Is an Income-Contingent Repayment Plan Right for You?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

The Income-Contingent Repayment (ICR) Plan is one of four income-driven repayment options for federal student loans. It’s the only one of these four options that parent PLUS borrowers can utilize, which is one of the main upsides, if you have that kind of loan. The ICR has the longest repayment period of any income-driven plan at 25 years. This allows for lower monthly payments for borrowers but, the total amount paid over the loan's lifespan, including interest, is generally higher compared to other plans.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated May 5, 2025

Table of Contents

- What You Need To Know About Income-Contingent Repayment Plans

- What Loans Are Eligible for an ICR Plan?

- How Long Will It Take To Pay Your Loans Under an Income-Contingent Repayment Plan?

- How Does the ICR Compare to Other Income-Driven Repayment Plans?

- Will My Monthly Payment Always Be the Same Under an ICR Plan?

- How Do I Apply for an Income-Contingent Repayment Plan?

- What You Need To Know About Income-Contingent Repayment Plans and Student Loan Forgiveness

- Have Too Much Student Loan Debt? Here Are Your Other Options

What You Need To Know About Income-Contingent Repayment Plans

The Income-Contingent Repayment (ICR) Plan is one of four federal student loan repayment plans that ties your monthly payment to your income and family size. As a category, these four plans are called income-driven repayment (IDR) plans. Each of these plans has its own eligibility requirements and repayment terms and conditions, which are set by the U.S. Department of Education.

Here are some key details about ICRs:

The repayment period for an ICR is 25 years.

There is no income eligibility requirement.

The interest rate for an ICR plan is fixed for the life of your loan.

Monthly payments are the lesser of (1) what you would pay on a repayment plan with a fixed monthly payment over 12 years, adjusted based on your income, or (2) 20% of your discretionary income, divided by 12.

You’ll have to recertify your income and family size information each year you’re on the plan. (Keep in mind that you can change your repayment plan at any time.)

What Loans Are Eligible for an ICR Plan?

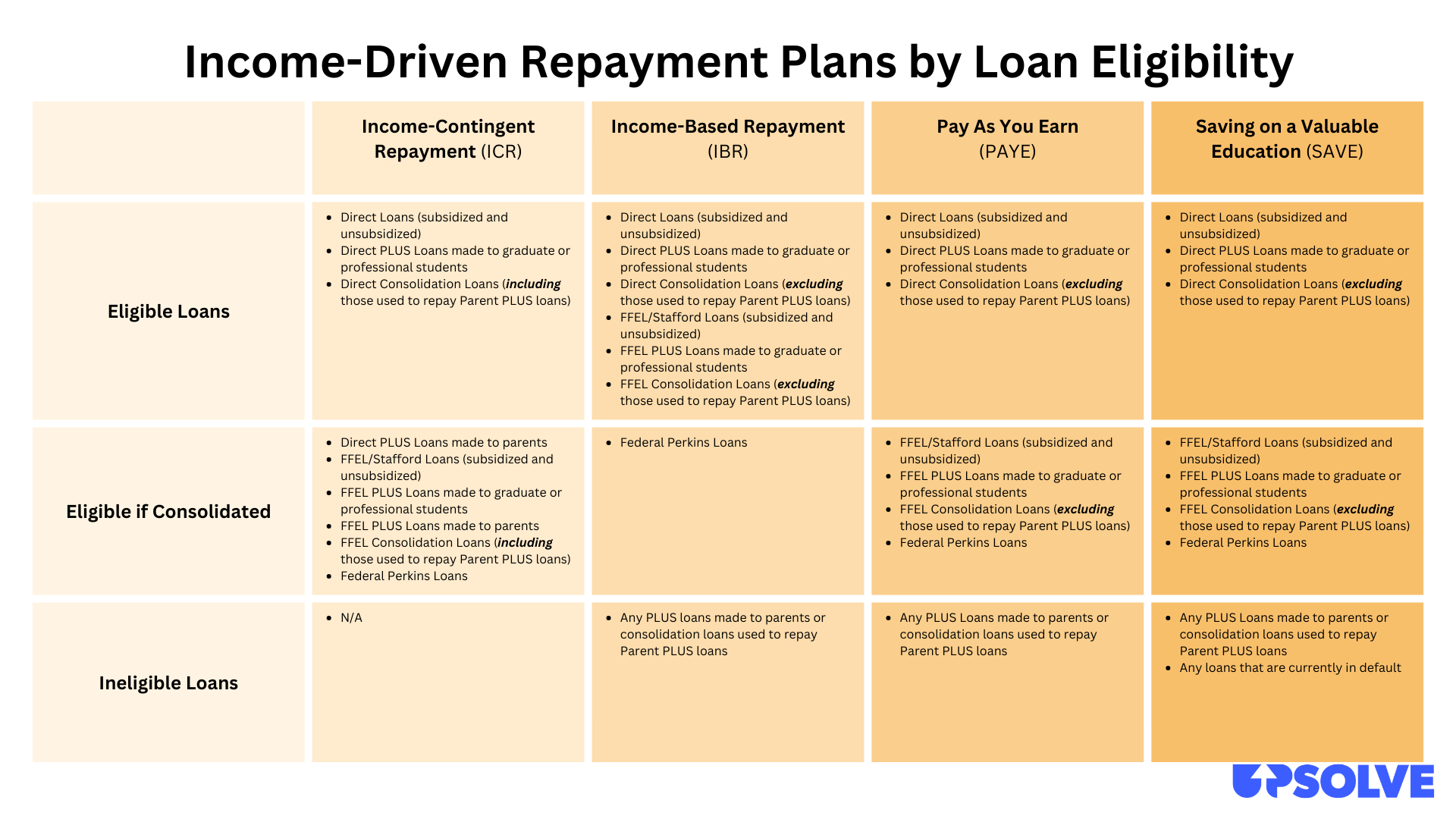

Income-contingent plans are available for almost every type of federal student loan. In fact, the ICR is the only income-driven repayment option for parent PLUS loan borrowers, though the loan(s) must first be consolidated into a Direct Consolidation Loan.

Other eligible loans include:

Federal Direct Loans (both subsidized loans and unsubsidized loans)

Direct Consolidation Loans*

Direct PLUS Loans made to graduate students

Direct PLUS Loans made to parents

*Federal Stafford loans (subsidized and unsubsidized), Federal Family Education Loans (FFEL), PLUS loans, FFEL Consolidation Loans, and Federal Perkins Loans are also eligible for ICR if the borrower first consolidates them into a Direct Consolidation Loan.

How Long Will It Take To Pay Your Loans Under an Income-Contingent Repayment Plan?

The repayment period for an ICR plan is 25 years, which has its pros and cons.

If you’re a parent PLUS borrower, the biggest advantage of an ICR is that you’re eligible for it! Borrowers with parent PLUS loans don’t qualify for any other income-driven repayment plan. The ICR allows these borrowers to get a lower monthly payment than they’ll have on the 10-year Standard Repayment Plan.

Another advantage of ICR is that if you have a remaining balance at the end of the repayment period (in this case, 25 years), you’re eligible to have that balance forgiven. This is true for all income-driven repayment plans.

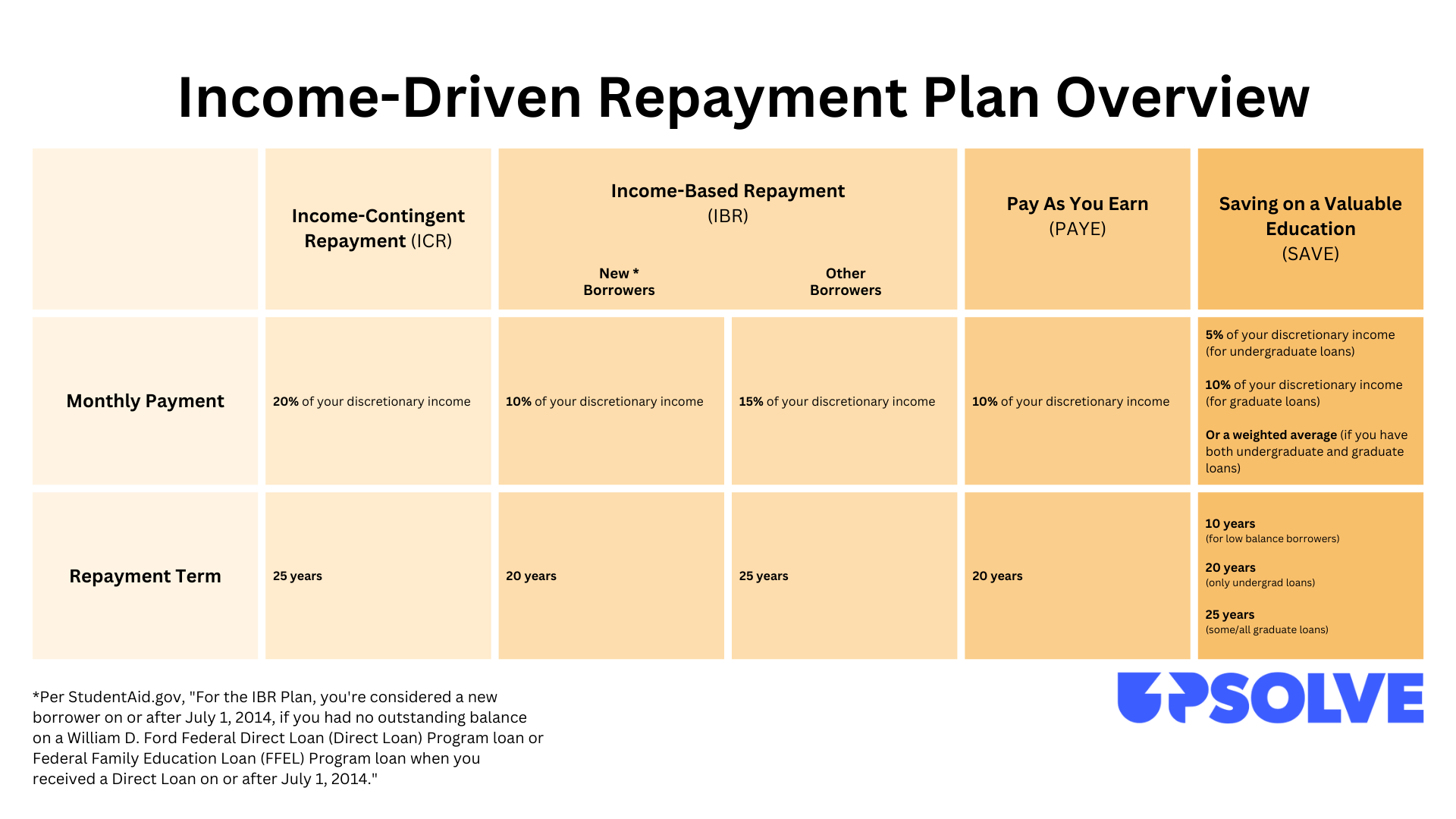

Under an ICR, your monthly payment will be 20% of your discretionary income. For some, this will feel like a win; for others, it may still feel like too much money. Other IDR plans only require borrowers to pay 10%–15% of their discretionary income (5%-10% for the Saving on a Valuable Education Plan).

Here’s a quick overview of income-driven repayment plans:

Perhaps the biggest downside of Income-Contingent Repayment Plans is that the total amount you pay over the life of the loan — including interest — is more than you would under other plans, especially the 10-year Standard Repayment Plan.

How Does the ICR Compare to Other Income-Driven Repayment Plans?

The Department of Education provides income-driven repayment options for federal student loan borrowers. The plans have a lot in common, but there are also some key differences.

First, here’s what they have in common:

Your monthly payment is determined by a percentage of your discretionary income (5%, 10%, 15%, or 20%) and your family size (more on discretionary income below).

You qualify for loan forgiveness after the repayment period (10 or 20 or 25 years).

You must recertify your income and family size annually (your monthly payment can change each year as these numbers fluctuate).

Here’s what different:

Under the ICR plan, you’ll have a higher monthly payment than you would under any other income-driven plan. It will be 20% of your discretionary income. Other income-driven plans only require 10% (or sometimes 15%) of your discretionary income.

The ICR also has the longest repayment period. Again, this can be helpful to get you a lower payment each month, but it also means you’ll end up paying more interest over the life of the loan.

What Is Discretionary Income and How Is It Calculated?

Your monthly payment under an ICR or any income-driven repayment plan is a percentage of your discretionary income. This percentage changes under different plans, and the way discretionary income is calculated varies by plan.

For Income-Contingent Repayment (ICR), discretionary income is the difference between your annual income and 100% of the poverty guideline for your family size and state of residence.

For Income-Based Repayment (IBR) and Pay As You Earn (PAYE), discretionary income is the difference between your annual income and 150% of the poverty guideline for your family size in your state of residence. For the Saving on a Valuable Education (SAVE)* plan, it's 225% of the poverty line.

*The SAVE plan has replaced the Revised Pay As You Earn (REPAYE) plan.

Does My Spouse’s Income Count for My Discretionary Income?

If you’re married, your monthly payments for the ICR will be based on your and your spouse's combined adjusted gross income and student loan debt, even if you file your taxes separately. This usually results in a higher monthly payment.

The other two income-driven plans (the IBR and PAYE plan) do not consider your spouse’s income or loan debt if you and your spouse file separate income tax returns.

Will My Monthly Payment Always Be the Same Under an ICR Plan?

Under all of the income-driven repayment plans, your monthly payment amount may fluctuate from year to year if your income or family size changes. As we mentioned, you must recertify your income and family size once a year. This means that you must provide updated income and family size information to your loan servicer so they can recalculate your payment. You’re required to do this even if there has been no change in your income or family size.

If your income or family size changes significantly before your annual certification date, you can submit updated information and request that your servicer recalculate your payment. It can be beneficial to submit updated information if your income falls or your family size increases.

Since all IDR plans are based on your income and family size, if your income increases, your payment amount will likely increase, too. The idea behind these plans is that you have a monthly student loan payment that is proportional to your income, so if your earning power increases, your payment usually does too.

How Do I Apply for an Income-Contingent Repayment Plan?

The easiest way to apply for an ICR plan or any other IDR plan is online. You can also request a form from your loan servicer.

If you aren’t sure which income-driven plan is best for you, ask your loan servicer (the company that manages your loan and payments) to tell you which income-driven plans you qualify for. You can also ask them which income-driven plan will give you the lowest monthly payment if that’s your goal. (Not sure what your goal is? Ask these nine questions!)

How Do I Find Information About My Loan(s)?

If you’re wondering what kinds of loans you have, who is servicing them, or how much you owe, there’s an easy way to find out. Read our article on How To Get Your Federal Student Loan Info From the NSLDS. Essentially, you log in to a database (the NSLDS) run by StudentAid.gov (the same place you filed your FAFSA) and run a quick report. Prefer to hop on the phone? You can call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

Note that if you have more than one servicer for the loans that you want to repay with an income-driven plan, you must submit a separate request to each servicer.

What You Need To Know About Income-Contingent Repayment Plans and Student Loan Forgiveness

If you are seeking Public Service Loan Forgiveness (PSLF), you must be enrolled in an income-driven repayment plan. This includes an ICR plan. If you qualify for PSLF, it isn’t usually in your financial best interest to pay more than your minimum monthly payment on your loans. That’s because PSLF is a 10-year (120 monthly payments) program after which your remaining student loan balance is forgiven.

It’s important to double-check your eligibility for PSLF. You must work for a qualifying employer.

PSLF is the most well known and popular loan forgiveness program, but it’s not the only one. There are other types of student loan forgiveness programs, too. Each has their own program requirements, and not all require borrowers to be on an income-driven plan.

For example, the Teacher Loan Forgiveness Program is available for those who teach full time for five complete and consecutive academic years in a low-income elementary school, secondary school, or educational service agency. If you qualify, you may have up to $17,500 of your Direct Loan or FFEL loans forgiven. This program doesn’t require borrowers to be enrolled in a specific payment plan. That said, some people qualify for both teacher loan forgiveness and PSLF.

Have Too Much Student Loan Debt? Here Are Your Other Options

If you’re reading this and thinking that 25 years — or even 20 — is too long to wait for loan forgiveness, or that it’ll be too stressful to manage your loans for two or more decades, you're not alone! An income-based repayment plan can be a great option for some borrowers, but for others it may feel like yet another financial stressor you can’t get out from under.

If that’s the case, you have some other options. Note that these will only help ease your federal student loan payments. If you have private student loans, your options are more limited. Your best best may be refinancing. (Read about your options in our Guide to Private Student Loans.)

Apply for Forbearance or Deferment for Temporary Relief

If you’re just encountering a rough patch and need some financial breathing room, consider requesting forbearance or deferment. If you’re approved, you can pause your federal student loan payments for up to a year (or more, but you must reapply annually).

Consider Filing Chapter 7 Bankruptcy

Thinking that bankruptcy isn’t an option? Think again! In late 2022, the U.S. Department of Education and Department of Justice teamed up and released new guidance for bankruptcy courts for how to handle student loan discharges in bankruptcy. The guidelines aim to clarify who is eligible for a student loan bankruptcy discharge. They create a clear process and application for Chapter 7 filers to follow if they want to discharge their student debt.

Here’s the truth: Bankruptcy isn’t for everyone. But for some people — including student loan borrowers with too much debt to pay off in this lifetime — it can be life-changing. You may have heard it’s bad to file bankruptcy, but bankruptcy is simply a legal tool designed to help ordinary people (and companies) get a financial fresh start when they’re drowning in debt and can’t keep up.

Deciding to file for bankruptcy can be a big decision. Upsolve is here to help… and we’re a nonprofit, so our help is free. If you want to explore this option, take our five-minute student loan screener now to see if you’re eligible for free help. Upsolve has helped thousands of Americans get rid of over $700 million in debt since we began in 2017. You could be next.