Every Type of Bankruptcy Explained

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

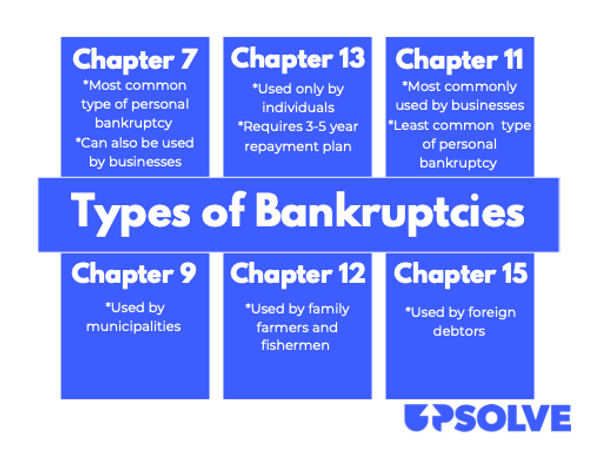

There are six different types of bankruptcies. Chapter 7 and Chapter 13 are the most common types of personal bankruptcy. Chapter 7 is also called a liquidation. It allows the filer to get rid of most of their debts without repaying anything. It works best for individuals without assets like a home. Chapter 13 bankruptcy puts the filer on a repayment plan and can help protect assets like a home. The goal of personal bankruptcies like Chapter 7 and 13 is to give the filer a financial fresh start and relieve them of debt they may never be able to repay. Businesses, farmers, and municipalities can also file bankruptcy under Chapters 9, 11, 12, and 15. These less common types of bankruptcy may be used to restructure or reorganize debt.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated January 23, 2026

Table of Contents

What Is Bankruptcy?

Bankruptcy is a tool for debt relief. There are six different types of bankruptcies under United States bankruptcy law. Each serves either an individual or an entity like a business or local government. Chapter 7 and Chapter 13 are personal bankruptcies that serve individuals who have a lot of medical, credit card, or other consumer debt. Chapters 9, 11, 12, and 15 are bankruptcies that serve business entities that need to reorganize or restructure their debt.

The bankruptcy types are called “chapters” because each one is named after a section called a chapter of the U.S. Bankruptcy Code. This is the federal law that governs bankruptcy cases. Because the bankruptcy court is a federal court and bankruptcy laws are federal, the bankruptcy process looks similar from state to state.

Here’s a quick visual overview of the six bankruptcy chapters.

The Six Bankruptcy Types: Explained

Chapter 7 and Chapter 13 bankruptcy are the two most common types of bankruptcy filings. But there are four other types — Chapters 9, 11, 12, and 15. Here is a breakdown of the six different types of bankruptcy filings, starting with the most common.

What Is Chapter 7 Bankruptcy?

People who are struggling with credit card debt, medical bills, or other debt that they can’t get out from under most commonly file Chapter 7. This often provides the quickest path to a financial fresh start. To be eligible for Chapter 7, you have to show the bankruptcy court that you don’t make enough to pay even a portion of your debts. You show this by taking what is called a means test.

✨ You may be able to file for free using Upsolve. Upsolve is a nonprofit with a free filing tool that walks you through the Chapter 7 process step by step. It just takes two minutes to see if you're eligible.

How Chapter 7 Bankruptcy Works

Chapter 7 is called a “liquidation bankruptcy” because if you own property that is not protected by exemptions, you must liquidate (sell) it to pay toward your debts. While this probably sounds scary, according to the American Bankruptcy Institute, upwards of 96% of Chapter 7 filers get to keep all their belongings. This is because many assets are protected by exemptions.

Most personal Chapter 7 bankruptcy cases last 4–6 months. Filers often get their bankruptcy discharge (the court order that eliminates your dischargeable debt) about 3–4 months after they file. Chapter 7 bankruptcy can stay on your credit report for up to 10 years, but many filers see a noticeable increase in their credit score within two years of filing their case. Keep in mind, you can start rebuilding your credit as soon as you get your discharge.

You can learn more about different aspects of Chapter 7 bankruptcy in our Learning Center:

What Is Chapter 13 Bankruptcy?

This is the second most common type of personal bankruptcy. Unlike Chapter 7 filings, businesses (other than sole proprietors, usually small business owners) are not allowed to file Chapter 13 bankruptcy.

Chapter 13 bankruptcy is more complicated than Chapter 7 and lasts much longer due to the required repayment plan. Chapter 13 helps you reorganize your debts. It puts you on a 3–5-year repayment plan. At the end of the repayment period, any remaining unsecured debt is discharged. To file Chapter 13, your secured debt and your unsecured debt (including personal loans) can’t exceed a certain amount. The filing will stay on your credit report for seven years.

Why would someone choose Chapter 13 over Chapter 7? One of the most common reasons is that they want to prevent their home from being foreclosed. Someone might also choose Chapter 13 over Chapter 7 if they make too much money to file Chapter 7.

How Chapter 13 Bankruptcy Works

You create a budget based on your monthly income and living expenses and tell the bankruptcy court how much you can afford to pay each month. The court and the bankruptcy trustee review your proposed reorganization plan.

Once it’s approved by the court, all you have to do is pay your disposable income to the trustee and send in your tax return every year. Your remaining debt (other than student loans) is wiped out once this is done.

Some people file Chapter 13 bankruptcy because they make too much money to qualify for Chapter 7 bankruptcy. Others choose to file Chapter 13 because it gives them a certain benefit they’re not able to get in Chapter 7. You can, for example, avoid the sale of non-exempt assets by filing Chapter 13.

Filing Chapter 13 also gives you the chance to pay back certain non-dischargeable debts, like past due alimony or child support, and pay off car loans with a lower interest rate. You can do it all in manageable monthly payments based on your regular income.

Chapter 7 vs. Chapter 13 Bankruptcy

While Chapter 7 and Chapter 13 bankruptcy are the two most common types of personal bankruptcy, they work in very different ways.

If you’re trying to decide between Chapter 7 and Chapter 13 bankruptcy, it can help to compare them based on key characteristics like timeline, debts handled, and eligibility. Here’s how they differ:

Eligibility: Chapter 7 is best for individuals with low income and few assets. To qualify, you must pass the means test, which shows the court you don’t have enough disposable income to repay your debts. Chapter 13 is better suited for people with a steady income who want to protect their home, car, or other valuable assets.

Timeline: Chapter 7 is much faster than Chapter 13. Most Chapter 7 cases take about 4–6 months from start to finish, making it ideal if you’re looking for quick debt relief. Chapter 13, by contrast, requires a 3–5-year payment plan before any remaining unsecured debts are discharged.

How debts are handled: Both types of bankruptcy can eliminate unsecured debts, like credit card balances, medical bills, and personal loans. However, Chapter 13 can also help you catch up on missed payments for secured debts, like a mortgage or car loan, which isn’t an option in Chapter 7.

How assets are handled: Chapter 7 may require you to sell non-exempt property to pay creditors, though most people can keep everything they own thanks to exemptions. Chapter 13 allows you to keep all your property, including non-exempt assets, as long as you stick to your repayment plan.

Choosing between Chapter 7 and Chapter 13 depends on your financial situation and goals. Chapter 7 provides fast debt relief if you qualify, while Chapter 13 gives you time to reorganize your finances and protect assets. If you aren’t sure which is right for you, Upsolve can set you up with a free consultation with a qualified bankruptcy attorney near you.

What Is Chapter 9 Bankruptcy?

Chapter 9 bankruptcy allows municipalities (including cities, towns, and villages), counties, taxing districts, municipal utilities, and school districts to restructure their financial obligations.

Much like the wage earner’s plan under Chapter 13 or the Chapter 11 plan of reorganization, a bankruptcy proceeding under Chapter 9 allows the filer to propose a repayment plan to deal with its obligations.

Since Chapter 9 does not cover states or territories outside of the United States, Congress had to pass the 2016 Puerto Rico Oversight, Management, and Economic Stability Act to allow the U.S. territory access to bankruptcy protection.

What Is Chapter 11 Bankruptcy?

Chapter 11 bankruptcy is also sometimes called corporate bankruptcy. Businesses, individuals, or married couples can file Chapter 11.

But this chapter isn’t typically included in the list of personal bankruptcy options because the court filing fee alone is more than $1,700 and bankruptcy attorney fees usually start somewhere around $15,000.

Filing Chapter 11 as an individual usually only makes sense if you’re a very high earner or business owner who can’t file a Chapter 13 bankruptcy because you have too much debt.

Chapter 7 vs. Chapter 11 Bankruptcy

While both Chapter 7 and Chapter 11 bankruptcy help individuals or businesses address overwhelming debt, they are very different in terms of process, purpose, and eligibility. Here’s how they compare based on key characteristics:

Purpose: Chapter 7 helps individuals or businesses eliminate most unsecured debts, like credit card bills or medical debt, when repayment isn’t possible. Chapter 11, on the other hand, is a reorganization bankruptcy used by businesses or high-income individuals to restructure debts while keeping operations or significant assets intact.

Eligibility: Chapter 7 is available to individuals and businesses who pass the means test (for individuals) or cannot reasonably repay their debts. Chapter 11 has no income or debt limit, making it a common choice for businesses with significant assets or for individuals who owe too much to qualify for Chapter 13.

Timeline: Chapter 7 is much faster, with most cases completed in about 4–6 months. Chapter 11 is a longer, more complex process that can take several months to years, depending on how long it takes to create and implement a reorganization plan.

How debts are handled: Chapter 7 involves liquidating non-exempt assets to pay creditors, with remaining dischargeable debts eliminated. Chapter 11 restructures debts, allowing the filer to propose a repayment plan that adjusts terms like timelines or balances so creditors recover part of what they’re owed.

Cost and complexity: Chapter 7 is simpler and more affordable, making it ideal for individuals or small businesses with limited resources. Chapter 11 is far more complex and costly, often used by businesses or wealthy individuals with significant debt or assets.

Chapter 7 is often best for individuals or businesses that want to eliminate debt and move on quickly. Chapter 11 works better for businesses or high-income individuals who want to keep operating or restructure their finances. Almost 91% of all the Chapter 11 bankruptcies filed in 2022 were filed by businesses.

What Is Chapter 12 Bankruptcy?

Chapter 12 bankruptcy gives family farmers and those operating a commercial fishing operation the ability to reorganize their debt without having to go through the expensive Chapter 11 bankruptcy process.

It works similar to a Chapter 13, but includes specific provisions to deal with the unique nature of family farming and family fishermen operations. Once the Chapter 12 repayment plan is completed, the filer receives a bankruptcy discharge.

What Is Chapter 15 Bankruptcy?

Chapter 15 bankruptcy comes into play when an individual (or business) files a bankruptcy case under the bankruptcy laws of another country but has assets or liabilities in the United States. Its purpose is to provide an effective way for dealing with cases that involve cross-border issues and to ensure cooperation between foreign and U.S. bankruptcy courts.

Let’s Summarize...

The U.S. Bankruptcy Code outlines several types of bankruptcies. Your financial situation typically determines what chapter of bankruptcy best meets your goals.

Remember that bankruptcy is a safety net, and there is absolutely no shame in using the United States bankruptcy laws for the purpose of getting a fresh start. That’s what they’re there for. If you need help filing, our free filing tool may be a good option if you’re ready to file but can’t afford to hire a bankruptcy attorney to review your bankruptcy case.