Student Loan Forgiveness for Healthcare Workers: The Ultimate Guide

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

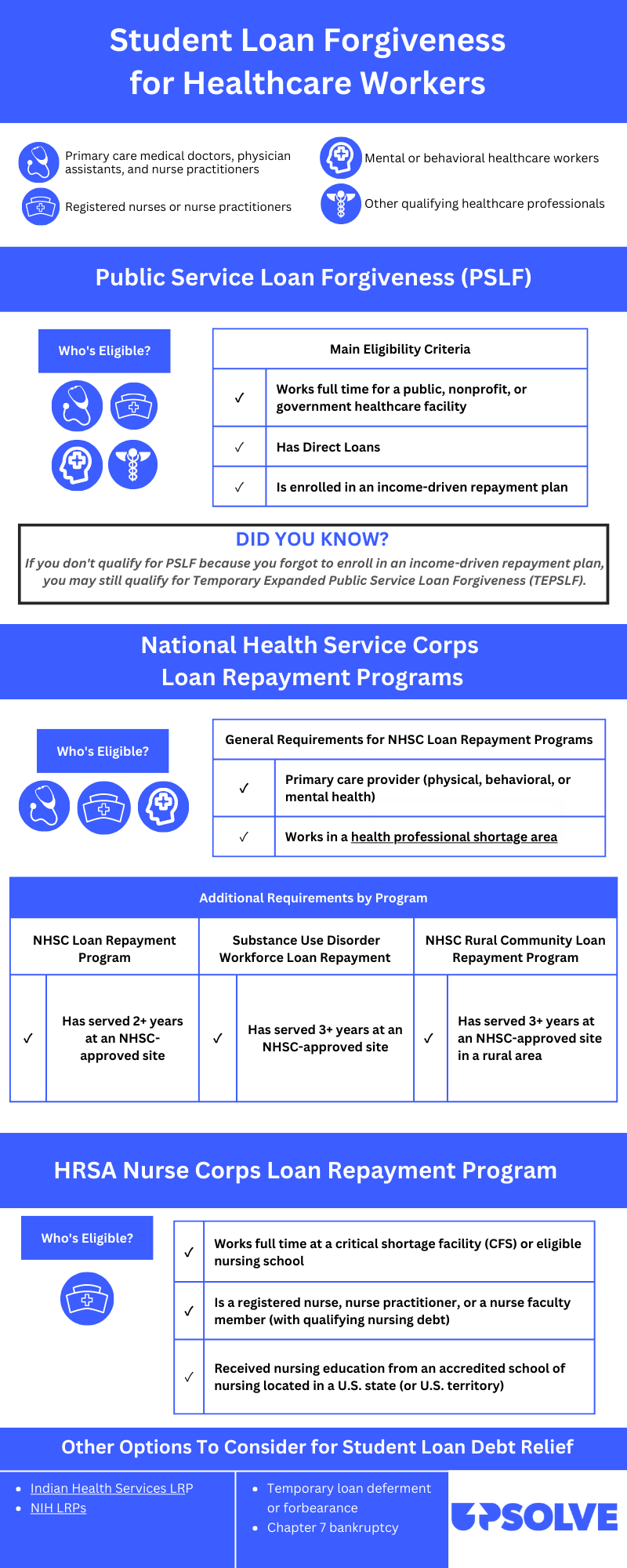

There are many programs designed specifically for healthcare workers to receive student loan forgiveness. Most serve specific types of healthcare workers and have other requirements around the length of time you work in healthcare and where you work. Consider each of these factors as you look at your options. If you’re struggling to pay your loans, you can also consider applying for a loan deferment or forbearance or switching to an income-driven repayment plan to help make your monthly payments more manageable.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated August 29, 2023

Table of Contents

What Are the Student Loan Forgiveness Options for Healthcare Workers?

Healthcare workers are essential, but getting a degree to work in healthcare is expensive. That’s why there are many programs offering loan forgiveness to healthcare workers.

Top programs include:

Public Student Loan Forgiveness (PSLF)

Temporary Expanded Public Service Loan Forgiveness (TEPSLF)

NHSC Loan Repayment Program(LRP)

NHSC Substance Use Disorder Workforce Loan Repayment Program

NHSC Rural Community Loan Repayment Program

HRSA Nurse Corps Loan Repayment Program

Indian Health Services Loan Repayment Program

National Institute of Health (NIH) Loan Repayment Programs

Public Service Loan Forgiveness (PSLF)

If you are a U.S. federal, state, local, or tribal government or not-for-profit organization employee, you are most likely eligible for the Public Service Loan Forgiveness Program.

Who Qualifies for Public Service Loan Forgiveness?

You qualify for the PSLF program if you:

Work full-time

Have direct loans (including direct consolidation loans)

Are repaying your loans under an income driven repayment plan

Have made 120 qualifying payments (10 years of qualifying payments)

Healthcare workers at public health facilities (public hospitals or not-for-profit hospitals), may be able to take advantage of Public Service Loan Forgiveness. You can check with your loan servicer to see if your loans are eligible for this program. You can also use this PSLF help tool, which guides you through the process of receiving Public Service Loan Forgiveness.

Who Doesn’t Qualify for Public Service Loan Forgiveness?

Healthcare workers who have private student loans do not qualify for public service student loan forgiveness for their non-federal loans.

Healthcare workers who work for for-profit organizations do not qualify for PSLF.

Healthcare workers with loans from the Federal Family Education Loan (FFEL) Program and the Federal Perkins Loan Program are not eligible for the PSLF program.

Temporary Expanded Public Service Loan Forgiveness (TEPSLF)

If you don’t qualify for the Public Service Loan Forgiveness program, you may be eligible for Temporary Expanded Public Service Loan Forgiveness. For example, if you failed to make your loan payments through a PSLF payment plan, you may qualify for TEPSLF.

Only Direct Loans are eligible for the TEPSLF program. Loans from the Federal Family Education Loan Program and the Federal Perkins Loan Program are not eligible for Temporary Expanded Public Service Loan Forgiveness.

NHSC Loan Repayment Program(LRP)

Eligible primary care providers can receive help with student loan payments through the National Health Service Corps LRP. To receive this specific student loan repayment, you must provide at least two years of service at an NHSC-approved site in a Health Professional Shortage Area.

Who Qualifies for the NHSC Loan Repayment Program?

Healthcare providers who are licensed in the following areas are eligible for the NHSC LRP:

Physician

Physician assistant

Nurse practitioner

Certified nurse midwife

Dentist

Dental hygienist

Behavioral & mental health professionals including health service psychologists, licensed clinical social worker (LCSW), psychiatric nurse specialist, marriage and family therapist, licensed professional counselor

Along with being a healthcare worker in one of the above categories, you must also be:

A United States citizen (U.S. born or naturalized)

A provider in the Medicare, Medicaid, and the State Children’s Health Insurance Program (if applicable)

Employed at an NHSC-approved site

NHSC Substance Use Disorder Workforce Loan Repayment Program

The National Health Service Corps Substance Use Disorder (SUD) Workforce LRP is geared toward licensed healthcare providers who work in behavioral/mental health or primary care. Just like the general NHSC student loan repayment program, you must provide service at an NHSC approved site in a health professional shortage area.

For this program you must serve three years at an NHSC approved Substance Use Disorder Treatment facility.

NHSC Rural Community Loan Repayment Program

The NHSC Rural Community LRP is like the SUD Workforce program but it specifically serves providers working at NHSC-approved sites in rural areas. While working at your approved site, NHSC will assist you with student loan payments.

HRSA Nurse Corps Loan Repayment Program

The HRSA Nurse Corps LRP is designed to help pay the student loan debts for professional registered nurses who are working full-time in Critical Shortage Facilities (CFS) or at an eligible nursing school.

Who Qualifies for the HRSA Nurse Corps Loan Repayment Program?

You are eligible for the Nurse Corps LRP if you:

Are a registered nurse, nurse practitioner, or a nurse faculty member (with qualifying nursing debt)

You received your nursing education from an accredited school of nursing located in a U.S. state (or U.S. territory)

Indian Health Services Loan Repayment Program

The Indian Health Services Loan Repayment Program is for healthcare workers who commit to serving two years in health facilities that specifically serve American Indian and Alaska Native communities.

Who Is Eligible for the Indian Health Services Loan Repayment Program?

This program has a wide range of eligibility. Not only are physicians, registered nurses, and dentists eligible, other healthcare professions like optometrists, pharmacist, registered dietician, and many more are too.

National Institute of Health (NIH) Loan Repayment Programs

The NIH Loan Repayment program is for healthcare professionals in biomedical and biobehavioral research careers. NIH provides loan repayment assistance as long as you are committed to research relevant to the NIH.

There are two different programs within the National Institute of Health student loan repayment program: the Extramural Program and the Intramural Program.

The Intramural Program is for those who are employed directly by NIH while the Extramural Program is for those who are not employed by the NIH but fall into one of the six approved categories of research.

Other Student Debt Relief Options for Healthcare Workers

If you do not qualify for one of the above student loan forgiveness programs, you can explore other student debt relief options.

Get Temporary Debt Relief With Loan Deferment or Forbearance

Loan deferment can give you temporary relief from your student loan debt. You can request a deferment with your student loan servicer. Eligibility varies depending on your situation. For example, you may qualify for an economic hardship deferment if you are enrolled in graduate study for the duration of that study.

It is important to note that no interest will accrue when your loans are in deferment.

Forbearance can also give you some temporary relief from your student loan debt. One positive aspect of forbearance is that your loans will accrue interest if you are in forbearance. However, it is important to know that there is a three-year limit on general forbearances and you can not be granted forbearance for more than 12 months at a time.

Apply for an Income Driven Repayment Plan

If you’re on a standard repayment plan, consider switching to an income driven repayment plan. Under these plans, your monthly payment is based on your income.

There are several different options:

Pay As You Earn Repayment (PAYE)

Income-Based Repayment (IBR)

Income-Contingent Repayment (ICR)

Saving on a Valuable Education (SAVE)

Formerly the Revised Pay As You Earn Repayment Plan (REPAYE)

If you participate in one of the above programs, any loan balance that remains after 20-25 years of repayment will be forgiven.

Student Loan Forgiveness vs. Student Loan Cancellation

The key difference between student loan forgiveness and loan cancellation is the effect it has on your taxable income for the year that the loan was forgiven or canceled.

If your loans are forgiven, the amount of forgiven debt is tax-free and does not count towards calculating your taxable income. However, if your loans are canceled, the amount of loan that is canceled counts toward your taxable income. This means the amount canceled will be taxed.

The Biden-Harris Administration’s Student Debt Relief Plan

President Biden, Vice President Harris, and the U.S. Department of Education (DOE) announced a three-part plan to forgive student loan debt up to $20,000 per borrower. The goal of this plan was to help borrowers transition back to regular payment as pandemic-related support expires.

Unfortunately, the plan was shot down by the Supreme Court. Federal student loan payments will resume in October of 2023.