How To Fill Out Schedule J: Your Expenses for Chapter 7

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Schedule J is a required bankruptcy form that lists your estimated monthly expenses after filing Chapter 7. It helps the court understand your household budget and determine whether you have any disposable income left to pay creditors. You’ll need to include a wide range of expenses, from rent and utilities to transportation and personal care. Expenses typically need to be both accurate and reasonable.

Written by Mae Koppes. Legally reviewed by Jonathan Petts

Updated November 11, 2025

Table of Contents

What Is Schedule J in Chapter 7?

Schedule J: Your Expenses is one of several official forms that are required to file Chapter 7 bankruptcy.

It shows the bankruptcy court what expenses you expect to pay after your bankruptcy filing.

The court can use this information along with the information in Schedule I: Your Income, to get a sense of your household budget post-filing.

What Expenses Need To Be Included in Schedule J?

Schedule J asks filers to list estimated expense amounts for several different categories, including:

Property expenses, which typically mean your monthly rent or mortgage expenses

This can also include real estate taxes, renters or homeowners insurance, home maintenance costs, and homeowners association dues.

Utility payments

This includes electricity, heat/gas, water/sewer, garbage, phone bills, and cable/internet bills.

Insurance payments

This includes any monthly payments you make for health, dental, life, or vehicle insurance.

Debt payments for non-dischargeable debts

If you have student loans or owe back taxes, those debts often survive a Chapter 7. Include payments on these debts as monthly expenses.

Medical expenses

This includes the cost of glasses or contact lenses, prescriptions, or other medical expenses.

Household expenses

This includes food (groceries or eating out), clothing, laundry/dry cleaning, charitable or religious donations, and entertainment/recreation expenses.

Personal care expenses

This includes personal care products/services and hair cuts.

Family/child care expenses

This includes child care and education-related expenses, child support or alimony (if not deducted from your paycheck), and contributions to family or friends.

Transportation expenses

If you own, lease, or borrow a car, this often includes gas, maintenance/repairs, and car insurance costs, as well as the monthly loan or lease payment.

If you don’t own, lease, or borrow a car, this usually includes the cost of bus passes, subway tickets, or rideshares.

Installment payments

This includes any monthly payments you have for leases or installments, such as a cellphone or rent-to-own furniture.

✨ If you use Upsolve’s free filling tool, it will guide you through each expense category. It only takes two minutes to see if you’re eligible.

How Do You Estimate Expenses Accurately?

You may not know the exact amount you spend in each of the above categories every month, and that’s okay. But the bankruptcy court does expect filers to estimate to the best of their ability and to include reasonable and accurate amounts on their forms.

📌 Here are some tips for how to estimate accurately:

Look at recent bills, bank statements, or credit card statements and calculate the average of your various expenses over the last few months.

Don’t forget expenses you pay annually or occasionally!

Some expenses may not occur every month but still need to be included as a monthly expense. For example, if you pay car insurance once every six months, divide the amount you pay by six to get your monthly expense number.

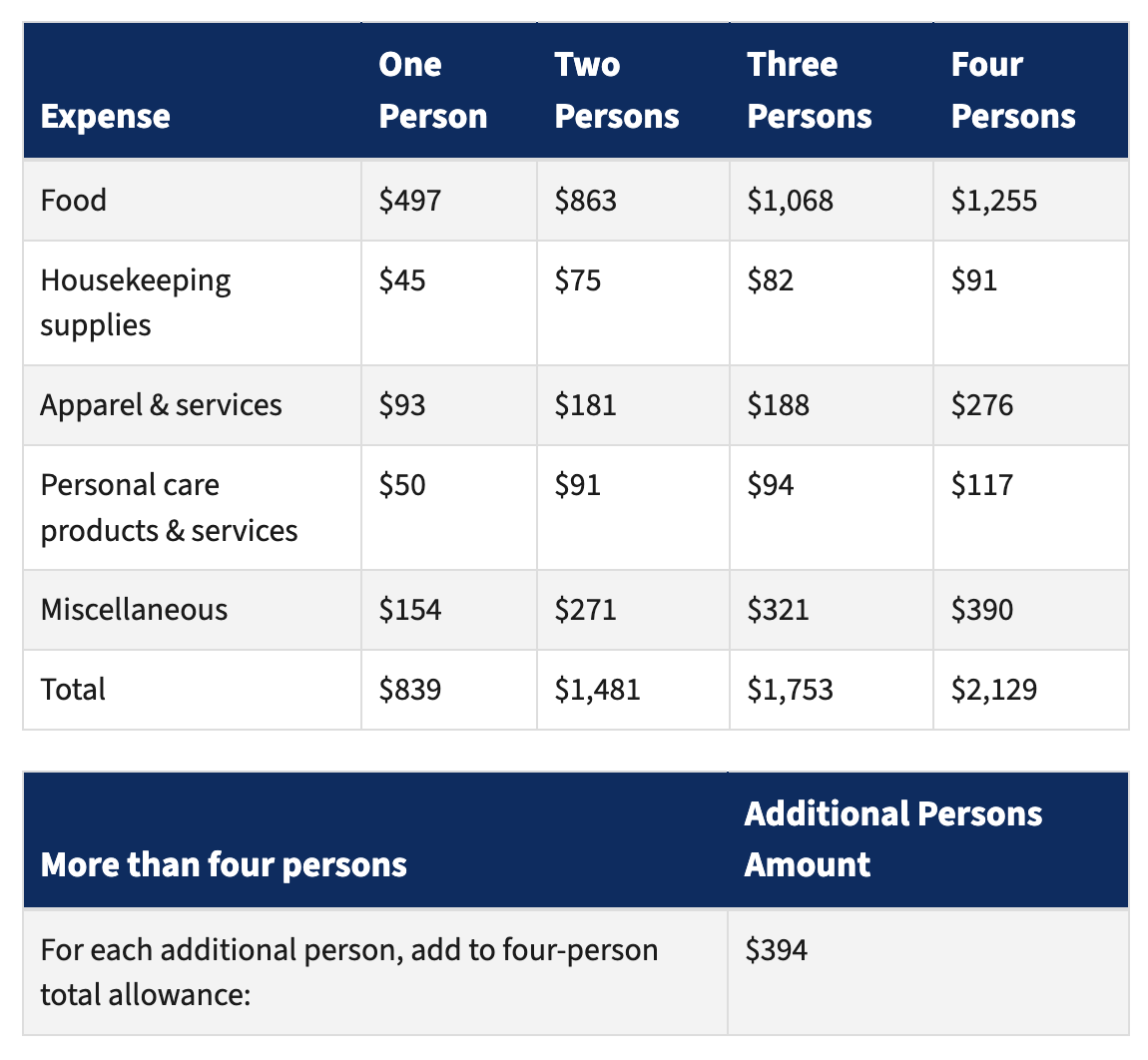

Household expenses can be harder than other categories to estimate since they are more occasional. The IRS’s National Standards can help you get a sense of typical expenses in this category based on household size.

☝️ Remember: Filers typically need to include all regular monthly expenses for themselves, their dependents, and anyone else in their household whose income is included on Schedule I.

IRS National Standards as of April 2025

How Does the Bankruptcy Court Use Schedule J?

Schedule J helps the bankruptcy court and trustee understand your current financial situation by showing what you plan to spend each month after your bankruptcy case is over.

When they compare it to your income (from Schedule I), they can see whether you have any money left over after covering your basic needs. That leftover money is called disposable income.

👀 If you're filing Chapter 7, the trustee may look closely at your expenses to see if they seem too high or unreasonable. If they do and if it looks like you may have disposable income to pay creditors, the trustee might ask the court to switch your case to Chapter 13 instead.

Also, the court may use Schedule J to decide if you can afford to reaffirm certain debts in Chapter 7, like keeping your car loan. If your budget shows you can keep up with the payments, the court may approve the reaffirmation agreement. If your budget shows you may struggle to keep up with the payments, the court may deny the reaffirmation.

Reasonable vs. Unreasonable Expenses

The court doesn’t expect you to live without any comfort or convenience, but your expenses should reflect a modest, necessary lifestyle.

If something stands out — like large entertainment costs, luxury items, or high charitable donations — the trustee might ask you to explain or provide proof. An expense is more likely to be seen as unreasonable if it’s way above average or if you just started paying it recently.

It helps if you can show a consistent history of that expense. If you can’t show it’s a necessary or long-standing part of your budget, the trustee may challenge it.