How Much Does Bankruptcy Cost?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

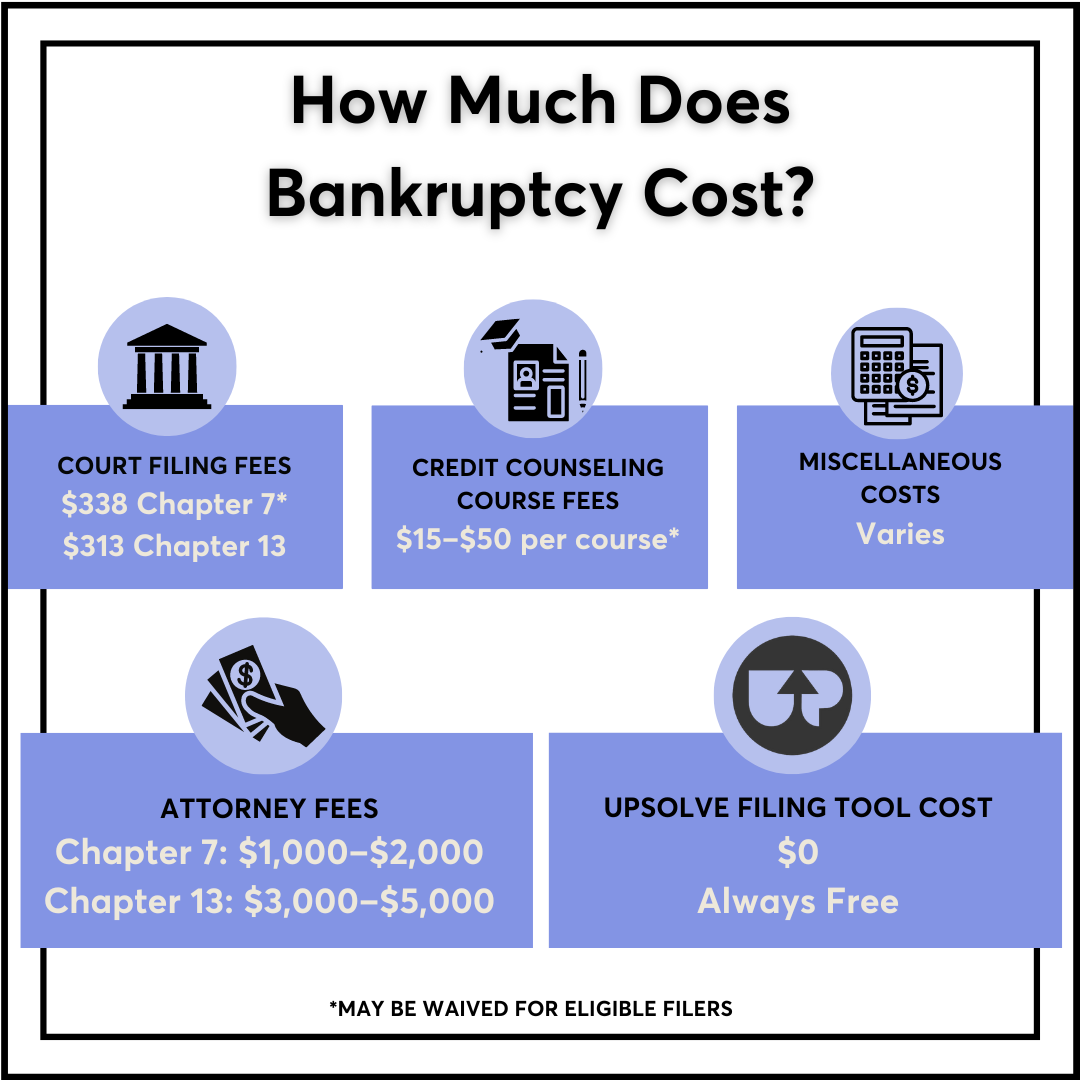

If you're able to file on your own and get fee waivers, filing bankruptcy can be free. Without waivers, it can cost as little as $400 to file for bankruptcy or up to as much as $3,000 or more if you hire a bankruptcy lawyer. Bankruptcy costs include court filing fees, credit counseling course fees, and attorney fees if you hire a bankruptcy lawyer. The total cost will largely depend on your financial situation, the complexity of your case, and whether you file Chapter 7 or Chapter 13 bankruptcy.

Written by Attorney Jenni Klock Morel. Legally reviewed by Attorney Andrea Wimmer

Updated January 14, 2026

Table of Contents

- What Are the Bankruptcy Court Filing Fees?

- How Much Do Credit Counseling Courses Cost?

- What Other Bankruptcy Costs Should I Account For?

- Can I File Bankruptcy for Free?

- How Much Do Bankruptcy Attorneys Charge?

- How Much Do Bankruptcy Attorneys Charge for Chapter 13 Bankruptcy?

- Who Actually Pays for Bankruptcies?

- Are Other Debt Relief Options Cheaper Than Bankruptcy?

How Much Does Bankruptcy Cost?

Bankruptcy costs can range from $400–$3,000 or more. The total cost will largely depend on the complexity of your case, the type of bankruptcy you file, and if you choose to hire a bankruptcy attorney.

Bankruptcy costs include:

Court filing fees: $338 for Chapter 7 (may be waived for eligible filers) or $313 for Chapter 13

Credit counseling course fees, which can range from $10–$50 per course (may be waived for eligible filers)

Miscellaneous fees (printing, travel, etc)

Attorney fees (if you hire a bankruptcy lawyer)

While these costs can add up, filing bankruptcy can give you a fresh start by completely eliminating credit card debt, medical debt, personal loans, and other unsecured debts. Note that bankruptcy can only sometimes help eliminate student loans and it can’t be used to get rid of child support, alimony, or past-due tax debt.

✨ If you're eligible, you can use Upsolve's free filing tool to prepare your Chapter 7 case, which can save you hundreds or even thousands of dollars in legal fees. Upsolve is a nonprofit that's helped over 21,000 Americans file bankruptcy on their own for free.

What Are the Bankruptcy Court Filing Fees?

Your court filing fee depends on the type of bankruptcy you are filing. There are six types of bankruptcy you can file: Chapter 7, 9, 11,12, 13, and 15. We will be focusing on the two most common types of bankruptcy: Chapter 7 and Chapter 13.

What Is the Fee To File Chapter 7?

As of 2026, the bankruptcy court filing fee for Chapter 7 bankruptcy is $338. It’s due when you file your bankruptcy petition (paperwork), unless the court grants an exception to this rule. If you need help paying your filing fee you can request to pay the court filing fee in installments or ask for a fee waiver.

How To Pay Your Court Filing Fee in Installments

You can request to pay the filing fee in installments to the Bankruptcy Court. This allows you to immediately receive bankruptcy protection (via the automatic stay) from debt collectors, even if you can’t pay the full filing fee upfront. This can be particularly helpful for those who are at risk for wage garnishment or foreclosure.

If you want to pay your filing fee in installments, fill out the installment application and submit it to the court. You’ll also want to find out how much your bankruptcy district charges as a down payment. The down payment counts towards the total fee and each bankruptcy district sets its own minimum. You can find this information online or ask your local bankruptcy court clerk.

It’s important to note that all installment payments must be paid within 120 days after bankruptcy filing.

How To Get a Fee Waiver

To be eligible to apply for a fee waiver your income must fall below 150% of the poverty line for your state and household size. However, being eligible to apply for a fee waiver doesn't mean that you will automatically get it. If the Bankruptcy Court denies your fee waiver, it will typically give you the chance to pay the filing fee in installments instead.

You can only apply for a fee waiver for Chapter 7 filings. Fee waivers are not available in Chapter 13 cases.

Chapter 13 Court Filing Fee

The Chapter 13 bankruptcy filing fee is $313. Chapter 13 cases require the filer to have disposable income to make monthly plan payments to the trustee. No fee waivers are available in Chapter 13 cases. That’s because, if you can’t pay the filing fee, the bankruptcy judge will find it hard to believe that you can make your Chapter 13 repayment plan in good faith. That said, you can apply to pay your filing fee in installments.

How Much Do Credit Counseling Courses Cost?

The required bankruptcy courses cost $10–$50, but if your income is less than 150% of the federal poverty guidelines, you can ask the course provider to waive the fee.

Everyone who files for bankruptcy must take two educational courses:

A credit counseling course before filing

A debtor education course after filing

The courses are the same for both Chapter 7 and Chapter 13 cases. Both courses can be completed online and generally are inexpensive and not too time-consuming.

The costs of either course cannot be more than $50 unless the provider gets a special exemption from the U.S. Trustee's Office. Approved credit counseling agencies are required to operate as nonprofit entities, so the cost tends to be slightly lower for the first course than the second course.

Generally speaking, you can expect to pay less than $25 for the credit counseling fee and less than $50 to complete debtor education.

What Other Bankruptcy Costs Should I Account For?

There are a few other costs that arise when filing bankruptcy, though they’re typically in the form of printing costs or travel expenses.

Here are some of the additional costs people encounter when filing bankruptcy:

The cost of printing paperwork (which could be 60+ pages)

The cost of mailing your documents to the court (or bankruptcy trustee)

Amendment filing fees (if applicable)

Travel fees (if you have to travel to meet your creditor)

Possible lost wages for time off work for any reason related to your case

Many people like to monitor their credit score throughout the bankruptcy process as well. While you can get your credit report for free, you may need to pay to see your credit score.

Can I File Bankruptcy for Free?

Upsolve has a free filing tool that helps people file Chapter 7 bankruptcy for free without the help of an attorney. Upsolve has helped over 20,000 people discharge over $970 million in debt.

While it’s possible to get a fresh start through Chapter 7 bankruptcy without an attorney, the success rates for filing Chapter 13 without an attorney are low. If you decide to file Chapter 13, it’s advisable to get an experienced bankruptcy lawyer to help ensure your case is successful.

Upsolve can help you get a free consultation with an experienced bankruptcy attorney near you.

How Much Do Bankruptcy Attorneys Charge?

If you choose to hire a bankruptcy attorney, lawyer fees will be included in the total cost of filing bankruptcy. Lawyer fees can range anywhere from $1,000–$2,000 for Chapter 7 cases. Chapter 13 bankruptcy cases tend to be more complicated and take longer since they require a 3–5 year repayment plan, so lawyers often charge more for these cases.

No matter your situation, it may be beneficial to meet with a bankruptcy lawyer for a free consultation. An attorney can help you navigate the bankruptcy process, understand which type of bankruptcy is best for you, and they can provide specific legal advice for your situation.

Our free online tool helps filers navigate the Chapter 7 bankruptcy process, which could potentially save you $1,000–$2,000 in attorney fees. See if you’re eligible!

Chapter 7 Flat Fees vs. Hourly Fees

Most attorneys handle Chapter 7 bankruptcy cases on a flat fee. This means that they charge a set amount up-front for the legal services involved in preparing and filing a Chapter 7 case. Flat fees for filing bankruptcy can vary greatly depending on the complexity of your case.

The alternative to charging a flat fee is charging an hourly fee. The hourly rate should also be included in a written agreement between the attorney and client. It's possible, but rare, for a bankruptcy law firm to bill hourly attorney fees for filing a Chapter 7 consumer bankruptcy.

Do Bankruptcy Attorneys Have Payment Plans?

Just as the bankruptcy court sometimes allows installment payments for the filing fee, most bankruptcy attorneys allow installment payments for the attorney fees.

Chapter 7 bankruptcy attorney fees typically have to be paid in full before the attorney files your case. This is because of the automatic stay, which stops your creditors from attempting to collect on a debt you owe them (usually unsecured debt).

How Much Do Bankruptcy Attorneys Charge for Chapter 13 Bankruptcy?

Attorney fees for a Chapter 13 bankruptcy tend to be more expensive than attorney fees for a Chapter 7 bankruptcy case. This is because there's a much greater workload associated with filing a Chapter 13 case and, unlike Chapter 7 bankruptcies (which usually take about four months), Chapter 13 cases are open for three to five years.

How Are Chapter 13 Attorney Fees Paid?

It isn't necessary to pay all of the attorney fees upfront in a Chapter 13 case. Usually, a Chapter 13 bankruptcy lawyer will require a portion of the attorney fees to be paid before filing the case. The remaining attorney fees then will get paid through the Chapter 13 repayment plan.

Chapter 13 Flat Fees vs. Hourly Fees

A lot of attorneys use the flat fee system in Chapter 13 bankruptcy cases. Whether flat fee or hourly, all attorney fees paid through the Chapter 13 plan are subject to court approval.

Outstanding attorney fees at the time of filing are not paid in addition to the plan payment, they're part of the plan payment. Lawyers can ask for priority to receive full payment before certain other creditors.

Who Actually Pays for Bankruptcies?

When someone files for bankruptcy, they’re usually the one who pays the court filing fee. Chapter 7 costs $338 to file and Chapter 13 costs $313 to file.

The filing fee helps cover the cost of running the bankruptcy court system.

💸 If you make less than 150% of the federal poverty guidelines, you can ask the court to waive the fee. That means the court covers the cost so you can still access the process.

If your court filing fee is waived, you may also qualify for a waiver of the required credit counseling and financial education courses. Many people find this especially helpful since every dollar counts during bankruptcy. Without a waiver, each course costs between $10 and $50, depending on the provider you use.

If you hire a lawyer to represent you, you’re responsible for paying their fees separately. Some people do this for peace of mind.

✨ If you have a simple Chapter 7, you may be eligible to use Upsolve's free filing tool to save on legal costs. Upsolve is a nonprofit, so our services are 100% free. We've helped over 18,000 people get rid of more than $850 million in debt.

Does The Government Pay for Bankruptcies?

In most cases, no — the government doesn’t directly pay for someone’s bankruptcy. People who file for bankruptcy usually pay their own court filing fee, which helps fund the bankruptcy system.

That said, the government can absorb the cost in certain situations. If someone earns less than 150% of the federal poverty line and can’t afford the fee, they can apply for a fee waiver. If approved, the Bankruptcy Court waives the filing fee, meaning the court system (and by extension, the government) covers the cost of that person's access to the bankruptcy process.

Are Other Debt Relief Options Cheaper Than Bankruptcy?

In many cases, bankruptcy can actually be a more cost-effective solution compared to other debt relief options, especially if you’re unable to fully repay your debts. But it’s worth considering other debt relief options to see if they're cheaper or better suited for your situation.

Here’s a quick look at how some alternatives compare:

Debt Settlement: You negotiate to pay less than what you owe. While this can reduce debt, if you hire a settlement company, they often charge high fees (up to 25% of the settled amount), and the process can take years. There's also the risk of forgiven debt being taxed as income.

Debt Management Plans (DMPs): Credit counseling agencies help negotiate lower interest rates and payments, allowing you to pay off your debt over 3–5 years. DMPs can be low cost, but you still need to repay the full debt, which might be more expensive than a Chapter 7 bankruptcy where most unsecured debts are wiped out.

Debt Consolidation: You take out a new loan to combine your debts into one payment. While this can lower interest rates or monthly payments, you'll still need to repay the full loan amount with interest, and not everyone qualifies for favorable terms.