How To Win Against Penn Credit

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If Penn Credit reaches out to you, they may be looking to collect a debt they think you owe. Before paying anything, validate that the debt is legitimate and yours. If you agree that you owe the money, you can figure out how much of the debt you can pay and begin debt settlement negotiations to pay less than the full amount. If Penn Credit sues you, respond immediately by filing an answer form. Most importantly, try not to stress — you’ve got this!

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated November 10, 2025

Table of Contents

Why Is Penn Credit Contacting Me?

Penn Credit is a debt collection agency that collects consumer debts for government entities, healthcare providers, telecommunication companies, and more. Penn Credit is likely contacting you because they bought a debt they believe belongs to you and are looking to collect it.

Read Upsolve’s How to Deal With Penn Credit article to learn more about Penn Credit and what to do if they contact you.

Do I Have To Pay Penn Credit?

If Penn Credit can prove the debt is valid, you probably have to pay them. If they can’t prove it, you don’t have to pay them, and they should stop contacting you.

If the debt is real and yours and you don’t pay, there can be some serious consequences. Penn Credit could win a court order for wage garnishments or bank account garnishments and take your hard-earned income.

On the bright side, if you do have to pay Penn Credit, you may not have to pay the full amount. You can negotiate a debt settlement to only pay a portion of the debt.

How To Negotiate a Debt Settlement With Penn Credit in 3 Steps

Debt collectors, like Penn Credit, are businesses. Just like any business, their goal is to make a profit. This sounds a bit icky, but their money motivation can actually work in your favor.

They don’t want you to know it, but many debt collectors will settle for 40%–60% of the original debt amount. Collectors are usually open to negotiating because they buy debt for significantly less than the debt is worth. This means that even if you only pay part of what you owe, they’re likely still making a profit.

Penn Credit could reach out to you with a settlement offer, but it's usually best for you to initiate the conversation.

If you’re nervous about the negotiation process, let’s go through it together. It’s not as scary as you may think!

Step 1: Make Sure the Debt Is Valid

The first step is validating the debt. Debt collectors must send you a debt validation letter within five days of contacting you and give you 30 days to dispute the debt. This is thanks to a debt collection rule created by the Consumer Financial Protection Bureau (CFPB). If Penn Credit doesn’t send you a validation letter, ask them for one.

Compare the information you have about your debt account with the information on the validation letter. If you need more information from Penn Credit, send a debt verification letter. You can also use your verification letter to dispute the debt and/or confirm that:

The debt truly belongs to you

Penn Credit owns the debt or has authorization to collect

The debt amount is accurate

Here’s a helpful explanation of the difference between validation and verification letters:

Step 2: Figure Out What You Can Pay

Once you verify that you owe the debt, you need to figure out how much of it you can reasonably pay. Analyze your monthly take-home pay, expenses, and existing debt obligations, like mortgages or auto loans.

The CFPB provides a budget worksheet to guide you through this process and a debt worksheet that helps you visualize your bills and analyze your expenses. Taking a detailed look at your finances can be stressful and confusing. If you want extra assistance, you can get a free consultation with an accredited nonprofit credit counselor.

Lump-Sum vs Payment Plan: Which is Better?

Debt collectors, like Penn Credit, usually prefer a one-time lump-sum payment. A lump sum is a good option if you experience a surge of income, like a work bonus or tax return. If you’re not expecting a windfall and don’t have enough disposable income to pay your debt outright, look into a payment option instead.

When presenting your payment plan offer, suggest a realistic monthly amount and a timeline you’re comfortable with, and offer to set up an automatic withdrawal from your bank account. This could convince Penn Credit to accept this payment option if they’re on the fence!

Step 3: Make a Settlement Offer to Penn Credit

Now that you know how much of the debt you can pay and how you’ll pay it, make Penn Credit an offer. You can make your offer in writing, but it’s usually best to call your debt collector and make the offer over the phone. If you choose to make your offer in writing, Upsolve’s Debt Settlement Letter template is a great resource for drafting your letter.

Don’t Just Negotiate the Amount… Negotiate Everything!

Did you know that you can negotiate more than just the debt amount in a debt settlement? You can negotiate how you repay and how Penn Credit reports your account to the major credit bureaus.

Debt collectors can report your account as “paid in full,” “partial payment,” or “settled.” It’s best for your credit score if Penn Credit reports your account ”settled,” so use your negotiation skills to make it happen!

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Often, yes! Even if Penn Credit files a debt lawsuit against you, it’s probably not too late to negotiate a debt settlement.

The most important thing you can do if you’re involved in a lawsuit is to respond. Even if you’re in the middle of settlement negotiations, follow all directions from the court and attend court appearances, if any, until your case is closed.

Tips for a Successful Debt Settlement

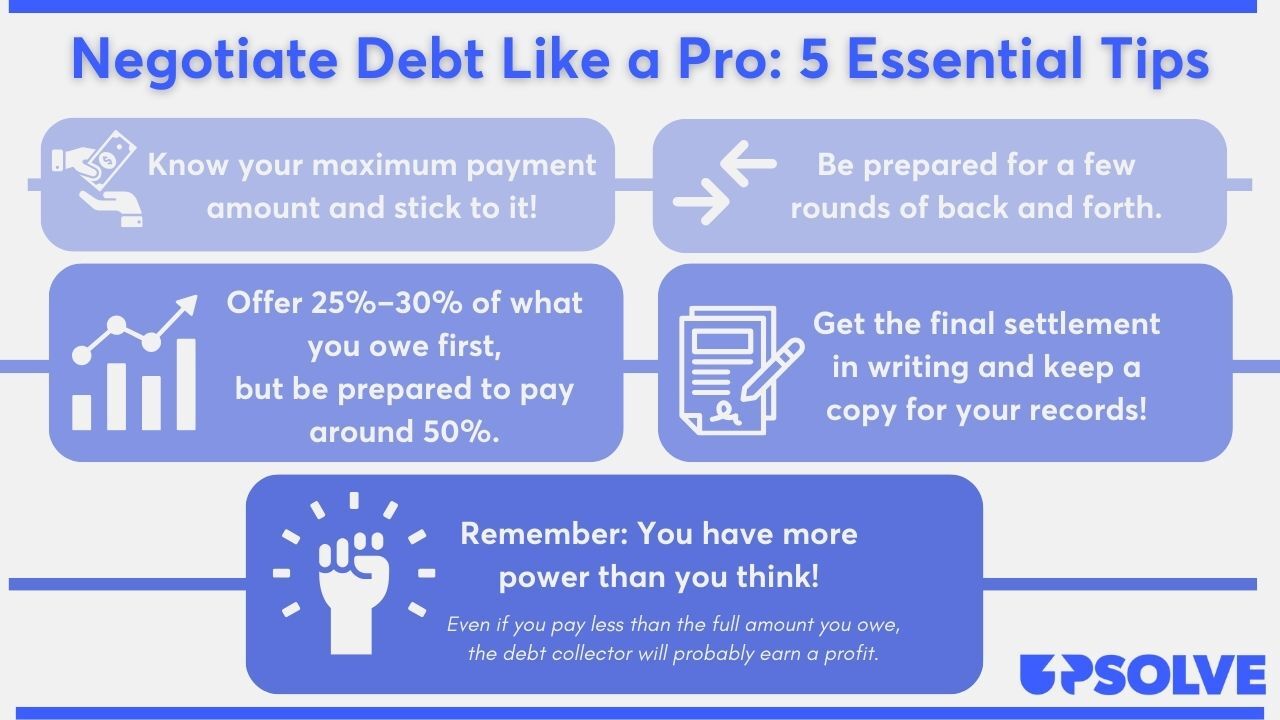

Still feeling nervous about negotiating? Check out our top tips on how to negotiate a debt settlement like a boss:

For even more tips and info, read 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Penn Credit in a Debt Lawsuit

If Penn Credit sues you, it’s important for you to carefully read your summons and complaint (official court documents) and respond to the lawsuit by filing an answer form.

Ignoring a debt collection lawsuit can be dangerous. If Penn Credit sues you and you ignore the lawsuit, they could automatically win the case. This would allow them to get an order to garnish your wages or bank account. Even if you’re in the middle of debt settlement negotiations with Penn Credit, you still need to respond to the lawsuit.

It may sound daunting, but responding to a debt collection lawsuit is simpler than you may think!

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Step 1: Read the Summons and Complaint Carefully

A summons form is a legal document that notifies you of a lawsuit against you. The summons has important information you need for filing out your answer form, including:

The name and address of the court you report to

Contact information for everyone involved in the case

The case number assigned to your case

Details of legal consequences if you don’t respond to the lawsuit

A complaint is another type of legal document that details the claims made against you. Depending on your court, the complaint form might arrive alongside your summons form. You’ll use this information when filling out your answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

You respond to your lawsuit by filing an answer form. You may be able to find a template on your court’s website, but not every court provides one. To check if your court has a template, Google your court name plus “answer form” or “court forms.”

If you have questions about your forms or need help with the filing process, reach out to your court clerk. Court clerks can’t give any legal advice, but they can help with the process and assist with paperwork.

The answer form is your opportunity to bring up any reasons you shouldn’t have to pay Penn Credit. These reasons are called affirmative defenses. To see some examples of affirmative defenses and learn more about the debt collection lawsuit process, read 3 Steps To Take if a Debt Collector Sues You.

Note: Some courts require you to file additional paperwork, like a certificate of service, along with your answer form. Check your court website or ask your court clerk to make sure you understand the filing process.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

Now it’s time to file your answer form with your court. The filing process is different for every court, but you can typically file in person. Some courts provide a mail-in or online filing option as well.

Regardless of how you file, you are often required to deliver a copy of your answer form to Penn Credit (the plaintiff in the case). This is called “serving the plaintiff.” You can usually mail them a copy using the address on the summons form. Again, if you need help with court processes, ask the court clerk to explain your options.

Let’s Summarize…

Penn Credit is a legitimate debt collection agency that collects consumer debts it buys from creditors. If Penn Credit is contacting you, they likely bought a debt they believe belongs to you. After confirming that you do owe the debt, you can negotiate how much of the debt you can pay and how you can pay it. If Penn Credit files a lawsuit against you, respond to the lawsuit by filing an answer form as soon as you can.