What Are the Most Bankruptcy-Friendly Credit Cards?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

It’s important to rebuild your credit after a bankruptcy. The good news is that you’ll get plenty of offers for credit after your bankruptcy discharge. The bad news is that some of those offers won’t be great, with high interest rates or hidden fees. If you want to rebuild your credit, you need to find the right card to work for you. Read on to learn about some of your options.

Written by Lawyer John Coble. Legally reviewed by Jonathan Petts

Updated December 15, 2025

Table of Contents

What Should I Look for in a Credit Card To Rebuild My Credit?

If you're rebuilding credit after bankruptcy, not all credit cards are created equal. Here’s what to look for:

✅ Low or no fees: Avoid cards with high annual fees or hidden charges.

✅ Low interest rates: High APRs can make carrying a balance expensive.

✅ No cash advances: These often come with extra fees and high interest.

✅ Reports to all three credit bureaus: This helps build your credit history faster.

✅ Free credit score access: Some cards include tools to track your progress.

💡 Quick tip on credit checks: Some lenders do a soft inquiry to prequalify you, which won’t impact your credit score. But when you actually apply, they’ll usually do a hard inquiry, which can slightly lower your score. If you’re applying for multiple cards, try to do it within a short time frame so the impact is smaller.

Secured vs. Unsecured Credit Cards: What’s a Better Fit After Bankruptcy?

When you’re rebuilding credit after bankruptcy, both secured and unsecured credit cards can help — but they work a little differently.

Secured credit cards require a refundable deposit, which usually sets your credit limit.

Some people prefer these cards because they feel more in control and less likely to overspend.

Secured cards are often easier to qualify for, especially right after your bankruptcy discharge.

Unsecured credit cards don’t require a deposit. These are more like traditional credit cards.

If you’ve been working on your money habits and feel ready to manage a card without putting down cash up front, some unsecured cards may offer better perks — like cashback or rewards — even for people with low or recovering credit.

📌 There’s no one right answer. Some people start with a secured card to build confidence and then move to an unsecured card later. Others jump right into an unsecured card if they find one that fits their needs. The key is to choose a card that matches your comfort level, spending habits, and financial goals.

Secured Credit Cards That Can Help You Rebuild Credit After Bankruptcy

This isn’t a complete list of all available secured credit card options. This list shows secured credit cards from some traditional banks and card issuers, along with some exciting innovative cards from some of the newer financial technology (aka fintech) companies.

✍️A quick note about features: Some cards include tools like card freezing, virtual card numbers for online shopping, or compatibility with digital wallets like Apple Pay and Google Pay. These can add convenience and help protect against fraud. A few cards also require you to open a checking account to qualify. Be sure to check the fine print before you apply.

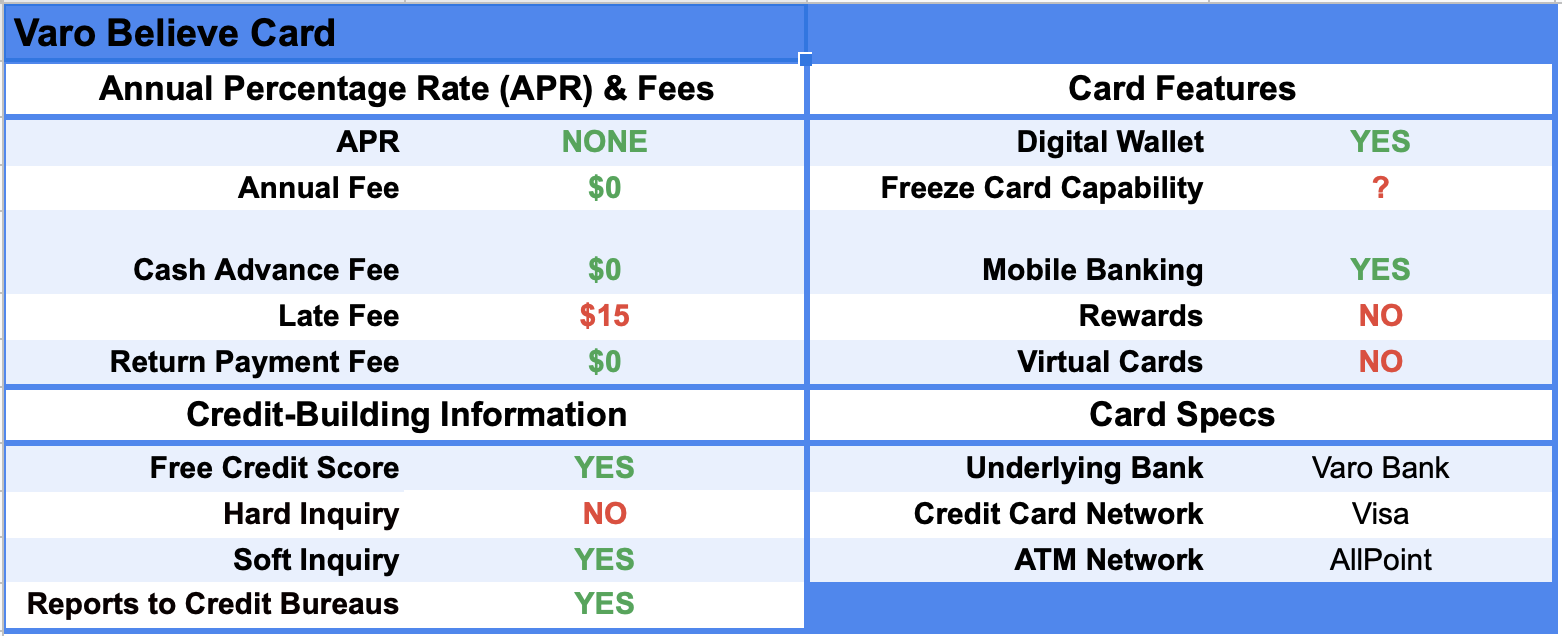

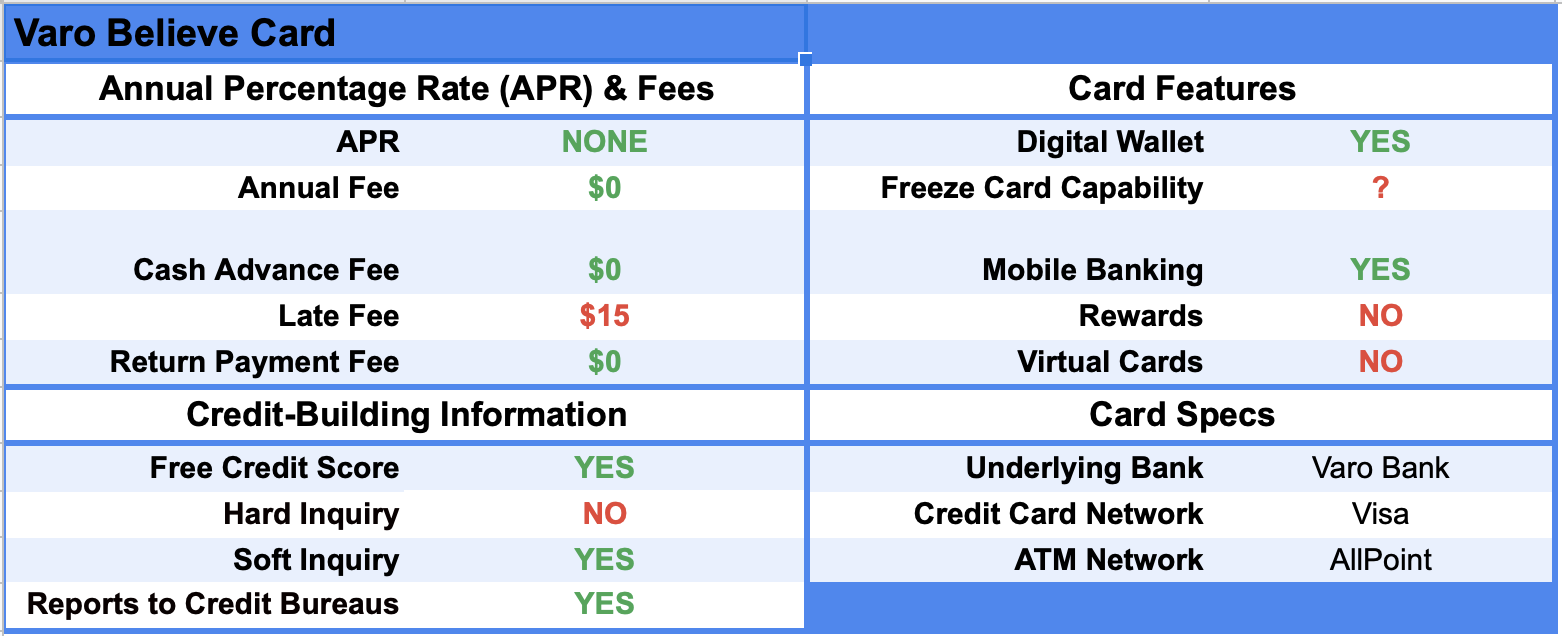

Varo Believe Card

You’ll need to have a Varo checking account and have direct deposit enabled on it to be eligible for the Varo Believe card. Once you have two qualifying direct deposits totaling more than $1,000 you should see an option in the app to apply for the Varo Believe Card. The Varo Believe card has no minimum deposit requirement. But the amount you deposit into your Varo Believe account is your credit limit.

Chime Credit Builder Card

You’ll need a Chime checking account with direct deposit enabled to be eligible for the Chime Credit Builder card. You only need one qualifying direct deposit of more than $200 to qualify for the Chime Credit Builder card. There’s no minimum deposit. Your credit limit is equal to the amount you deposit into your credit-builder account.

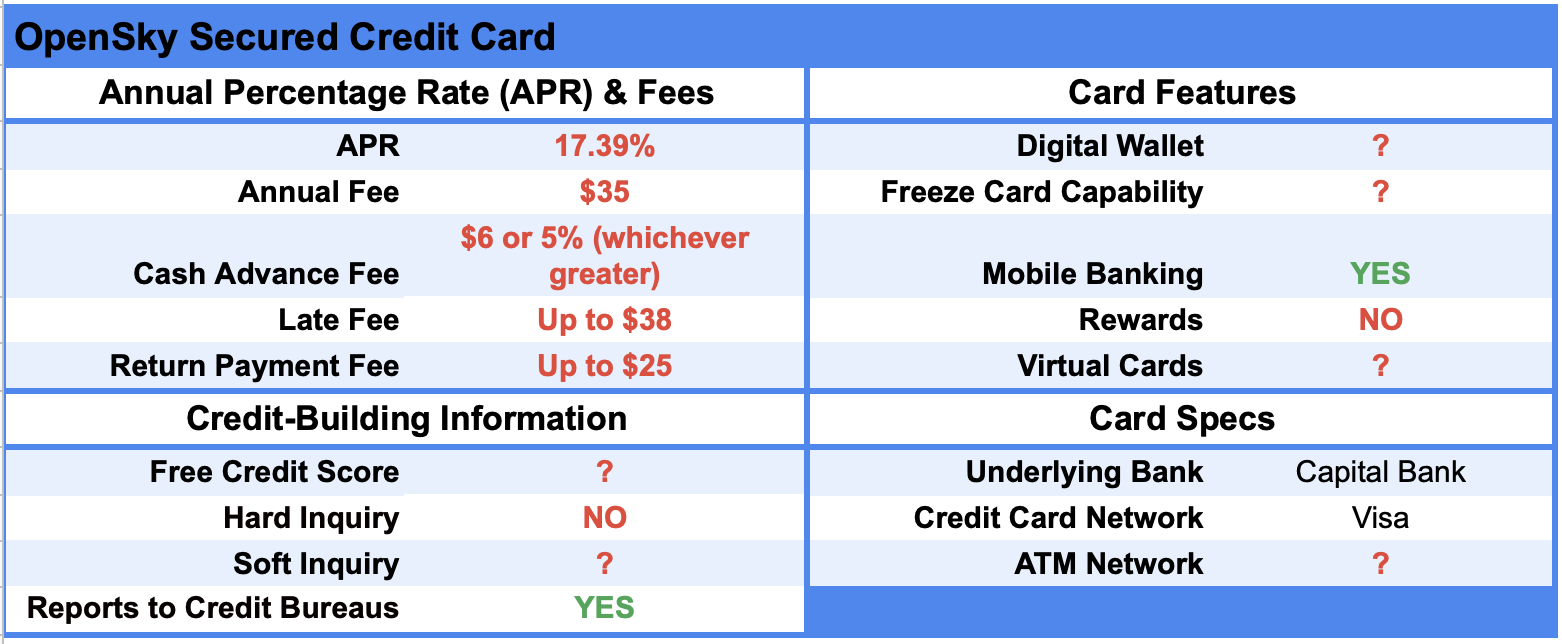

OpenSky Secured Credit Card

OpenSky is a secured card with no credit check and no checking account requirement. Your credit limit is the amount you deposit into the OpenSky account. There’s a minimum deposit of $200.

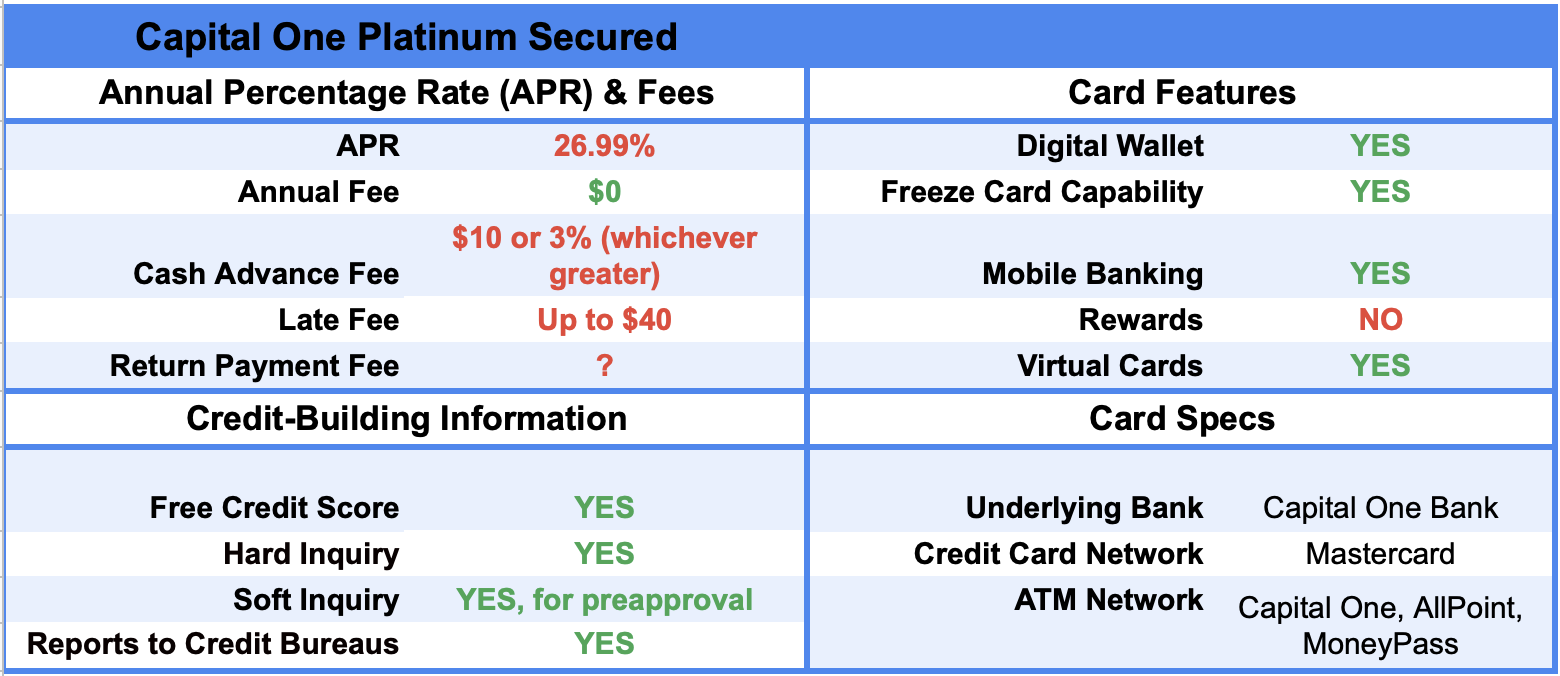

Capital One Platinum Secured

If you want to go with a well-known traditional bank, the Capital One Secured Card may be your best choice. The minimum initial deposit is $49, but you get a $200 line of credit. That means though it’s a secured card, it can be partially unsecured. Capital One reviews your account every six months to see if they should increase your line of credit or graduate you to an unsecured credit card. You can prequalify before applying for the card.

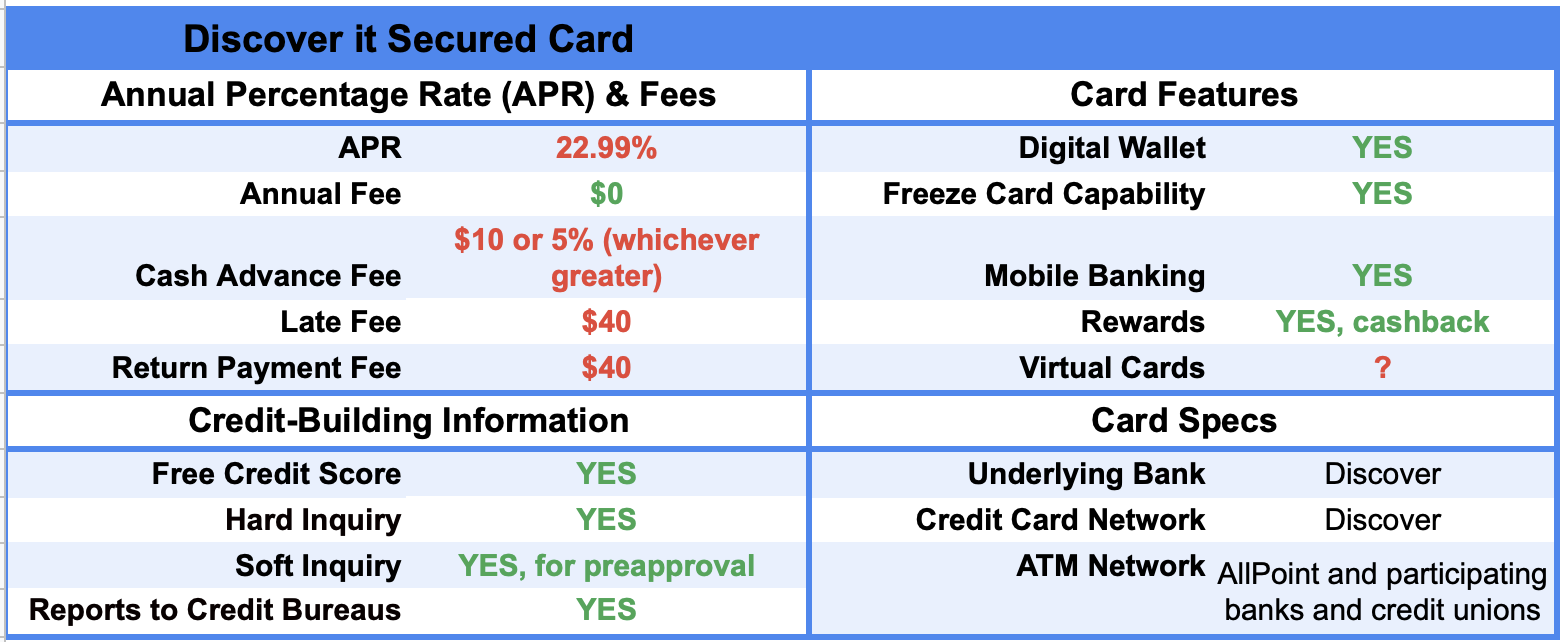

Discover it Secured Credit Card

The Discover it Secured Card has an intro APR of 10.99% for the first six months. After that, it increases to 22.99%. The minimum deposit is $200. Your credit line equals your deposited amount. After seven months, the company reviews your account monthly to see if you can upgrade to an unsecured credit card. Discover card has an excellent cashback rewards program. You either get 1% or 2% depending on the merchant. At the end of the year, Discover matches your cashback with an annual refund.

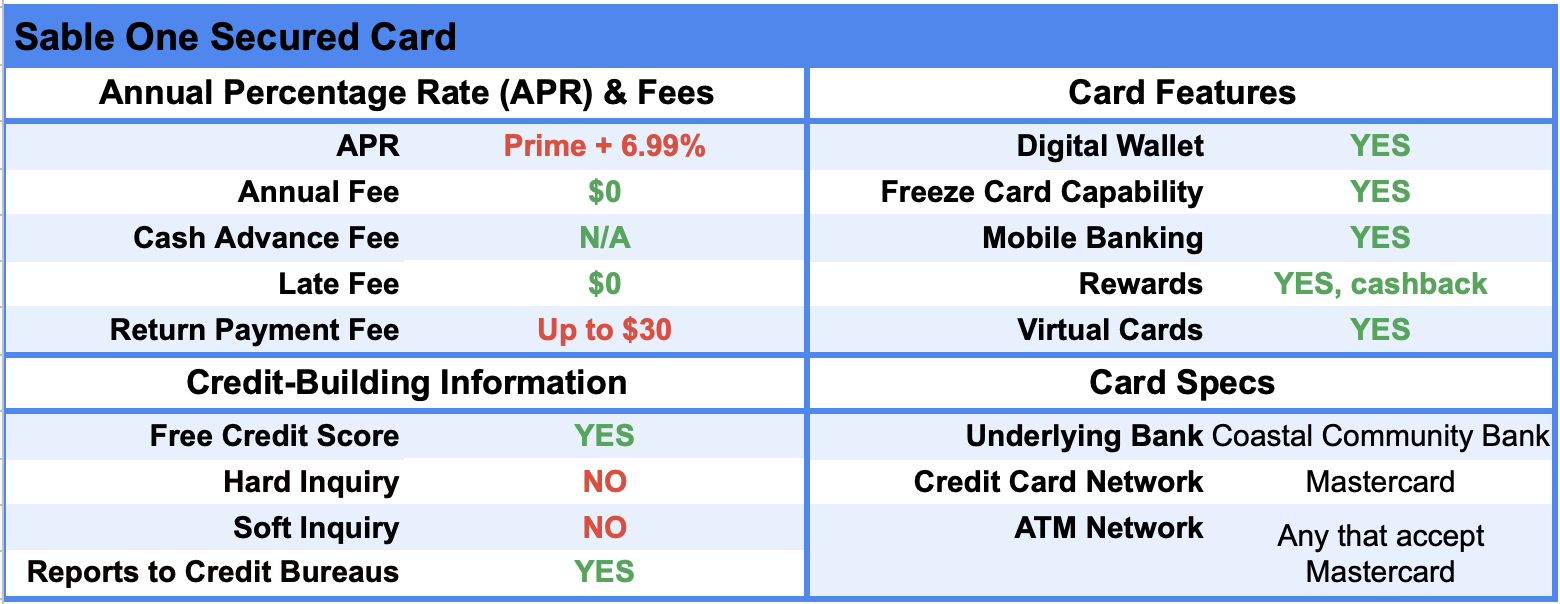

Sable One Secured Card

With Sable, you can graduate to a traditional unsecured credit card in as few as four months. While there is no minimum deposit, your security deposit is your credit limit. Like Chime and Varo, you must have a Sable checking account to get the Sable One secured credit card. There are several perks with this credit card, including rental car insurance and phone insurance. Sable’s cashback rewards program rivals Discover Card’s program as one of the best.

It doesn’t explicitly say on the website that Sable provides free credit scores. It does show its credit coach functionality with a credit score. It also doesn’t explicitly say on the website that it provides credit updates to all three major credit bureaus, but it does say it provides more data than other credit card issuers to the major credit bureaus.

Unsecured Credit Cards That Can Help You Rebuild Credit After Bankruptcy

These are some of the best credit cards that may be available to you that don't require a security deposit. The cards listed below are a mix of traditional credit cards and some fintech credit cards for people who have poor credit.

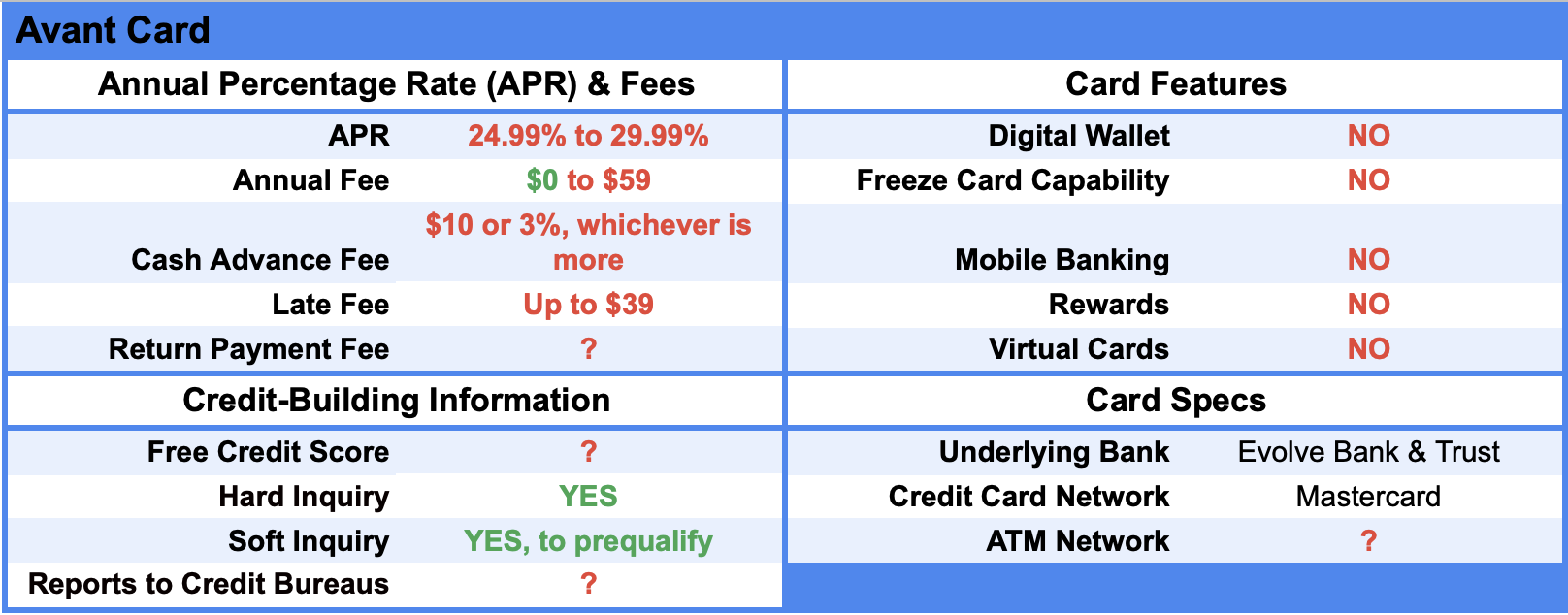

Avant

The Avant card is more of a traditional credit card for people with bad credit. The website doesn’t say how you qualify for no annual fee. The lower interest rate is for people with better credit scores.

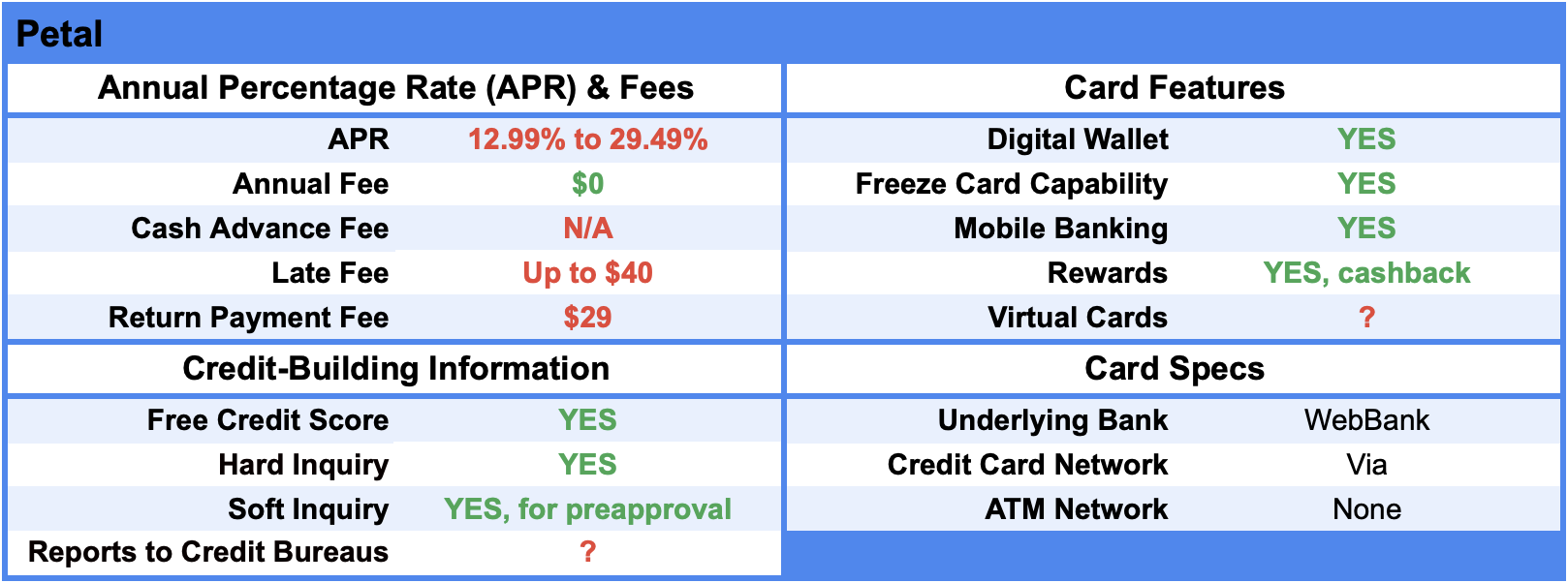

Petal Credit Card

Petal is an innovative company backed by WebBank, offering cards with credit limits from $300 to $5,000. It offers two cards with different perks and features that are designed to build credit. To qualify, Petal looks at borrowers' unique "cash score," which they create for you using your banking history and your income.

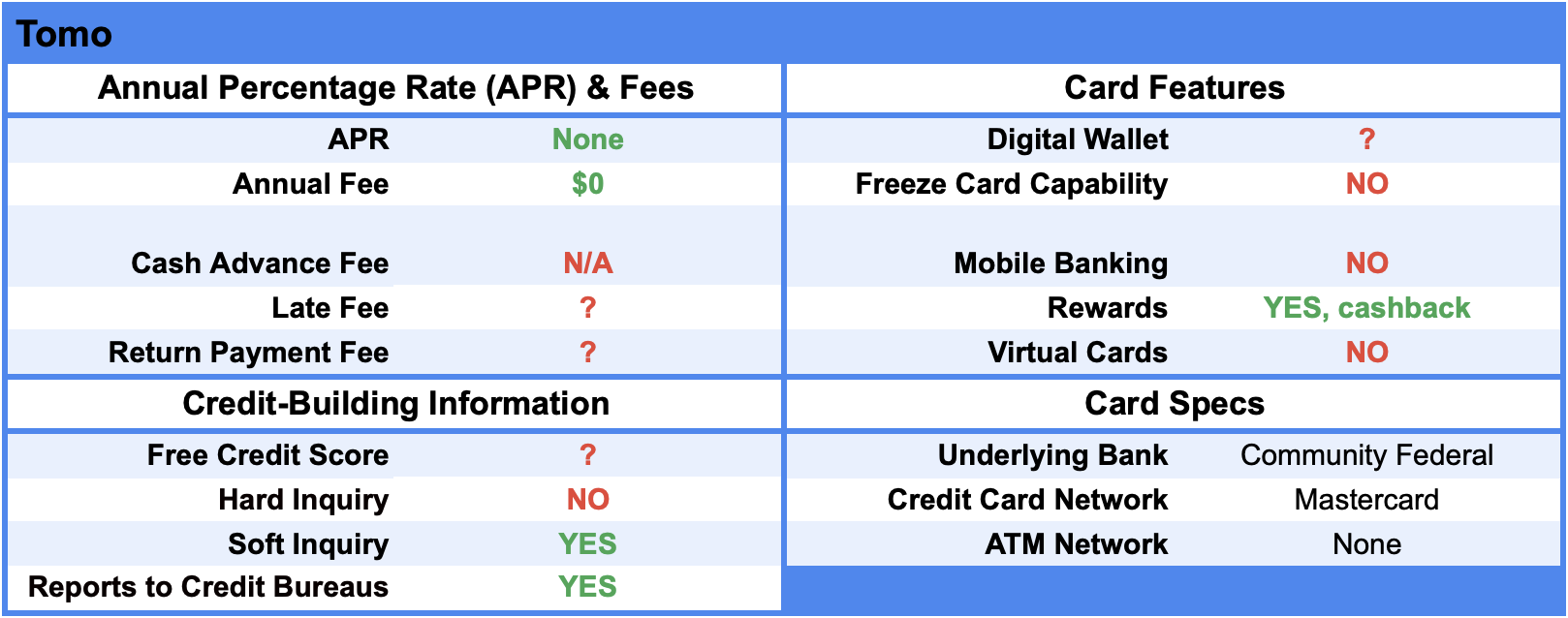

Tomo Credit Card

Tomo is the rare unsecured card that doesn’t require a hard credit check to qualify. Even more impressive, there’s no interest or annual fee. How do they do it? You must link at least one bank account to the card. But unlike other cards, it doesn’t have to be an account with Tomo. Then, you’ll autopay your credit card bill once a week instead of the traditional monthly payment. Credit limits range from $100 to $10,000.

Cred.ai Credit Card

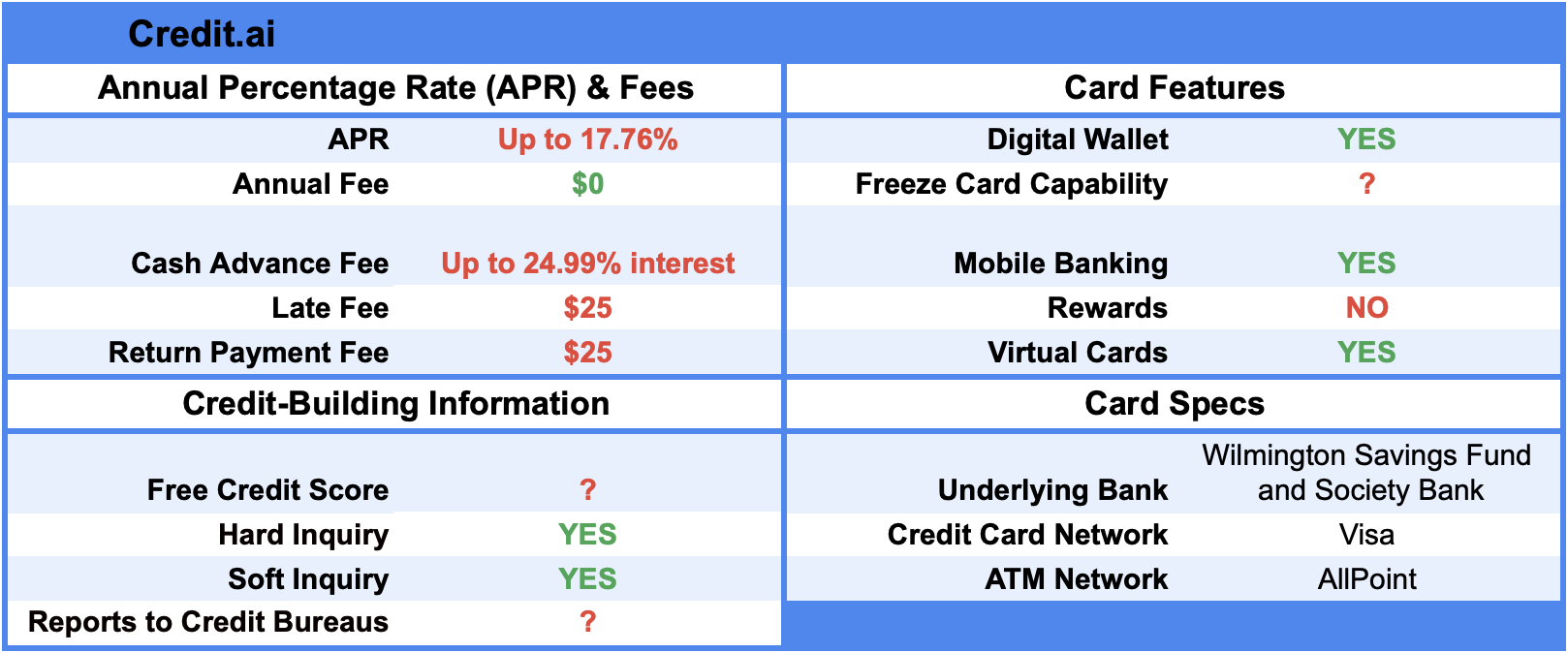

Cred.ai is another innovative fintech that uses quirky ‘80s sci-fi terminology to describe its many features. If you feel comfortable turning your finances over to artificial intelligence, this is the account for you. It automates much of your finances.

Cred.ai offers a guarantee against fees and interest. But it only applies if you turn on all its automated systems. These systems make sure you stay on time with your credit card bill so you won’t be charged interest or fees. Cred.ai also puts a premium on your privacy. It doesn’t share your information with third parties, except for credit bureaus.

Rebuilding Credit After Bankruptcy: Why It Matters & Where To Start

After your bankruptcy discharge, you’ll probably get credit offers, but many come with high interest rates or fees. The good news? You don’t have to settle for a bad deal. This is a fresh start, and a great time to rebuild your credit the smart way.

📈 Using a credit card responsibly is one of the most effective ways to build a better credit history. Many people start by using a card for small, everyday purchases and paying the balance in full each month. Staying on budget and using mobile tools to track spending can make this easier.

Some credit cards even offer helpful features like free credit score tracking and automatic reporting to the three major credit bureaus (Equifax, Experian, and TransUnion). These tools make it easier to monitor your progress and stay on track.

A better credit score can save you a lot of money down the line — from lower interest rates on car loans and mortgages to smaller monthly payments. Your path to rebuilding credit will depend on which type of bankruptcy you filed.

Building Credit After Bankruptcy: Chapter 7 vs Chapter 13 Bankruptcy

Most people file either Chapter 7 or Chapter 13 bankruptcy.

In Chapter 7 cases, your debts will be discharged more quickly — usually in 4-6 months.

In Chapter 13, your debts are reorganized into a 3-5 year repayment plan. After that time, your remaining debts are discharged.

Because of these differences, building credit looks a little different after each type of bankruptcy.

Building Credit After a Chapter 7 Bankruptcy

Often, Chapter 7 bankruptcy filers improve their credit score considerably in the first year after their bankruptcy discharge. You’ll want to be proactive in rebuilding your credit in this first year and beyond. To do so:

Use one of the credit cards listed below.

Make on-time payments every month

Don't use your entire available credit. Not using all your available credit lowers your credit utilization ratio, which improves your credit score.

Using your credit cards responsibly will lead to credit line increases. With a higher credit limit, you can improve your credit score even more quickly by using the card more and not having any late payments. This will get you to the 680 credit score you need to get a good car loan.

Building Credit After a Chapter 13 Bankruptcy

With a Chapter 13 bankruptcy, you’re paying off most of your debts over 3-5 years. As your debt decreases, your credit score often improves even though you’re in bankruptcy. It’s not unusual for people to buy houses and cars while they’re in a Chapter 13 bankruptcy. Though these purchases are subject to approval from the bankruptcy court.

After the bankruptcy is discharged, it’s a good idea to get a credit card to boost your credit score. The trick is to pay off your balance in full every month.