How to tell if you have property that is not protected by an exemption

1 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

Schedule A/B lists everything you own. Schedule C lists all everything you own that is protected by an exemption. Here is how you can tell what’s protected by an exemption by looking at your Schedule C, complete with an example to illustrate what it means when something is only partially exempt.

Written by Attorney Andrea Wimmer.

Updated August 10, 2020

Schedule A/B lists everything you own. Schedule C lists all everything you own that is protected by an exemption.

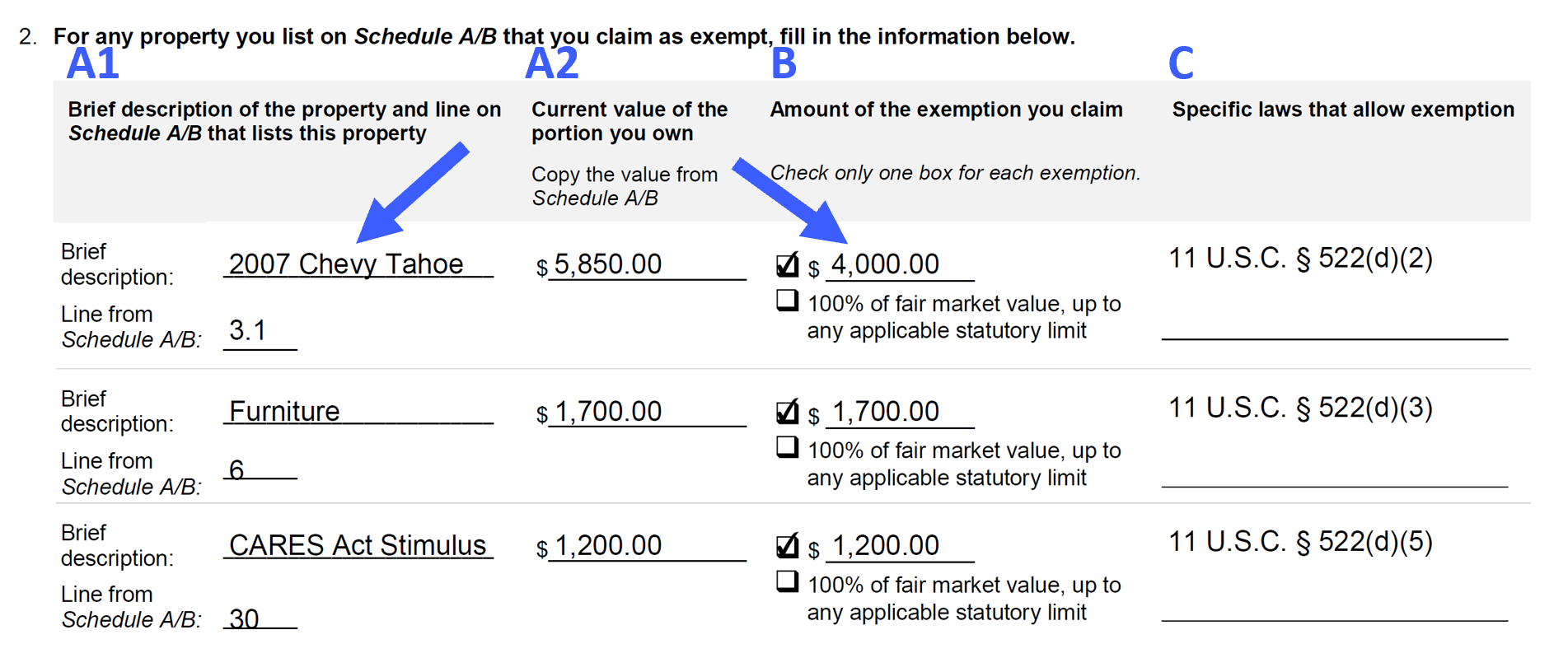

Here is how you can tell what’s protected by an exemption by looking at your Schedule C, using the example below:

The columns labeled as A1 and A2 just repeat what you’ve already listed on your Schedule A/B: your property and its value.

The column labeled B lists the amount of the claimed exemption and column C lists the specific law that provides for this protection.

In the example above, the Furniture and the CARES Act Stimulus is fully exempt. You can tell because the number in A2 matches the number in B. The vehicle, on the other hand, has some nonexempt equity. The value of the car is greater than the available exemption. This means that the car is only partially exempt.

Anything that is listed on your Schedule A/B that does not also appear on your Schedule C is a nonexempt asset.