Your Guide to Indiana’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you live in Indiana, your best protection against bad debt collector behavior is the Fair Debt Collection Practices Act (FDCPA). Under Indiana law, all debt collection agencies operating in the state must be licensed.

For the most common types of consumer debts (credit card and medical), the state of Indiana has a six-year statute of limitations time period.

Written by Upsolve Team.

Updated May 22, 2025

Table of Contents

- What Are the Debt Collection Laws in Indiana?

- Indiana Requires Debt Collectors To Be Licensed

- What You Can Do if a Debt Collector Breaks the Law in Indiana

- File a Lawsuit Against the Debt Collector

- What Is the Statute of Limitations for Debt Collection in Indiana?

- What Debt Collectors Can Do To Collect Debt in Indiana

- Need Help With Debt Relief? Here Are Some Options

What Are the Debt Collection Laws in Indiana?

Indiana has several state debt collection laws. These are outlined in Indiana's state statutes on consumer sales and collection agencies.

The first law is a general consumer protection law that addresses third-party debt collection practices. This law is modeled after the FDCPA — an important federal law that prohibits debt collectors from harassing consumers or using unfair practices to collect on a debt.

The second law focuses on regulating debt collection agencies. This is mainly enforced through a registration requirement that is mandatory for debt collection agencies in Indiana.

Federal Laws Provide the Most Protection for Indiana Residents

Both of Indiana’s state laws described above work alongside the federal Fair Debt Collection Practices Act (FDCPA). This federal law protects consumers from harassment and abusive debt collection practices. Every citizen in Indiana is protected under the FDCPA.

Here’s an overview of the law:

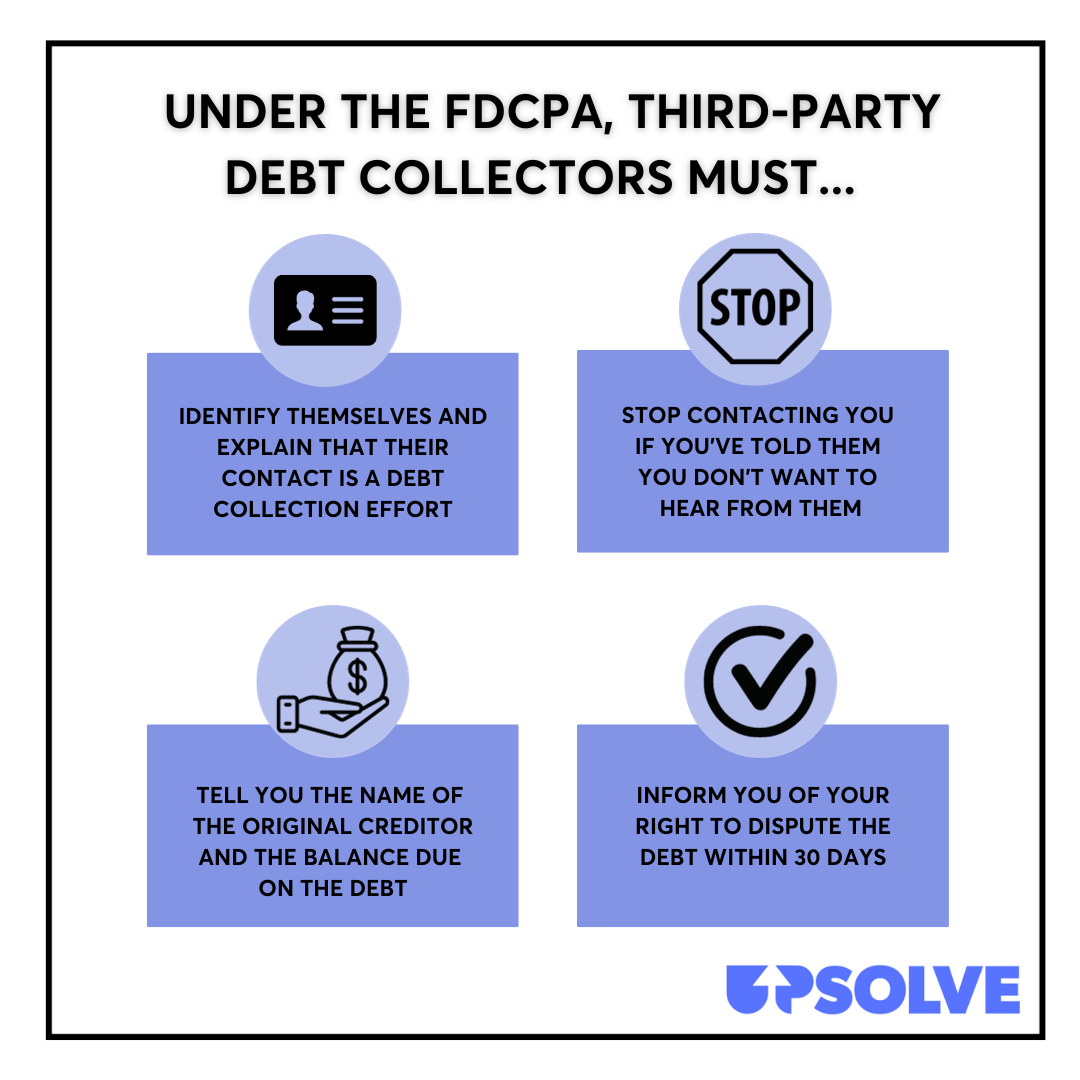

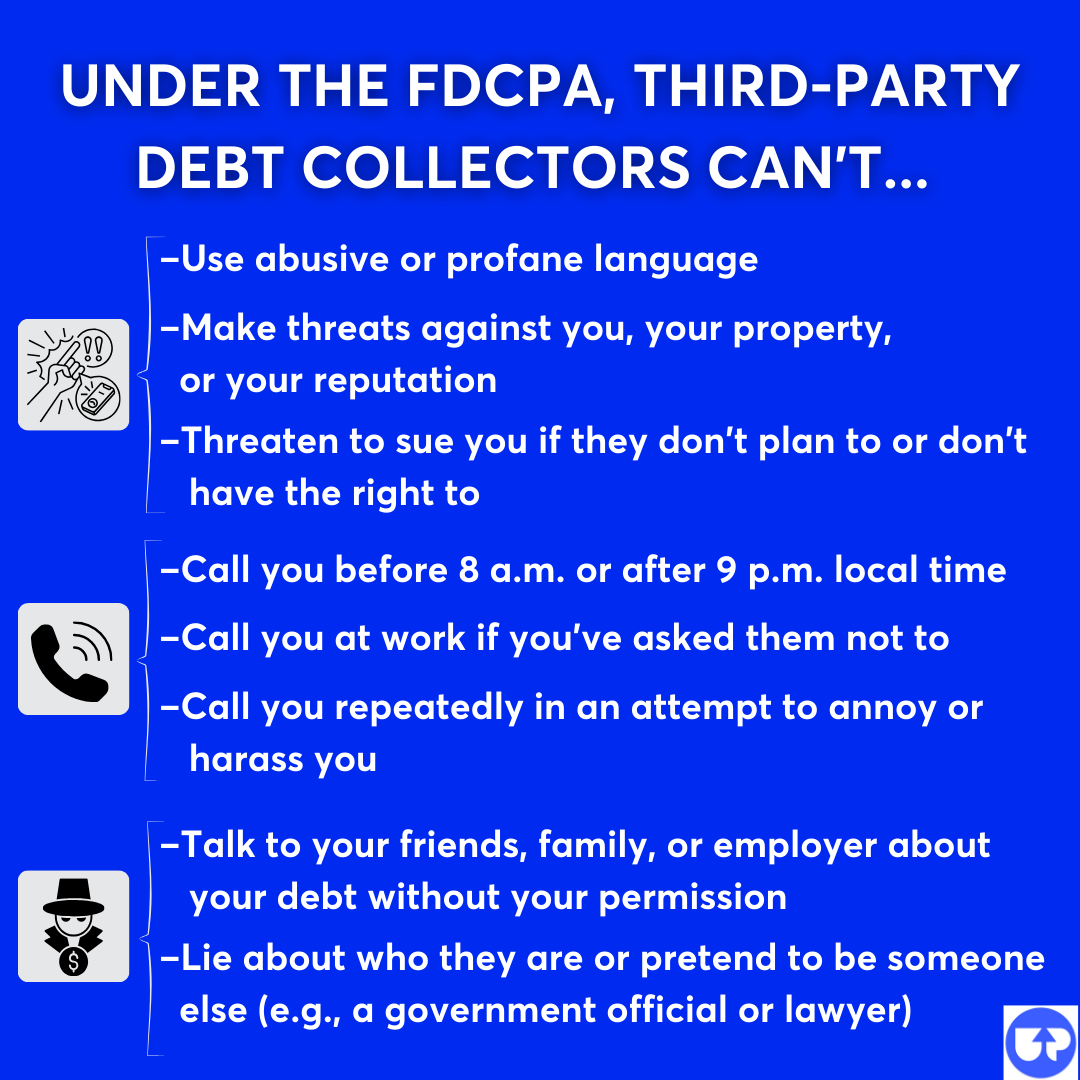

The main purpose of the FDCPA is to provide protections for consumers against third-party debt collectors. It also outlines what debt collectors are and aren’t allowed to do.

While the FDCPA provides the greatest protections for consumers in Indiana, the state is one of a minority that requires all collection agencies to have a state license.

Indiana Requires Debt Collectors To Be Licensed

Not every state has a licensing requirement for collection agencies; Indiana does have a licensing requirement for every collection agency in the state.

According to Indiana state law, a “collection agency” is anyone (an individual, a firm, etc.) who is looking to collect claims (debt) owed to them. A collection agency must register with the Indiana Secretary of State, Securities Division through the Nationwide Multistate Licensing System (NMLS) to receive their license.

Ask for the Debt Collection Agency’s Licensing Information

If you’re being contacted by a debt collection agency, you have the right to ask for the agency’s licensing info to verify that the collection activity is lawful and you aren't being scammed.

If the agency’s information is not included in the debt validation letter they’re required to send you, ask for it to protect yourself. The debt validation letter includes basic information about the debt that the agency is trying to collect from you and information about your right to dispute the debt. Third-party collectors are required to send such a letter before or within five days of first contacting you.

Upsolve Member Experiences

3,804+ Members OnlineWhat You Can Do if a Debt Collector Breaks the Law in Indiana

If you believe a debt collector or debt collection agency has broken the law or violated your rights in Indiana, you can hold them accountable by filing a complaint.

File a Complaint With the Indiana Secretary of State

If you think a collection agency has broken the law in the state of Indiana, you can file a complaint with the Indiana Secretary of State. Before you file your complaint, compile any documents you have that support your claim. The Indiana Attorney General’s office has some useful tips to help you file a complaint.

File a Complaint With the Consumer Financial Protection Bureau (CFPB)

If you need to report a violation of the FDCPA, you can file a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is a U.S. government agency that protects consumers. Their mission is to empower and educate consumers and help enforce consumer protection laws.

File a Lawsuit Against the Debt Collector

You can sue third-party debt collectors who violate the FDCPA. You may be able to sue in state or federal court. It’s best to speak with an attorney if you want to file a lawsuit against a debt collector for violating the law. If the attorney works on contingency, you won’t have to pay their fees upfront, and they can ask for the fees to be reimbursed as part of the lawsuit.

Under the FDCPA, you could get actual damages (for example, lost wages) plus up to $1,000 in statutory damages if you win your case.

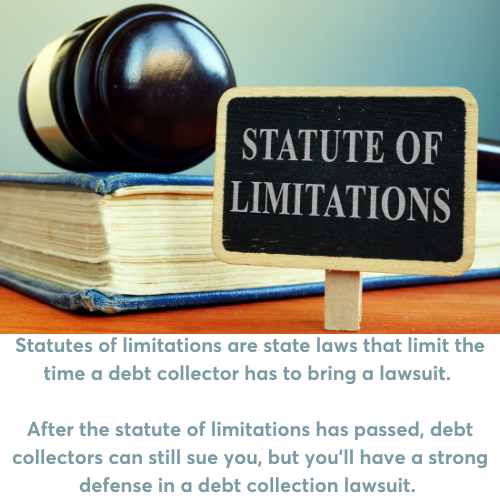

What Is the Statute of Limitations for Debt Collection in Indiana?

In Indiana, the statute of limitations for different kinds of debt/debt contracts ranges, depending on the debt/contract. Statutes of limitations can get complicated, so there may be some exceptions to the following:

| Debt Type | Statute of Limitations |

|---|---|

| Credit cards | 6 years |

| Written contracts (including promissory notes) | 6 years |

| Medical debt | 6 years |

| Contract of sales | 4 years |

What Debt Collectors Can Do To Collect Debt in Indiana

It’s important to know what debt collectors are legally allowed to do to collect debt so you can tell if a collector is using unfair or illegal practices. In Indiana, debt collectors can sue you for a judgment and legally repossess property (like a car).

Debt Collectors Can Sue for a Judgment to Garnish Your Paycheck

Debt collectors can take you to court for an unpaid debt. If you get sued by a collection agency and lose, the judge will issue a court order called a judgment to the collector. This allows the agency to get an order for wage garnishment, a bank levy, or a property lien.

In Indiana, original creditors, debt collectors, and debt buyers can all get a wage garnishment against you as long as they have a valid court judgment.

If a case is filed against you in the state of Indiana, it is important that you answer your court summons within 20 days if it was delivered to you personally or left at your home or within 23 days if it was mailed to you. To learn more, check out Upsolve’s guide to responding to an Indiana court summons.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Debt Collectors Can Repossess Your Car

If you don’t make your car payments on time, the lender can repossess the vehicle. They do not need a court order to take your vehicle. If you default on your auto loan contract, you’re at risk of repossession. This could happen after only one missed payment, so it’s important to review your auto loan contract to understand your terms.

Need Help With Debt Relief? Here Are Some Options

Living with debt can be overwhelming. If you’re not sure how to begin your journey to a debt-free life, consumer credit counseling is a great place to start. Meeting with an accredited nonprofit credit counselor can give you personalized insight into how to tackle your debt and meet your financial goals. A counselor might suggest a debt management plan, debt consolidation, or bankruptcy.

Bankruptcy is a powerful legal tool that gives you the power to reclaim your finances. If your debt has become unmanageable and you’re looking for a fresh start, filing bankruptcy might be the right option for you. Filing bankruptcy also halts all collection efforts, including any wage garnishment orders against you.

If you’re looking to file Chapter 7 bankruptcy, you can use Upsolve’s free online filing tool. It walks you through the Chapter 7 process so you can file on your own with confidence.