Your Guide to Oklahoma’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you live in Oklahoma, your best line of protection against unfair debt collectors is the Fair Debt Collection Practices Act (FDCPA). This is a federal consumer protection law. Oklahoma hasn’t passed any state-specific debt collection laws to protect its residents. The statute of limitations for written debt contracts — including medical debt and credit card debt — is four years in Oklahoma.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated January 22, 2026

Table of Contents

What Are the Debt Collection Laws in Oklahoma?

Oklahoma doesn’t have any state-specific laws that regulate third-party debt collectors or original creditors. But residents are still fully protected by the federal Fair Debt Collection Practices Act (FDCPA).

The FDCPA is a federal law that applies to everyone in Oklahoma and across the U.S. It protects you from harassment, abuse, and deceptive practices by debt collectors.

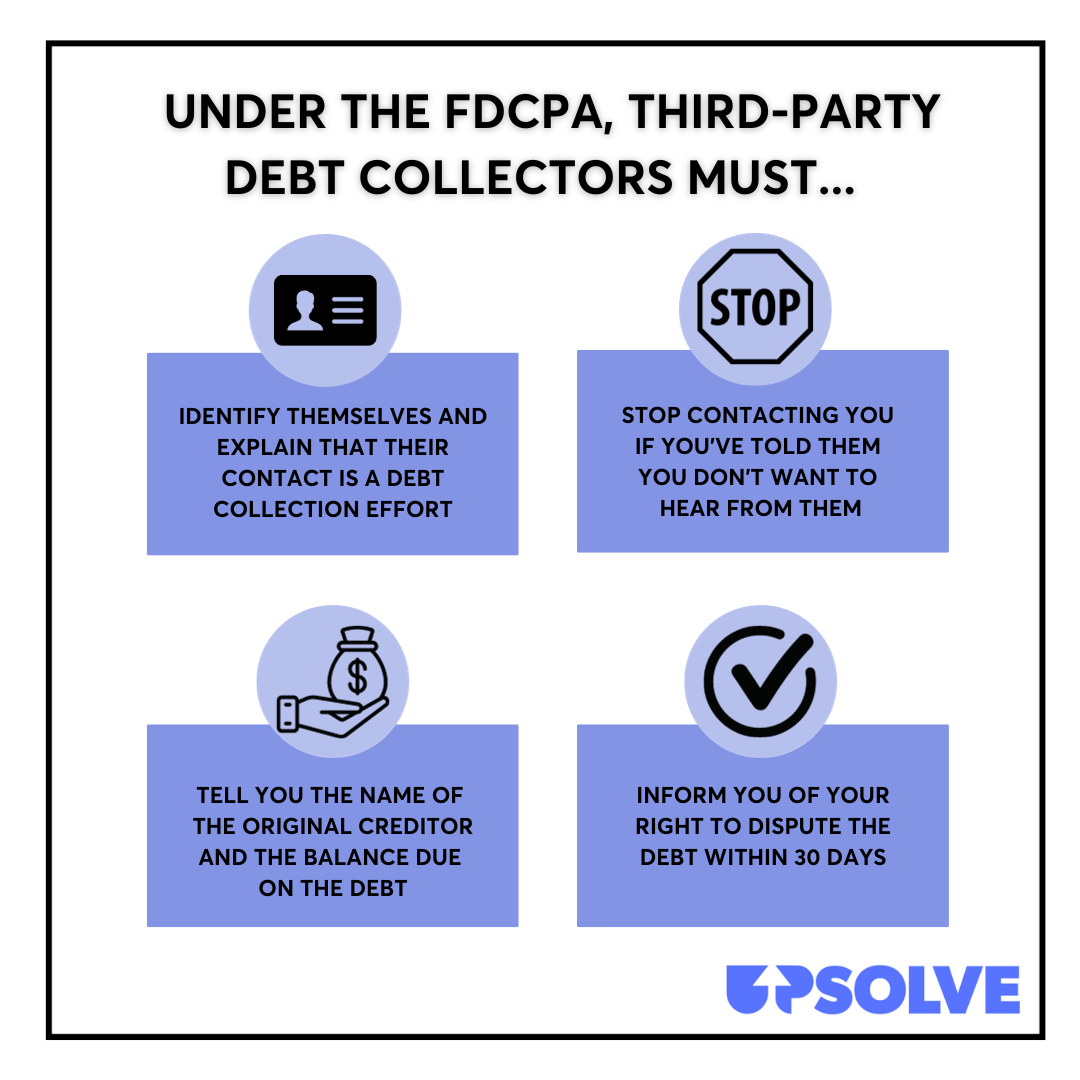

Here’s an overview of the law:

The FDCPA sets clear rules for how collectors can contact you and what they’re allowed to say and do. It also gives you rights — like disputing a debt and requesting written proof before you pay.

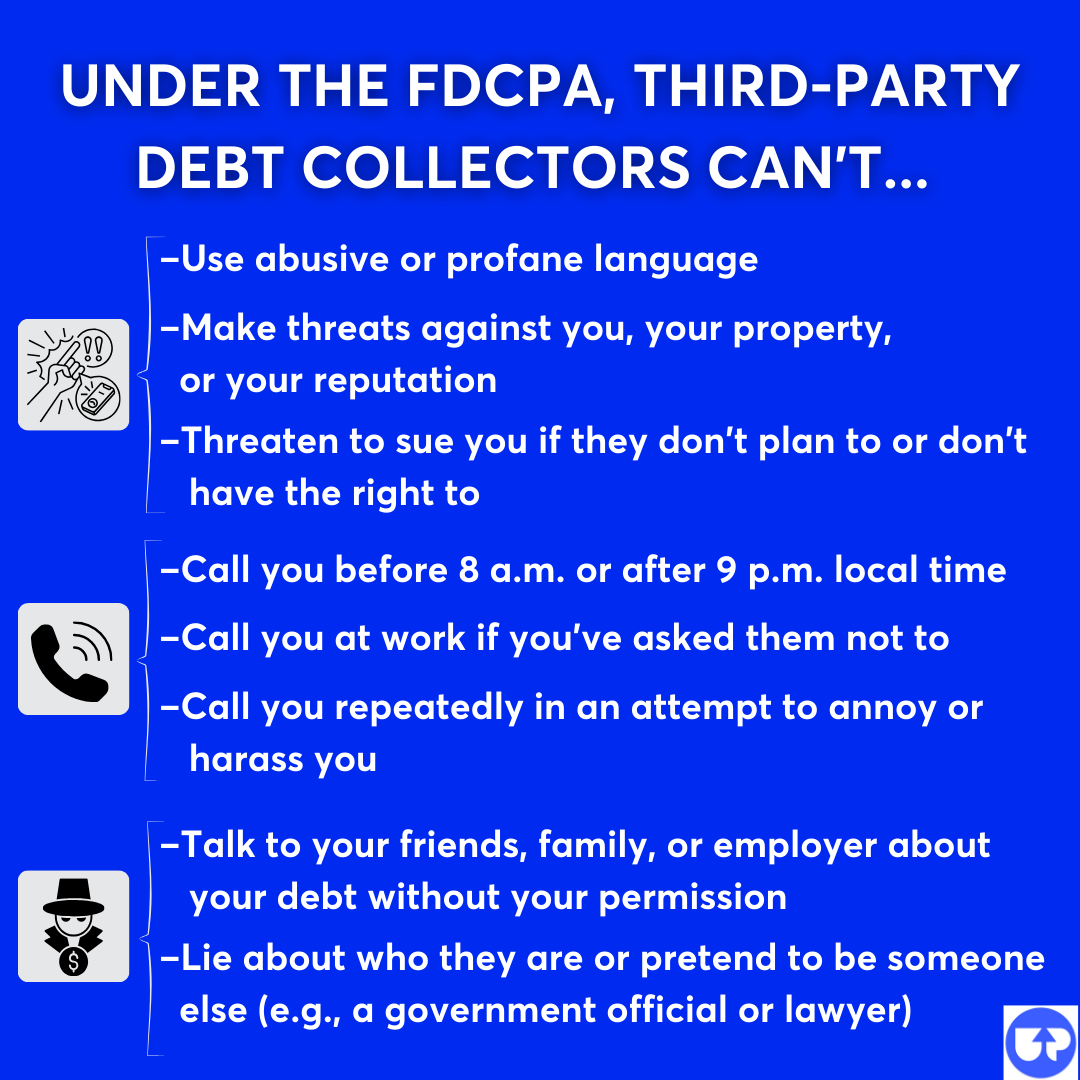

The FDCPA also outlines what third-party debt collectors can’t do:

What Can You Do if a Debt Collector Breaks the Law in Oklahoma?

If you think a debt collector has violated the FDCPA, the best place to start is to file a complaint with the Consumer Financial Protection Bureau (CFPB). This federal agency reviews complaints, investigates issues, and may take action against collectors who break the law. Filing a complaint can also help you get a response or resolution from the debt collector.

📢 You can also report the collector to the Federal Trade Commission (FTC), which monitors deceptive and abusive business practices, including those by debt collectors.

While the Oklahoma Attorney General’s Office accepts consumer complaints, it may have limited authority to act on violations of federal law. Still, it can be helpful to notify them if a debt collector is acting in bad faith, especially if others in the state have had similar complaints.

⚖️ Finally, if the violation is serious, you also have the right to sue the collector in federal court. If you win, you may be entitled to damages and attorney fees.

What Is the Statute of Limitations for Debt Collection in Oklahoma?

The statute of limitations for written debt contracts in Oklahoma is typically five years. But in practice, courts often apply a shorter time limit — usually four years — to certain types of debt, like installment contracts, medical bills, and open-ended accounts such as credit cards. The statute of limitations for unwritten, oral, or implied contracts is three years.

🕒 In most cases, the statute of limitations clock starts on the date of your last payment. If you make a new payment — or even make a written promise to pay — it can restart the clock and give the collector more time to sue you. That’s why it’s important to be cautious about what you say or agree to, especially if the debt is several years old.

Source: Okla. Stat. tit. 12, § 95(A)(1), (2); see also Okla. Stat. tit. 12, § 101 on how payments or written promises can restart the limitation period.

What Can Debt Collectors Do To Collect Debt in Oklahoma?

It’s important to understand what debt collectors are legally allowed to do so you can protect yourself and make informed choices. Most debt collectors start the collection process by calling or sending letters. If the debt isn’t resolved, they may eventually take legal action — and that can lead to more serious collection measures.

In Oklahoma, debt collectors can sue you in court. If they win, they can try to collect the debt through wage garnishment. In some cases, they may also be able to repossess certain property, like your car.

🚨 If you’re sued, you will receive a summons and complaint, official court documents explaining the claims against you and what you need to do. It’s important to respond to the summons! If you ignore it, the collector may win a default judgment against you, giving them easier access to severe collection measures.

Debt Collectors Can Garnish Your Wages (With a Court Order)

Debt collectors can take you to court for an unpaid debt. If they sue you and win, the court will issue a judgment against you. This judgment gives them legal authority to collect the money in other ways, like garnishing your wages, freezing funds in your bank account (called a bank levy), or placing a lien on your property.

Wage garnishment is the most common method. In Oklahoma, state law limits how much a collector can take from each paycheck so you won’t lose your entire income, but it can still make it harder to cover your basic expenses.

Debt Collectors Can Repossess Your Car

🚗 If you fall behind on your auto loan, your lender can legally repossess your vehicle — and they aren’t required to warn you ahead of time or get a court order first. Even one missed payment could trigger repossession, depending on the terms of your loan.

If you're having trouble keeping up with payments, it's a good idea to review your loan agreement so you understand your rights and what the lender can do.

Need Help With Debt Relief? Here Are Some Options

If you're in debt, it can feel like an uphill climb to get your finances back on track, and it’s completely normal to feel overwhelmed. In a stressful situation like this, one helpful first step is to schedule a free session with a nonprofit credit counselor.

A certified credit counselor can review your situation and help you understand your options. Depending on your finances, they may suggest a debt management plan, debt consolidation, or even bankruptcy.

Chapter 7 bankruptcy is a powerful legal tool that can help you get a fresh start. If your debt feels unmanageable, filing bankruptcy might be the best way to move forward. It also stops collection efforts right away, including wage garnishment orders.

✨ If you’re thinking about filing Chapter 7, you can check if you’re eligible to use Upsolve’s free online filing tool. It walks you through each step of the process so you can file on your own with support along the way.

Looking for Legal Help?

If you're dealing with a debt collection lawsuit or want to learn more about the debt collection laws in Oklahoma, the resources below can help. These Oklahoma-based legal organizations provide support and information for people facing legal challenges, including issues with debt:

Legal Aid Services of Oklahoma offers free legal help to eligible low-income residents across the state.

OKLegalConnect.org is an online hub with links to legal aid programs and other helpful organizations throughout Oklahoma.

OKLaw.org provides easy-to-understand legal guides, forms, and self-help resources online.

Oklahoma Bar Association Legal Resources lists free or low-cost legal help options, including clinics and other support services across the state.

Community Action Agency of Oklahoma City gives legal support to low-income people living in Oklahoma City, as well as in Canadian and Oklahoma Counties.