How To Answer a North Carolina Court Summons for Debt Collection

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If a debt collector sues you in North Carolina, your next step will depend on which court your case was filed in — small claims or a district court. If your case was filed in small claims court, you are not required to file an answer. You need to show up for the trial date on the summons.

If your case is heard in a district court, you must file an answer form within 30 days of getting notice of the lawsuit. You also have to send a copy of the stamped forms to the plaintiff (the person suing you). This guide explains each step.

Written by Upsolve Team.

Updated April 23, 2025

Table of Contents

Getting a debt collection summons in the mail can feel overwhelming—but you're not alone. This guide explains exactly what a summons means, how to figure out which court is handling your case, and what steps to take to protect yourself. Whether you’re in small claims or district court, responding quickly can make a big difference in your case.

How Do Debt Collection Lawsuits in North Carolina Work?

If your bills are piling up and you find yourself in debt, it’s important to be aware that your debt may end up in collections. If this happens, you’ll receive debt collection phone calls and written notices. And if you ignore these debt collection efforts, the debt collector may decide to bring a debt collection lawsuit against you.

You will be notified of the lawsuit with a summons and complaint.

What Is a Summons and Complaint?

If a debt collector files a debt collection lawsuit against you, you will receive a summons and complaint for money owed. These are official documents that tell you that a lawsuit has been filed against you and what the lawsuit involves.

A summons is a court document that tells you someone is suing you. It includes your court date and your deadline to respond.

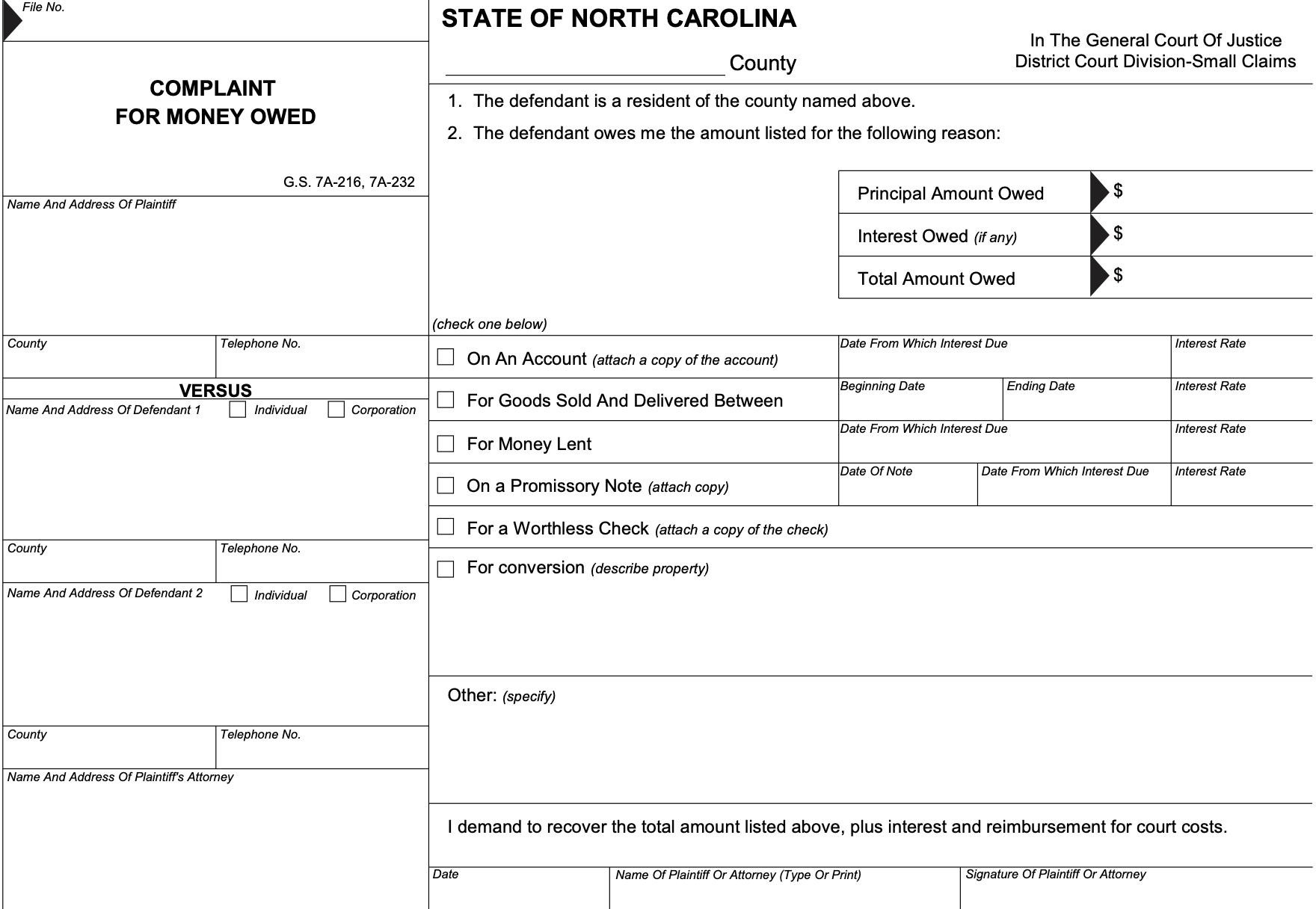

A complaint lists the reason for the lawsuit — usually a debt you allegedly owe — and what the creditor wants the court to order you to pay. In North Carolina, this document is usually called a Complaint for Money Owed.

The complaint will also explain what the debt collector wants. Usually, they are looking for a court-ordered money judgment to collect the debt. The judgment amount could include the debt the collector believes you owe, any interest that has accrued since your last payment, or any other costs the plaintiff thinks you should cover as a part of the lawsuit.

Here is an example of a complaint form in the state of North Carolina:

What Happens if You Ignore the Summons?

It is never a good idea to ignore a lawsuit. If you ignore a lawsuit, you’re likely to lose the case by default. If this happens, the judge assigned to your case could issue a default judgment against you.

A default judgment is a court order that allows the person or company suing you to request a judgment and to collect that debt through the use of a wage garnishment, a bank account levy, or a property lien.

💪 Debt collectors count on you not showing up to court or responding to the lawsuit. By simply taking action and responding to the lawsuit, you give yourself a fighting chance to win the debt collection lawsuit.

If a default judgment has already been ordered against you, you can file a motion to vacate the judgment. This is essentially a motion to cancel the judgment ordered.

You can file this motion by submitting an official request with the court you were served from. This process can be difficult to navigate, so seek legal help as needed.

What Kind of Court Is Handling Your Case?

In North Carolina, where your case is filed depends mostly on how much the creditor says you owe:

Small Claims Court: Usually handles cases under $10,000 (sometimes $5,000 depending on the county).

District Court: Handles cases from $10,000 to $25,000.

Superior Court: For lawsuits over $25,000, but these are rare for consumer debt cases.

💡 Your summons will list the court name. If you're not sure, contact the court clerk or use the North Carolina Judicial Branch’s courthouse locator.

Upsolve Member Experiences

4,047+ Members OnlineHow To Answer a North Carolina Court Summons for Debt Collection

If you’ve been sued for a debt in North Carolina, your next steps depend on which court is handling your case.

If your case is in small claims court, you are not required to file an answer. You can still choose to file an answer or a counterclaim, but it’s optional. If you don’t file anything, you must still show up for your court date, which will be listed on your summons.

If your case is in district court, you are required to file an answer within 30 days. There’s no filing fee to file an answer or a counterclaim.

Follow the steps below to file an answer form.

✨Though you can respond to a debt lawsuit on your own, if you want some extra help consider working with our partner, SoloSuit. They can help you draft and send a lawsuit response and negotiate a debt settlement. They even have a 100% money-back guarantee.

Step 1: Get the Answer Form

You have 30 days from the date you receive the summons and complaint to file your response.

You respond by filling out an official form called an Answer to Complaint form. You can get the answer form from the court that served you. The North Carolina Judicial Branch has a small claims eCourt Guide and File tool that can create the documents electronically for you to print yourself.

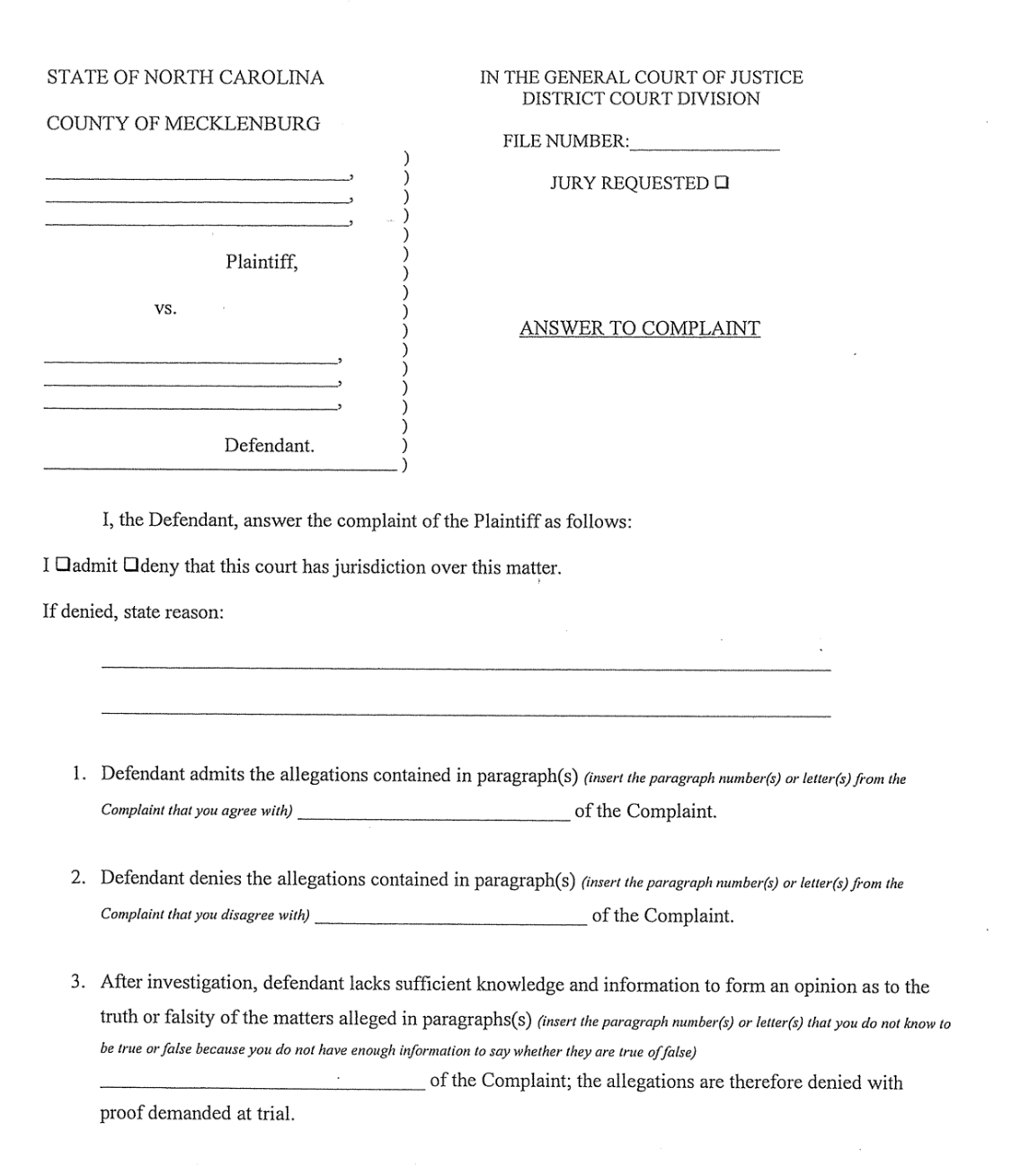

Here is what the first page of the answer form for Mecklenburg County District Court looks like:

Step 2: Respond to Each Claim From the Complaint

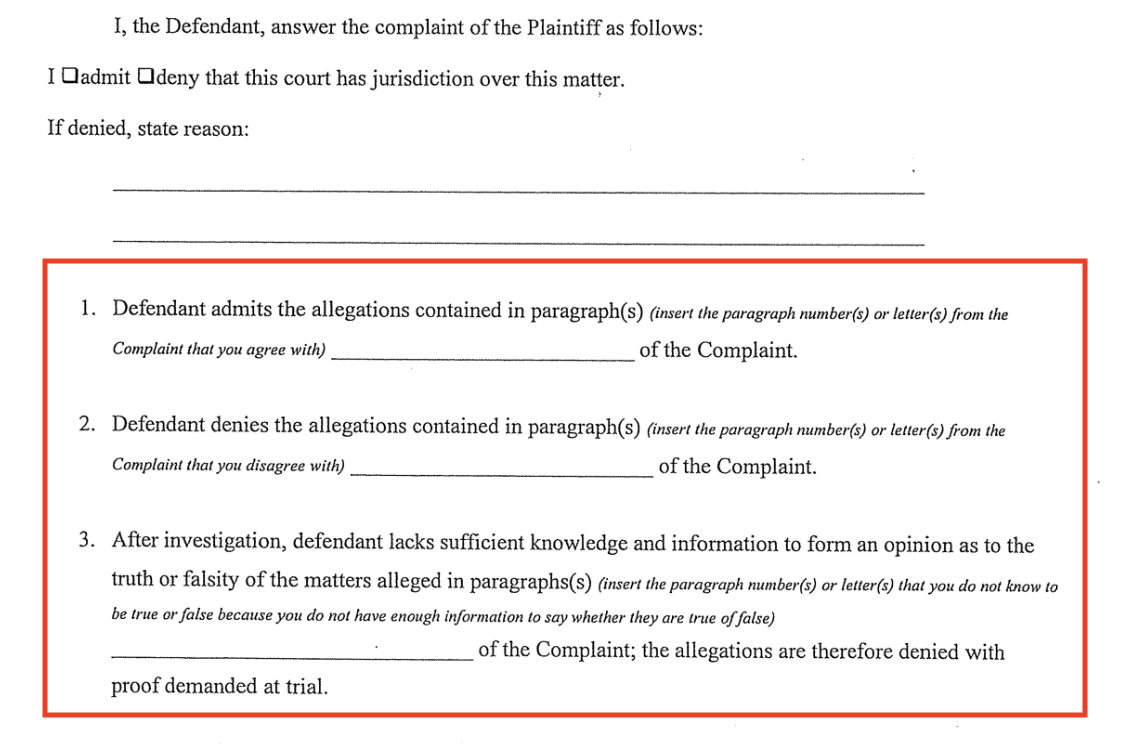

The complaint lists the claims the creditor is making against you. On the answer form, you will respond to each claim by checking one of the following boxes:

Admit (you agree with the claim)

Deny (you disagree with the claim)

Lack knowledge (you’re not sure if the claim is true)

Here is what that section of the answer forms looks like:

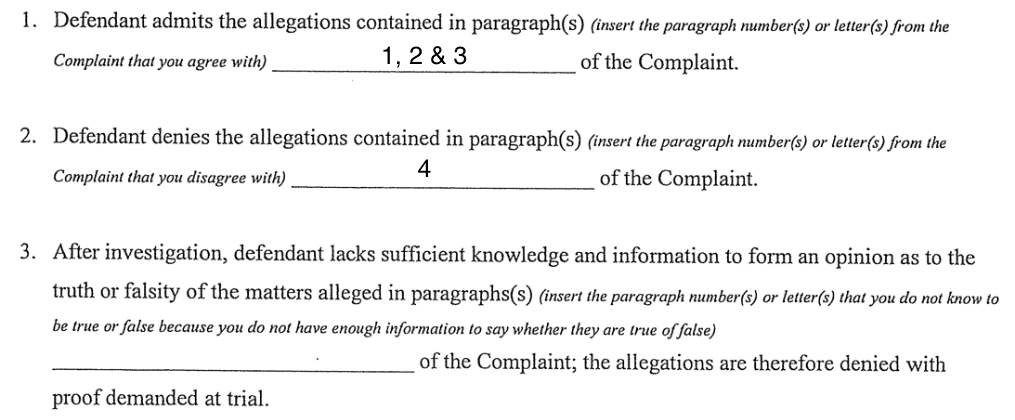

To fill out the answer form, follow along with the complaint and write the paragraph number for each allegation onto the corresponding admit/deny/lacks knowledge line.

For example, if your complaint outlined four allegations and you admit to allegations 1–3 but deny the fourth allegation, your answer form would look like this:

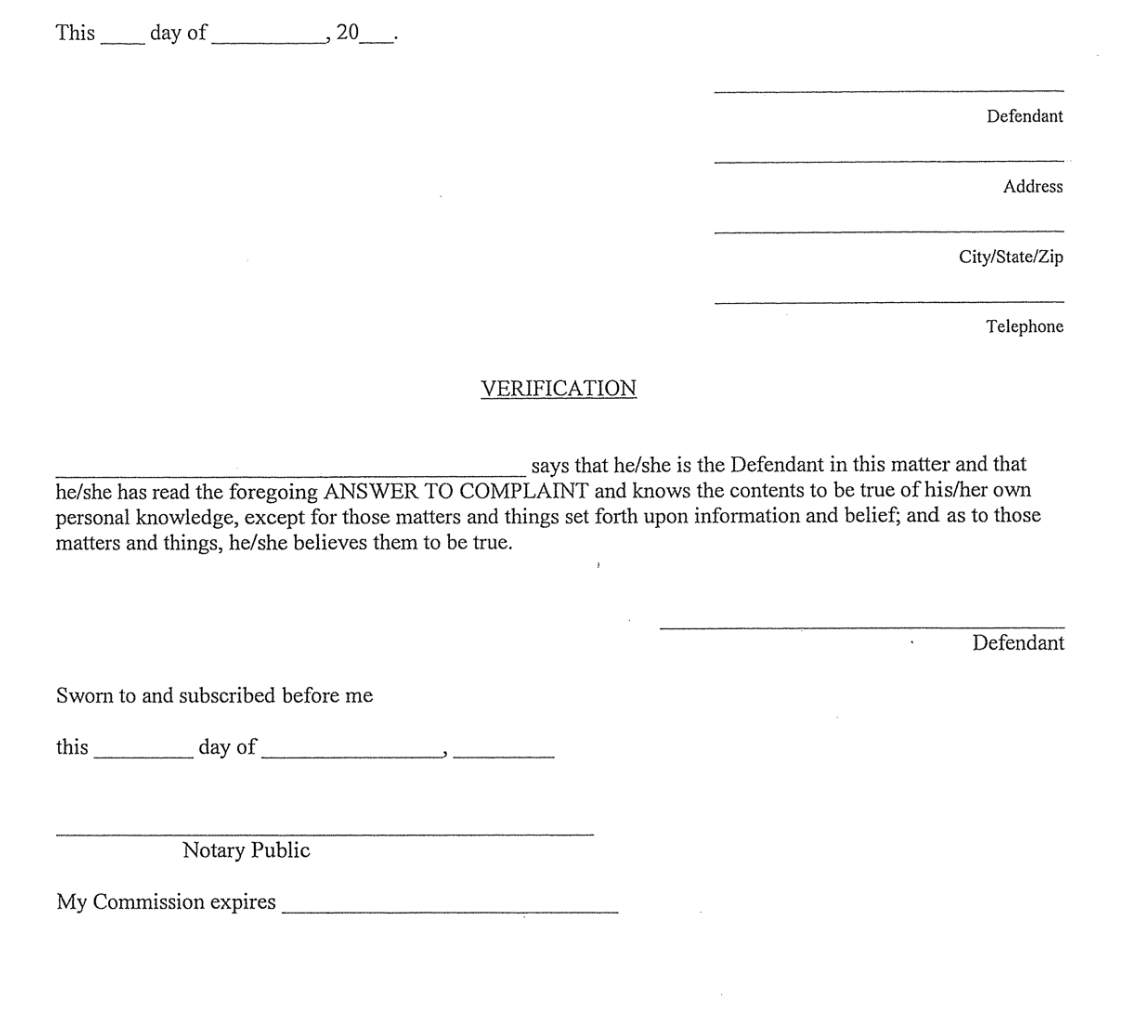

Step 3: Fill Out and Sign the Verification Section With a Notary Present

After you've filled out the form, you need to sign it in the verification section in front of a notary public.

Notaries can be found at banks, post offices, libraries, or by using the North Carolina Secretary of State’s notary search tool.

⚠️ Do not sign the form until the notary is present.

Your signature means you’re agreeing that:

You are the defendant.

All information provided is true to your knowledge.

Here is what that section of the answer form looks like:

Step 4: Make Copies of Your Answer Form

Make two copies of your completed answer form.

File the original with the court, either by mail or in person

Mail or hand-deliver one copy to the plaintiff (the creditor or debt collector)

Keep one copy for your records

LawHelpNC.org recommends you file the form in person at the court.

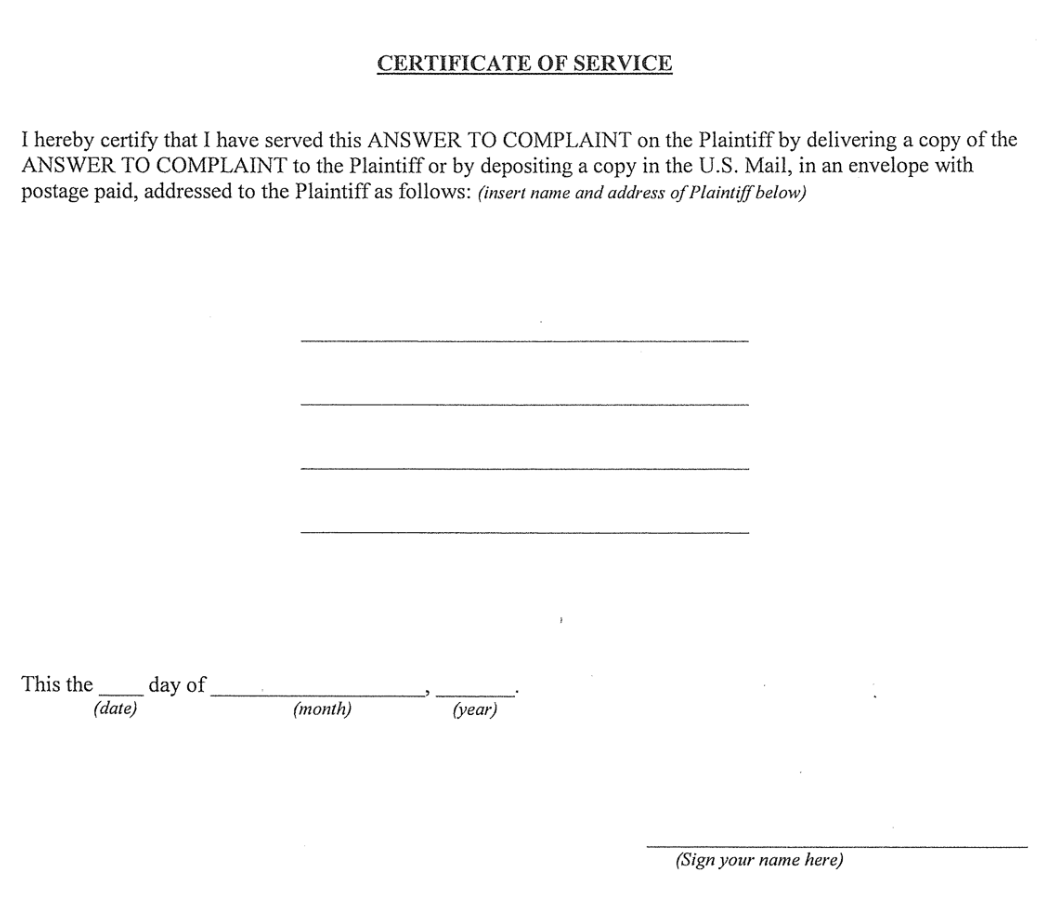

Step 5: Sign the Certificate of Service

This section confirms that you gave the plaintiff a copy of your answer. You’ll fill in the date and method of delivery and sign this section at the bottom of the form.

You can deliver the copy to the plaintiff in person or mail it to them. This is called serving the plaintiff.

The last section of the answer form looks like this:

Tips To Prepare for Court Appearances

After you file your answer form, you will be put on the court’s calendar for either trial or arbitration. The claim in your case must be for less than $15,000 to qualify for arbitration in a North Carolina District Court.

If your debt collection case is heard by a small claims court, your court date will be within 30 days of when the complaint was filed since an answer is not required.

According to LawHelpNC.org, the best way to prepare for court is to:

Prep and organize your paperwork.

Prepare any notes/talking points.

Arrive early on your court date.

Dress appropriately — think job interview attire.

You can learn more about what to expect at the courthouse and more detailed steps on how to prepare by looking at LawHelpNC’s Preparing for Court guide.

Where To Get Free or Low-Cost Legal Help

Legal Aid of North Carolina has a Guide to Small Claims Court that breaks down the small claims court process and free online legal services for certain legal matters.

North Carolina Judicial Branch has a small claims eCourt Guide and File tool that can create legal documents for you to file yourself.

LawHelpNC.org has a detailed guide on how to fill out and file an answer form.

SoloSuit can help you respond to a debt collection lawsuit for a small fee. They've help over 280,000 people respond to debt lawsuits and settle debts. They have a money-back guarantee.