How To Answer a Georgia Court Summons for Debt Collection

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Though it may feel intimidating to get a court summons for a debt collection lawsuit, you can respond without hiring an attorney. To do so, you simply need to draft or fill out a few legal documents, including an answer form, a verification form, and a certificate of service. Then you give copies of certain forms to the court and to the debt collector who is suing you and await a hearing date from the court.

Written by Upsolve Team.

Updated May 8, 2025

Table of Contents

- How Do Debt Collection Lawsuits in Georgia Work?

- How Do You Respond to a Georgia Court Summons for Debt Collection?

- How To Fill Out the Court-Provided Answer Form

- What Happens After You Respond to the Summons?

- What Happens if You Don’t Respond to the Lawsuit?

- What Do You Do if the Court Already Issued a Default Judgment Against You?

- Need Legal Help?

How Do Debt Collection Lawsuits in Georgia Work?

If a debt collector or creditor has been contacting you about an unpaid debt and you haven’t responded, they may eventually decide to file a debt collection lawsuit against you. In other words, they might sue you for the money they think you owe.

In Georgia, debt collection lawsuits are typically filed in Superior Court. There are 10 Superior Courts Districts in Georgia, each with several courts serving different counties. You can look up the Superior Court for your county with this finder tool.

The court that’s hearing your case will also be named in the official paperwork you receive that notifies you of the lawsuit. These documents are called the summons and complaint. To learn more, keep reading, or watch this short video from Georgia Legal Aid.

What Is a Summons and Complaint?

A summons is a document that informs you that a lawsuit has been filed against you. It contains important information, including:

The plaintiff’s (person suing you) contact information, which you’ll need later

The name of the Superior Court where the case was filed

The deadline to respond to the court case by filing an answer

A complaint is another type of official document. It outlines the claim(s) the plaintiff (the person suing you) is bringing against you and the outcome they want in the case. This is typically a money judgment, which is a court order saying the defendant (the person who’s being sued) must pay the outstanding debt noted in the complaint along with potential other costs like court fees, legal fees, and interest charges.

How Do You Respond to a Georgia Court Summons for Debt Collection?

Responding to (called “answering”) a court summons in Georgia is pretty straightforward.

You’ll need to complete the following three documents and file them with the court within 30 days of receiving the summons:

The answer form, which includes your responses to claims listed in the complaint as well as any counterclaims you want to bring

A verification form signed by a notary public, certifying that you’re telling the truth in your answer documents

A certificate of service, which is your proof to the court that you mailed a copy of the answer to the plaintiff

Don’t worry, we’ll explain each of these forms in more detail below.

You’ll also need to send a copy of the summons to the person/company suing you. Finally, wait to receive further instructions from the court about upcoming hearings or appearances.

Upsolve Member Experiences

4,443+ Members OnlineHow To Fill Out the Court-Provided Answer Form

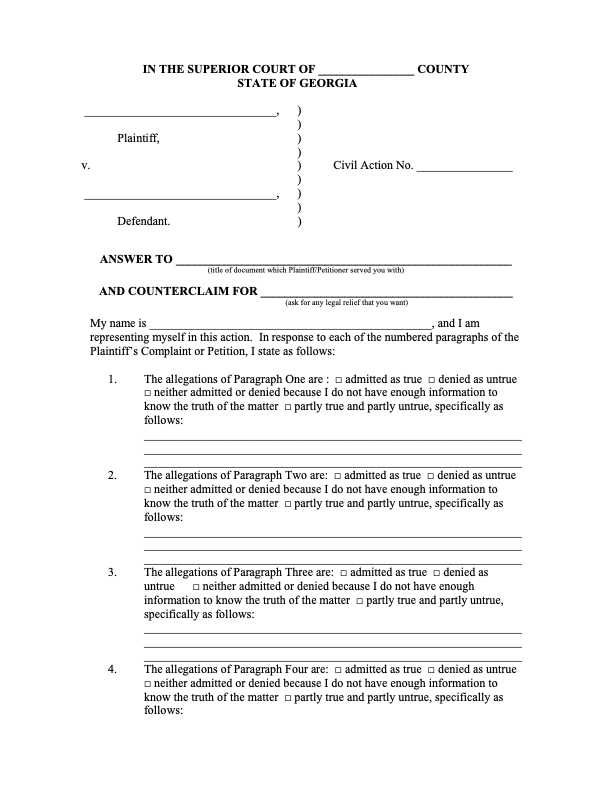

In Georgia, the answer form is where you’ll respond, paragraph by paragraph, to the legal claims listed in the complaint form you received. Georgia courts assembled a useful answer packet to guide you through this process. The packet also contains templates for each of the required court forms.

Here’s what the first page of the answer form looks like:

Step 1: Address Each Allegation/Complaint

Most complaints will include multiple allegations or claims. These are laid out in numbered paragraphs. When you fill out your answer form, be sure to address each allegation brought against you. On the Georgia court form, you can simply check one of the following boxes:

Admitted as true: This means you admit to or agree with the allegation.

Denied as untrue: This means you don’t agree with the allegation or believe it to be untrue.

Neither admitted or denied because I do not have enough information to know the truth of the matter: This is essentially saying you’re not sure if the allegation is true or not.

Partly true and partly untrue, specifically as follows: This means that you believe some of the information in the allegation is true but other information is not true. This response is followed by a space to further explain your response.

Step 2: Raise Your Defenses and Counterclaims

You can also raise any affirmative defenses you have in this form. An affirmative defense is a reason you shouldn’t have to pay the debt. Simply saying, “I can’t afford to pay the debt,” isn’t an affirmative defense.

Georgia Legal Aid provides examples of common defenses in debt collection lawsuits, which include things like:

The debt isn’t yours.

The debt is too old to collect (in other words, it’s beyond the statute of limitations).

You’ve already paid the debt.

The debt was discharged in bankruptcy.

The amount is wrong.

If you want to bring a counterclaim, you can also do that on the answer form. A counterclaim is a legal action you, as the defendant, file against the plaintiff as part of the same lawsuit. If the debt collector has violated state or federal consumer protection laws, you may be able to bring a counterclaim for damages.

Some types of counterclaims can be brought later, but others can’t. This can get complicated. If you feel like you need legal help to bring a counterclaim, you can look for free legal aid or law clinics or see if a local consumer protection attorney offers free consultations. Visit the resources section at the end of this article to learn about more community resources.

Step 3: Complete the Verification and Certificate of Service Forms

You’re probably understanding by now that court cases require a lot of paperwork. Luckily, these two forms are quite simple and straightforward to fill out.

Here’s what the verification form looks like:

You'll need to make one small modification to the form. The template from the court says "... the facts set out in this Complaint are true." Cross out "Complaint" and write in "Answer" since you stating that the facts in your answer form are complete and true.

By signing the form in front of a notary public, you’re certifying that you’re telling the truth in your answer documents. After you sign, the notary public will sign, date, and stamp the form.

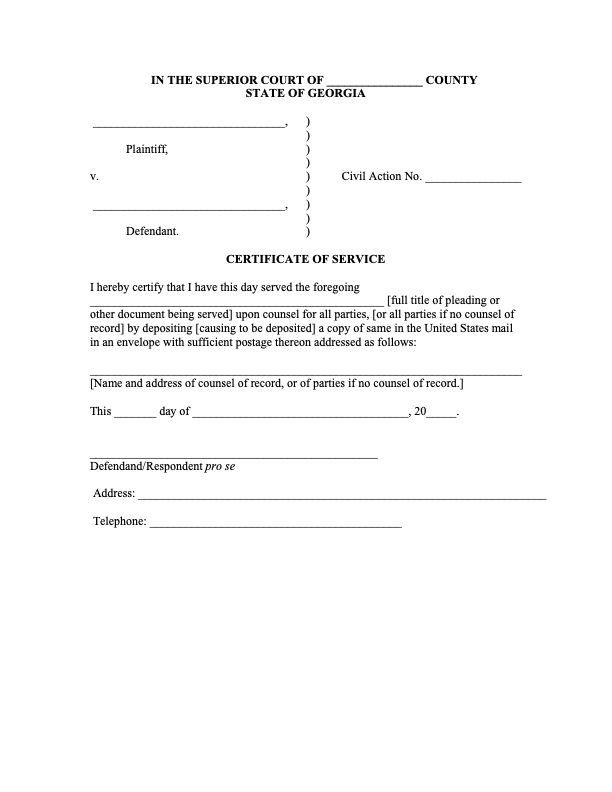

The final form you’ll fill out is the certificate of service form. Here’s what it looks like:

When you respond to a lawsuit, you’re required to send a copy of your response (the answer form) to the person/company suing you so they’re aware that you’ve replied to (and potentially contested) their claims.

By signing the certificate of service form, you’re certifying that you’ve mailed a copy of your answer form to the plaintiff (the party suing you). You can find the plaintiff’s name and address on the summons you received.

You’ll sign where it says “Defendant/Respondent pro se.” Pro se means you’re representing yourself.

Step 4: Make Copies of Your Forms & File With the Court

After filling out the documents, make three copies of your answer form(s):

File the original with the court clerk

Serve (deliver) a copy to the plaintiff

Keep a copy for your records

You must file these documents with the court within 30 days of receiving the summons. There’s one exception to this: If you were notified of the lawsuit through publication (instead of being mailed the forms directly), you get 60 days to file your answer.

Step 5: Serve a Copy of the Answer on the Plaintiff

As your final step, you need to deliver a copy of your answer form(s) to the plaintiff.

In the legal world, service means proper delivery. You’re required to serve your answer form (and counterclaims) on the plaintiff at the address listed on the court summons. Often, but not always, this will be an attorney representing the creditor or debt collector. Either way, the information, including the name and address, should be easily identifiable on the summons.

To properly serve your answer in Georgia, you can simply mail the answer form to the plaintiff. While it’s not required, you may choose to send it via certified mail so you have proof from USPS that the documents were sent.

What Happens After You Respond to the Summons?

Keep a look out for court notices. You should be notified of any scheduled appearances or court hearings. It’s important to attend these hearings. If you don’t, you risk losing the case without the judge hearing your side of the story.

If you can’t attend a scheduled hearing, contact the clerk of court as soon as possible. They can tell you what your options are and what, if any, paperwork you need to file to get the hearing rescheduled.

It’s also possible that the court will recommend or require mediation prior to a court trial or hearing. If so, you’ll also be notified about the time and place. In some cases, hearing or mediation sessions may be held remotely.

How To Prepare for Court Appearances

Going to court might feel intimidating, but prepare as best you can by learning about the court process and making sure you have all the relevant documents to support your claims.

Also, arrive early for your hearing and follow courtroom etiquette. Speaking respectfully to the judge, dressing professionally, and coming prepared can go a long way in supporting your case. Upsolve’s article on What Happens In Small Claims Court has other helpful tips.

If the process becomes overwhelming, consider seeking assistance from a legal aid clinic or consulting with an attorney for guidance. See suggestions below.

What Happens if You Don’t Respond to the Lawsuit?

As the Carroll County Clerk’s office puts it, “It is very important to file a written answer to any legal action which is brought against you… If you fail to file a written answer, this tells the Court that you are not contesting or disputing what the other side has asked for.” Filing an answer also means you’ll be notified of the hearing date and place, so you can show up to defend yourself.

In essence, if you don’t respond to the lawsuit, the debt collector will probably win by default. If they do, the court can issue an order called default judgment, which gives the debt collector access to serious collection actions including garnishing your paycheck or bank account.

And here’s the sad truth, most debt collectors bring these lawsuits and count on people to not show up so they can get an easy win. Because of this, sometimes simply responding to the lawsuit can lead the debt collector to drop the suit or contact you to negotiate a debt settlement agreement. If you want to negotiate a debt settlement, now is a good time. But you should still reply to the lawsuit and follow any court instructions unless and until the settlement is final.

Though it can feel intimidating to deal with legal matters, don’t give debt collectors an easy win! You can address and maybe even win the debt collection lawsuit.

What Do You Do if the Court Already Issued a Default Judgment Against You?

If you didn’t reply to the summons or appear for scheduled hearings and the judge issued a default judgment against you, you may still be able to file a motion with the court to have the judgment canceled.

Under Georgia law, you can file a motion with the court asking for the judgment to be vacated or modified. A motion is a formal written request you make to the court. In this case, you’re requesting that the court cancel (vacate) or change (modify) the default judgment they issued against you. To be successful with your motion, you’ll need to have “good cause” for filing it.

You may need to seek legal help if you wish to file a motion to vacate. See a list of resources in the next section.

Need Legal Help?

GeorgiaLegalAid.org provides easy-to-understand resources and free or low-cost legal help for eligible individuals.

Georgia Legal Services Program offers free legal services to low-income individuals across the state of Georgia.

Atlanta Legal Aid provides civil legal assistance to qualifying low-income individuals.

Find a Lawyer is a directory of lawyers across the state, presented by the State Bar of Georgia.