How Do Deficiency Judgments Work in Florida?

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

When the sale price of an asset — like a home or car — is less than the debt owed to a lender, a deficiency balance arises. Florida law allows lenders to pursue deficiency balances from borrowers once a court grants them a deficiency judgment. But sometimes, borrowers are protected from collection efforts.

Written by Curtis Lee, JD.

Updated April 12, 2022

Table of Contents

When a Florida borrower defaults on a debt, there are laws governing how creditors can recover the debt. The steps creditors can take depend on Florida law and also the type of debt and the terms of the loan. For example, one popular debt collection tool is repossession. But sometimes, the value of the repossessed property isn’t enough to fully cover the unpaid loan amount. When this happens, it creates a deficiency balance.

Before the creditor can collect this outstanding balance, they must first get a deficiency judgment from the court. This principle is almost universal across the United States. But each state has its own set of rules in place outlining how the deficiency judgment process works. This article will explore how it works in the Sunshine State.

What Is a Deficiency Judgment?

When a creditor or debt collector sues you and the court rules in their favor, they can get a deficiency judgment to collect a deficiency balance. Deficiency balances typically arise with secured loans, which are backed by collateral. If the borrower defaults, the lender can take the collateral property back and sell it to recoup its costs. If the collateral’s value isn’t enough to fully repay the debt, there’s a deficiency balance.

Almost any property can serve as collateral to secure a debt. But what often happens is that the property purchased with the loan also serves as collateral for that loan. For example, vehicles often secure car loans and real estate usually secures mortgage loans. Within the context of real estate and mortgages, taking back the property is called foreclosure. When a creditor tries to take back a car for an unpaid car loan, it’s usually referred to as a vehicle repossession.

To illustrate how a deficiency balance works, say a homeowner owes $100,000 on their mortgage and they default. After the foreclosure, the bank sells the house at a foreclosure sale for $90,000. You can see that the sale proceeds aren’t enough to pay off the remaining mortgage balance. It’s $10,000 short. This $10,000 difference is the deficiency balance. Depending on state law and the terms of the promissory note, the homeowner may still owe the bank this amount.

This example parallels car loans. But instead of a foreclosed property being sold to pay off a mortgage, the repossessed car gets sold to pay off the car loan. And if the car sells for less than what the borrower owes, it can also lead to a deficiency balance.

Florida Law – Mortgage Foreclosures

Mortgaged property is one of the biggest sources of deficiency judgments in Florida. But there’s good and bad news when it comes to deficiency judgments in Florida. The bad news is that Florida statutes permit deficiency judgments in home foreclosures. The good news is that lenders foreclosing on a home can only do so with a judicial foreclosure. This means that before a bank or lender can foreclose on your home after you default, they can’t use a nonjudicial foreclosure. Instead, they must first file a foreclosure lawsuit in court.

Assuming the court grants the foreclosure, the lender must again get court approval before they can collect the deficiency judgment amount. Lenders can do this by either filing a motion during the foreclosure lawsuit or by filing a second lawsuit after the foreclosure is complete. If a mortgage company or bank has filed the lawsuit, it will usually file a motion asking for a deficiency judgment during the judicial foreclosure proceeding. But debt buyers are more likely to file a separate lawsuit after the foreclosure ends.

Calculating a Deficiency Balance After a Foreclosure Action

Regardless of which approach the lender takes, it must prove that it’s legally entitled to recover the deficiency balance and show how it calculated the amount it’s trying to recover. Under Florida law, the deficiency balance has to be calculated following a specific set of rules.

To calculate, the court will look at two numbers: 1.) How much money the borrower still owes on their mortgage, and 2.) The fair market value of the property or the foreclosure sale price. Courts determine a residential property’s fair market value by getting testimony from one or more property appraisers who are familiar with the property values of similar homes in the same geographic area. The court will then take the difference between the remaining balance on the mortgage and the larger of these two values.

For instance, let’s say a borrower has an unpaid mortgage balance of $140,000 when their home is foreclosed. The home’s fair market value is $130,000, and the home sells for $100,000 at the Florida foreclosure sale. Since the fair market value is larger than the sale price, that’s what’s used to calculate the deficiency balance. The deficiency balance is $10,000 ($140,000 - $130,000).

Florida created this law to protect homeowners from lenders who might accept a lowball price during the foreclosure sale. If this happens, the amount of the deficiency balance may be larger than what the borrower would otherwise have to pay if the property sold for a more reasonable price.

One thing to keep in mind is that if a lender files a separate lawsuit to get a deficiency judgment, there’s a one-year statute of limitations. This means Florida foreclosure law gives the bank or mortgage loan company one year to begin its deficiency judgment lawsuit. This one-year “clock” begins from the day the clerk issues a certificate of title or the homeowner gives the deed in lieu of foreclosure to the mortgage company.

Upsolve Member Experiences

1,725+ Members OnlineFlorida Law – Personal Property Deficiency Balances

Deficiency balances tend to be most common with mortgages and real estate. But they can still exist in other contexts, like car loans or other loans secured by personal property. The general concept is the same in that a lender can ask the court to grant them a deficiency judgment to collect a deficiency balance. But there are two major differences in Florida between deficiency judgments concerning mortgages and deficiency judgments following the repossession of personal property.

First, a court won’t grant a deficiency judgment unless the deficiency balance is more than $2,000. Second, there’s no statute of limitations on when a lender can bring a deficiency judgment action to recover the deficiency balance involving personal property.

Addressing a Deficiency Balance

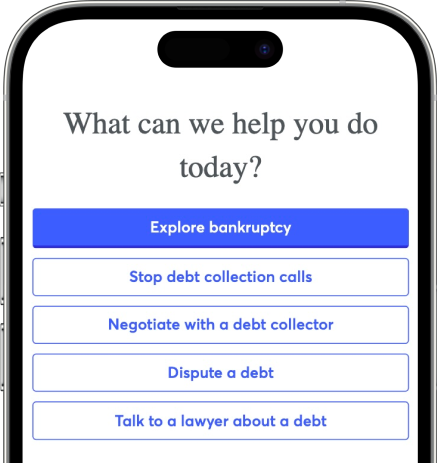

If a lender has repossessed your personal property or foreclosed on your home and a deficiency balance remains, you have a few options. One option is to negotiate with your lender to eliminate or reduce the deficiency balance. This is sometimes done when arranging a deed in lieu of foreclosure.

Another option is to use debt settlement or other negotiations to convince your lender to reduce your deficiency balance amount. In certain situations, lenders will accept an amount that’s less than what you owe. They might do this to get their money more quickly, if it’s unrealistic to expect you to pay the full deficiency balance, or when suing you would be too expensive.

As a third option, you can try to set up a repayment plan with your lender. This might result in paying more money in the end, but it may make it possible to pay back the deficiency balance over time with monthly payments instead of one lump sum.

Finally, there’s filing bankruptcy. You may be able to discharge a deficiency balance in bankruptcy, depending on the type of bankruptcy you file. To get a better understanding of how this process works, you should consider talking to a bankruptcy lawyer. Many of them offer free consultations to help you take advantage of your rights and legal options.

Let’s Summarize…

Florida permits creditors of secured loans to recover deficiency balances from borrowers. There’s a deficiency balance when the value of the collateral is less than the unpaid loan balance. But before a creditor can recover a deficiency balance, they must get a deficiency judgment. This is a court ruling authorizing the collection of a deficiency balance. A Florida court will grant a deficiency judgment for deficiency balances stemming from mortgage foreclosures and the repossession of personal property. However, there are special rules in place to help protect borrowers under certain conditions.