How To Win Against Pressler, Felt & Warshaw LLP

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Pressler, Felt & Warshaw LLP will contact you when they’re trying to collect a debt or inform you that they’ve sued you to collect a debt. If Pressler hasn’t sued you yet, you can fight back by making them validate the debt. If the debt is valid, you can try to settle it for less than what you owe. If you’ve been sued, respond to the lawsuit even if you’re trying to negotiate a settlement. Keep reading to find out how.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated October 13, 2025

Table of Contents

- Why Is Pressler, Felt & Warshaw LLP Contacting Me?

- Do I Have To Pay Pressler, Felt & Warshaw LLP?

- How To Negotiate a Debt Settlement With Pressler, Felt & Warshaw LLP in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Pressler, Felt & Warshaw LLP in a Debt Lawsuit

- Let’s Summarize…

Why Is Pressler, Felt & Warshaw LLP Contacting Me?

Pressler, Felt & Warshaw LLP is a law firm that represents original creditors and other debt collectors by suing consumers for unpaid debt. If Pressler, Felt & Warshaw calls you or sends you a letter, they’re probably trying to collect a consumer debt from you on behalf of their client. Another reason you might hear from Pressler is if they sued you to collect a debt.

To learn more, read Upsolve’s guide, How to Deal with Pressler, Felt & Warshaw LLP.

Do I Have To Pay Pressler, Felt & Warshaw LLP?

It largely depends on whether they validate the debt they’re trying to collect from you. If they validate the debt and you have no reason to dispute what you owe, then you probably have to pay at least part of it.

If you don’t pay, you could face significant consequences, like wage or bank account garnishment. Paying Pressler can help avoid these things, but you want Pressler to validate the debt first. Even if they do, there’s still the possibility that you can settle your debt for less than what you owe.

How To Negotiate a Debt Settlement With Pressler, Felt & Warshaw LLP in 3 Steps

It might be hard to believe, but there’s a lot of money to be made in debt collection. Many debt collection companies operate by purchasing past-due debts from creditors for pennies on the dollar. Other debt collectors, like Pressler, get paid a percentage of debts they can collect on behalf of creditors.

Regardless, Pressler stands to make a substantial profit even if they don’t collect the full amount of your debt. So they are usually willing to negotiate a debt settlement for you to pay off your debt for 40% to 60% of the original amount.

If Pressler doesn’t bring up this possibility first, you can start the negotiation process yourself. It sounds like an intimidating process, but it’s not difficult once you understand how it works.

Step 1: Make Sure the Debt Is Valid

A debt collection rule from the Consumer Financial Protection Bureau (CFPB) requires third-party debt collectors to send you a debt validation letter and give you 30 days to dispute the debt if you disagree with any aspect of it. If you did not receive a debt validation letter from Pressler, Felt & Warshaw, you can send them a debt verification letter that requests details about the debt. You can also use a debt verification letter to dispute the debt.

The goal of these letters is to confirm that:

Pressler, Felt & Warshaw owns the debt or can collect the debt for its client.

The debt belongs to you (there’s no identity theft or accountholder misidentification).

The debt is in the correct amount.

Here is a breakdown of the difference between a validation letter and a verification letter:

Step 2: Figure Out What You Can Pay

The more you’re willing to pay, the more likely Pressler will accept your settlement offer. But be careful to offer only what you can afford because the last thing you want to do is fail to pay another debt or get stuck with a new debt because of an unexpected bill.

To determine how much you can afford, add up your monthly income from all sources, then subtract your expenses, including any existing debt payments. It’s also a good idea to subtract a small amount for any surprise expenses that might come up in a particular month. What’s left is what you can afford to pay Pressler each month.

To help with this process, the CFPB has two helpful online worksheets for making a budget and organizing your debts. If you’re having difficulty with this process, don’t hesitate to get in touch with an accredited nonprofit credit counselor for a free consultation.

Lump-Sum Versus Payment Plan Offer

When you negotiate with Pressler, you’ll most likely have the option of submitting a lump sum or a payment plan offer. All else being equal, Pressler is more likely to accept a lump-sum offer than a payment plan. To offer a lump sum, consider other sources of income, such as a tax refund, work bonus, or proceeds from selling personal property you don’t need.

If you can only afford to go with a payment plan, suggest a monthly payment plan over a period of months that you can reasonably afford. Pressler may be more agreeable to your settlement offer if you set up an automatic withdrawal from your bank account to make each monthly payment.

Step 3: Make a Settlement Offer to Pressler, Felt & Warshaw LLP

When starting the negotiation process, make an offer that’s lower than what you can afford. This gives you room to negotiate and meet somewhere in the middle. Remember, this is a negotiation, so counteroffers (and some back and forth) are normal.

When negotiating, try to do so in writing, such as by email or letter. You can negotiate over the phone, but request any agreement you reach with Pressler in writing so you have a record.

Don’t Just Negotiate the Amount… Negotiate Everything!

The negotiation process can include other aspects of paying off a debt, such as how Pressler reports the debt account to the three major credit reporting bureaus, Experian, Equifax, and TransUnion.

Because a “paid in full” settlement on your credit report is best for improving your credit score, see if Pressler will agree to this report instead of “partial payment” or “settled.”

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Usually, yes! A lawsuit can make it more likely that a debt collector will negotiate a debt settlement. Litigation takes time and money, so the sooner Pressler can end the lawsuit, the more money they can save.

One thing to remember while negotiating during a lawsuit is to respond to the lawsuit process until the case is officially closed or dismissed. Until either occurs, you have to continue responding to court notices and filings or showing up to case hearings — even if you are in negotiations with Pressler.

Tips for a Successful Debt Settlement

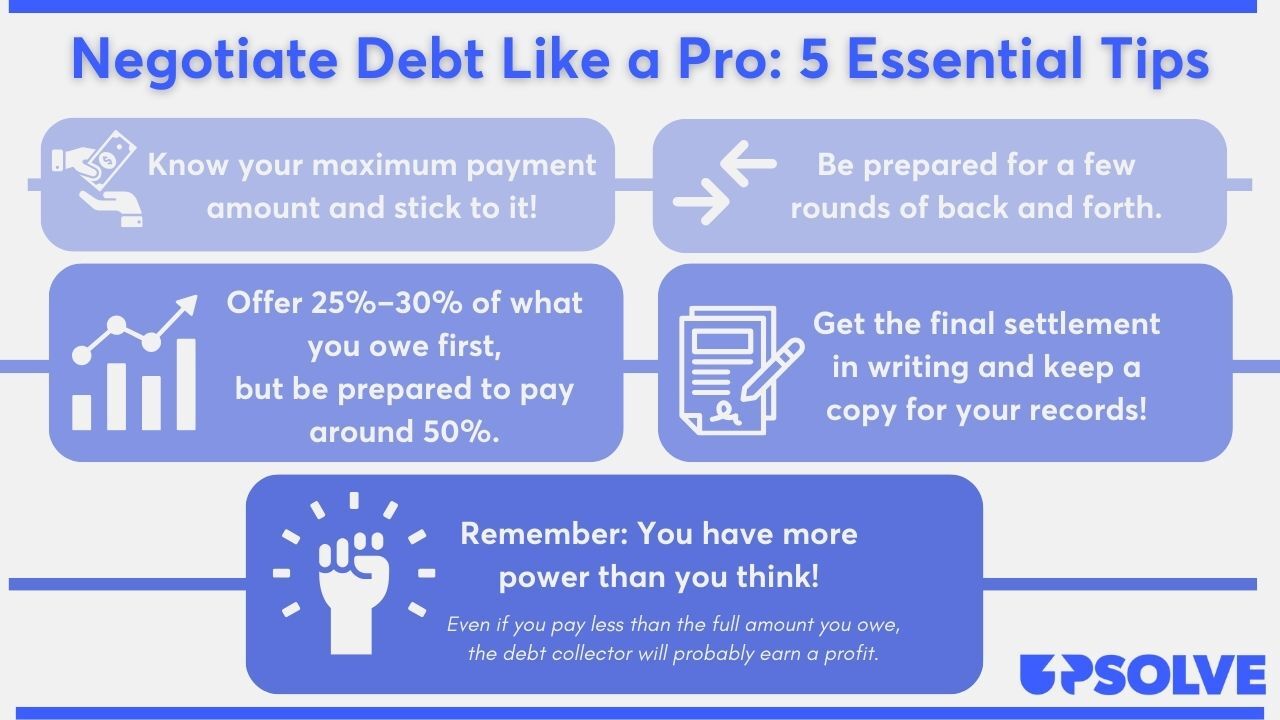

Negotiating with a debt collector can feel like a daunting task. Here are tips to increase your confidence and likelihood of success:

To learn more information and tips, read Upsolve’s 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Pressler, Felt & Warshaw LLP in a Debt Lawsuit

Pressler, Felt & Warshaw LLP is a law firm, so they sometimes file debt collection lawsuits on behalf of their clients. If they sue you, you’ll receive court documents called a summons and complaint. You need to respond to the complaint to avoid a default judgment, which could allow Pressler to garnish your wages or bank account.

Responding to the complaint might seem difficult, but it’s easier than you think. The following steps can help you respond to a lawsuit, and they apply even if you and Pressler are still trying to negotiate a debt settlement.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that provides you with basic information about the lawsuit. These forms vary among states and courts, but you’ll typically find the following information on a summons:

The name and addresses of the plaintiff (person or company suing you) and defendant (you)

The name and address of the court handling your case

Case number and nature of the lawsuit

A deadline for you to respond to the lawsuit

Legal consequences of ignoring the lawsuit

Instructions on how to respond to the lawsuit as a defendant

The complaint is the court document that lists (usually in numbered paragraphs) why the plaintiff is suing you.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

You’ll respond to the summons and complaint using an answer form. Many courts offer blank answer template forms. These may be available in paper format at the courthouse or online on the court’s website. Try Googling the court’s name plus “court forms” or “answer form.” These forms will often come with basic instructions, but if you need additional guidance, the court clerk can help. They can’t give you legal advice, but they can help explain the court processes and available resources.

Completing the answer form is your opportunity to raise any affirmative defenses. These are reasons you believe Pressler should lose its case against you. To learn more about affirmative defenses that may apply in a debt collection case, read Upsolve’s 3 Steps To Take if a Debt Collector Sues You.

Some courts require that you file additional forms with your answer, such as a certificate of service. Depending on the court, this could be a separate document or part of your answer. Your court’s website or clerk can explain any additional forms you may need.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After you complete your answer and any other forms, you must file them with the court and then serve copies to the plaintiff.

The process of filing your answer depends on the court, but most courts have at least two filing methods. In-person filing is almost always accepted, as is filing by mail. Many courts also have e-filing systems in place. The exact filing procedures will be listed on the court’s website, or the court clerk can explain how to do it.

After filing the answer and accompanying forms with the court, you must deliver a copy of them to the plaintiff. Again, this process depends on the court and its specific rules, but you can typically serve the plaintiff by mailing copies to them. The summons should include Pressler’s contact information, including an address where you can send the answer.

Let’s Summarize…

Getting a phone call or letter from Pressler, Felt & Warshaw LLP likely means you owe a consumer debt they’re trying to collect. Before you pay anything to anyone, you want Pressler to validate the debt. If they can, you must decide how to approach the debt settlement negotiation process. If Pressler sues you, you can still try to negotiate a settlement but don’t forget you’ll still need to respond to the lawsuit and follow any court orders until the case is officially over.