How To Respond to a Debt Collection Lawsuit in Connecticut

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If a creditor or debt collector brings a debt collection lawsuit against you in Connecticut, you can fight it on your own! If you’re sued for $5,000 or less, your case will likely be heard in a small claims court. These courts aim to provide a simplified and expedited legal process.

Here are the basic steps of how to respond to a debt collection case in Connecticut:

1. Receive and read the Small Claims Writ and Notice of Suit.

2. Fill out the court-provided answer form — respond to the claim, explain your defense, and raise a countersuit (if applicable).

3. File your answer with the court.

4. Deliver a copy of your answer to the person suing you.

5. Attend scheduled court hearings or appearances, including mediation.

Written by Upsolve Team.

Updated November 20, 2023

Table of Contents

How Do Debt Collection Lawsuits in Connecticut Work?

If you don’t respond to collection calls or a creditor’s attempts to collect a debt, you may be served with official paperwork indicating that the debt collector or creditor has started a debt collection lawsuit against you.

Debt collection lawsuits are civil actions (as opposed to criminal). If you are sued for $5,000 or less, your case will be filed in Small Claims court, and you’ll be notified with a Small Claims Writ and Notice of Suit form. The majority of debt collection lawsuits in the U.S. fall within this range, so this article will focus primarily on responding to a small claims debt lawsuit.

If you are sued for more than $5,000, your case will be filed in a Superior Court on the regular docket (in other words, not in Small Claims), and you’ll be served with a summons and complaint instead of a Small Claims Writ. This article doesn’t cover this process in detail, but generally speaking, the process is similar. The paperwork you receive may look different and include more information since these cases tend to be more complex than small claims cases.

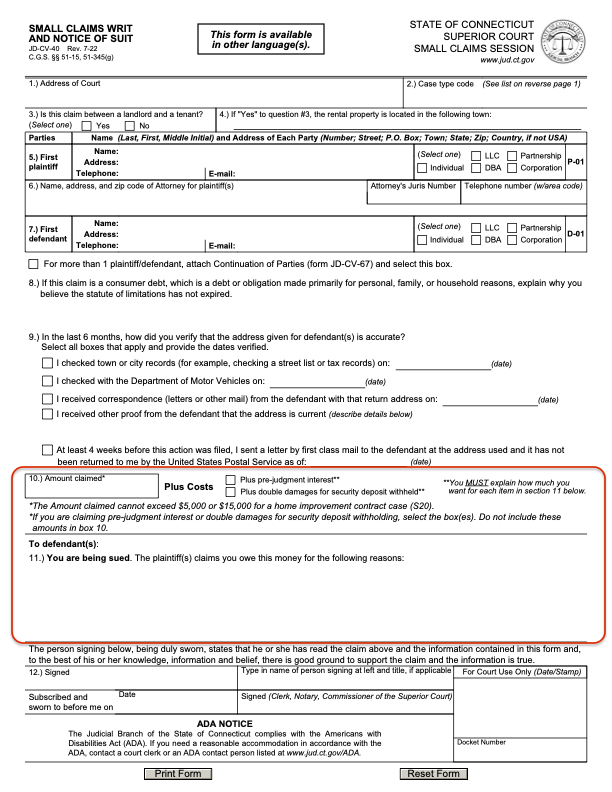

What Is a Small Claims Writ and Notice of Suit?

If your case is filed in a Small Claims court, you’ll get a Small Claims Writ and Notice of Suit. This is the official court form notifying you that someone has sued you to collect on a debt they allege that you owe.

This form also tells you:

The name and address of the court reviewing your case

The name of the party suing you (the plaintiff)

The amount claimed and the costs the plaintiff seeks to recover in the lawsuit

The reason the plaintiff believes you owe the money

Here’s what the form looks like with the claim amount and reasoning highlighted in red:

How To Respond to a Small Claims Debt Collection Case in Connecticut

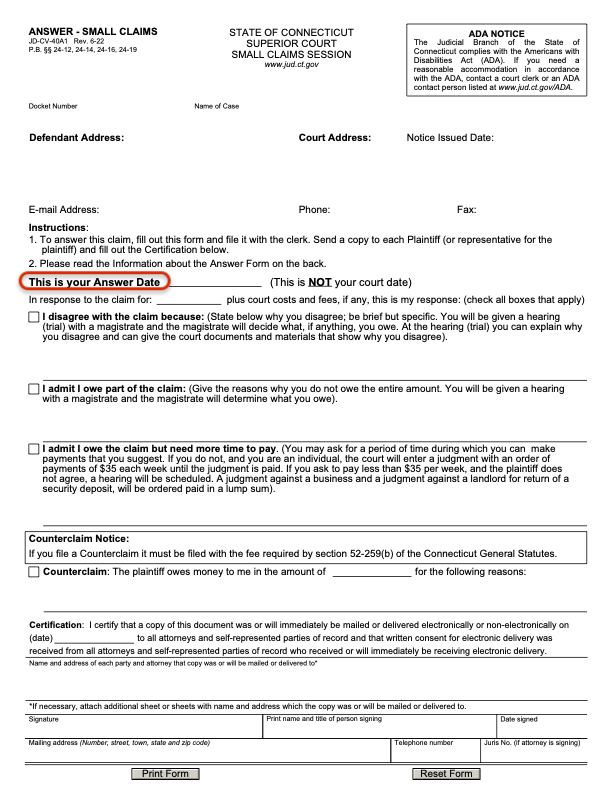

You’ll need to respond to the Small Claims Writ and Notice of Suit by filing an answer form with the court. The court will send you an answer form within six weeks of the Small Claims Writ being sent. The form will have the title Answer - Small Claims at the top left. If you haven’t received an answer form within six weeks of getting the Small Claims Writ, contact the court and let them know.

Here’s what the answer form looks like, with the answer date portion circled in red:

Step 1: Fill Out Your Response to the Claim

When you receive your answer form, the claim amount and answer date will be filled in by the court.

To answer the lawsuit, check the relevant option for your situation and provide a brief explanation. The options are:

I disagree with the claim because

I admit I owe part of the claim

I admit I owe the claim but need more time to pay

If you disagree with the whole claim written on the Small Claims Writ you received, you can check the first box to indicate that. There’s also space for a short explanation of why you disagree. If you have a good defense, include that information here.

List Your Affirmative Defense(s)

Affirmative defenses are reasons you shouldn’t lose the lawsuit. They’re usually based on information that was not included in the Small Claims Writ. Here are some common affirmative defenses used in debt collection lawsuits:

The debt is too old (in other words, the statute of limitations has expired). The statute of limitations for credit card and medical debt is six years in Connecticut.

You already paid the debt.

The debt isn’t yours.

The debt was discharged in bankruptcy.

Step 2: File a Counterclaim (if Applicable)

The form also provides a space for you to file a counterclaim if you want to bring one. There’s a $95 filing fee for counterclaims. It’s advisable to get legal help if you want to file a counterclaim.

If you’re just responding to a court case, you get to play defense. The person suing you has to do all the work to prove what they said in their complaint. If you file a counterclaim, then you need to do the work to prove your claim to the court. In Connecticut, if you file a counterclaim, your case may be moved from the small court docket to the regular civil court docket.

Step 3: Sign and Certify the Form

Certification is the final section of the answer form. When you sign this, you are agreeing that you have sent or will immediately send a copy of your answer form to the person suing you. You’ll also include their name and address in the box provided.

Step 4: Make Copies and File the Form

Finally, make three copies of this form: one for your records, one to file with the court, and one to deliver to the plaintiff (the person suing you).

To file with the court, you can go in person to the courthouse and hand-deliver your form to the clerk, or you can send the form via mail or fax. If you have signed up and been approved for E-Services, you can also file the form electronically. It’s free to enroll in the court’s E-Services.

Finally, deliver a copy of your answer form to the plaintiff. You can send the copy via regular mail or you can deliver it electronically if the other party has agreed to receive electronic correspondence. If you deliver the copy via mail, it’s a good idea to send it by certified mail so you can show the court proof that you sent it when you said you did on your answer form.

The Connecticut Judicial Branch provides a comprehensive instructional packet that details each of these steps as well.

Upsolve Member Experiences

3,804+ Members OnlineWhat Happens After You File Your Answer Form?

Prior to the court hearing, you may be required to participate in an online dispute resolution (ODR) process to see if you and the plaintiff can settle the dispute without going before a judge or magistrate. While you must attend the ODR, you are not required to come to an agreement. If you and the plaintiff can’t agree on a resolution, the case will proceed to a court hearing.

You should receive notice about next steps, including a hearing date and time, from the court via mail or email (if you opted in to electronic communications).

What Happens if You Don’t Respond to the Lawsuit?

If you don’t respond to the lawsuit within the required timeline, the judge can issue a default judgment. This means the debt collector has won by default because you didn’t participate in the lawsuit.

Many debt collectors rely on this. They’re counting on you not to show up to defend yourself so they can get an easy win. While getting a court summons can feel intimidating, rest assured that with some knowledge of how the process works, you can fight and maybe even win the debt collection lawsuit. Sometimes, simply responding to the lawsuit (by filing an appearance and answer) is enough to scare off the debt collector and get the lawsuit dropped.

Keep in mind that if the debt collector wins the lawsuit, you could face serious collection measures, including wage garnishment or a bank account levy. If the debt in question is related to an auto loan, you may be at risk of a car repossession. If the debt is related to a mortgage or rent, you may be at risk for foreclosure or eviction.

Upsolve’s Learning Center contains state-specific articles on each of these issues:

What Do You Do if the Court Already Issued a Default Judgment Against You?

If you don’t respond to the debt collection lawsuit within the required time frame, the court can enter a default judgment against you.

If the Court Has Only Entered a ‘Default for Failure To Appear’...

If you don’t file the appearance form by the deadline (within two days of the Return Date on the summons) the court will likely enter a “default for failure to appear” into the court record.

This is typically followed by a default judgment, the formal court order that recognizes the plaintiff has won the case and that you owe the amount listed in the court documents.

Court processes take some time, and there is often a lag between these two actions. If you file an appearance after the court enters the default but before the court has entered a judgment against you, the court must set aside (cancel) the default judgment.

In this case, be prepared to follow the steps outlined above to respond to the debt collection lawsuit: filing an answer, listing defenses (if applicable), serving the plaintiff, and showing up to court appearances.

If the Court Has Entered a Formal Default Judgment Against You…

If the judge in your case has entered a court order for a default judgment, you can still act to have the case reopened.

To do so, you’ll need to file a Motion To Open Judgment (Small Claims and Housing Matters) form with the court. You must also deliver a copy of this motion to the plaintiff or the plaintiff’s attorney. To successfully open a judgment, you’ll need to “show good cause” for not appearing in the initial case.

You’ll need to file this motion within four months of the judgment being issued unless an exception applies (e.g., fraud). You can learn more about how to file a Motion To Open Judgment in this video from the CT Judicial Branch.

Can You Appeal a Small Claims Ruling?

No. In the state of Connecticut, you can’t appeal a small claims ruling. This is part of the reason it’s so important to prepare for and respond to the debt collection lawsuit as best as possible.

If the court has ruled against you, you may still be able to negotiate a payment plan with the creditor or debt collector, especially if you’re operating in good faith and show a willingness to repay the debt.

Need Legal Help?

While many individuals are able to successfully represent themselves in small claims cases, if you want some legal advice or guidance, you can try the following organizations/services:

Connecticut Legal Services: the state’s largest legal aid agency providing free or low-cost legal services to low-income individuals

Pro Bono Organizations from the Connecticut Bar Association: a comprehensive list of volunteer attorneys and free or low-cost legal services across the state

Legal Clinics and Help from the CT Judicial Branch: once-a-month, in-person help from volunteer attorneys for folks facing small claims cases