City of Chicago’s “Fresh Start” Parking Ticket Debt Payment Plan Program

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Within the past few years, investigative reporters from ProPublica have uncovered the disparate effects of Chicago’s parking and red-light ticketing system on low-income communities of color. Under a new Illinois ordinance, people filing Chapter 7 bankruptcy could erase their ticket debt if they met certain qualifications.Read on to learn more.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated April 21, 2025

Table of Contents

Within the past few years, investigative reporters from ProPublica have uncovered the disparate effects of Chicago’s parking and red-light ticketing system on low-income communities of color. As part of their investigation, the journalists discovered that many low-income Black and Brown motorists were being coerced into filing Chapter 13 bankruptcy cases and entering into lengthy payment plans which they could not afford. Once they fell behind on their monthly payments, their Chapter 13 bankruptcy cases would get dismissed and they would end up right back where they started, subject to license suspensions and car impoundments. In response, Chicago city council members met to amend the city’s municipal code to provide a better option to discharge these debts and obtain lasting relief from Chicago tickets than Chapter 13 bankruptcy. Under the new Illinois ordinance, as of January 1, 2019, people filing Chapter 7 bankruptcy could erase their ticket debt if they met certain qualifications.

How do I qualify to participate in the “Fresh Start” Program?

The program is available to anyone that is eligible for a discharge in a pending Chapter 7 bankruptcy case or that has received a discharge in a Chapter 7 bankruptcy case in the past.

How do the debt-relief payment plans work?

The Fresh Start payment plan program provides Chapter 7 bankruptcy filers with the opportunity to pay just the initial fine amount for parking, standing compliance, and red-light camera tickets that were incurred in the 3-year period immediately before the bankruptcy filing date and up to the date of enrollment in the program.

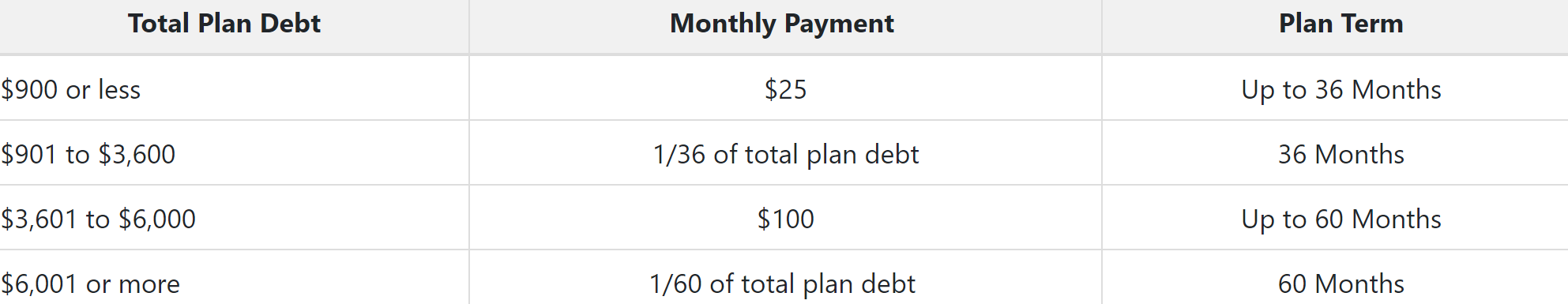

The amount paid under the plan and the length of the plan will depend on the total amount owed, as shown in the chart:

Once you have completed all your payments under the “fresh start” plan and have received a Chapter 7 discharge, all unpaid parking, standing, compliance, and red-light camera tickets older than 3 years as of the date of your bankruptcy filing and all penalties (including late payment penalties), fees, and costs associated with parking, standing, compliance, and red-light camera tickets (whether older than 3 years or not) will be waived.

If you have no tickets, fines or fees incurred within the 3 years before your Chapter 7 filing date, you will not have to make any payments to the City of Chicago. All parking, standing, compliance, and red-light camera tickets older than 3 years at the time of your Chapter 7 filing will be erased once you receive your Chapter 7 discharge without you having to make any payments at all to the bankruptcy court or the City.

How do I enroll in the “Fresh Start” Program?

Step 1: File for Chapter 7 Bankruptcy

To qualify for enrollment in the program, you’ll need to be in a pending Chapter 7 bankruptcy case or have filed for a Chapter 7 bankruptcy case and received a discharge previously. Making the decision to file bankruptcy is not a decision you should take lightly. You should consider all the pros and cons of filing for bankruptcy, including how filing for bankruptcy will affect the other debts you owe and the property that you have.

If you are currently in a Chapter 13 bankruptcy case, you will only be eligible to enroll in the “Fresh Start” program once you’ve converted your case to a Chapter 7. The “3-year look-back” period begins at the date of your Chapter 13 filing. To convert your Chapter 13 case to a Chapter 7 case, you can contact a bankruptcy attorney or law firm in your area for a free consultation.

Step 2: Find out what the Payment Plan Terms will be (you can do this before Step 1)

Send an email to Arnold Scott Harris, P.C. at ChicagoFreshStart@harriscollection.com with the following information:

Your name

Your address

Your driver’s license number

All known vehicle license plate numbers (past and present)

If your car has been booted or impounded, also state the reason for the impoundment or boot in the email (e.g., outstanding or unpaid tickets, driving on a suspended license). You will receive a response with the proposed terms of your plan.

If you’re unable to send an email, you can visit the payment center at 400 West Superior Street and bring in all the information required. You will need to provide the City with your contact information so that they can follow up with the proposed payment plan terms at a later date.

Step 3: Complete the Enrollment Process and Begin Making Your Payments

Bring the following documents to 400 West Superior Street:

A copy of your filed bankruptcy forms, schedules, and statement of financial affairs

Your driver’s license

The “Fresh Start” proposed payment plan terms

You will then be provided with a contract stating the final terms of the program. You are effectively enrolled once the contract is signed and you have made your first payment (including any down payment for the release of your impounded vehicle). The first payment of your repayment plan and any down payment can be paid with cash, cashier’s check, or money order (from USPS only).

All future monthly payments must be made payable to the “City of Chicago” and mailed or delivered to Arnold Scott Harris, P.C., 111 W. Jackson, Blvd., Suite 600, Chicago, IL 60604.

If your driver’s license is currently suspended for unpaid parking tickets, you can now reinstate it upon the filing of your Chapter 7 bankruptcy case and upon acceptance into the “Fresh Start” program.

Conclusion

The City of Chicago’s “Fresh Start” Debt Relief Program is not a perfect solution to addressing the City’s widespread parking and red-light ticketing problem, but it’s a step in the right direction. If you are dealing with ticket debt in the City of Chicago, you are most certainly not alone. If you’re worried about license suspensions, boots or vehicle impoundments, due to unpaid parking or red-light tickets, look into the “Fresh Start” program to find out if it might be the best option for you.