How To Answer a Michigan Court Summons for Debt Collection

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you receive a court summons in Michigan, you will need to respond within 21 days (if you’re served in Michigan) or 28 days (if you’re served outside the state). To respond, you’ll need to file a written answer with the court named in the summons and complaint documents that notified you of the lawsuit. Be sure to make multiple copies of your answer form and to deliver a copy to the plaintiff (the person or company suing you). Finally, you’ll need to complete a certificate of service form after serving the plaintiff.

Written by Upsolve Team.

Updated November 29, 2023

Table of Contents

How Do Debt Collection Lawsuits in Michigan Work?

In Michigan, three major sources of debt are credit cards, medical bills, and utilities. If you fall behind on your payments, your debt will eventually be sent to collections and you may even face a debt collection lawsuit.

If you get sued for unpaid debt, you will receive a summons and complaint.

In Michigan, your debt collection case will most likely be reviewed by the District Court. If the amount in dispute is under $25,000, the District Court is the court that will hear your case. Since the average consumer debt lawsuit is for $1,600, most of these cases are heard by the District Court.

What Is a Summons and Complaint?

If a debt collector files a lawsuit against you, you will receive both a summons and a complaint. The summons is a document issued by the court notifying you that a lawsuit has been filed against you. The summons will give you the deadline for when you must respond to the complaint.

The complaint details the allegations, or claims, that the plaintiff (the person suing you) is making against you. In a debt collection lawsuit, this usually means claims about your debt, when the last payment was made, and how much the debt collector believes you currently owe.

The debt collector will also request a money judgment if they win the lawsuit. This is a court order for you to repay the debt along with any interest, legal fees, court costs, or other expenses outlined in the complaint document.

How Do You Respond to a Michigan Court Summons for Debt Collection?

If you receive a court summons in the state of Michigan, you have either 21 or 28 days — depending on where and how you were served — to file your response (answer) with the court. You will submit your answer form to the court listed on the summons. You also have to deliver a copy to the plaintiff (the debt collector suing you) and then complete the certificate of service section on your answer form.

Upsolve Member Experiences

3,804+ Members OnlineHow Do You Fill Out and File an Answer Form?

You can download an answer form or request a form in person at the courthouse. Then follow the steps below.

Alternatively, you can use this free resource from Law Help Interactive to have your forms generated for free.

Step 1: Address Each Complaint/Allegation

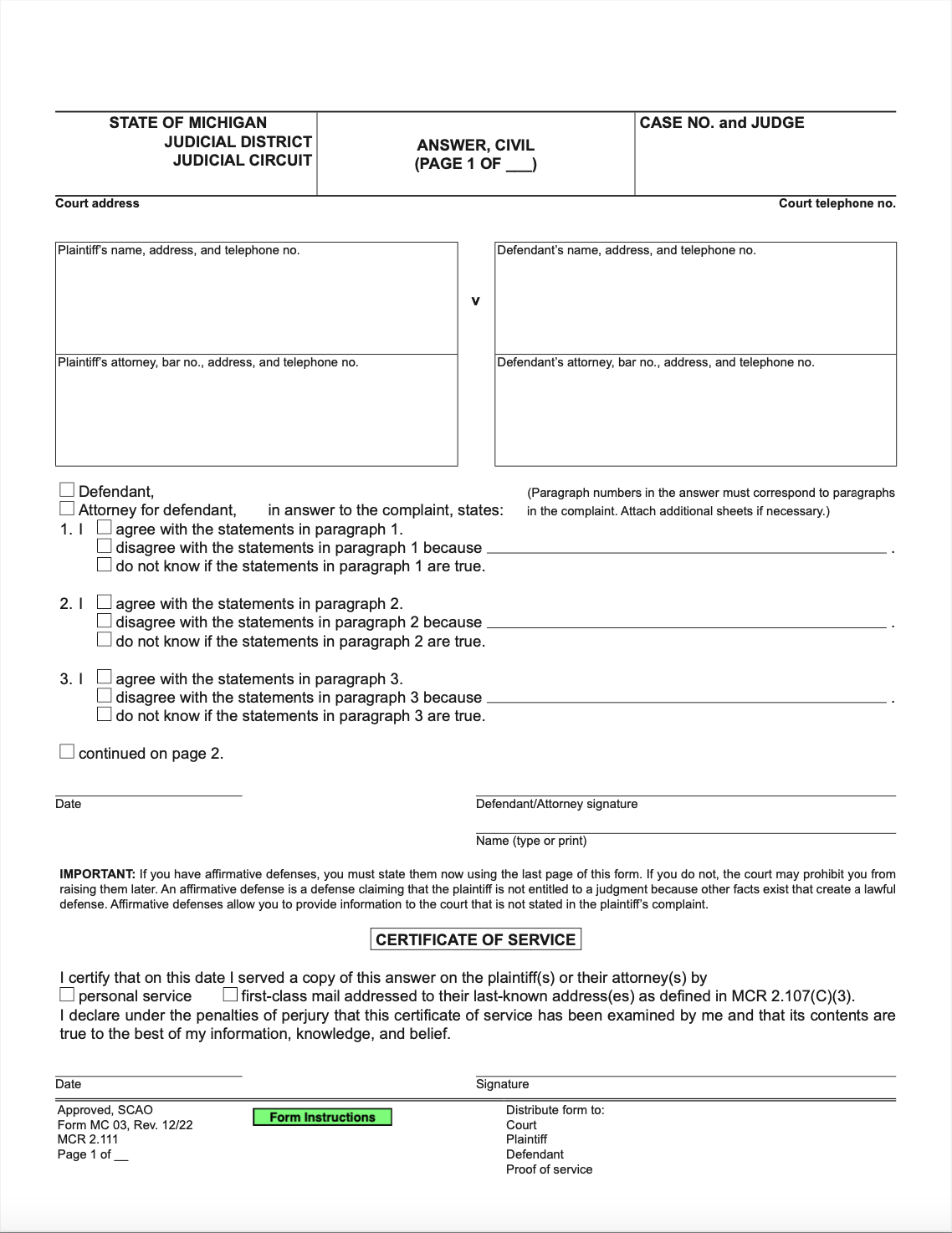

In your answer, you will respond to each allegation (claim against you) from the complaint. The allegations will be broken down by paragraph, so you will follow along with the answer form and mark “agree,” “disagree,” or “do not know” to every paragraph outlined in the complaint.

The paragraphs in the complaint should be numbered, so your responses on the answer form need to match the paragraphs in the complaint.

Here is what this section of the Michigan answer form looks like:

Step 2: Raise Your Defenses and Counterclaims

On the last page of the answer form, you will have space to add any affirmative defenses you may have. The affirmative defenses section is where you state why the plaintiff (the debt collector) should not receive a judgment. This is your opportunity to defend yourself and tell your side of the story.

Common Affirmative Defenses in Debt Collection Cases in Michigan

You can use several affirmative defenses in a debt collection case. In Michigan, it’s pretty easy to include a defense in your answer because there’s a list of possible defenses on the answer form. To include an affirmative defense, check the box next to the one that applies to you and fill in any supporting information requested.

Here is what the affirmative defenses section of the Michigan answer form looks like:

Step 3: File Your Forms With the Court Clerk Within 21 Days

If you owe a debt collector in Michigan and you’re served while in the state, you need to file your answer form within 21 days of receiving the summons. If you owe a debt collector in Michigan but you’re outside of Michigan when you get served (or you’re served by mail), you have 28 days to answer.

Before you file your answer, make 2–3 copies of the form(s).

File one copy with the court listed on the summons.

Save one copy for your records.

Deliver one copy to the plaintiff.

Each court has its own rules about how you can file your answer form. You may be able to do it in person, via mail, or electronically. Check with your local court clerk to see what your options are and be sure to comply with the court’s instructions.

Step 4: Deliver a Copy of the Answer to the Plaintiff

After you file your answer form with the court, send or deliver a copy to the plaintiff (in this case, the debt collector).

Delivering the documents to the plaintiffs is formally called “service,” and you can do it in two ways:

Personal service, where you or a process server (a professional you hire to deliver court papers) deliver the documents in person

First-class mail, where you send the documents via USPS

If the debt collector (the plaintiff) has an attorney, you would serve the attorney, not the debt collector. You can find this information by looking at who is named on the court documents you got with the summons.

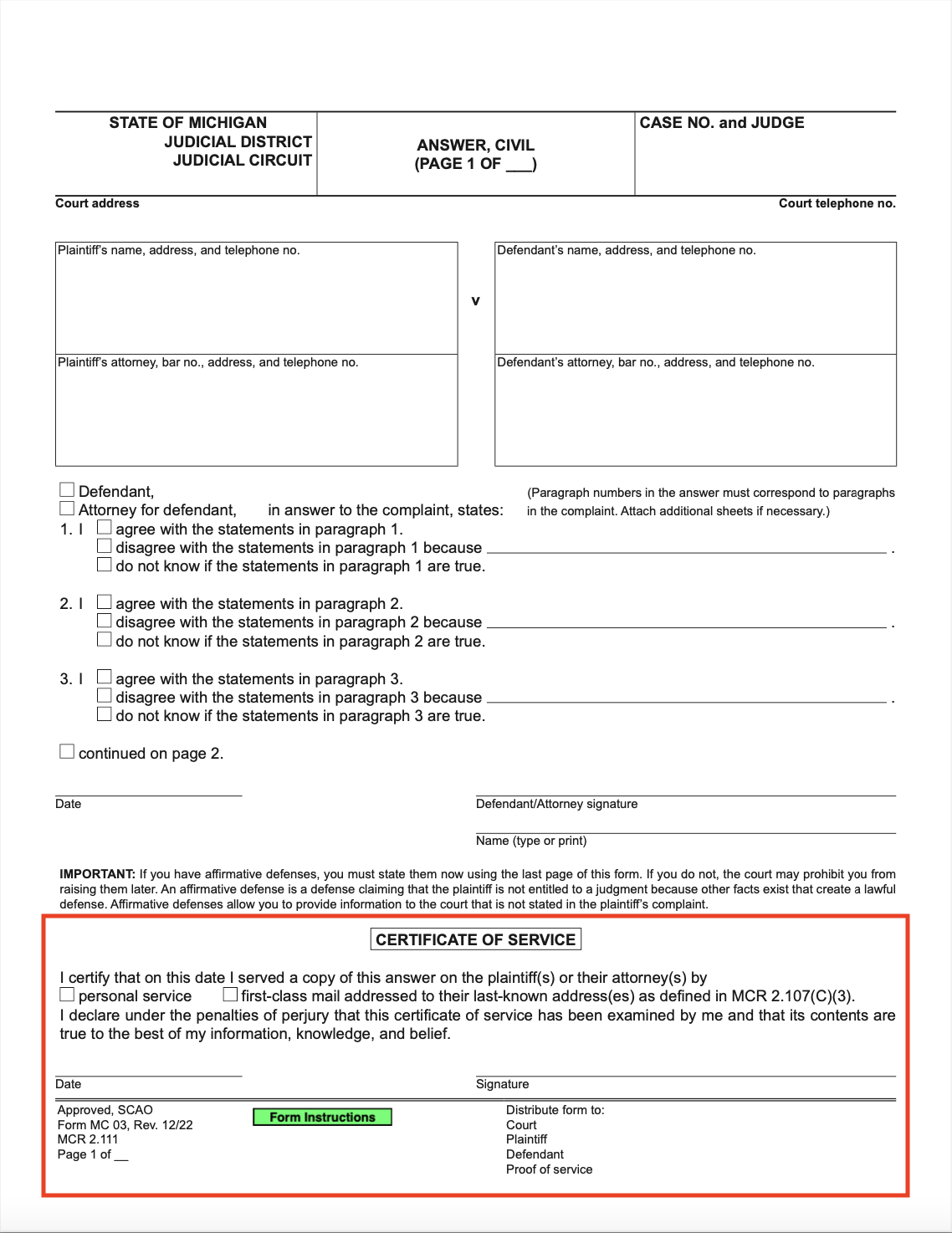

Step 5: Complete the Certificate of Service

After you fill out, file, and serve the plaintiff your answer, you will fill out the certificate of service section at the bottom of the first page on the two remaining copies of your answer forms. Then file one copy with the court and keep one for your records.

The certificate of service section proves to the court that you served the plaintiff (or their lawyer).

What Happens After You Respond to the Lawsuit?

After you submit your court paperwork, you’ll wait to hear from the court about what happens next. Make sure the court has your correct mailing address and email address. At some point, you should get a notice about a hearing or, potentially, about mediation. If you can’t make a hearing at the time and date set by the court, call the court clerk to ask if and how you can reschedule. If you don’t show up for a scheduled appearance, you can lose the case.

How To Prepare for Court Appearances

Going to court may feel intimidating, but preparing yourself ahead of time can help to ease your mind. Michigan Legal Help recommends doing your own research beforehand, organizing your paperwork, and arriving to court early.

If you raised any affirmative defenses in your answer form, come with documentation or other evidence that helps prove your claims.

What Happens if You Don’t Respond to the Lawsuit?

If you don’t respond to a lawsuit, you will probably lose by default. When this happens, the judge issues a default judgment against you. A default judgment is a court order that allows the person or company suing you to access things like wage garnishment, a bank account levy, or property (usually vehicle) repossession.

The most important thing you can do if a lawsuit is filed against you is respond. Often, debt collectors are counting on you to not show up to court or respond to the lawsuit. They want an easy win, and that gives it to them. By simply responding to the lawsuit, you give yourself a fighting chance at winning a debt collection lawsuit.

What Do You Do if the Court Already Issued a Default Judgment Against You?

If the court has filed a default judgment against you, you can file a Motion to Set Aside Default in response. When you file a Motion to Set Aside Default, you are giving yourself the opportunity to give the court your side before they make a final decision on the judgment. Michigan Legal Help has a very helpful Do-It-Yourself Motion to Set Aside Default tool that can help you file the motion for free!

You have 21 days from the day the default judgment is entered to file the motion. The exception to this 21-day rule is if you were not served the summons and complaint in person and did not find out about the lawsuit until after the default judgment was ordered. In that case, the 21-day rule does not apply to you.

A default judgment is issued when you don’t respond to a lawsuit. This means that, in Michigan, the only way to have a default “set aside” is by proving that you had good cause for failing to answer your lawsuit and that you have one or more valid meritorious defense(s).

For example, if you have a reasonable excuse for not meeting a requirement of your case (willfully ignoring the lawsuit is not a reasonable excuse), and you can prove that the plaintiff should not win the case based on a valid defense, you can prove that the default should be set aside.

Need Legal Help?

Michigan Legal Help is a great resource for Michigan residents who need legal help. The organization has a Do-It-Yourself Civil Answer Form guide that can walk you through the process of creating your answer form and a Guide to Legal Help feature that can help you find legal resources.

The State Bar of Michigan also has a legal resource and referral center with links to legal aid agencies for free or low-cost legal help for low-income individuals. The State Bar also offers the Modest Means Program, which makes legal help more accessible to moderate-income individuals.