Car Co-Owner vs. Co-Signer: What’s the difference?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

A co-signer on a car loan is obligated to pay the loan if the other person defaults on their payment obligation while a co-owner of a car has an ownership interest in the vehicle itself. This article explains how to properly disclose these relationships in your bankruptcy forms.

Written by Jonathan Petts. Legally reviewed by Ben Jackson

Updated April 28, 2025

Table of Contents

When completing your Chapter 7 bankruptcy forms, it's important to include information about co-signers and co-owners of your property. This most commonly affects cars and car loans.

What does co-owner mean?

A co-owner is someone who owns an asset jointly with another person. In the case of a car, both the owner and the co-owner are listed on the title. It doesn’t matter if only one of you is on the insurance or registration for the car.

What is the difference between owner and co-owner?

Having a co-owner doesn’t change the fact that you own the property. But, depending on your agreement with your co-owner, you may need their permission before you can sell the car. After all, it’s partially theirs.

In a bankruptcy filing, you have to list your ownership interest (and that you have a co-owner) on your bankruptcy forms.

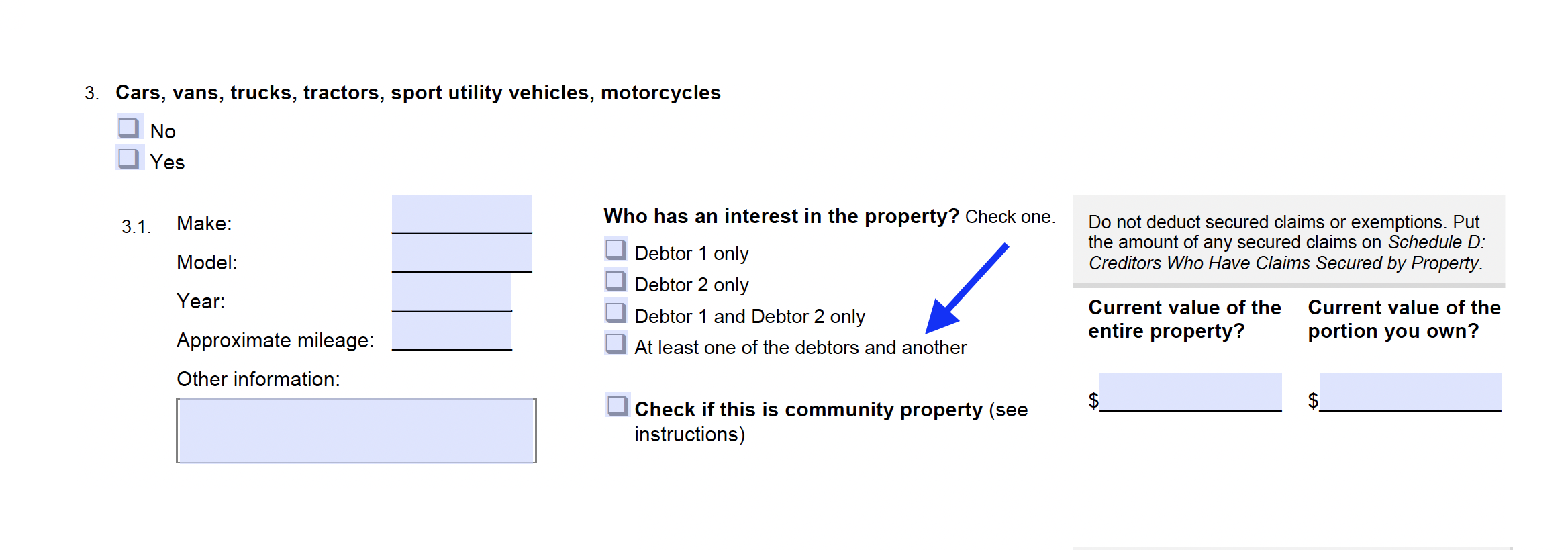

How to list a co-owner on your bankruptcy forms

You have to disclose the fact that another person owns the vehicle with you on your Schedule A/B:

If the car is paid off, that’s the only part of your forms where you list that you have a co-owner.

How filing bankruptcy affects your co-owner

If the car is an old beater worth less than the exemption you can claim on your Schedule C to protect it, your bankruptcy won’t affect your co-owner.

If the car’s value is higher than the available exemption or it’s not your only car, be careful. The fact that you have a co-owner may not be enough to keep the bankruptcy trustee away. In that case, consider speaking to a bankruptcy attorney in your state to find out whether a Chapter 7 filing would affect your co-owner.

What does co-signer mean?

A co-signer, sometimes referred to as a co-borrower, is a person that has agreed to take responsibility for the loan if the primary borrower stops making payments.

If you have a co-signer and you stop making payments on your car loan, the bank will look to them to continue making payments.

If you cosigned a loan for someone else, you are the one that took on this responsibility in case they default. If you file Chapter 7 bankruptcy, your personal obligation to pay this debt will be discharged.

How are co-signers and co-owners connected?

A lot of times the co-signer of a car loan is also a co-owner but that is not always the case.

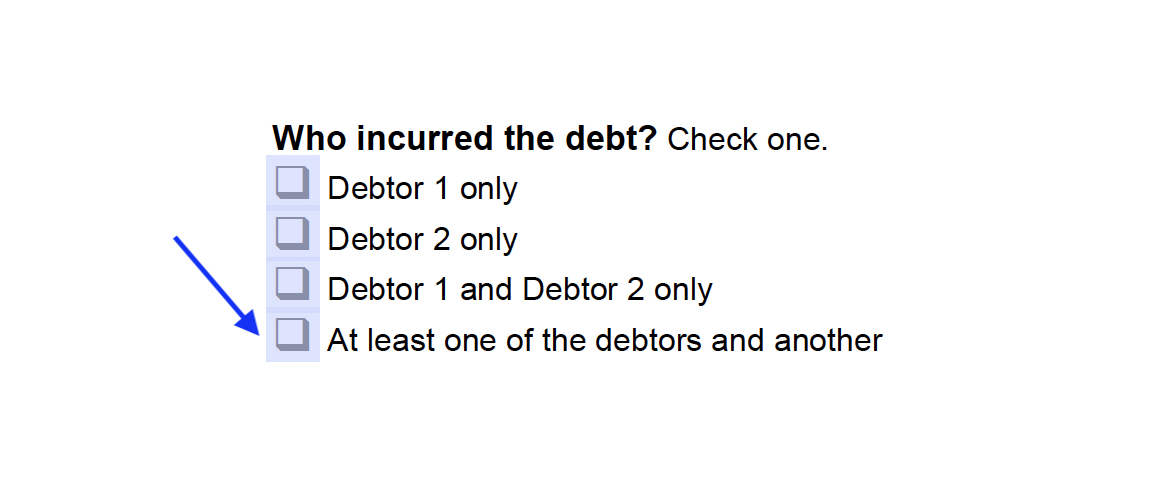

How to disclose a co-signer in your bankruptcy forms

If you're on a debt with someone else who is not your spouse, you have to disclose this fact by checking the correct box on your Schedule D or Schedule E/F:

This is true whether it's a car loan, other secured debt or an unsecured debt.

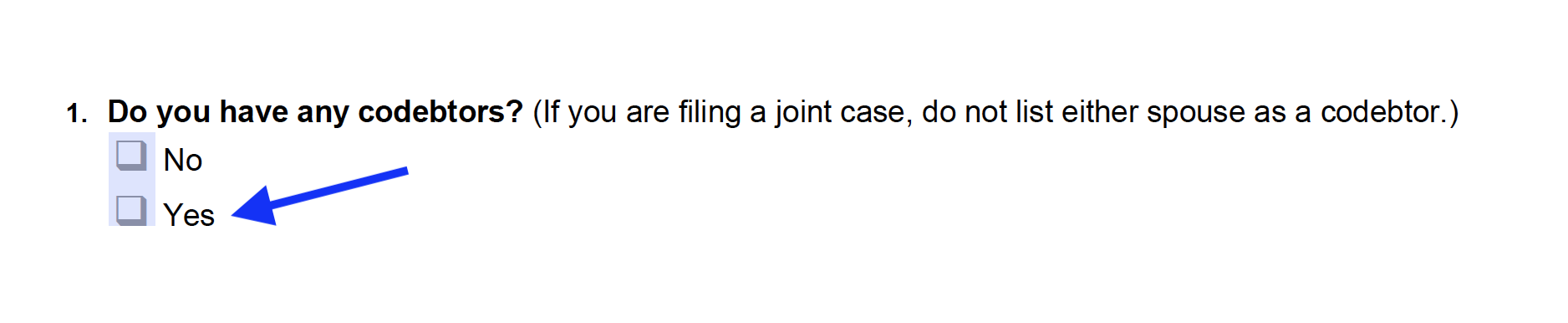

You will also have to identify the co-signer on your Schedule H, first by disclosing that you have one or more co-signers in response to Question 1:

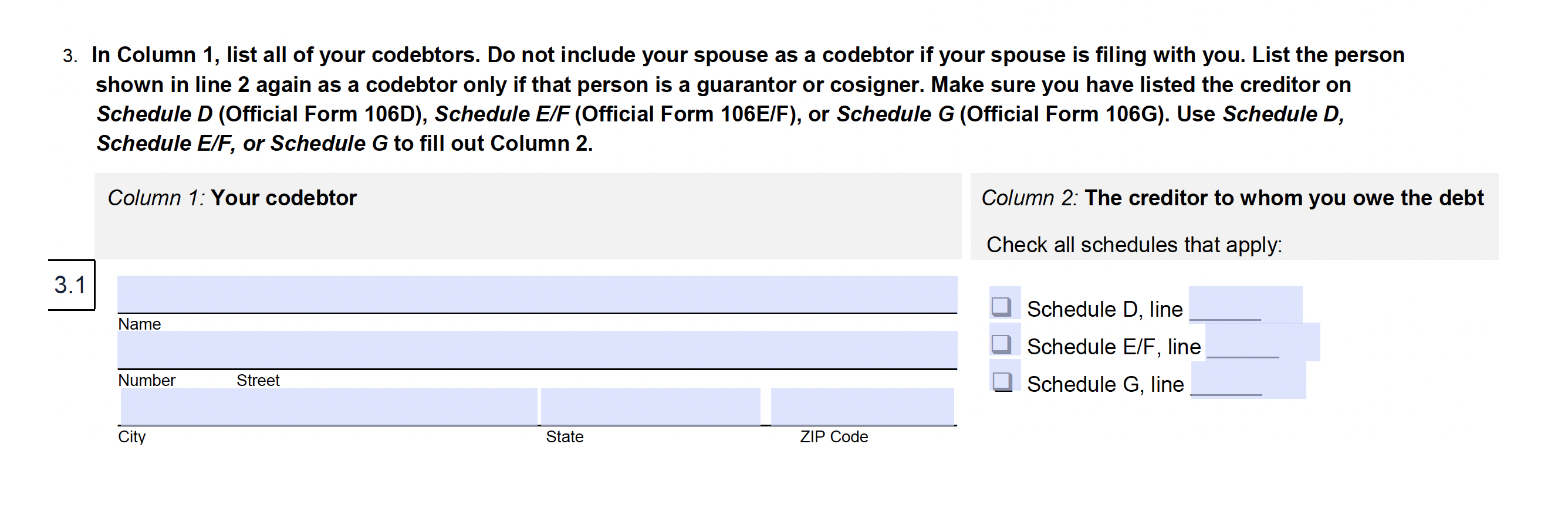

Then by providing the court with the name and address of the other person responsible for the loan:

How filing bankruptcy affects your co-signer

This depends on what you decide to do about the debt. To find out how it works, check out this article on what happens to the co-signer of a car in bankruptcy in our Learning Center.