Connecticut Debt Collection Laws: Know Your Rights

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

The state of Connecticut has two robust debt collection laws that protect its residents from creditor harassment and unfair practices in the debt collection process. Connecticut law also requires third-party collection agencies to be licensed. These laws accompany the federal Fair Debt Collection Practices Act (FDCPA), which seeks to protect consumers from exploitative third-party debt collectors.

Written by Upsolve Team.

Updated May 6, 2025

Table of Contents

- What Are the Debt Collection Laws in Connecticut?

- Connecticut Requires Debt Collectors To Be Licensed

- What Can You Do if a Debt Collector Breaks the Law in Connecticut?

- What Is the Statute of Limitations for Debt Collection in Connecticut?

- What Are Debt Collectors Allowed To Do To Collect Debt in Connecticut?

- Need Help With Debt Relief? Here Are Some Options

What Are the Debt Collection Laws in Connecticut?

Connecticut residents get the benefit of three major debt collection protection laws:

The federal Fair Debt Collection Practices Act (FDCPA)

The state of Connecticut’s Creditors’ Collections Practices Act (CCPA)

The state of Connecticut’s Consumer Collection Agency (CCA) law

How the FDCPA Protects Consumers in Connecticut

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers across the U.S. from third-party debt collector harassment and abuse.

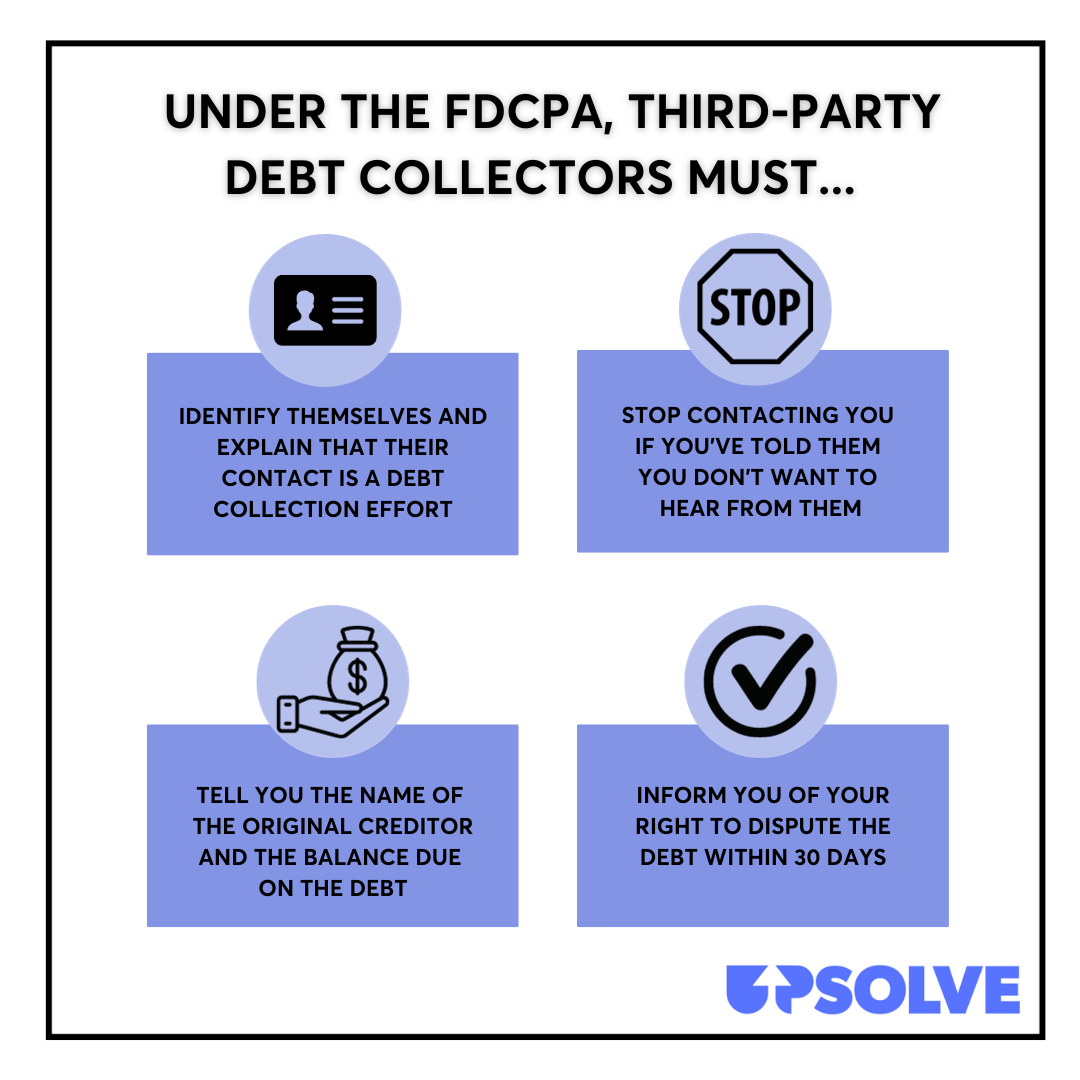

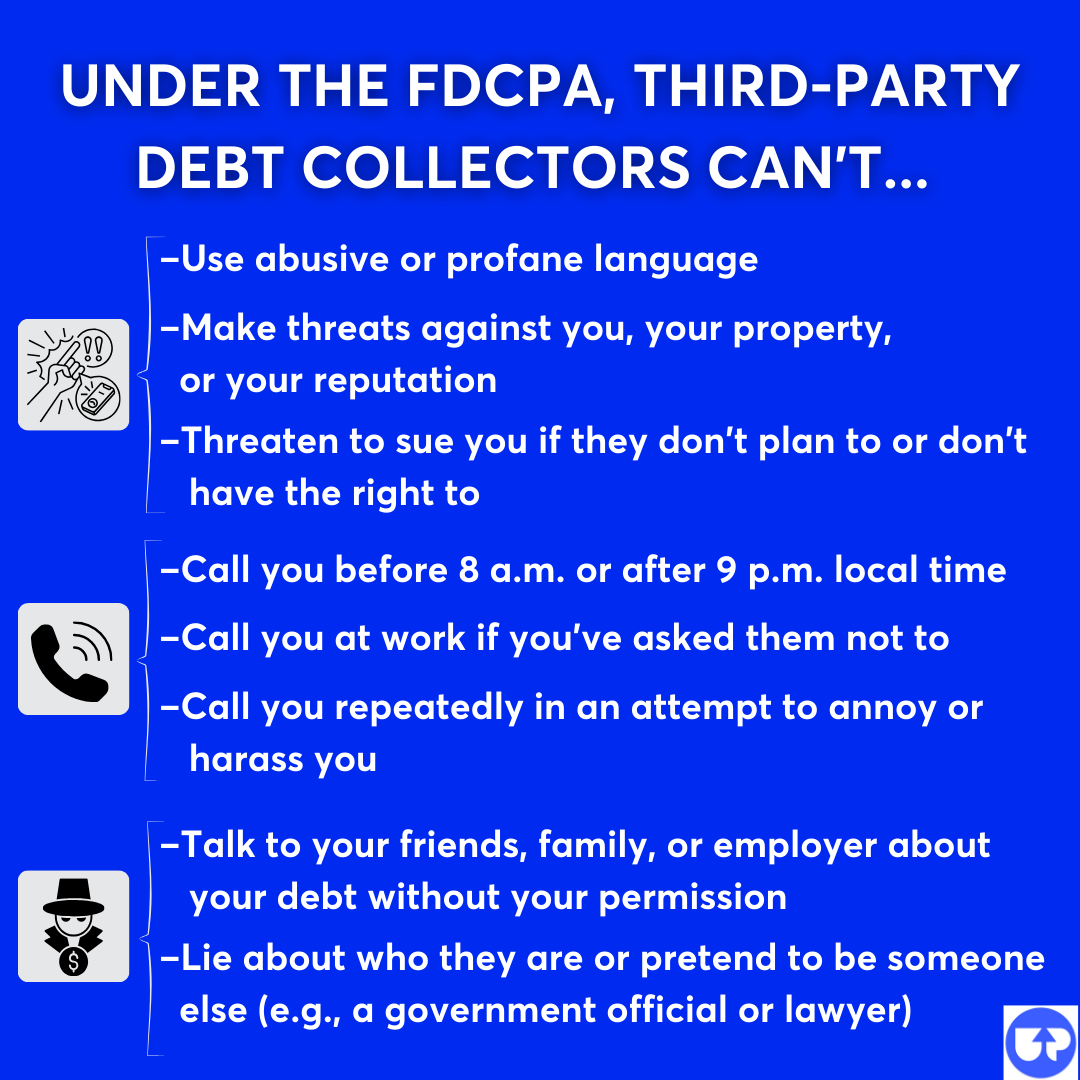

Here’s the overview of the FDCPA:

The FDCPA provides many protections for consumers. Here are some of the key protections and rights it provides:

To learn more about the FDCPA, read our popular article How the Fair Debt Collection Practices Act Protects You.

Connecticut Debt Collection Laws Provide Further Protections

Not every state has consumer protection laws that give residents additional rights when it comes to debt collection. However, the state of Connecticut does. In fact, it has several laws that seek to protect consumers.

Two primary state laws address debt collection and debt collectors: the Creditors’ Collections Practices Act (CCPA) and the Consumer Collection Agency (CCA) law.

The Creditors’ Collections Practices Act (CCPA)

The CCPA is similar to the federal FDCPA. The CCPA aims to protect Connecticut consumers from harassment, abuse, and unfair or deceptive practices when it comes to debt collection. But there is one key difference: The FDCPA applies only to third-party debt collections, while the CCPA applies to the original creditor and sometimes to debt buyers.

This means that no matter who is doing the debt collection activities — the original creditor or lender or a third-party collection agency — Connecticut residents maintain legal rights and protections.

The Consumer Collection Agency (CCA) Law

The CCA prohibits consumer debt collection agencies from adding additional or duplicate collection fees if they are not in the contract. Even if the fees are in the contract, they should be no more than 15% of the full payment accepted.

Collection agencies also have to follow the rules and provisions outlined in the debt contract. For example, if the contract doesn't allow for additional debt collection fees, the debt collector can’t charge them. Most contracts allow for fees, but you can review your bills to see if the fees are over 15% of the full payment amount.

The CCA also requires third-party debt collectors to have a license to collect debt in the state of Connecticut. Read on to learn more.

Connecticut Requires Debt Collectors To Be Licensed

Connecticut’s Consumer Collection Agency (CCA) law requires third-party debt collectors to have a state license to operate.

Though there are some exceptions to this rule, generally speaking, debt collectors who regularly conduct business in the state of Connecticut are required to have a license to do so. This requirement stands even if the collection agency does not have physical offices in the state.

Ask for the Debt Collection Agency’s Licensing Information

Though state and federal laws regulate the Connecticut debt collectors’ action, they do have the right to try to collect unpaid debt from you. You can expect them to exercise this right.

If you’ve been contacted about a debt that’s unfamiliar or that you don’t believe you owe, assert your rights, too. One such right is asking for the debt collector’s licensing number.

Getting a debt collector’s licensing information can help you verify that the company is legally allowed to collect debt in the state of Connecticut. It can also help you avoid debt collection scams.

If you write a debt verification letter to get more information about the debt or to begin the dispute process, you should ask for the debt collector’s licensing information in the letter as well. Here’s how to write a debt verification letter, including a template you can use.

Upsolve Member Experiences

3,804+ Members OnlineWhat Can You Do if a Debt Collector Breaks the Law in Connecticut?

If a creditor or debt collector has made phone calls outside normal hours, harassed or abused you, or otherwise violated the law, you can report them. You may also be able to bring a lawsuit for damages.

You can file a consumer collection agency complaint online through the Connecticut Department of Banking. You can also call the department at 860-240-8170 or email them at banking.complaints@ct.gov. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that protects consumers against unfair financial practices. It works in conjunction with the Federal Trade Commission (FTC).

If the original creditor (or in certain cases, a debt buyer) has violated your rights under the Creditors’ Collections Practices Act (CCPA) you can bring a lawsuit against them in state court. Under Connecticut law, you may be able to recover actual damages, attorney fees, and up to $1,000 in additional compensation. You only have one year (from when the violation occurred) to file a lawsuit for CCPA violations.

You can also file a lawsuit in federal court against third-party debt collection agencies that violate the FDCPA.

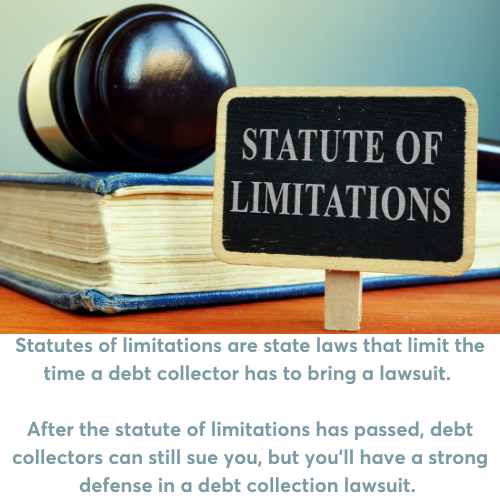

What Is the Statute of Limitations for Debt Collection in Connecticut?

Different types of debt have different statutes of limitations. In Connecticut, the shortest statute of limitations, at three years, is for debt with an oral contract. Credit card debt and medical debt — two of the most common types of consumer debt — both have a statute of limitations of six years.

| Type of Debt Contract | Statute of Limitations (in years) |

|---|---|

| Credit card contracts (written) | 6 years |

| Medical debt contracts (written) | 6 years |

| Oral contracts | 3 years |

| Contracts for the sale of goods | 4 years |

When Does the Statute of Limitations Start in Connecticut?

The statute of limitations in Connecticut typically begins when you default on your debt repayment. This often happens after missing one or more required monthly payments. You can check the terms of your contract to see when your lender or creditor considers you to be in default.

Knowing the statute of limitations for the type of debt you have is an important way to protect your rights and provide a strong defense if you get sued. But it’s often unwise to wait out the statute of limitations. Late or missed debt payments will be recorded on your credit report and hurt your credit score.

What Are Debt Collectors Allowed To Do To Collect Debt in Connecticut?

While there are laws to regulate debt collector harassment and deception, debt collectors can still contact you to try to collect on an unpaid debt. If phone calls and other attempts to reach you aren’t successful, debt collectors may eventually decide to take you to court.

If you get sued by a debt collector and they win the case, they can get access to your paycheck or bank account through wage garnishment or a bank levy. If you own personal property, they may also be able to put a lien on that property, which means when you go to sell it, the debt will be repaid from the proceeds of the sale before you get them.

Thankfully, there are limits on how much of your paycheck can be garnished in Connecticut.

The most important thing you can do if you get a court summons notifying you of a debt collector lawsuit is answer the court summons. This simply means filing certain required paperwork with the court and delivering copies to the person suing you. You can learn more about this process in Upsolve's guide to answering a Connecticut court summons.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Need Help With Debt Relief? Here Are Some Options

Consumer debt is on the rise in the U.S. If you're struggling with credit card debt or medical bills, you aren't alone. If this is a serious stressor for you, it may be time to get some help. You can get free help from a consumer credit counselor. These professionals work at nonprofit agencies and help individuals deal with debt, learn to budget, and make and reach their financial goals.

A credit counselor will go over your financial situation with you and then suggest debt relief options such as a debt management plan, debt consolidation, or bankruptcy.

As consumer debt is on the rise, bankruptcy filings are, too. Filing Chapter 7 bankruptcy can wipe out credit card and medical debt and give you a financial fresh start. It also stops all collection activities while your case is pending thanks to the automatic stay.

Free Legal Services & Legal Aid

Connecticut Legal Services: The state’s largest legal aid agency providing free or low-cost legal services to low-income individuals

Pro Bono Organizations from the Connecticut Bar Association: A comprehensive list of volunteer attorneys and free or low-cost legal services across the state

Legal Clinics and Help from the CT Judicial Branch: Once-a-month, in-person help from volunteer attorneys for folks facing small claims cases

More Information About Debt Collection in Connecticut

Debt Collection: Know Your Rights: Easy-to-read information about your rights in the debt collection process from CTLawHelp.org

Consumer Collection Practices from the State of Connecticut’s Department of Banking: Basic information on debt collection and consumer rights in Connecticut

Connecticut Law About Debt Collection from the Connecticut Judicial Branch Law Libraries: Somewhat technical but comprehensive research guides and links to state statutes

Though it’s quite technical, the Connecticut Practice Book is a comprehensive resource to learn more about the legal process, court rules, and expected conduct for civil cases. This resource is provided by the State of Connecticut’s Superior Court (www.jud.ct.gov).