How To Dispute a Debt You Don’t Owe

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you’re contacted about a debt you don’t owe, you can dispute it with the creditor or debt collector. Often, these consumer debts are also incorrectly reported to the three major credit bureaus, so you’ll want to check your credit report, too. You can send a dispute letter to the credit bureaus asking them to remove incorrect information. Here are the four basic steps to dispute a debt you don’t owe: 1. Validate the debt. 2. Send a dispute letter (or the tear-off portion of the debt validation letter, which allows you to easily start the dispute process). 3. Check your credit report, and send a credit dispute letter or notices of dispute to any reporting agency with inaccurate information. 4. Follow up if/as needed until the matter is resolved.

Written by Mae Koppes. Legally reviewed by Attorney Paige Hooper

Updated October 13, 2025

Table of Contents

Why Am I Being Contacted About a Debt I Don’t Owe?

If you have fallen behind on medical bills, credit card debt, or other bills, the original creditor or a debt collector may contact you to ask for payment. Usually, the original creditor will first try to collect on the overdue debt. If the account remains delinquent, the lender may charge off the debt and sell it to a third-party collection agency.

Unpaid debt accounts are bought and sold frequently, and mistakes can happen. So, unfortunately, it’s common for people to be contacted about a debt they don’t owe. If this happens to you, you can dispute the debt. You can file disputes with the creditor or debt collector. You can also file a dispute with any credit reporting agency that shows inaccurate information on your credit report.

How To Dispute a Debt With Creditors & Debt Collectors

Disputing a debt with the original creditor or a debt collector is fairly straightforward. The process looks like this:

Make sure the debt collector has validated the debt.

Send a dispute letter or the tear-off portion of the debt validation letter, which allows you to easily start the dispute process.

Check your credit report and send a credit dispute letter to any reporting agency with inaccurate information.

Follow up as needed until the matter is resolved.

Let’s explore each step in more detail.

Step 1: Validate the Debt

If you receive a phone call or written notice about a debt, make sure the company validates the debt. For one thing, debt validation is required by law if the debt is held by a third-party collection agency. For another, mistakes are common in the debt collection world.

Verifying the debt allows you to make sure the debt is, in fact, yours and is still collectible.

Debt Validation and Your Legal Rights

If a third-party debt collector is contacting you about a debt, they are required by federal law to send a debt validation letter. They must do this before their first contact with you or within five days after first contact.

The debt validation letter should include basic information like:

The amount of debt you owe

The debt collector’s contact information

Information about your right to dispute the debt

⏱️ You have 30 days to request verification of the debt or dispute it. If you do so within 30 days, the debt collector must stop collection efforts until they verify the debt. After 30 days, you can still dispute the debt, but the debt collector can assume the debt is valid and continue contacting to collect the debt.

Step 2: How To Write a Debt Dispute Letter (+ Template)

Now it’s time to notify the debt collector that you dispute the debt. You have a few options here. You can:

Fill out the tear-off form from the debt validation notice the debt collector sent you.

Draft a dispute letter.

Do a combination of both, using the letter to provide more information about the dispute.

How To Use the Tear-Off Form To Dispute a Debt

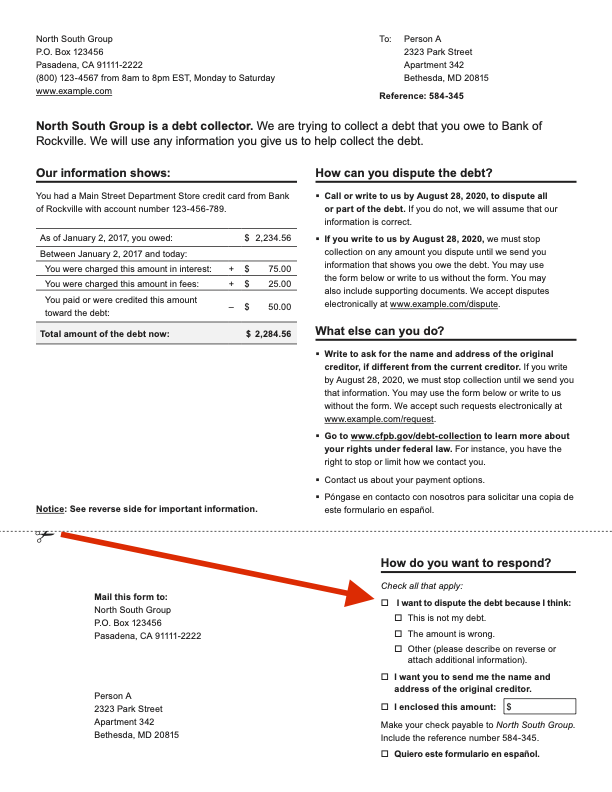

Debt collectors are required to include a tear-off portion on their debt validation form that allows you to easily dispute the debt. It might look something like this:

You can use this form to start your dispute. Cut the “How do you want to respond?” portion from the debt validation letter and check the appropriate box:

This is not my debt. This means that the debt collector has improperly identified you as the owner of the debt. Check this box if the debt isn’t and never was yours.

The amount is wrong. If you recognize the debt account but the amount of the debt is incorrect, you can check this box. You’ll want to provide documents that show what the actual debt amount should be and payments you’ve made in the past. If applicable, also show any settlement agreements you came to with the original creditor.

Other (please describe on reverse or attach additional information). If a collector contacts you about a debt you once owed but already paid off, you can check this box. Also check this box if there are any other reasons you want to dispute the debt. Again, send along additional documentation to support your claim. In this case, it may be beneficial to also send a dispute letter.

How To Write a Dispute Letter (+ Dispute Letter Template)

If the debt validation letter you received didn’t include a detachable form, you can write a dispute letter. You can also write a letter if you need more space to explain your dispute or request additional information. This letter can be combined with a debt verification letter.

You can write a debt verification letter to ask for additional information without disputing the debt. But if you aren’t certain that the information and amount on the debt validation letter is correct, then dispute them. Don’t allow the debt collector to assume they’re correct if you’re unsure.

Your dispute letter notifies the debt collector that you dispute the debt and why. You can also use this letter to request additional information about the debt that wasn’t included in the debt validation letter.

For example, if the debt is old, you can use this letter to ask if the debt is past the statute of limitations in your state. If it is, that doesn’t necessarily mean you don’t owe the debt. But it does mean that the debt collector can’t sue you to collect the debt. In this case, a cease and desist letter may be your next step.

The statute of limitations can be a confusing concept. The timelines also vary by state and the type of debt you owe. To learn more, read our article What Is the Statute of Limitations for Debt?

Dispute Letter Template

You can use the sample letter below to get started writing your dispute letter. Customize anything in bold font for your situation.

This is only a template. It doesn’t constitute legal advice.

[Your Name]

[Your Address]

[Your City, State, Zip Code]

[Date]

[Collection Company Name*] [Street Address] [City, State, Zip Code]

Your company contacted me about an alleged debt on [date of contact]. I do not believe I owe this debt because [provide a brief explanation you can back up with documentation].

In addition, please provide the following information in a written notification so I can verify the alleged debt:

The alleged debt amount

The name of the creditor and their mailing address for this alleged debt

Documentation that can prove I am responsible for the alleged debt

Documentation showing you are licensed to collect debts in [your state**]

Since I am sending this letter within the 30-day dispute period, you must stop all collection action on the alleged debt until this dispute is resolved. Continued collection efforts violate the Fair Debt Collection Practices Act. I will file a complaint in response to such illegal behavior.

Sincerely,

[SIGNATURE] [Your name] [Date]

*This information should be included on the debt validation letter.

**Most, but not all, states require debt collectors to be licensed. You can Google to see if licensing is required in your state. If it is, request the debt collector’s license number.

Dispute Letter: Best Practices

Be sure to modify the letter to reflect your situation.

Be as specific as possible about why you don’t believe you owe the alleged debt. But avoid giving any unnecessary personal information or other details.

It’s not enough to say, “I don’t believe I owe the alleged debt.” You need to explain why. This will vary based on your situation, but here are a few examples:

I don’t believe I owe this debt because I’ve never had an account with this creditor/store/bank.

I think you’ve confused me with someone else or misidentified me as the owner of this debt.

I already paid this debt. A copy of the canceled check is attached.

This debt was discharged in bankruptcy. I’ve attached a copy of my discharge order.

Include your name and contact information. Also include the account number or any reference numbers included on the debt validation letter. But don’t include any information that was not provided in the debt validation letter.

Send the letter by certified mail with a return receipt requested so you can verify (and prove, if necessary) that the letter was received and when.

Make and keep a copy of the letter and all other correspondence you have with the debt collector.

Step 3: Check Your Credit Report and Send a Credit Dispute Letter (if Necessary)

If a debt collector contacts you about a debt with wrong information, chances are good they reported those incorrect details to the major credit bureaus as well. If so, there may be incorrect information on your credit report about missed payments or collection activity. This will likely hurt your credit score. And it’s why you have the right to dispute inaccurate information and have it removed.

How To Review Your Credit Report

If you are pursued for a debt, you should request an updated copy of your credit report. You’re entitled to a free copy of your credit report from all three major credit bureaus every year.

You can get your free credit report from AnnualCreditReport.com. This is the official site authorized by the federal government to provide credit reports from the major credit bureaus.

You should review all three of your credit reports from Equifax, TransUnion, and Experian. While they’re supposed to report the same information, this isn’t always the case.

When reviewing your credit reports, look for any inaccurate information. Accounts you don’t recognize may be tied to instances of identity theft. You’ll also want to review collection accounts and ensure the validity and accuracy of those accounts, too.

How To Dispute Collections on Your Credit Report

Each credit report you pull will include information on the dispute process for that credit bureau. You’ll be able to dispute a debt or account on your credit report by mail, phone, or online.

The three major credit bureaus — Equifax, TransUnion, and Experian — allow you to file your dispute online. Though this is convenient, it may be beneficial to write a dispute letter instead.

Sending a dispute letter (via certified mail) allows you to keep a record of your dispute and when you submitted it. The Consumer Financial Protection Bureau (CFPB) has excellent information about disputing errors on your credit report. The CFPB also has a free dispute letter template you can use.

Once the dispute process is underway, the credit bureau has a duty to investigate the validity of the debt you’re disputing. This may be completed in as little as 30–45 days, but sometimes it takes longer. The disputed debt won’t affect your credit score while the dispute is being investigated.

For a more comprehensive look at this topic, read our Guide To Disputing Credit Report Errors.

Know Your Rights!

Two important federal laws protect consumers when it comes to debt and credit reporting.

The Fair Debt Collection Practices Act (FDCPA) regulates third-party debt collectors and debt collection agencies. The FDCPA’s purpose is to protect consumers from abusive, deceptive, and unfair debt collection practices. To learn more, read What Is the Fair Debt Collection Practices Act?

The Fair Credit Reporting Act (FCRA) is a federal law that requires that the information on your credit report be truthful and accurate. The credit reporting agency and creditor must remove any inaccurate information from your credit report, or they may face penalties.

If a debt collection agency or credit reporting agency has violated either of these laws, you can:

File a complaint with the Consumer Financial Protection Bureau.

File a complaint with the Federal Trade Commission (FTC).

What Happens After You Dispute a Debt Collection?

Once you dispute a debt collection, the debt collector and credit bureaus must investigate your claim.

👉 If you dispute the debt within 30 days of receiving a validation notice, the collector must stop all collection efforts until they verify the debt. This means they can’t call, send letters, or take legal action against you while the dispute is under review.

❌ If the collector can’t verify the debt, they must remove it from their records and stop reporting it to the credit bureaus. If the debt was already on your credit report, it should be deleted.

✅ If the collector provides proper documentation proving the debt is valid, they can resume collection efforts. In that case, you still have options. You may be able to:

Set up a payment plan.

Check if the debt is past the statute of limitations, which you can use as a defense if they sue you.

Disputing a debt won’t always make it disappear, but it can stop inaccurate collections from damaging your credit. If your dispute is denied and you still believe the debt is incorrect, you can request additional proof. You can also escalate your complaint to the CFPB or your state’s attorney general office.

FAQs: How To Dispute a Debt Collection & Remove Collections

Disputing a debt collection can be confusing, especially if you don’t recognize the debt or believe it’s inaccurate. Below are answers to common questions about disputing collections, your rights, and how to remove incorrect debts from your credit report.