Your Guide to Debt Collection Laws in Texas

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Texans benefit from two major debt collection laws. One is the federal Fair Debt Collection Practices Act, which helps prevent harassment and unlawful practices from third-party debt collectors. The other is a state law that regulates the collection practices of both original creditors and third-party debt collectors. The statute of limitations for consumer debts in Texas is four years.

Written by Upsolve Team.

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Texas?

In Texas, two main laws provide consumer rights and protections: the federal Fair Debt Collection Practices Act (FDCPA) and the laws outlined in the Texas Finance Code. Texas’ state law expands on the protections of the FDCPA.

How Does the FDCPA Protect Texans?

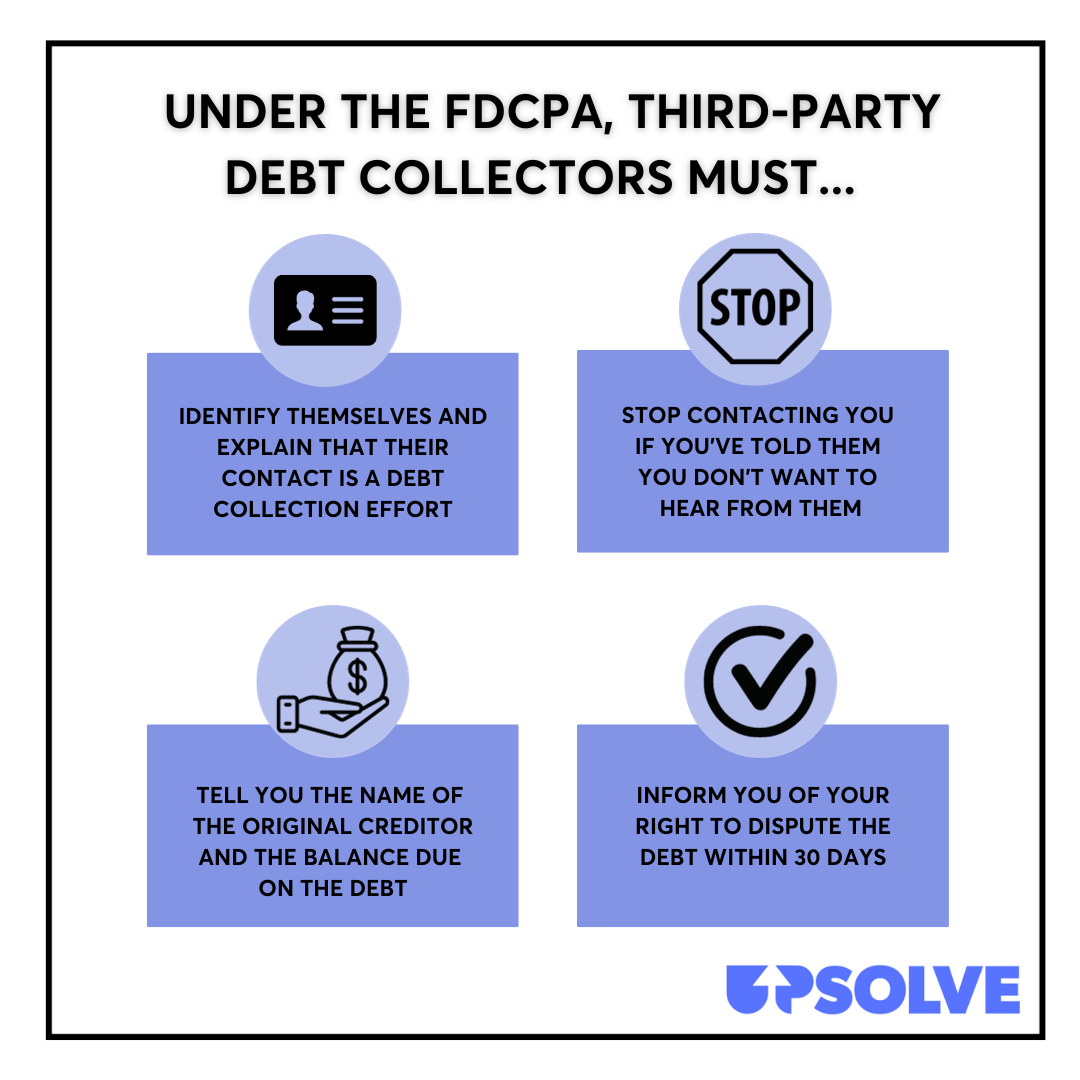

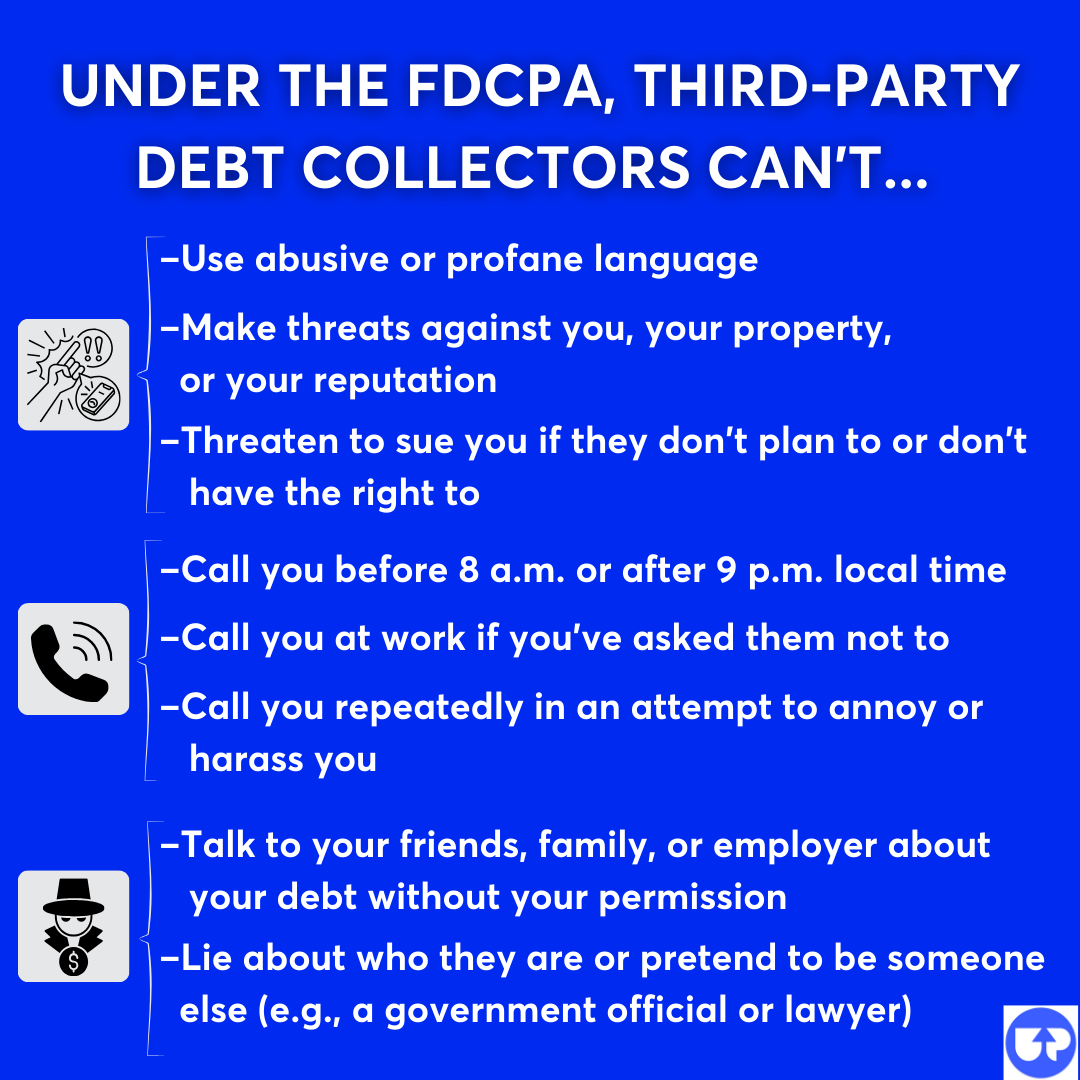

The federal Fair Debt Collection Practices Act was passed to regulate third-party debt collectors and increase transparency in the debt collection process.

Here’s a basic overview of this important law:

And here's an overview of your major rights and protections under the FDCPA:

How Does the Texas Finance Code Protect Texans?

The rules regulating debt collection in Texas are outlined in Chapter 392 of the Texas Finance Code. Many of these regulations mirror the major FDCPA regulations. The one major difference is the state law also applies to original creditors, not just third-party debt collectors.

That means that if an original creditor or a debt collector is trying to collect a debt from you, they can’t:

Use threats or coercion, such as threatening to put you in jail or tell others about your debt

Harass or abuse you, such as making repeated phone calls or using profane language when speaking to you

Use unfair practices, such as adding fees to your debt that aren’t allowed by law or the debt contract

Mislead or deceive you, such as by misrepresenting who they are or not identifying themselves as a debt collector in their communications with you or by being untruthful about how much you owe or other aspects of the debt in question

The law also prohibits creditors from hiring a third-party debt collection agency if the creditor knows the agency has violated the state law.

Finally, the law prevents debt collectors from trying to extend the time they have to collect on an old debt. Under Texas law, the statute of limitations won’t be revived if you reaffirm that you owe the debt, make a partial payment on the debt, or engage in any other activity related to the debt. This provision is unique to Texas and can help you if you’re contacted about or sued for an old debt.

What Is the Statute of Limitations for Debt Collection in Texas?

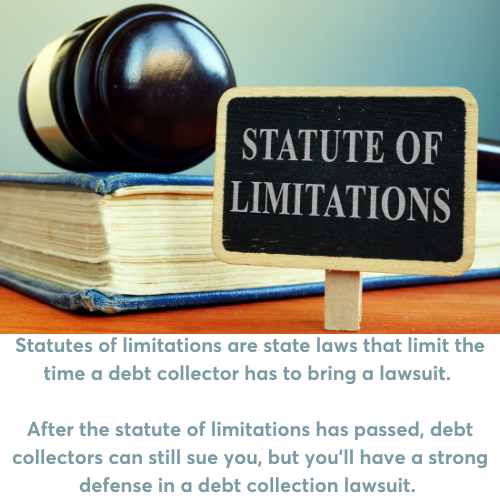

The statute of limitations is an important part of debt collection law because it limits the amount of time a debt collector has to sue you for a debt. The goal is to prevent debt collectors from trying to sue you for debt that’s several years old.

In Texas, the statute of limitations is four years for consumer debts like credit cards, car loans, and medical debt. If you’re sued for a debt that you think is past the statute of limitations, you may be able to use this as a defense in your debt collection lawsuit. You can learn more about how to do this in our article on answering a summons for debt collection in Texas.

Similarly, if you’re contacted about an old debt, you can tell the debt collector you believe the statute of limitations has expired and the debt collector doesn’t have legal standing to collect the debt. It’s good to keep your communications with the debt collector in writing. In this case, you can use a debt verification letter to contest the debt.

Upsolve Member Experiences

3,877+ Members OnlineWhat You Can Do if a Debt Collector Breaks the Law in Texas

If you believe a debt collector or creditor has broken the law while trying to collect a debt from you, you can file a complaint or a lawsuit against them.

File a Complaint

The Texas Attorney General and the Texas Office Of Consumer Credit Commissioner both help enforce consumer protection laws in the state. The Consumer Financial Protection Bureau also helps regulate this on a federal level. You can file a complaint online with any of these organizations to report bad or illegal behavior from debt collectors:

File a consumer complaint with the Texas Office of the Attorney General

File a complaint with the Texas Office of Consumer Credit Commissioner

Submit a complaint about a financial product or service with the Consumer Financial Protection Bureau

Reporting a debt collector who's harassing you or breaking the law can help protect you and others from unfair treatment. It can stop the debt collector from bothering you and might even lead to consequences for their actions. Your report helps authorities keep an eye on these companies and could make things better for everyone dealing with debt collectors.

File a Lawsuit

You can also file a lawsuit against a debt collector who has violated the state law or the FDCPA. When you file a lawsuit, you can ask for damages. This is the legal way of saying compensation. Under state law, you may be entitled to compensation for any damage or harm that resulted from the debt collector’s behavior. These are called actual damages. For example, this might include lost wages or unfair overcharges. You can also be compensated for your attorney fees and court costs.

If you bring a lawsuit for FDCPA violations, you may be entitled to actual damages as well as up to $1,000 in statutory damages, which is another form of compensation you receive if/when the judge determines that the debt collector broke the law.

What Are Debt Collectors Allowed To Do To Collect Debt in Texas?

A debt collector’s first line of defense will be to contact you by calling you, sending you notices in the mail, and potentially even messaging you on social media. Debt collectors are known to be quite persistent, but if they aren’t getting what they want, they might eventually give up on contacting you and decide to sue you instead.

It’s entirely legal for a debt collector to take you to court. This is an increasingly common tactic because if the debt collector wins, they can ask for a court order to garnish your paycheck, take money from your bank account, or put a lien on any property you own. In other words, it allows them to go from requesting money from you to taking it directly from you. Wage garnishment is the most common result of these lawsuits. This can cause serious stress because it directly reduces your take-home pay. Luckily, there are wage garnishment limits, so you won’t lose your whole paycheck.

If you’re being contacted about debt related to an auto loan, you’re also at risk of repossession. Debt collectors don’t need a court order to repossess your vehicle.

How To Deal With a Debt Lawsuit

If you get sued, the most important thing you can do is respond to the lawsuit. Contrary to popular belief, you do not have to have a lawyer to do this. You will need some knowledge and patience, but you can fill out the necessary forms by yourself and submit them to the court. It’s important to understand the process and the deadlines. To learn more about this, read our article on responding to a debt collection lawsuit in Texas.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Need Help With Debt Relief? Here Are Some Options

No one chooses to fall behind on paying their bills or to interact with debt collectors. Unfortunately, one emergency or life event can wreak financial havoc quickly. If this has happened to you, don’t be ashamed to ask for help.

There’s a free resource that many people don’t know about or take advantage of: credit counseling. Nonprofit credit counseling agencies employ professionals who can help you look at your debt, finances, and goals and figure out the best way for you to get on track. A credit counselor might suggest a debt management plan, debt consolidation, or even bankruptcy. Upsolve can help you find a credit counselor near you.

If you file bankruptcy, the protections kick in right away: As soon as you file, debt collectors can’t continue any collection efforts against you, including lawsuits. Bankruptcy has many other benefits. It gives you a financial fresh start and can improve your mental and emotional health. Upsolve’s filing tool helps you file your Chapter 7 bankruptcy for free, without a lawyer. Upsolve has helped thousands of people get rid of almost $700 million of debt. You could be next.