continued to mistreat its consumers. Ocwen settled with the State of Florida for $11 million in October 2020. The settlement was a result of the Florida attorney general suing Ocwen on accusations that it:

Failed to credit customers with making on-time mortgage payments. This caused them to wrongfully incur late fees, which the company then reported as negative events to credit bureaus.

Failed to correctly apply payments and calculate loan balances.

Knowingly gave false information to borrowers.

The CFPB also sued Ocwen in Florida for similar issues. Ocwen won a partial summary judgment, but the CFPB appealed. Finally, Ocwen prevailed in the CFPB’s lawsuit when a federal judge in the Southern District of Florida said most of the claims were precluded by the earlier district court settlement.

Let’s Summarize…

As the largest non-bank mortgage servicer in the country, Ocwen was sued by the CFPB, 49 states, and the District of Columbia in 2012 for multiple servicing violations of federal and state law. While Ocwen has already paid the fines under the settlement, it remains subject to the servicing standards imposed by the settlement, as well as other changes in the law to ensure the fair treatment of borrowers.

Even after the multibillion-dollar settlement, Ocwen has continued to violate the law when servicing mortgage loans. As a result, some borrowers may still have reasons to make claims against Ocwen for unlawful practices related to their mortgage loans, including illegal foreclosures. If you’ve encountered such problems, consult your state attorney general’s office and an attorney to see if you have a valid legal claim.