How To Answer an Indiana Court Summons for Debt Collection

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If a creditor or debt collector files a debt collection lawsuit against you, you need to respond to the court case or you risk losing the suit and owing money. To respond to the case, you need to file paperwork, called an answer form or appearance. Include any defenses you have when you file your answer with the court. You’ll also need to deliver a copy of your answer form to the person suing you and affirm that you did so by filing a Certificate of Service form with the court.

The Indiana courts don’t provide a lot of information online, but you can always speak with the court clerk to ask if local forms are available or to get clarification on court rules and procedures.

Written by Upsolve Team.

Updated May 15, 2025

Table of Contents

- How Do Debt Collection Lawsuits in Indiana Work?

- How Do You Respond to an Indiana Court Summons for Debt Collection?

- What Happens After You Respond to the Lawsuit?

- What Happens if You Don’t Respond to the Lawsuit?

- What Do You Do if the Court Already Issued a Default Judgment Against You?

- Need Legal Help?

How Do Debt Collection Lawsuits in Indiana Work?

If you’ve had a debt sent to collections, then you know that debt collectors will try to get in touch with you in any way they can. If they aren’t successful in reaching you, after a period of time, they may decide to file a debt collection lawsuit.

If you live in Marion County and you’re being sued for $10,000 or less, your case may be filed in small claims court or in a superior court (a type of trial court). If you live outside Marion County and you’re being sued for $10,000 or less, your case will likely be heard in a superior court.

The rules differ by the type of court: Small claims courts tend to be less formal and are easier to navigate if you’re representing yourself. Trial courts follow formal rules and procedures, which is why many people hire lawyers to help with these cases.

As a first step to deal with your case, figure out which court the debt collector filed the case in. This will be listed on the court summons you’ll receive if you’ve been sued.

What Is a Summons and Complaint?

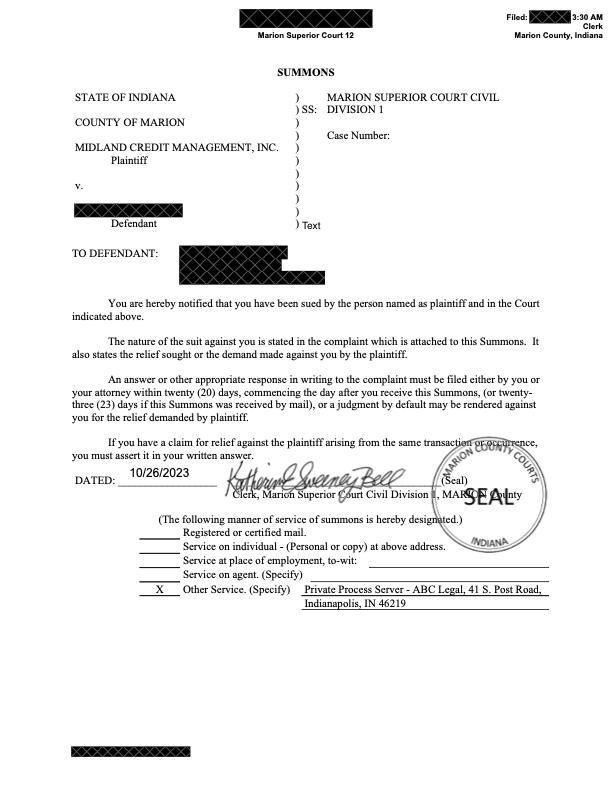

A court summons is an official document notifying you that a lawsuit has been brought against you. It will list the name of the court the case was filed in as well as the name of the person or company suing you. This person/company is called the plaintiff. You, the person fighting the case, are called the defendant. The summons should also list your deadline to respond. This is very important, so take note!

Here’s what a summons form in Indiana looks like (all personal information has been redacted):

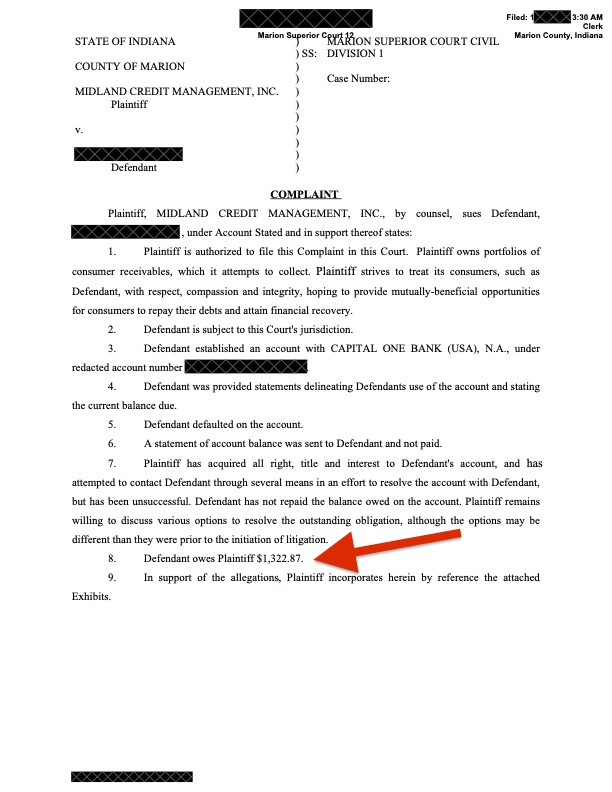

Accompanying the summons will be a complaint. The complaint will list the claims against you in numbered lines or paragraphs. One line will list how much the plaintiff alleges that you owe.

Here’s an example of what the first page of a debt collection complaint looks like (all personal information has been redacted). This was filed in 2023 in a Marion Superior Court:

The complaint will also state what the debt collector is asking the court for. This is usually a court order called a judgment. If the debt collector wins the lawsuit and gets a court judgment, they can gain access to collection measures like wage garnishment or a bank account levy.

How Do You Respond to an Indiana Court Summons for Debt Collection?

Responding to a debt collection lawsuit in Indiana means filing an answer or appearance with the court within 20 days of receiving the summons. You’ll also need to deliver a copy of your answer or appearance form to the person/company suing you, so that they get notice that you’ve responded to the case. You must also file a Certificate of Service (with your answer) to show that you’ve delivered the paperwork to the plaintiff (the person suing you).

Step 1: File an Answer to the Summons Within 20 Days

In some states, the process and paperwork to answer the summons for a debt collection is very clear. Unfortunately, in Indiana, it’s less clear. There is no form available for defendants to download and fill out from the Indiana Courts. The upside is that learning how to file your answer may be as simple as speaking to the court clerk.

First, you should contact the court clerk and tell them you received a summons for a debt collection lawsuit and want to know what the court rules are for filing an answer. You can call the court clerk or visit the courthouse in person. If possible, visit the courthouse in person so you can fill out any paperwork the clerk may provide for you.

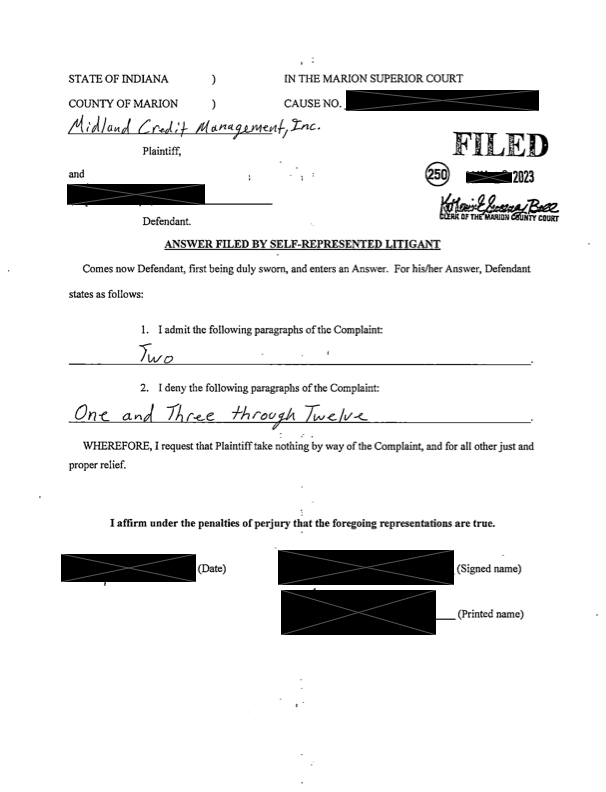

Here’s an example of an answer form from a Marion County Superior Court for a collections case:

You can see this is a pretty simple form. The defendant in this case admitted to one claim listed in the complaint (in paragraph two) and denied the rest of the claims in the complaint. It’s important that you deny any claims you don’t intend to admit; court rules in Indiana say that a lack of denial is akin to admitting.They also signed and dated the form. Then, the clerk stamped it and filed it with the court.

When you file your answer, you’ll need to include a Certificate of Service. This is a simple form you can get from the court. You have to sign and date it to attest that you’ve sent the plaintiff a copy of the answer form you filed with the court. (See Step 3 for more information on this process.)

Again, rules about how to serve your answer on the plaintiff may vary slightly by court. The clerk can explain what the rules are for proper service (delivery) at the court where you’re being sued.

Step 2: Raise Your Affirmative Defenses

Sometimes debt collectors get their facts wrong, make mistakes, or violate debt collection laws. If so, you may have a defense — commonly called an affirmative defense, in legal terms — for your lawsuit.

An affirmative defense is a reason why the judge shouldn’t rule against you or should dismiss the lawsuit. Importantly, if an affirmative defense applies to your case, you can raise it whether you owe the debt or not. If the judge agrees with you, you can get the case dismissed for good.

If you want to raise affirmative defenses in your case, you’ll need to do so when you file your answer. Again, you can ask the court clerk what the process is for doing so. You may need to write or type out your affirmative defenses as part of your answer form.

Some of the most common defenses in debt collection lawsuits are:

The debt is too old (it’s beyond the statute of limitations).

Someone stole your identity, and the debt isn’t yours.

You already paid the debt off.

The plaintiff didn’t serve the court summons and complaint properly.

You’ve filed for bankruptcy and are protected by the automatic stay.

The debt collector violated the Fair Debt Collection Practices Act (FDCPA) or a state law by harassing you, deceiving you, or ignoring your rights.

Keep in mind that if you raise affirmative defenses, you’ll need to provide evidence to support them. The evidence you need depends on the defense you’re using. Consider including any of the following that are relevant to your claim: the original debt contract, letters/communications from the creditor or debt collector, copies of identity theft reports, copies of your credit report, a copy of your bankruptcy discharge order or an official court document with your bankruptcy case number on it.

These are not the only affirmative defenses that exist, so be sure to do your research or ask for legal help (see a list of local resources at the end of this article) if you plan to raise an affirmative defense in your case.

Should You Always Raise a Defense in an Indiana Debt Collection Lawsuit?

Not necessarily. Though it is always a good idea to answer the lawsuit!

Affirmative defenses can help you get your case dismissed, but they also create more work for you. You’ll have to collect evidence to back up your claim and be prepared to explain your reasoning to the judge during the hearing. You may also have to answer questions about your defenses from the judge or the plaintiff (who will likely be an attorney).

Also, keep in mind that if you don’t raise affirmative defenses, all the heavy lifting for the lawsuit (or in legal terms, “the burden of proof”) is on the person suing you. If you raise affirmative defenses, you’ll also need to prove your claims are true.

If you aren’t sure what the best course of action is for you, see if you can talk your case through with a volunteer attorney at a legal clinic or a lawyer at a legal aid agency in your community. See the last section of this article for some helpful links to get started.

Step 3: Deliver a Copy of the Answer to the Plaintiff

To keep things fair, you have to give a copy of your answer form to the plaintiff (the person suing you) so they know that you’ve decided to respond to the case and (potentially) raise defenses against the claims in the complaint. The formal process of delivering your answer form is called “service” or “serving the papers.” In Indiana, service simply means sending your answer form by first-class mail or, if allowed, by email. The court clerk can provide the address you need to send it to, though the address will be listed on your court summons or complaint.

Upsolve Member Experiences

3,877+ Members OnlineWhat Happens After You Respond to the Lawsuit?

Next, you’ll wait to hear back from the court. The court will likely schedule a hearing for your case and send you a notice of the time and place. If so, you’ll need to prepare for the trial or appearance. Make sure you know where you’re supposed to go for the hearing (it may be in person or online), allot plenty of time for the hearing (make plans for missing work or getting child or elder care if needed), and bring any documentation that supports your case.

What Happens if You Don’t Respond to the Lawsuit?

There are two ways the debt collector can win:

By default because you don’t answer the lawsuit or show up in court as required

By proving to the judge that you actually owe the debt

The first way is easy for the debt collector: They file the case, and the court grants a default judgment since you haven’t contested it. This judgment can give the debt collector the power to take money from your paycheck or bank account. Don’t make this easy for them!

The second way of winning is a lot harder for debt collectors. They often bring lawsuits against people with no intention of proving the debt or fighting in court. They want to win by default. You can win the debt collection lawsuit, but you have to answer the complaint and follow the court procedures required.

Sometimes simply responding to the lawsuit is enough to scare the debt collector off. Even if it doesn’t, it shows the debt collector you’re serious and willing to fight the case.

What Do You Do if the Court Already Issued a Default Judgment Against You?

If you didn’t respond to the summons with an answer or responded but later didn’t attend a required hearing or trial, the court likely ruled in the plaintiff’s favor and issued a default judgment against you. Though this can feel defeating, it’s not necessarily the end of the road.

If you weren’t properly served with the summons or there was a “mistake, surprise, or excusable neglect,” you can file a Motion To Set Aside Judgment within one year of the judge’s ruling. Doing so makes a formal request to the court to cancel the default judgment. This essentially reopens the case, so you should be prepared to file an answer, raise defenses, and attend court hearings if you file such a motion.

The judge in your case will determine what’s considered a mistake, surprise, or excusable neglect. If you were seriously ill or in the hospital when the case was ongoing, that may be considered excusable neglect. Willfully ignoring the lawsuit isn’t usually considered excusable neglect.

Need Legal Help?

Indiana Legal Help can help you find free or low-cost legal help in your community.

If you live in Marion County, the Indianapolis Legal Aid Society offers legal help to low-income individuals and families.

The Indiana State Government provides information and resources on getting legal help when you’re representing yourself.