What Are Bankruptcy-Friendly Credit Cards?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

It’s important to rebuild your credit after a bankruptcy. The good news is that you’ll get plenty of offers for credit after your bankruptcy discharge. The bad news is that some of those offers won’t be great, with high interest rates or hidden fees. If you want to rebuild your credit, you need to find the right card to work for you. Read on to learn about some of your options.

Written by Lawyer John Coble. Legally reviewed by Jonathan Petts

Updated June 19, 2025

Table of Contents

If you’ve just had your debts discharged in bankruptcy, you may be wondering what to do next to build a strong financial foundation for this new chapter. One good place to start is by rebuilding your credit. You may wonder why you should rebuild your credit if credit cards and other debts are what caused you to file bankruptcy in the first place.

It’s important to rebuild your credit because if you have a financial emergency, you may need to borrow money to get you through it. And if you want to buy a home or car, you’ll probably need to take out a mortgage or car loan. Having good credit means you can avoid high interest rates. This is the perfect time to start rebuilding. Read on to learn why and what the best credit card features to consider are.

How To Rebuild Credit After Bankruptcy

The good news is that you’ll get plenty of offers for credit after your bankruptcy discharge. The bad news is that some of those offers won’t be great. They may have high APRs (annual percentage rates) or high fees. You can do better than that.

The trick with credit is you have to use it to build a good credit score. After a bankruptcy, you have greatly improved your financial situation by eliminating old debts. This is why it’s a great time to build a better credit history. One of the best ways to rebuild credit is by opening a credit card account, using it for everyday expenses, and paying the entire balance every month. Keep a tight budget with your card, and use its online or mobile apps to make sure you know where your money is going.

Many cards have credit-building tools that can help you on your journey. Look for a card that gives you free access to your credit scores and reports your payment history to the major credit bureaus: Equifax, Experian, and TransUnion. Knowing exactly where you stand with your credit score and history allows you to rebuild your credit quicker.

Why Your Credit Score Is So Important

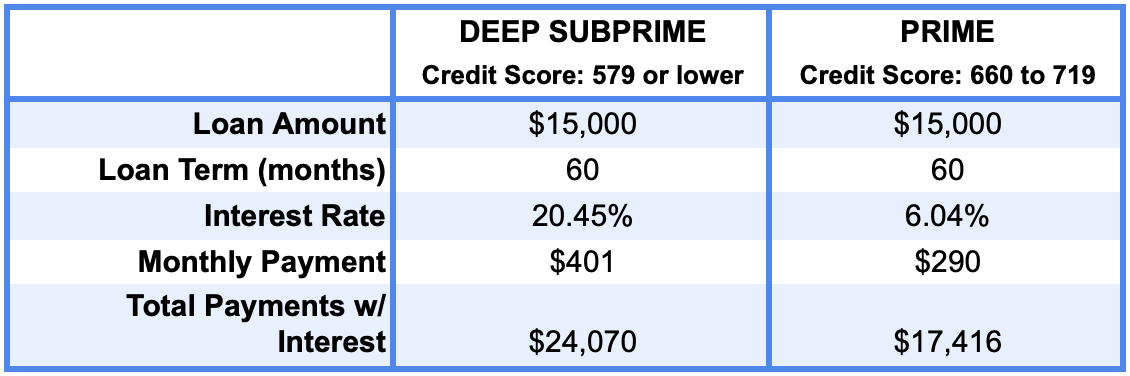

Having good credit saves you money in the long run. You’ll be able to get lower interest rate loans, which means you pay far less in interest payments over time. Your monthly payment will be more affordable too! Here’s an example that illustrates how much you can save:

*The data on credit scores and interest rates comes from Experian and is from the first quarter of 2020.

As this example shows, having a credit score that’s just 81 points higher (579 vs 660) translated to a monthly payment that’s $111 lower each month ($401 - $290 = $111). And with a credit score of 660, you’ll pay $6,654 less over the loan’s five-year term than the person with a credit score of 579. It’s easy to see that with a better credit score, you have a much better chance of avoiding future debt problems.

Building Credit After Bankruptcy: Chapter 7 vs Chapter 13 Bankruptcy

Most people file either Chapter 7 or Chapter 13 bankruptcy. In Chapter 7 cases, your debts will be discharged more quickly — usually in 4-6 months. In Chapter 13, your debts are reorganized into a 3-5 year repayment plan. After that time, your remaining debts are discharged. Because of these differences, building credit looks a little different after each type of bankruptcy.

Building Credit After a Chapter 7 Bankruptcy

Often, Chapter 7 bankruptcy filers improve their credit score considerably in the first year after their bankruptcy discharge. You’ll want to be proactive in rebuilding your credit in this first year and beyond. To do so:

Use one of the credit cards listed below.

Make on-time payments every month

Don't use your entire available credit. Not using all your available credit lowers your credit utilization ratio, which improves your credit score.

Using your credit cards responsibly will lead to credit line increases. With a higher credit limit, you can improve your credit score even more quickly by using the card more and not having any late payments. This will get you to the 680 credit score you need to get a good car loan.

Building Credit After a Chapter 13 Bankruptcy

With a Chapter 13 bankruptcy, you’re paying off most of your debts over 3-5 years. As your debt decreases, your credit score often improves even though you’re in bankruptcy. It’s not unusual for people to buy houses and cars while they’re in a Chapter 13 bankruptcy. Though these purchases are subject to approval from the bankruptcy court. After the bankruptcy is discharged, it’s a good idea to get a credit card to boost your credit score. The trick is to pay off your balance in full every month.

Secured Credit Cards and Unsecured Credit Cards

With a secured credit card, you deposit money into a savings account. That money “secures” the card, meaning the lender can use it if you don’t make your payments. These cards aren't prepaid cards since the credit card company only takes your security deposit if you fail to pay. Often, your credit limit is the amount you have on deposit with the credit card company. For example, if you have $300 deposited, you’ll have a $300 credit limit.

Secured cards are easier to get than unsecured cards if you have bad credit. An unsecured card is a traditional credit card. It doesn’t require a security deposit. They’re harder to get than the secured cards since there’s nothing to guarantee the lender will get paid if you don’t make your payments. That said, there’s been a lot of innovation in the financial sector, and there are companies that may give you a good deal on an unsecured credit card shortly after a bankruptcy discharge.

What Should I Look for in a Credit Card To Rebuild My Credit?

When it comes to getting a credit card, remember that you have a lot of options. You don’t have to accept a card with ridiculously high interest. Instead, look for a card with a low rate and low or no fees. High interest and fees, like an annual fee, are your enemies when trying to rebuild your credit. It’s also best to avoid carrying a balance or getting cash advances when trying to rebuild your credit.

Apply for a secured card or unsecured card that offers you a good deal. At some point, most credit card companies (but not all of them) will make a hard inquiry into your credit history. This reduces your credit score a little and stays on your credit report for two years. That’s why it’s best to do all your credit card applications within a short period. For your VantageScore, the credit bureaus count all hard inquiries made in a two-week period as only one hard inquiry. Multiple hard inquiries for credit cards will still affect your FICO score, though. It only combines multiple inquiries into one for large purchases like auto loans.

Many of these companies will do soft inquiries to “prequalify” you. This doesn’t harm your credit report. But just because you’re prequalified doesn’t mean they won’t reject your credit card application. They’ll probably do a hard inquiry when you apply. If there’s a new negative item on your credit report you could still be rejected. This is rare, but it happens.

Some companies don’t check your credit at all. They’ll use other information to determine your creditworthiness.

How To Use the Credit Card Tables in This Article

We’ve compiled information to help you compare different credit cards. Not every credit card issuer provides all the information needed to complete the grid. For this reason, you’ll see question marks for many features.

Here’s some information on a few of the features:

Virtual Card Feature: Many companies offer this feature, which allows you to use a different card number for online transactions or digital wallet transactions. This is a big benefit when it comes to dealing with fraud. If there’s a fraudulent charge, instead of waiting for a new card, the card issuer can change the number in seconds and you’re back up and running.

Freeze Card Feature: This allows you to block all transactions when you’re not using the card. To restart the card, you simply tap the mobile app to start using your card again. The best credit cards on the market today will have a freeze or lock card option.

Digital Wallets/Contactless Payment: Digital wallets like Apple Pay, Google Pay, Samsung Pay, and others allow you to tap your phone or smartwatch to the terminal to pay. There’s no need to get your physical card out of your pocket. Some cards have the same ability. You only tap the card (or get it close) on the terminal to pay.

Many of these companies aren’t banks in their own right, and several require you to have a checking account with them before you can apply for a credit card. The underlying bank part of the grid shows where your funds are actually deposited. They are all FDIC-insured for $250,000.

With interest rates, the annual percentage rates (APRs) are all tied to the prime rate. If the prime rate increases, these APRs will increase.

Secured Credit Cards That Can Help You Rebuild Credit After Bankruptcy

This isn’t a complete list of all available secured credit card options. This list shows secured credit cards from some traditional banks and card issuers, along with some exciting innovative cards from some of the newer financial technology (aka fintech) companies.

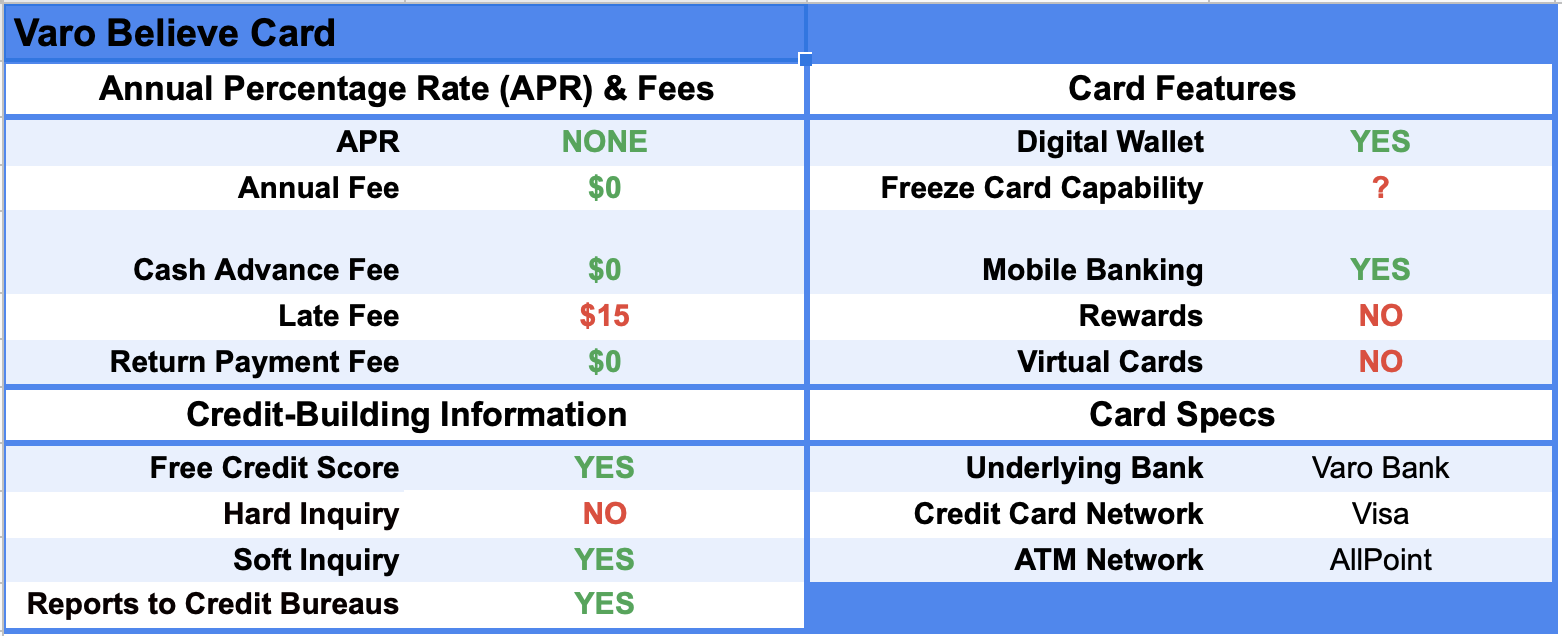

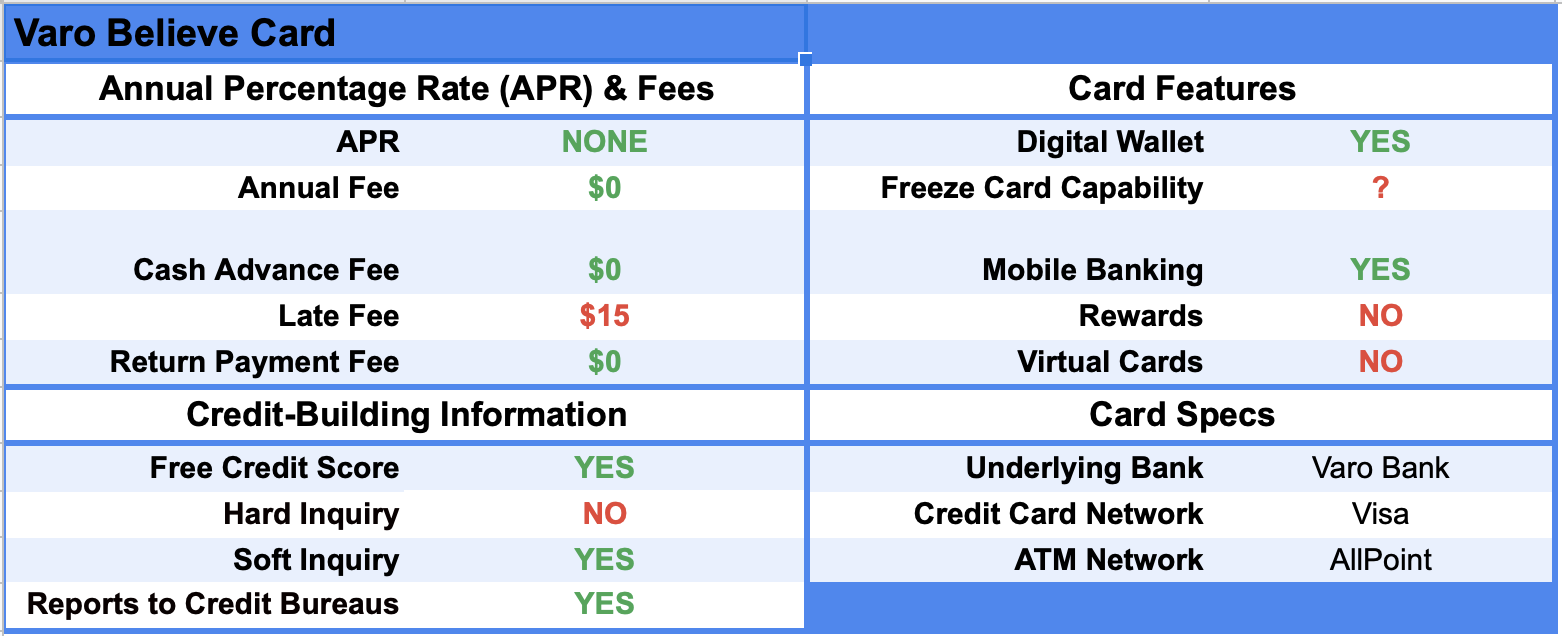

Varo Believe Card

You’ll need to have a Varo checking account and have direct deposit enabled on it to be eligible for the Varo Believe card. Once you have two qualifying direct deposits totaling more than $1,000 you should see an option in the app to apply for the Varo Believe Card. The Varo Believe card has no minimum deposit requirement. But the amount you deposit into your Varo Believe account is your credit limit.

Chime Credit Builder Card

You’ll need a Chime checking account with direct deposit enabled to be eligible for the Chime Credit Builder card. You only need one qualifying direct deposit of more than $200 to qualify for the Chime Credit Builder card. There’s no minimum deposit. Your credit limit is equal to the amount you deposit into your credit-builder account.

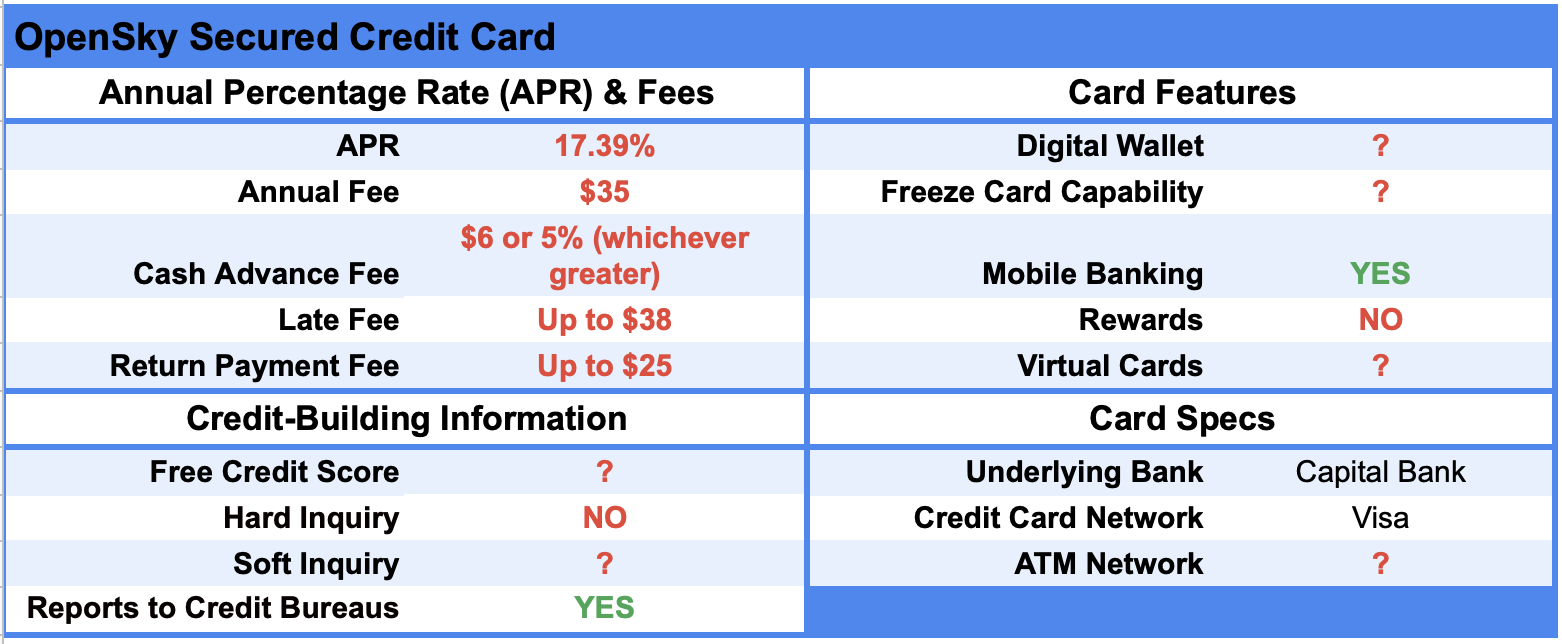

OpenSky Secured Credit Card

OpenSky is a secured card with no credit check and no checking account requirement. Your credit limit is the amount you deposit into the OpenSky account. There’s a minimum deposit of $200.

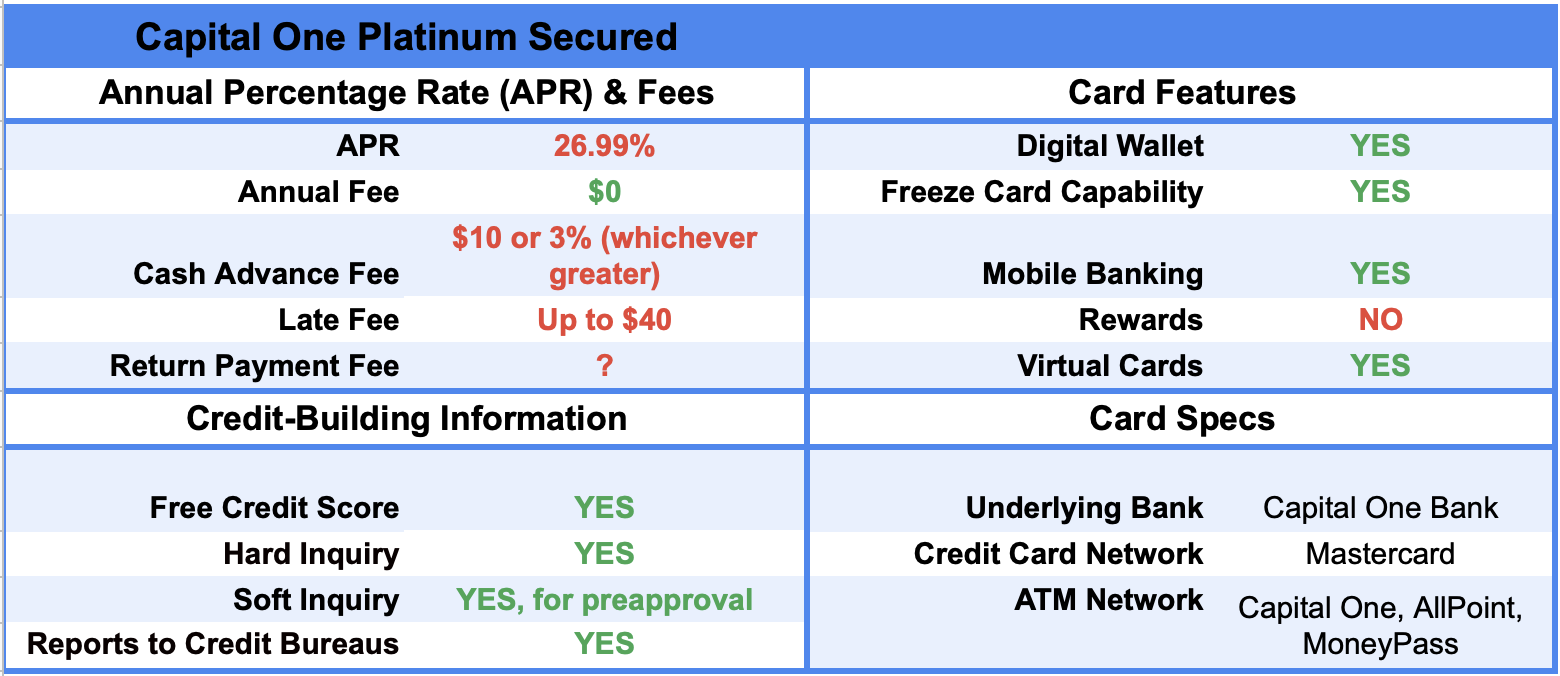

Capital One Platinum Secured

If you want to go with a well-known traditional bank, the Capital One Secured Card may be your best choice. The minimum initial deposit is $49, but you get a $200 line of credit. That means though it’s a secured card, it can be partially unsecured. Capital One reviews your account every six months to see if they should increase your line of credit or graduate you to an unsecured credit card. You can prequalify before applying for the card.

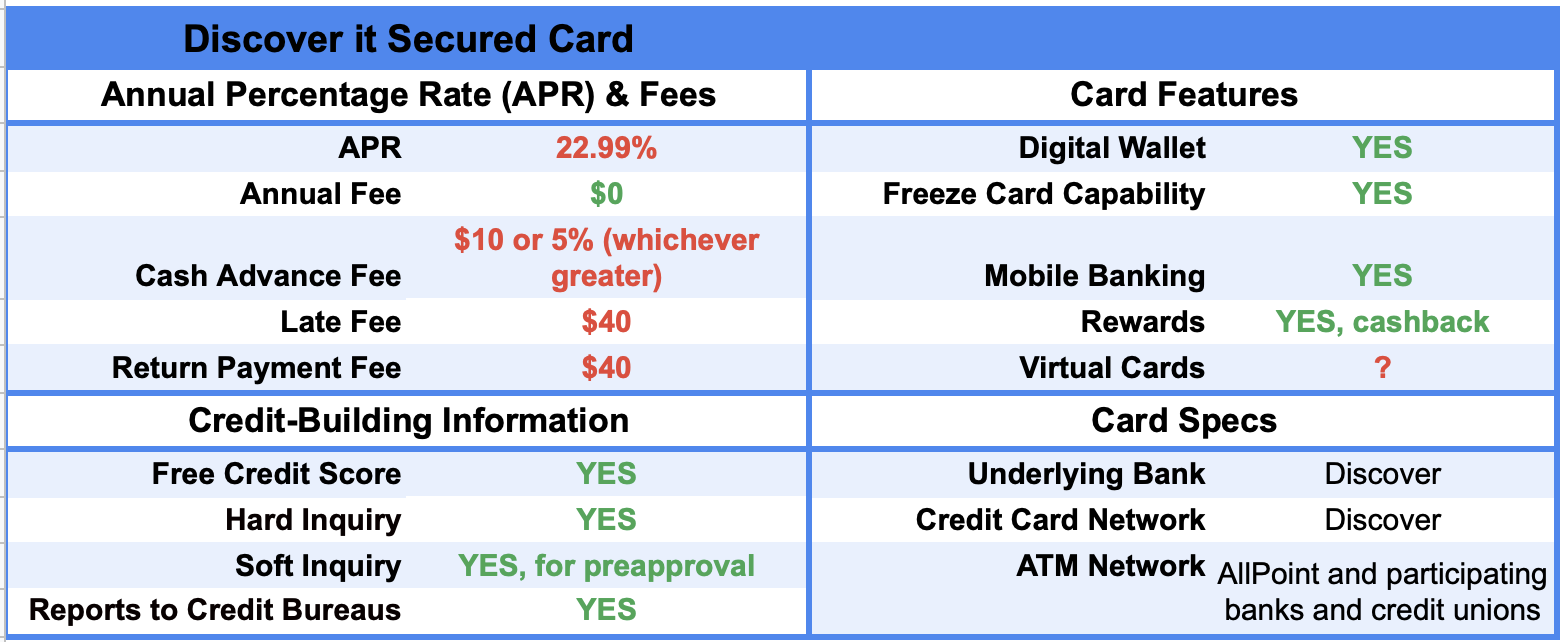

Discover it Secured Credit Card

The Discover it Secured Card has an intro APR of 10.99% for the first six months. After that, it increases to 22.99%. The minimum deposit is $200. Your credit line equals your deposited amount. After seven months, the company reviews your account monthly to see if you can upgrade to an unsecured credit card. Discover card has an excellent cashback rewards program. You either get 1% or 2% depending on the merchant. At the end of the year, Discover matches your cashback with an annual refund.

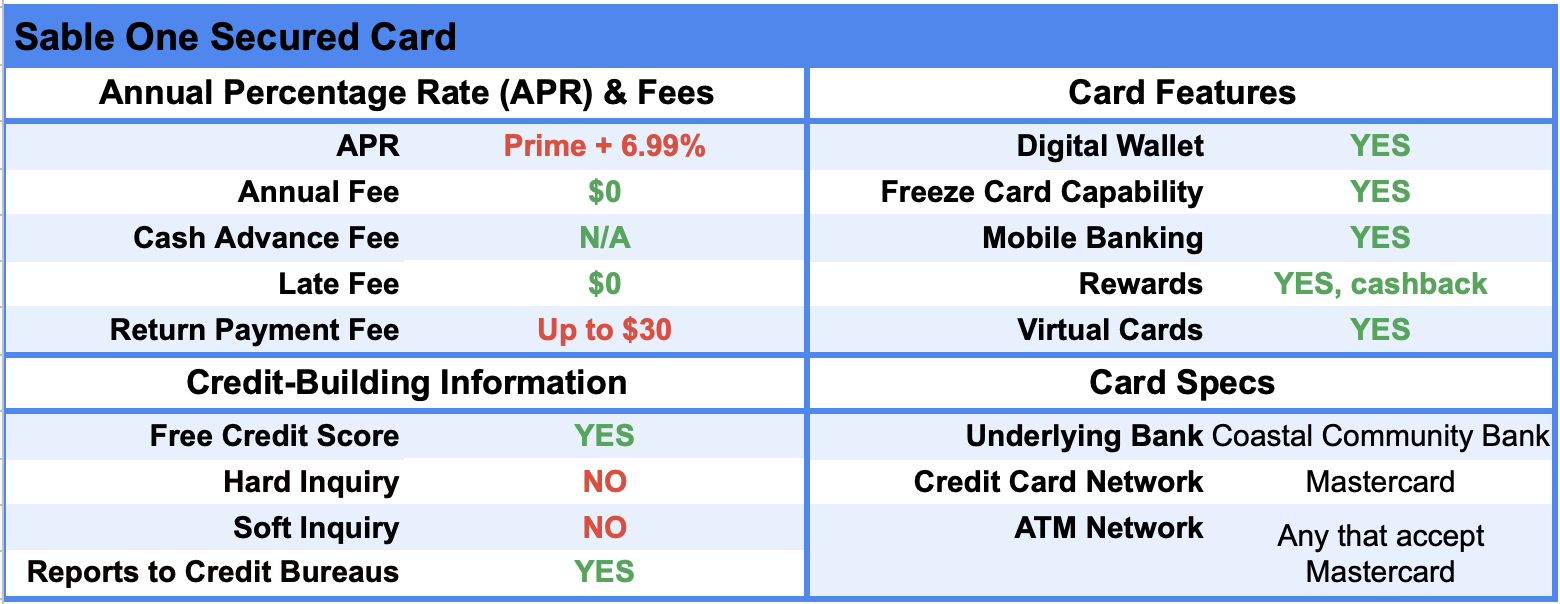

Sable One Secured Card

With Sable, you can graduate to a traditional unsecured credit card in as few as four months. While there is no minimum deposit, your security deposit is your credit limit. Like Chime and Varo, you must have a Sable checking account to get the Sable One secured credit card. There are several perks with this credit card, including rental car insurance and phone insurance. Sable’s cashback rewards program rivals Discover Card’s program as one of the best.

It doesn’t explicitly say on the website that Sable provides free credit scores. It does show its credit coach functionality with a credit score. It also doesn’t explicitly say on the website that it provides credit updates to all three major credit bureaus, but it does say it provides more data than other credit card issuers to the major credit bureaus.

Unsecured Credit Cards That Can Help You Rebuild Credit After Bankruptcy

These are some of the best credit cards that may be available to you that don't require a security deposit. The cards listed below are a mix of traditional credit cards and some fintech credit cards for people who have poor credit.

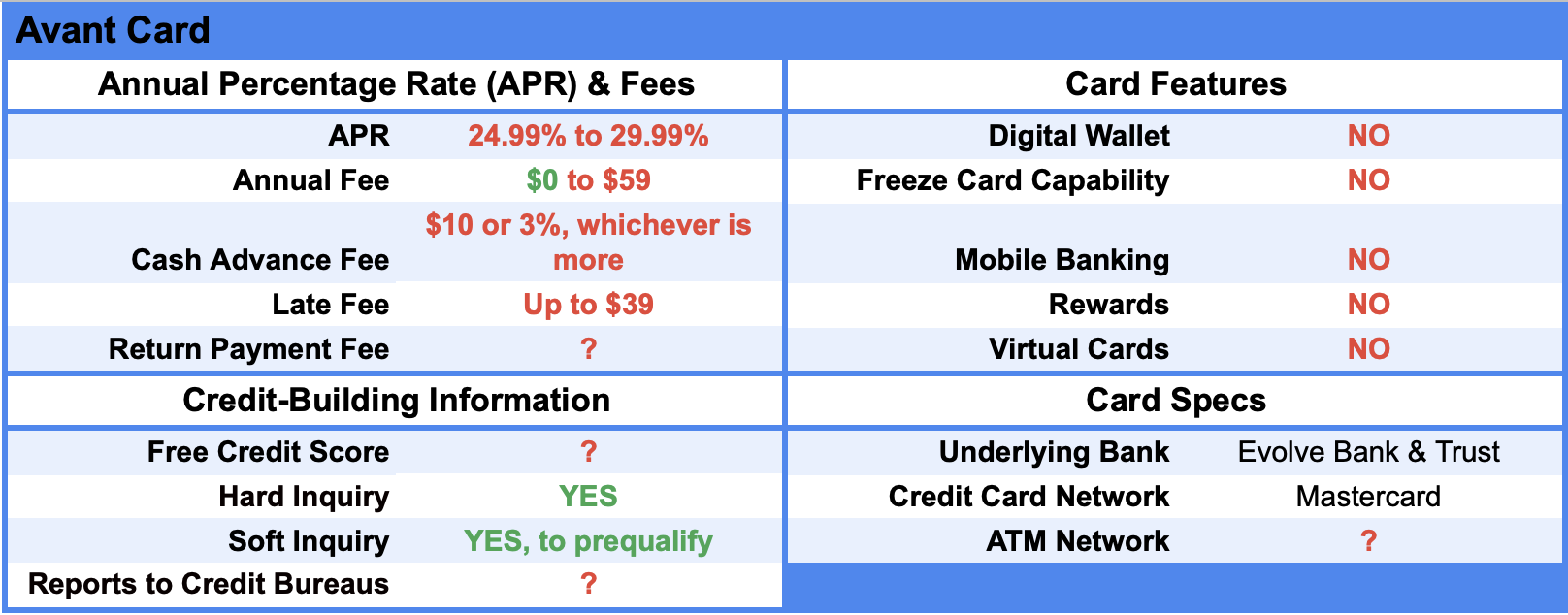

Avant

The Avant card is more of a traditional credit card for people with bad credit. The website doesn’t say how you qualify for no annual fee. The lower interest rate is for people with better credit scores.

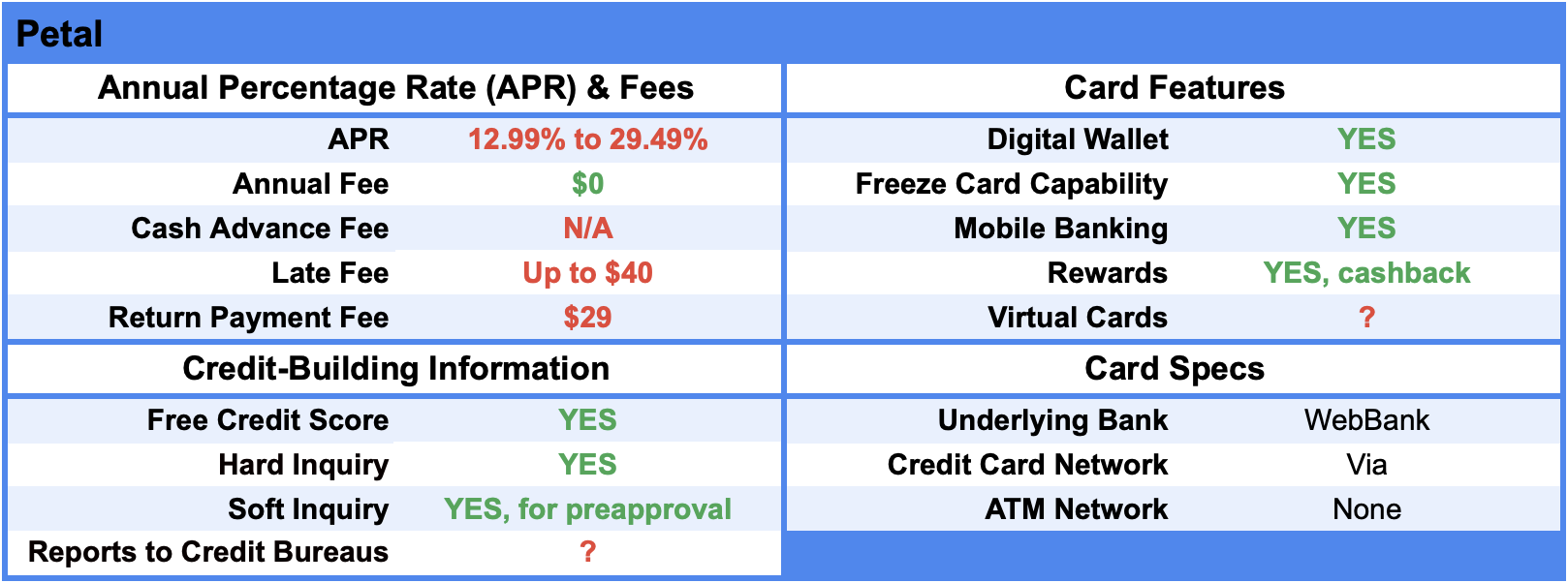

Petal Credit Card

Petal is an innovative company backed by WebBank, offering cards with credit limits from $300 to $5,000. It offers two cards with different perks and features that are designed to build credit. To qualify, Petal looks at borrowers' unique "cash score," which they create for you using your banking history and your income.

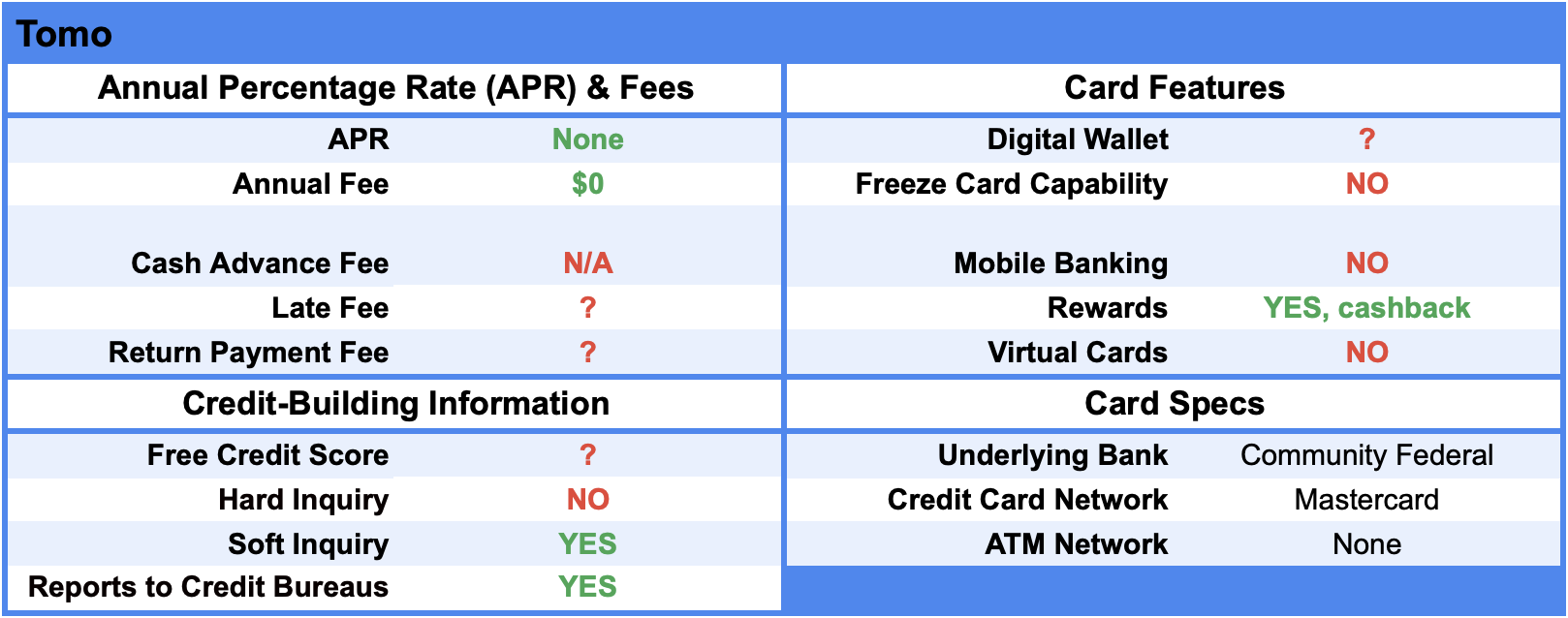

Tomo Credit Card

Tomo is the rare unsecured card that doesn’t require a hard credit check to qualify. Even more impressive, there’s no interest or annual fee. How do they do it? You must link at least one bank account to the card. But unlike other cards, it doesn’t have to be an account with Tomo. Then, you’ll autopay your credit card bill once a week instead of the traditional monthly payment. Credit limits range from $100 to $10,000.

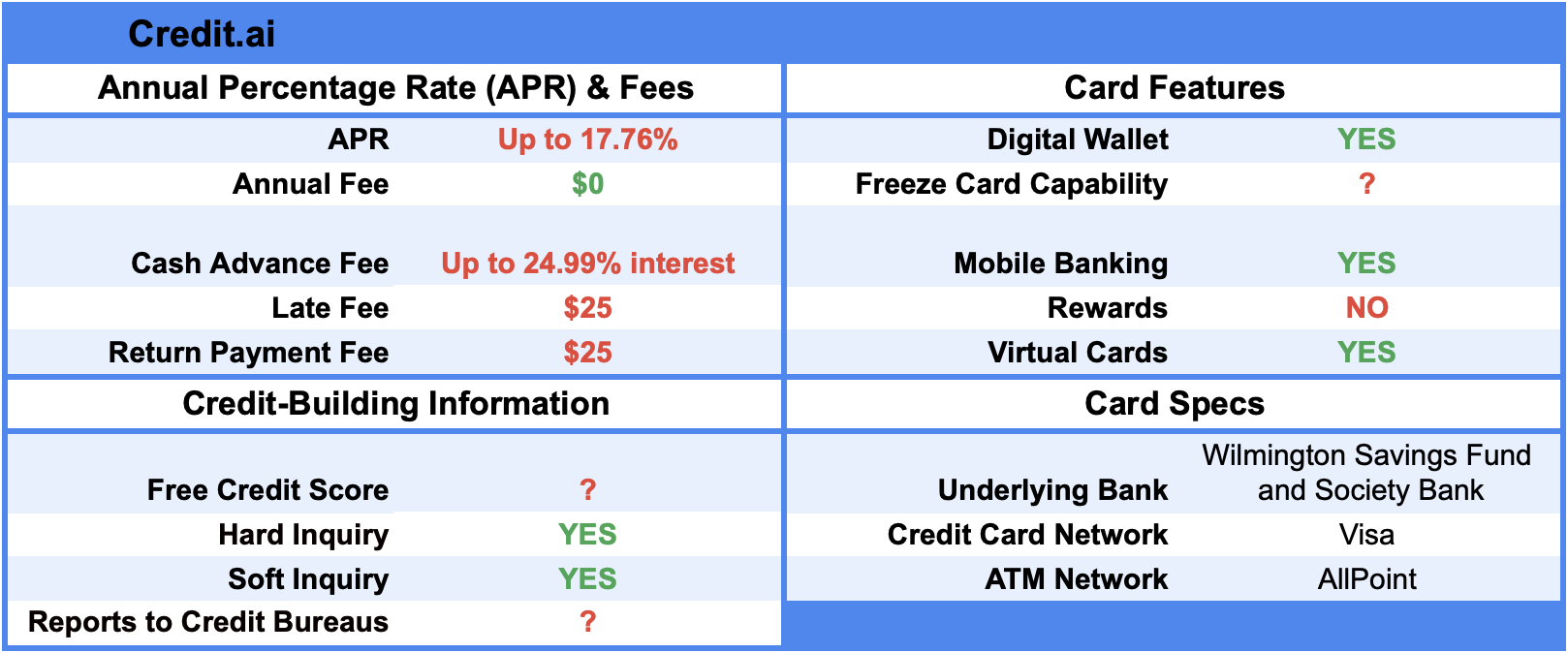

Cred.ai Credit Card

Cred.ai is another innovative fintech that uses quirky ‘80s sci-fi terminology to describe its many features. If you feel comfortable turning your finances over to artificial intelligence, this is the account for you. It automates much of your finances.

Cred.ai offers a guarantee against fees and interest. But it only applies if you turn on all its automated systems. These systems make sure you stay on time with your credit card bill so you won’t be charged interest or fees. Cred.ai also puts a premium on your privacy. It doesn’t share your information with third parties, except for credit bureaus.

Let’s Summarize…

It’s not hard to get credit after your bankruptcy discharge. In fact, it’s usually quite easy. But if you want to rebuild your credit, you need to find the right card to work for you. Then, make sure to pay the balance every month and not use too much of your credit. This will help build your score fast.

If an emergency expense arises and you need to put it on your card, remember this is one of the reasons you need credit. In this case, you may have to carry a balance for a few months. But make this the exception, not the rule.

If you rebuild your credit for a year after a Chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage. Having a good credit score translates into lower, more affordable monthly loan payments and saves you hundreds of dollars in interest over the life of the loan. Though your credit will be better after a Chapter 13 bankruptcy discharge, getting a new credit card can help boost your credit score in this case, too.