Your Guide to Tennessee Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

When it comes to debt collection, Tennesseans are primarily protected by the federal Fair Debt Collection Practices Act (FDCPA). That said, Tennessee’s Consumer Protection Act does provide some consumer protections against misconduct that aren’t specifically outlined in the FDCPA. The Tennessee Consumer Protection Act also requires third-party debt collectors and debt buyers to register with the Tennessee Collection Service Board. The statute of limitations for medical debt and credit card debt is six years in Tennessee.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated January 22, 2026

Table of Contents

What Are the Debt Collection Laws in Tennessee?

Tennessee doesn’t have a specific debt collection law. However, the Tennessee Consumer Protection Act (TCPA) protects people from unfair or deceptive business practices, and that can include certain debt collection behaviors.

Tennessee residents are also protected by the Fair Debt Collection Practices Act (FDCPA). This federal law sets rules for how third-party debt collectors can contact you and what they can and can’t do.

How does the TCPA Protect People in Tennessee?

The TCPA helps protect people from harmful business practices that may not be fully covered by federal law. It also requires third-party debt collectors and debt buyers to register with the state.

The TCPA can apply to both original creditors (the companies you originally owed) and third-party debt collectors. To be protected under the TCPA in a debt collection lawsuit, the debt must come from a consumer transaction — like a credit card, personal loan, or medical bill — and the collector’s behavior must be unfair or deceptive.

📋 In Tennessee, most third-party debt collectors and debt buyers are required to register with the Tennessee Collection Service Board before they can legally collect debts. This rule doesn’t apply to collection attorneys, original creditors, or companies that own debt but use a licensed agency or attorney to collect it (unless they’re pretending to be someone else when they contact you).

🔍 If you want to verify whether a debt collector is licensed, you can visit the Tennessee Collection Service Board’s website. If they’re not properly licensed, you can file a complaint with the board.

Sources: Tenn. Code Ann. § 62-20-103 – Exemptions and Tenn. Code Ann. § 62-20-105 – License Requirements

How Does the FDCPA Help Tennesseans?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects people across the U.S., including Tennesseans, from harassment and other abusive behavior by debt collectors. It works alongside Tennessee’s own consumer protection laws to create stronger protections for people dealing with debt.

Here’s a quick overview of what the FDCPA covers:

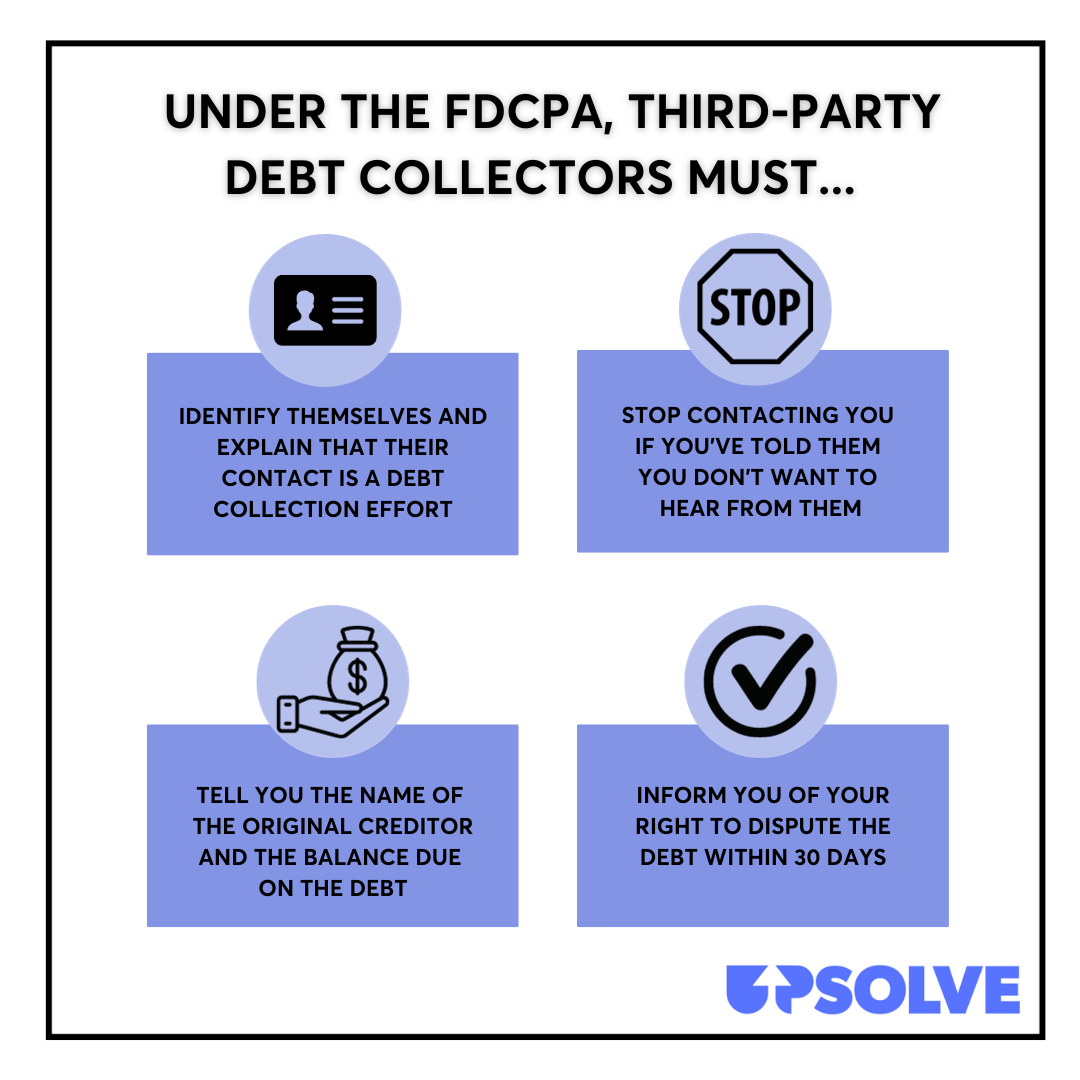

The main purpose of the FDCPA is to protect consumers against third-party debt collectors. It also outlines certain responsibilities debt collectors have to you, including:

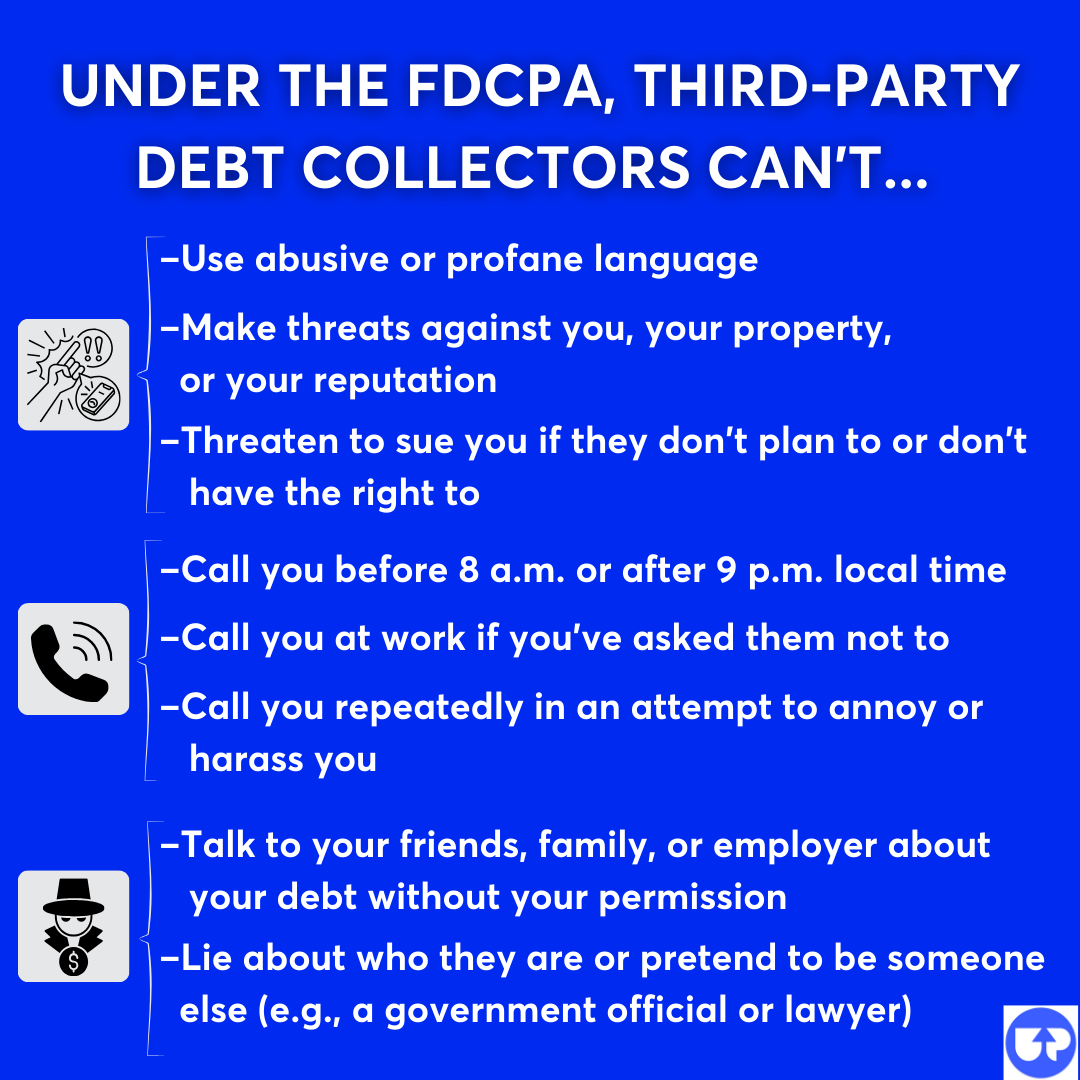

The FDCPA also outlines what third-party debt collectors can’t do:

What Can You Do if a Debt Collector Breaks the Law in Tennessee?

If you think a debt collector is acting unfairly or illegally, you have options. The right place to report the issue depends on what happened. If the collector broke federal rules — like harassing you or contacting you at work — you can report it to the Consumer Financial Protection Bureau (CFPB), a federal agency.

🗂️ If the issue involves unfair or deceptive business practices — like misrepresenting the amount you owe — you can file a complaint with the Tennessee Attorney General’s Office.

These agencies review complaints and may investigate or penalize collectors who break the rules. If the collector caused financial harm or serious stress, some people choose to file a lawsuit against the collector. When a case is successful, the court may award more than just the actual losses, such as court costs and attorney fees.

What Is the Statute of Limitations for Debt Collection in Tennessee?

The statute of limitations for oral and written contracts in Tennessee is six years. This includes common types of consumer debt like medical bills, credit card debt, and other open accounts.

🕒 In most cases, the six-year “clock” starts from the date you last made a payment. For installment loans (like personal loans or auto loans with fixed payments), the clock starts on the due date of each missed payment. That means every missed payment may have its own timeline for how long the lender has to sue you.

⚠️ If a debt is old, be careful about what you say to a debt collector. In some cases, even admitting the debt or agreeing to pay can restart the clock.

Source: Tenn. Code Ann. § 28-3-109 – Statute of limitations for contracts

What Can Debt Collectors Do To Collect Debt in Tennessee?

It’s important to understand what debt collectors legally can do so you can protect yourself and make informed choices. Most collection efforts start with phone calls and letters, but if the debt isn’t resolved, collectors may take more serious collection measures.

In Tennessee, a debt collector can file a lawsuit against you. If they win in court, they may be able to garnish your wages or repossess your property (usually a car, if the loan was tied to the vehicle).

Debt Collectors Can Garnish Your Wages (With a Court Order)

Debt collectors can take you to court for an unpaid debt. If you get sued by a collection agency and lose, the court may issue a judgment that allows the collector to take further action. This can include wage garnishment, a bank account levy, or placing a lien on your property. Of these, wage garnishment is the most common.

Tennessee law limits how much money a debt collector or creditor can take from your paycheck. These limits are meant to make sure you still have enough to cover basic living expenses.

Debt Collectors Can Repossess Your Car

If you fall behind on your car loan, the lender can legally repossess your vehicle — and they don’t need to give you notice or get a court order first. In Tennessee, repossession can happen after just one missed payment, depending on the terms of your loan.

🧐 That’s why it’s a good idea to review your loan agreement if you're behind on payments. Check for things like grace periods or how many missed payments lead to repossession. Knowing the terms can help you understand what to expect and avoid surprises.

Need Help With Debt Relief? Here Are Some Options

Being in debt is stressful, and it can be hard to find the time or energy to figure out how to get back on track. If you're feeling stuck, consider getting some free help. A great place to start is by scheduling a free session with a nonprofit credit counselor.

Meeting with an accredited credit counselor can give you personalized advice and help you understand your options. They might suggest a debt management plan, debt consolidation, or even bankruptcy.

Chapter 7 bankruptcy is a powerful legal tool that gives you a fresh start. If your debt feels unmanageable and you don't see a way out, it may be worth exploring. One major benefit of filing is that it immediately stops all collection efforts, including wage garnishment.

✨ If you're thinking about filing Chapter 7 bankruptcy, you can see if you're eligible to use Upsolve’s free online filing tool. It guides you through the process step by step so you can file on your own with confidence.

Looking for Legal Help?

If you're facing a debt collection lawsuit or just want to understand the debt collection laws in Tennessee, help is available! The resources below can connect you with free or low-cost legal support across the state:

Help4TN offers easy-to-understand legal guides online and has a free telephone hotline you can call at 888-HELP4TN (888-395-9297).

TN Free Legal Answers is a virtual legal clinic where volunteer attorneys answer your legal

questions via email or chat.

Tennessee Access to Justice Initiative provides online self-help resources and referrals to local legal aid providers across the state.

Memphis Area Legal Services serves residents of Shelby, Tipton, Fayette, and Lauderdale counties with legal help and referrals.

West Tennessee Legal Services supports people in 17 counties in West Tennessee with legal resources and referrals.

Legal Aid Society of Middle Tennessee & the Cumberlands helps residents in 48 counties across Middle Tennessee with legal aid and online tools.

Legal Aid of East Tennessee offers resources and referrals for legal help in 26 counties in East Tennessee.